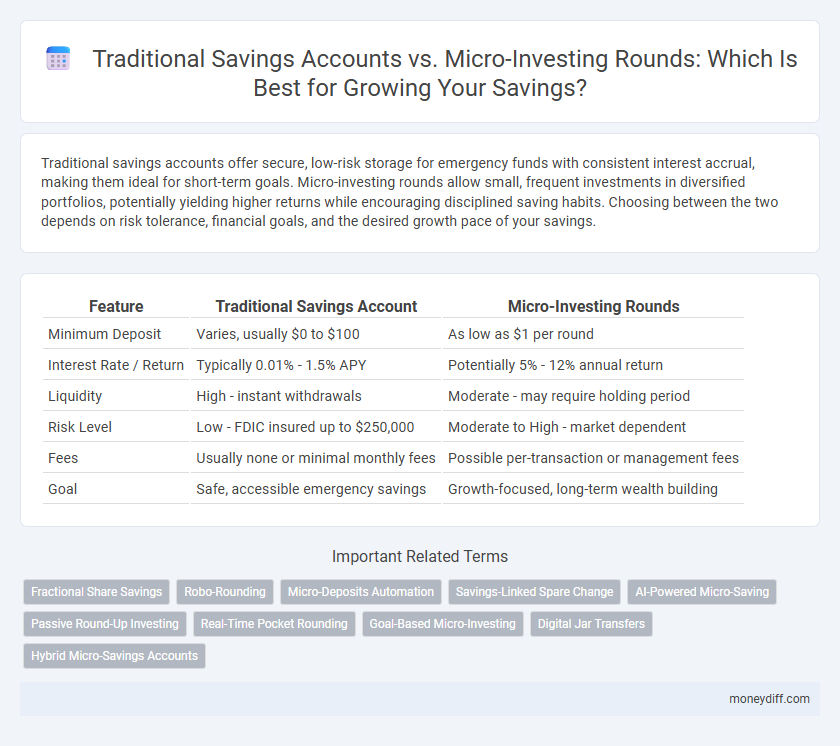

Traditional savings accounts offer secure, low-risk storage for emergency funds with consistent interest accrual, making them ideal for short-term goals. Micro-investing rounds allow small, frequent investments in diversified portfolios, potentially yielding higher returns while encouraging disciplined saving habits. Choosing between the two depends on risk tolerance, financial goals, and the desired growth pace of your savings.

Table of Comparison

| Feature | Traditional Savings Account | Micro-Investing Rounds |

|---|---|---|

| Minimum Deposit | Varies, usually $0 to $100 | As low as $1 per round |

| Interest Rate / Return | Typically 0.01% - 1.5% APY | Potentially 5% - 12% annual return |

| Liquidity | High - instant withdrawals | Moderate - may require holding period |

| Risk Level | Low - FDIC insured up to $250,000 | Moderate to High - market dependent |

| Fees | Usually none or minimal monthly fees | Possible per-transaction or management fees |

| Goal | Safe, accessible emergency savings | Growth-focused, long-term wealth building |

Understanding Traditional Savings Accounts

Traditional savings accounts offer a secure way to save money with federally insured deposits and typically provide fixed interest rates, although these rates are often lower compared to other investment options. They allow easy access to funds through withdrawals and transfers, making them ideal for emergency funds and short-term savings goals. The lack of market risk and simplicity in managing traditional savings accounts provide a stable foundation for financial planning and wealth preservation.

What Are Micro-Investing Rounds?

Micro-investing rounds are small, incremental investments typically made through automated platforms that round up everyday purchases to the nearest dollar and invest the spare change into diversified portfolios. Unlike traditional savings accounts that offer interest on deposited funds, micro-investing rounds aim to grow wealth over time by leveraging market returns with minimal initial capital. This approach encourages consistent investment habits and can complement traditional savings by providing potential higher returns and exposure to financial markets.

Comparing Accessibility: Savings Accounts vs Micro-Investing

Traditional savings accounts offer quick access to funds with minimal requirements, making them highly accessible for everyday saving needs. Micro-investing platforms enable users to invest small amounts in fractional shares, expanding access to investment opportunities without significant capital. Both methods provide accessible entry points to grow savings, but micro-investing introduces potential for higher returns alongside varying liquidity conditions.

Interest vs Investment Returns: Which Grows Your Money Faster?

Traditional savings accounts offer low but guaranteed interest rates, typically ranging from 0.01% to 1.5% annually, ensuring steady growth with minimal risk. Micro-investing rounds, however, can yield higher returns averaging 5% to 12% per year by investing in diversified portfolios, although these come with greater market volatility and risk. Comparing interest versus investment returns, micro-investing rounds generally grow your money faster over the long term, but they may not provide the stability that traditional savings accounts guarantee.

Fees and Costs: Traditional Savings Accounts vs Micro-Investing Apps

Traditional savings accounts typically charge minimal or no fees, offering straightforward access to deposited funds with guaranteed interest rates, making them ideal for low-risk savers. Micro-investing apps often impose fees through subscription plans, management fees, or transaction costs, which can gradually reduce overall returns, especially on smaller balances. Evaluating fee structures relative to potential growth is crucial for savers choosing between the steady, low-cost nature of traditional accounts and the growth opportunities paired with higher fees in micro-investing rounds.

Saving Habits: Automation in Traditional and Micro-Investing Methods

Automation in traditional savings accounts enables systematic deposits through scheduled transfers, fostering consistent saving habits without active management. Micro-investing rounds leverage app-based features that automatically round up everyday purchases to invest the spare change, seamlessly integrating saving with daily spending. Both methods enhance financial discipline by simplifying the process, reducing decision fatigue, and encouraging incremental growth of savings over time.

