Traditional savings accounts offer easy access and widespread availability but often come with lower interest rates that limit long-term growth potential. High-yield digital accounts provide significantly higher interest rates, enabling faster savings growth while requiring online management and fewer physical branches. Choosing between the two depends on balancing convenience with maximizing returns on your savings.

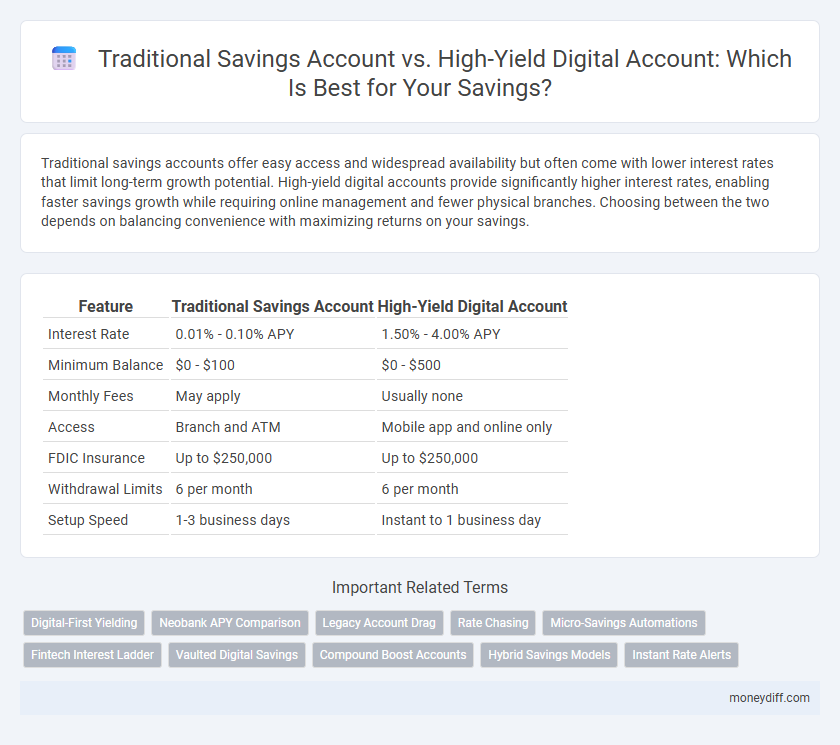

Table of Comparison

| Feature | Traditional Savings Account | High-Yield Digital Account |

|---|---|---|

| Interest Rate | 0.01% - 0.10% APY | 1.50% - 4.00% APY |

| Minimum Balance | $0 - $100 | $0 - $500 |

| Monthly Fees | May apply | Usually none |

| Access | Branch and ATM | Mobile app and online only |

| FDIC Insurance | Up to $250,000 | Up to $250,000 |

| Withdrawal Limits | 6 per month | 6 per month |

| Setup Speed | 1-3 business days | Instant to 1 business day |

Understanding Traditional Savings Accounts

Traditional savings accounts offer a secure method to grow funds with FDIC insurance up to $250,000, providing easy access through bank branches and ATMs. These accounts typically feature lower interest rates, often below 0.10% APY, resulting in modest growth compared to high-yield options. Understanding their stability and liquidity is essential when comparing to high-yield digital accounts that emphasize higher returns but may require online management.

What Are High-Yield Digital Savings Accounts?

High-yield digital savings accounts offer significantly higher interest rates compared to traditional savings accounts, often ranging from 3% to 5% APY, making them ideal for growing savings faster. These accounts operate primarily online, eliminating physical branch costs, which allows banks to pass on higher returns to customers. Features commonly include low minimum balance requirements, FDIC insurance up to $250,000, and easy access to funds via mobile apps and websites.

Interest Rates: A Comparative Analysis

Traditional savings accounts typically offer lower interest rates, averaging around 0.01% to 0.10% APY, compared to high-yield digital accounts that can provide rates ranging from 3% to 5% APY. High-yield digital savings accounts leverage lower overhead costs to pass greater returns to customers, making them more attractive for maximizing interest earnings. Choosing a high-yield digital account can significantly accelerate savings growth through substantially higher compounded interest.

Accessibility and Convenience in Account Management

Traditional savings accounts offer easy access through widespread branch networks and ATM availability, but often involve limited online features. High-yield digital savings accounts provide superior convenience with 24/7 access via mobile apps and online platforms, enabling seamless transfers and real-time balance monitoring. Enhanced digital tools and automated alerts in high-yield accounts improve account management, making them ideal for tech-savvy savers seeking efficiency.

Fees and Minimum Balance Requirements

Traditional savings accounts often have higher fees and require a minimum balance to avoid monthly charges, which can reduce overall savings growth. High-yield digital savings accounts typically offer lower or no fees and have minimal or no minimum balance requirements, maximizing the interest earned. Choosing a digital high-yield account can enhance savings by minimizing costs and allowing more flexible account management.

Security and Insurance Considerations

Traditional savings accounts offer strong security backed by federal insurance through the FDIC or NCUA, ensuring deposits up to $250,000 are protected. High-yield digital savings accounts also provide similar federal insurance coverage but may carry additional cybersecurity risks due to their online-only nature. Evaluating the security protocols and insurance limits is essential when choosing between these options for maximizing both safety and returns.

