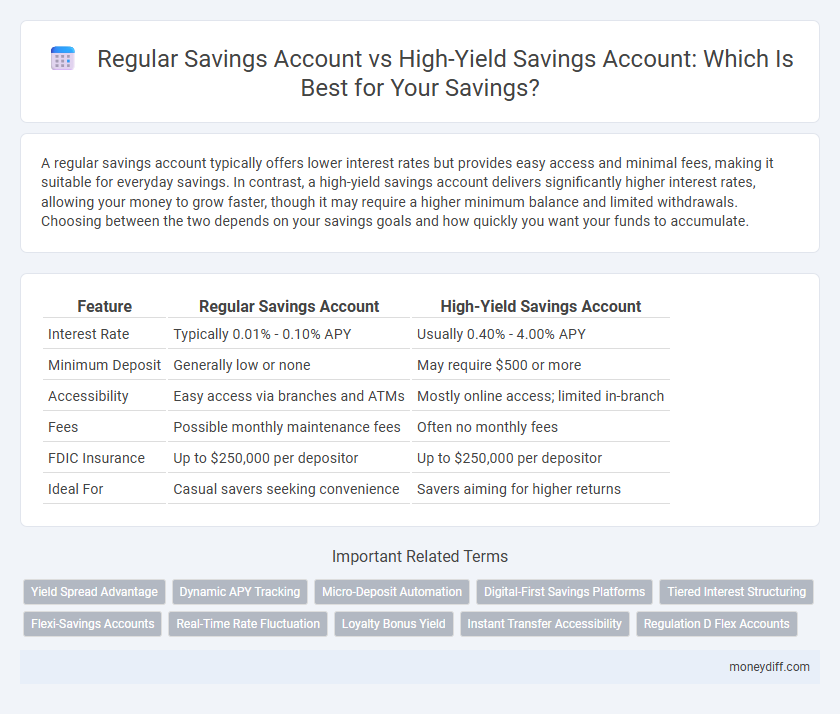

A regular savings account typically offers lower interest rates but provides easy access and minimal fees, making it suitable for everyday savings. In contrast, a high-yield savings account delivers significantly higher interest rates, allowing your money to grow faster, though it may require a higher minimum balance and limited withdrawals. Choosing between the two depends on your savings goals and how quickly you want your funds to accumulate.

Table of Comparison

| Feature | Regular Savings Account | High-Yield Savings Account |

|---|---|---|

| Interest Rate | Typically 0.01% - 0.10% APY | Usually 0.40% - 4.00% APY |

| Minimum Deposit | Generally low or none | May require $500 or more |

| Accessibility | Easy access via branches and ATMs | Mostly online access; limited in-branch |

| Fees | Possible monthly maintenance fees | Often no monthly fees |

| FDIC Insurance | Up to $250,000 per depositor | Up to $250,000 per depositor |

| Ideal For | Casual savers seeking convenience | Savers aiming for higher returns |

Introduction to Regular and High-Yield Savings Accounts

Regular savings accounts offer a safe place to store money while earning modest interest rates, typically ranging from 0.01% to 0.10% APY. High-yield savings accounts provide significantly higher interest rates, often between 3.00% and 5.00% APY, making them ideal for maximizing returns on savings. Both account types are FDIC insured and offer easy access to funds, but high-yield accounts usually require higher minimum balances or have limited physical branch access.

What is a Regular Savings Account?

A regular savings account is a basic deposit account offered by banks and credit unions, designed to help individuals save money securely while earning modest interest. These accounts typically have lower interest rates compared to high-yield savings accounts but offer easy access to funds with minimal fees. Regular savings accounts also provide FDIC or NCUA insurance protection, ensuring the safety of deposits up to $250,000.

What is a High-Yield Savings Account?

A high-yield savings account offers significantly higher interest rates compared to a regular savings account, allowing your money to grow faster over time. These accounts often require a higher minimum balance but provide enhanced earnings through compound interest, making them ideal for long-term savings goals. Unlike regular savings accounts, high-yield options are typically offered by online banks or credit unions, leveraging digital platforms to reduce costs and pass savings to customers.

Key Differences Between Regular and High-Yield Savings Accounts

Regular savings accounts typically offer lower interest rates, usually around 0.01% to 0.10%, whereas high-yield savings accounts provide significantly higher rates, often between 3% and 5%, maximizing growth on deposited funds. Regular accounts generally have low minimum balance requirements and widespread access through traditional banks, while high-yield accounts often require higher minimum deposits and are predominantly offered by online banks with fewer physical branches. Liquidity and security remain similar, both federally insured, but high-yield accounts excel in generating greater compound interest, making them ideal for long-term savings goals.

Interest Rate Comparison: Regular vs High-Yield Savings

High-yield savings accounts offer significantly higher interest rates, often ranging from 3.5% to 5% APY, compared to regular savings accounts that typically provide rates below 0.5% APY. This substantial difference in interest rates allows high-yield accounts to generate more compound interest, accelerating savings growth over time. Choosing a high-yield savings account maximizes returns while maintaining the liquidity and security of a traditional savings vehicle.

Accessibility and Convenience Features

Regular savings accounts offer easy access through extensive branch networks, ATMs, and online banking platforms, making deposits and withdrawals straightforward. High-yield savings accounts typically provide online-only access, which may limit in-person services but often includes enhanced digital tools and higher interest rates. Both account types support automatic transfers and mobile banking, but regular savings accounts prioritize accessibility while high-yield accounts emphasize convenience and returns.

