Money market accounts offer higher interest rates than traditional savings accounts with easy access to funds and FDIC insurance, making them ideal for conservative savers seeking liquidity and moderate returns. Prize-linked savings combine the security of regular savings with the chance to win cash prizes, encouraging disciplined saving through the appeal of potential rewards. Choosing between these options depends on whether you prioritize steady growth or a motivating chance-based incentive to boost savings.

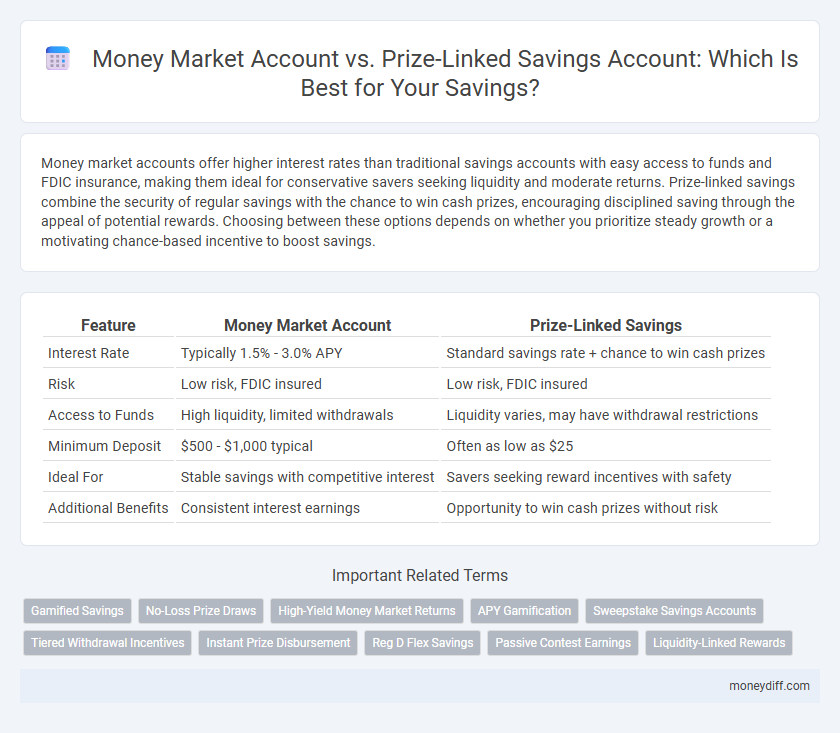

Table of Comparison

| Feature | Money Market Account | Prize-Linked Savings |

|---|---|---|

| Interest Rate | Typically 1.5% - 3.0% APY | Standard savings rate + chance to win cash prizes |

| Risk | Low risk, FDIC insured | Low risk, FDIC insured |

| Access to Funds | High liquidity, limited withdrawals | Liquidity varies, may have withdrawal restrictions |

| Minimum Deposit | $500 - $1,000 typical | Often as low as $25 |

| Ideal For | Stable savings with competitive interest | Savers seeking reward incentives with safety |

| Additional Benefits | Consistent interest earnings | Opportunity to win cash prizes without risk |

Introduction: Understanding Savings Options

Money market accounts offer higher interest rates than regular savings accounts, providing liquidity with limited risk through insured deposits. Prize-linked savings combine saving discipline with the chance to win cash prizes, motivating consistent contributions without risking principal. Comparing interest earnings and incentive structures helps savers choose the most effective option for building wealth.

What Is a Money Market Account?

A Money Market Account (MMA) is a type of savings account that typically offers higher interest rates compared to regular savings accounts by investing in short-term, low-risk securities. MMAs provide liquidity through check-writing privileges and limited transactions, making them flexible for savers seeking both accessibility and growth. The interest earned is usually tiered based on account balance, allowing higher deposits to earn better returns while maintaining federal insurance protection up to $250,000.

What Are Prize-Linked Savings Accounts?

Prize-linked savings accounts offer a unique way to save by combining traditional savings with the chance to win cash prizes through periodic drawings. Unlike money market accounts that provide interest based on market rates, prize-linked accounts incentivize saving by rewarding account holders with entries into prize drawings proportional to their deposits or balances. This innovative approach encourages disciplined saving habits while potentially yielding higher rewards without risking the principal amount.

Key Features: Money Market vs Prize-Linked Savings

Money Market Accounts offer higher interest rates with immediate liquidity and FDIC insurance, making them ideal for conservative savers seeking steady growth and security. Prize-Linked Savings combine the safety of traditional savings with the chance to win cash prizes, motivating saver engagement without compromising principal protection. Both options provide low-risk saving solutions, but Money Market Accounts emphasize consistent returns while Prize-Linked Savings enhance saving behavior through gamified incentives.

Interest Rates and Potential Returns Comparison

Money Market Accounts typically offer higher interest rates than traditional savings accounts, ranging from 0.50% to 2.00%, providing stable and predictable returns. Prize-Linked Savings accounts combine lower base interest rates, often around 0.10% to 0.30%, with the chance to win cash prizes, which can substantially boost overall potential returns. While Money Market Accounts prioritize steady interest accrual, Prize-Linked Savings accounts appeal to savers seeking both modest guaranteed returns and the excitement of potentially large, tax-free prizes.

Accessibility and Withdrawal Flexibility

Money Market Accounts typically offer easier access to funds with features like check writing and debit card usage, providing greater withdrawal flexibility compared to Prize-Linked Savings accounts. Prize-Linked Savings often restrict withdrawals to encourage long-term saving, limiting accessibility but potentially increasing savings discipline. Choosing between the two depends on the priority of liquidity versus the incentive of prize-based rewards for consistent saving.