Customer Service and Support Differences

Traditional savings accounts often provide in-person customer service through branch visits, phone support, and dedicated account managers, which appeals to customers seeking personalized assistance. High-yield digital accounts primarily rely on online support channels such as chat, email, and phone, offering 24/7 accessibility but limited face-to-face interactions. Customers valuing immediate, hands-on service may prefer traditional banks, whereas tech-savvy savers prioritize convenience and digital responsiveness in high-yield accounts.

Digital Features and Technological Advantages

High-yield digital savings accounts leverage advanced technology to offer seamless mobile access, real-time transaction alerts, and automated savings tools, enhancing user experience and financial management. Unlike traditional savings accounts, digital options provide higher interest rates through lower overhead costs and efficient online platforms with features like customizable savings goals and instant fund transfers. These technological advantages enable faster account setup, enhanced security with biometric authentication, and 24/7 account monitoring, driving greater convenience and optimized savings growth.

Who Should Choose Traditional vs High-Yield Accounts?

Traditional savings accounts suit individuals valuing easy access and branch services, often preferred by those with minimal tech experience or seeking FDIC-insured security. High-yield digital accounts benefit savers aiming to maximize interest returns through higher APYs, appropriate for tech-savvy users comfortable with online-only banking. Choosing depends on prioritizing convenience and in-person support versus maximizing savings growth through elevated interest rates.

Making the Best Choice for Your Savings Goals

Traditional savings accounts offer stability and easy access with lower interest rates, making them suitable for emergency funds or short-term savings. High-yield digital accounts provide significantly higher annual percentage yields (APYs), ideal for maximizing growth on long-term savings, but may have limited physical branch access. Evaluating factors like interest rates, accessibility, fees, and your savings timeline ensures choosing the best account aligned with your financial goals.

Related Important Terms

Digital-First Yielding

High-yield digital savings accounts typically offer interest rates 10 to 20 times higher than traditional savings accounts, leveraging lower overhead costs and advanced technology to maximize returns. These digital-first platforms provide instant access, seamless mobile banking, and compound interest benefits, making them a superior choice for savers seeking efficient growth and liquidity.

Neobank APY Comparison

High-yield digital savings accounts from neobanks offer APYs often exceeding 4%, significantly outperforming traditional savings accounts with average rates around 0.05% to 0.50%. Neobank platforms leverage low overhead costs to deliver enhanced interest rates, faster access to funds, and user-friendly mobile interfaces, making them a superior option for maximizing savings growth.

Legacy Account Drag

Traditional savings accounts often suffer from legacy account drag, characterized by lower interest rates and outdated fee structures that reduce overall savings growth. High-yield digital accounts leverage advanced technology and streamlined operations to offer significantly higher returns, minimizing legacy cost burdens and maximizing interest earnings for savers.

Rate Chasing

Traditional savings accounts typically offer lower interest rates averaging around 0.01% to 0.10%, making them less effective for rate chasing compared to high-yield digital accounts that frequently deliver rates between 3.00% and 5.00%. High-yield digital accounts leverage online platforms to minimize overhead costs, enabling them to pass significant interest rate benefits directly to savers aiming to maximize returns.

Micro-Savings Automations

Traditional savings accounts typically offer lower interest rates and require manual transfers, limiting the growth potential of small, regular deposits. High-yield digital accounts leverage micro-savings automations that round up purchases or set recurring transfers, maximizing savings growth through consistent, automated contributions and competitive APYs.

Fintech Interest Ladder

High-yield digital accounts offered by fintech companies often provide interest rates multiple times higher than traditional savings accounts, leveraging agile technology platforms to optimize returns. By using the fintech interest ladder, savers can strategically allocate funds across various digital savings products to maximize interest income while maintaining liquidity.

Vaulted Digital Savings

Vaulted Digital Savings offers significantly higher annual percentage yields (APYs) compared to traditional savings accounts, enabling faster growth of your funds through compounded interest. Its fully digital platform provides seamless access, reduced fees, and enhanced security features, making it an efficient choice for modern savers seeking maximum returns.

Compound Boost Accounts

Compound Boost Accounts offer significantly higher interest rates compared to traditional savings accounts, leveraging digital platforms to maximize compound growth and accelerate savings over time. Unlike conventional accounts with lower yields, these high-yield digital options optimize returns through frequent compounding and reduced fees, enhancing overall savings performance.

Hybrid Savings Models

Hybrid savings models combine the stability of traditional savings accounts, offering FDIC insurance and branch access, with the higher interest rates and digital convenience of high-yield online accounts. These hybrid options optimize liquidity and growth potential by leveraging both physical banking services and competitive yields from digital platforms, addressing diverse saver needs in a single financial product.

Instant Rate Alerts

High-yield digital savings accounts offer instant rate alerts to notify users of interest rate changes, enabling timely adjustments to maximize returns. Traditional savings accounts typically lack real-time notifications, potentially causing missed opportunities for optimizing savings growth.

Traditional Savings Account vs High-Yield Digital Account for savings. Infographic

moneydiff.com

moneydiff.com