Account Fees and Minimum Balance Requirements

Regular Savings Accounts usually have lower or no monthly account fees and require minimal or no minimum balance, making them accessible for starter savers. High-Yield Savings Accounts often impose higher minimum balance requirements to avoid fees but offer significantly better interest rates, enhancing long-term savings growth. Evaluating fee structures and balance thresholds is crucial to choosing the most cost-effective account for maximizing returns.

FDIC Insurance and Account Security

Regular savings accounts and high-yield savings accounts both offer FDIC insurance, protecting deposits up to $250,000 per depositor, per insured bank, ensuring account security. The primary difference lies in interest rates, while both maintain equal federal protection and security measures against bank failure. Choosing between them depends on the desired return, not the safety or insurance coverage of funds.

Who Should Choose a Regular Savings Account?

A Regular Savings Account is ideal for individuals who prioritize easy access to their funds with minimal balance requirements and lower risk. It suits savers who prefer stable, predictable interest rates and often use their savings for short-term financial goals or emergency funds. Customers seeking convenience and lower fees should consider this account type over high-yield options.

Who Benefits Most From a High-Yield Savings Account?

High-yield savings accounts benefit individuals seeking faster growth on their savings through higher interest rates compared to regular savings accounts, making them ideal for those with emergency funds or medium-term financial goals. Consumers who maintain higher balances gain the most due to compounded interest, accelerating wealth accumulation. These accounts suit disciplined savers who prioritize maximizing returns without risking principal.

Related Important Terms

Yield Spread Advantage

High-yield savings accounts typically offer interest rates ranging from 0.40% to 1.00% APY, significantly surpassing the average 0.01% to 0.05% APY found in regular savings accounts, resulting in a notable yield spread advantage that maximizes passive income over time. This yield spread can translate into hundreds of dollars in additional earnings annually on a balance of $10,000, making high-yield accounts the more profitable choice for savers looking to optimize growth.

Dynamic APY Tracking

A High-Yield Savings Account offers a dynamic APY that adjusts based on market conditions, maximizing interest earnings compared to the fixed rates of a Regular Savings Account. Tracking these variable APYs in real-time enables savers to optimize returns and respond promptly to fluctuating economic trends.

Micro-Deposit Automation

Regular Savings Accounts provide basic interest rates with manual deposit tracking, whereas High-Yield Savings Accounts offer significantly higher annual percentage yields (APYs) and often integrate micro-deposit automation for seamless, incremental fund transfers. This automation enhances liquidity management by enabling automated small deposits that accumulate interest efficiently, optimizing savings growth without manual intervention.

Digital-First Savings Platforms

Digital-first savings platforms offer both Regular Savings Accounts and High-Yield Savings Accounts, with the latter typically providing annual percentage yields (APYs) that are 10 to 20 times higher than traditional accounts, maximizing growth potential for savers. These platforms leverage automated features and seamless mobile access, enabling users to efficiently manage funds while earning competitive interest rates without the fees commonly associated with brick-and-mortar banks.

Tiered Interest Structuring

Regular savings accounts typically offer a fixed, low interest rate regardless of the balance, while high-yield savings accounts use tiered interest structuring to provide increasing interest rates as the account balance grows, maximizing earnings potential. This tiered approach rewards larger deposits by applying higher interest rates at specific balance thresholds, making high-yield options more advantageous for savers with substantial funds.

Flexi-Savings Accounts

Flexi-savings accounts offer a blend of regular savings account flexibility with higher interest rates typically found in high-yield savings accounts, allowing depositors to access funds without penalties while earning competitive returns. These accounts often feature tiered interest rates based on balance thresholds, combining liquidity with optimized growth potential for short-term and emergency savings.

Real-Time Rate Fluctuation

Regular savings accounts typically offer stable but lower interest rates with minimal real-time rate fluctuation, providing predictable growth. High-yield savings accounts, however, feature rates that can fluctuate in real-time with market conditions, potentially maximizing earnings when interest rates rise.

Loyalty Bonus Yield

Regular savings accounts typically offer lower interest rates, whereas high-yield savings accounts provide significantly higher returns, sometimes enhanced by loyalty bonus yields that reward consistent account activity. These loyalty bonus yields can increase the annual percentage yield (APY) by 0.1% to 0.5%, making high-yield accounts more lucrative for long-term savers who maintain regular deposits and minimal withdrawals.

Instant Transfer Accessibility

High-yield savings accounts often provide instant transfer accessibility with faster transaction processing compared to regular savings accounts, enabling immediate fund availability for emergencies or investments. Regular savings accounts generally have slower transfer speeds and limited liquidity, which may delay access to funds when needed quickly.

Regulation D Flex Accounts

Regular Savings Accounts typically limit withdrawals to six per month due to Regulation D, while High-Yield Savings Accounts often offer similar withdrawal restrictions but provide higher interest rates to grow savings faster. Regulation D Flex Accounts combine features from both, allowing more flexible transaction limits with competitive yields, making them ideal for savers seeking both accessibility and higher returns.

Regular Savings Account vs High-Yield Savings Account for savings. Infographic

moneydiff.com

moneydiff.com