Risk Factors: Safety of Savings Accounts and Micro-Investing

Traditional savings accounts offer high safety due to federal insurance protection like FDIC or NCUA, ensuring deposits up to $250,000 are secured against bank failures. Micro-investing rounds, while providing opportunities for growth through diversified portfolios, carry higher risk from market volatility and lack of federal insurance on investments. Investors must weigh the guaranteed principal security of savings accounts against the potential returns and inherent market risks of micro-investing platforms.

Long-Term Growth Potential: Savings Accounts vs Micro-Investing

Traditional savings accounts offer low risk and liquidity but typically yield minimal interest rates, limiting long-term growth potential. Micro-investing rounds, by contrast, enable incremental investments in diversified portfolios with potential for higher returns driven by market appreciation and dividends. Over extended periods, micro-investing often outperforms savings accounts by leveraging compound growth despite increased exposure to market volatility.

Best for Beginners: Choosing Between Savings Accounts and Micro-Investing Rounds

Traditional savings accounts offer low-risk, FDIC-insured options with modest interest rates, ideal for beginners seeking stability and easy access to funds. Micro-investing rounds enable small, incremental investments in diversified portfolios, promoting wealth growth and financial literacy with minimal upfront capital. Beginners should assess their risk tolerance and financial goals to decide between the guaranteed returns of savings accounts and the growth potential of micro-investing platforms.

Which Option Suits Your Financial Goals?

Traditional savings accounts offer low-risk, liquid options with modest interest rates, ideal for emergency funds or short-term goals. Micro-investing rounds allow incremental investments in diversified portfolios, targeting long-term growth but with higher market risk. Choosing between these depends on your risk tolerance, investment horizon, and financial objectives.

Related Important Terms

Fractional Share Savings

Traditional savings accounts offer low-interest rates and limited growth potential, while micro-investing rounds enable savings through fractional share purchases, allowing for diversified portfolios with minimal capital. Fractional share savings empower individuals to invest small amounts regularly, maximizing returns beyond standard bank interest rates and fostering long-term wealth accumulation.

Robo-Rounding

Traditional savings accounts offer low-interest rates and easy access to funds, but often lack growth potential compared to micro-investing rounds enabled by robo-rounding technology. Robo-rounding automatically invests spare change from everyday purchases into diversified portfolios, enhancing savings growth through compounding and reducing the temptation to spend extra cash.

Micro-Deposits Automation

Micro-investing rounds automate savings by rounding up everyday purchases and transferring the difference into investment accounts, enabling consistent wealth growth with minimal effort. Traditional savings accounts offer low-risk, liquid storage but typically yield lower returns compared to automated micro-deposits that capitalize on compounding investment gains.

Savings-Linked Spare Change

Savings-linked spare change through micro-investing rounds automatically rounds transactions up to the nearest dollar, directing the difference into diversified investment portfolios that potentially yield higher returns compared to traditional savings accounts with low interest rates. This method promotes disciplined saving by leveraging everyday spending habits, transforming small, incremental amounts into significant long-term wealth accumulation.

AI-Powered Micro-Saving

Traditional savings accounts offer stable interest rates and easy access but typically yield lower returns compared to AI-powered micro-investing rounds, which use machine learning algorithms to optimize small, frequent investments for higher growth potential. AI-driven platforms analyze spending patterns and market trends to automate and personalize micro-savings, enhancing long-term wealth accumulation beyond conventional savings methods.

Passive Round-Up Investing

Traditional savings accounts offer low-interest rates that often fail to outpace inflation, limiting the growth of your savings over time. Passive round-up investing automatically rounds up everyday purchases to the nearest dollar, funneling small, consistent amounts into diversified portfolios, which can significantly enhance long-term wealth accumulation compared to static savings accounts.

Real-Time Pocket Rounding

Traditional savings accounts typically offer low interest rates and lack real-time growth opportunities, whereas micro-investing rounds with real-time pocket rounding enable users to automatically invest spare change from everyday purchases, boosting savings through continuous, incremental investments. This approach leverages technology to optimize wealth accumulation by turning small, frequent transactions into meaningful investment contributions without impacting cash flow.

Goal-Based Micro-Investing

Goal-based micro-investing rounds allow savers to allocate small, regular amounts into diversified portfolios tailored to specific financial objectives, often yielding higher returns than traditional savings accounts with low-interest rates. These investment rounds leverage automation and behavioral economics to enhance disciplined saving and wealth-building, surpassing the passive growth typical of conventional savings accounts.

Digital Jar Transfers

Traditional savings accounts offer secure, low-yield interest rates with easy access to funds, but often lack the dynamic growth potential of micro-investing rounds that leverage digital jar transfers to automate small, frequent contributions into diversified portfolios; this method enhances compound growth while maintaining affordability and user engagement through seamless mobile app integrations. Digital jar transfers optimize savings habits by rounding up everyday purchases and transferring the difference into micro-investing accounts, promoting disciplined saving that adapts to spending patterns without requiring significant financial commitments.

Hybrid Micro-Savings Accounts

Hybrid micro-savings accounts combine the low-risk stability of traditional savings accounts with the growth potential of micro-investing rounds, allowing users to automatically invest small, rounded-up amounts from their daily transactions. This innovative approach maximizes savings efficiency by balancing liquidity and higher returns, making it an optimal solution for individuals seeking steady wealth accumulation while maintaining easy access to funds.

Traditional Savings Account vs Micro-Investing Rounds for savings. Infographic

moneydiff.com

moneydiff.com