Safety and Security of Your Savings

Money Market Accounts offer federal insurance through the FDIC or NCUA, ensuring protection up to $250,000, making them a safe choice for preserving principal. Prize-Linked Savings accounts provide a similar level of security since funds are typically held in FDIC-insured accounts, while adding a gamified incentive to boost savings. Both options prioritize the safety and security of your savings, but Money Market Accounts emphasize stability, whereas Prize-Linked Savings combine security with potential rewards.

Who Should Choose a Money Market Account?

Individuals seeking low-risk, liquid savings with higher interest rates than regular savings accounts should consider Money Market Accounts, especially those who prioritize easy access to funds and FDIC insurance protection. Money Market Accounts are ideal for savers who want to maintain a balance with check-writing capabilities while earning competitive yields. Those avoiding the uncertainty of Prize-Linked Savings yet desiring stable returns often find Money Market Accounts more suitable for their financial goals.

Who Should Consider Prize-Linked Savings?

Prize-linked savings accounts appeal to individuals seeking a low-risk way to build savings while enjoying the excitement of potential cash prizes. Those who struggle with traditional saving methods may find these accounts motivating due to the chance-based rewards that encourage consistent deposits. Prize-linked savings are especially suitable for younger savers or those with irregular incomes looking to combine financial discipline with engaging incentives.

Choosing the Right Savings Solution for You

Money Market Accounts offer higher interest rates and easy access to funds, making them ideal for savers seeking liquidity and moderate growth. Prize-Linked Savings combine the security of traditional savings with the excitement of lottery-style prizes, appealing to those motivated by potential rewards. Evaluating your risk tolerance, savings goals, and need for accessibility helps determine whether a steady return or chance-based incentives align better with your financial strategy.

Related Important Terms

Gamified Savings

Money Market Accounts offer stable interest rates with easy access to funds, making them ideal for conservative savers seeking liquidity and safety. Prize-Linked Savings combine the benefits of traditional savings with the excitement of lottery-style rewards, incentivizing regular deposits through gamified experiences and chances to win cash prizes.

No-Loss Prize Draws

Money Market Accounts offer stable interest rates with easy access to funds, while Prize-Linked Savings accounts combine savings growth with no-loss prize draws that boost motivation without risking principal. No-loss prize draws provide an incentive for savers by awarding cash prizes based on account balances, enhancing saving habits without sacrificing security.

High-Yield Money Market Returns

Money Market Accounts offer high-yield returns through competitive interest rates and liquidity, making them ideal for risk-averse savers seeking stable growth. Prize-Linked Savings combine the benefits of traditional savings with chances to win cash prizes but typically yield lower average returns compared to Money Market Accounts.

APY Gamification

Money Market Accounts typically offer stable APYs around 0.50% to 1.00%, providing predictable earnings on savings, while Prize-Linked Savings accounts use gamification to potentially increase returns through sweepstakes and cash prizes without risking the principal. The gamified element in Prize-Linked Savings enhances user engagement and savings motivation by combining traditional interest earnings with the excitement of winning, often leading to higher overall savings rates despite lower base APYs.

Sweepstake Savings Accounts

Money Market Accounts offer higher interest rates with liquidity and FDIC insurance, ideal for conservative savers seeking steady returns, while Prize-Linked Savings Accounts combine savings growth with the excitement of sweepstakes entries, encouraging consistent deposits through potential cash prizes. Sweepstake Savings Accounts incentivize regular saving habits by providing chances to win prizes without risking principal, appealing to younger or motivational savers aiming to build emergency funds.

Tiered Withdrawal Incentives

Money Market Accounts offer tiered withdrawal incentives based on balance thresholds, encouraging higher deposits with progressively better interest rates, while Prize-Linked Savings accounts provide chances to win cash prizes instead of traditional interest, appealing to savers motivated by potential rewards rather than incremental yield. The choice depends on prioritizing predictable tiered returns versus the excitement of prize-based incentives in savings behavior.

Instant Prize Disbursement

Money Market Accounts offer stable interest rates with easy access to funds, but Prize-Linked Savings accounts enhance saving motivation through instant prize disbursement, providing immediate financial rewards alongside potential interest earnings. Instant prize disbursement in Prize-Linked Savings creates a unique incentive to save by combining traditional savings growth with the excitement of frequent prize wins.

Reg D Flex Savings

Reg D Flex Savings offers flexible withdrawal options exempt from the traditional six-per-month limit under Regulation D, making it more accessible than Money Market Accounts, which often have higher minimum balance requirements and lower interest rates. Prize-Linked Savings accounts enhance savings motivation through periodic cash prizes without risking principal, but typically lack the liquidity and flexible withdrawal terms of Reg D Flex Savings, positioning them as a complementary but less flexible savings vehicle.

Passive Contest Earnings

Money market accounts offer steady interest with liquidity, while prize-linked savings accounts provide a chance to earn lottery-style rewards without risking principal, making them attractive for passive contest earnings. These accounts combine financial security with the excitement of potential high returns, appealing to savers seeking low-risk growth alongside occasional windfalls.

Liquidity-Linked Rewards

Money Market Accounts offer high liquidity with interest rates tied to market conditions, enabling quick access to funds while earning steady returns; Prize-Linked Savings provide lower liquidity but incentivize saving through chances to win cash prizes, blending the excitement of lotteries with financial discipline. Comparing liquidity-linked rewards, Money Market Accounts prioritize immediate fund accessibility alongside stable growth, whereas Prize-Linked Savings reward patience and consistent deposits with periodic prize opportunities.

Money Market Account vs Prize-Linked Savings for savings. Infographic

moneydiff.com

moneydiff.com