A high-yield cash management account typically offers significantly higher interest rates compared to traditional savings accounts, making it a more efficient option for growing your savings. These accounts often come with added features such as limited check writing and debit card access, combining the benefits of saving and spending flexibility. However, savings accounts provide greater stability and are usually insured by the FDIC, ensuring the safety of your funds.

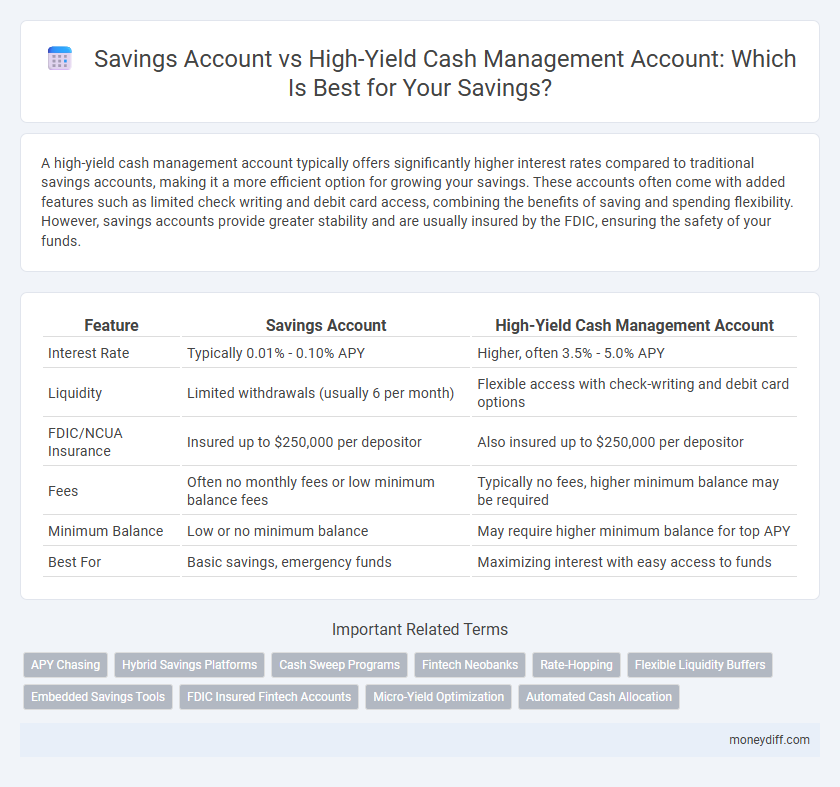

Table of Comparison

| Feature | Savings Account | High-Yield Cash Management Account |

|---|---|---|

| Interest Rate | Typically 0.01% - 0.10% APY | Higher, often 3.5% - 5.0% APY |

| Liquidity | Limited withdrawals (usually 6 per month) | Flexible access with check-writing and debit card options |

| FDIC/NCUA Insurance | Insured up to $250,000 per depositor | Also insured up to $250,000 per depositor |

| Fees | Often no monthly fees or low minimum balance fees | Typically no fees, higher minimum balance may be required |

| Minimum Balance | Low or no minimum balance | May require higher minimum balance for top APY |

| Best For | Basic savings, emergency funds | Maximizing interest with easy access to funds |

Understanding Savings Accounts: Key Features and Benefits

Savings accounts typically offer easy access to funds with FDIC insurance up to $250,000, making them a secure option for storing emergency money. High-yield cash management accounts provide significantly higher interest rates, often exceeding 4%, while combining features of both savings and checking accounts, including ATM access and bill pay. Comparing annual percentage yields (APY), fees, and liquidity helps determine the best choice for maximizing growth while maintaining flexibility.

What Is a High-Yield Cash Management Account?

A high-yield cash management account is a financial product that combines the benefits of a traditional savings account with higher interest rates typically offered by investment platforms or fintech companies. It allows users to earn significantly more interest on their savings while maintaining liquidity and easy access to funds through features like debit cards and check-writing. These accounts often provide FDIC insurance through partner banks, making them a secure alternative for maximizing returns on savings compared to standard savings accounts.

Comparing Interest Rates: Savings vs High-Yield Cash Management

High-yield cash management accounts typically offer interest rates ranging from 3.5% to 5.0% APY, significantly higher than traditional savings accounts, which average around 0.01% to 0.10% APY. This substantial difference in interest rates allows high-yield cash management accounts to grow your savings faster while maintaining liquidity. Choosing a high-yield cash management account can maximize earnings on idle funds without sacrificing easy access compared to standard savings accounts.

Accessibility and Withdrawal Limits: Which Account Wins?

High-yield cash management accounts generally offer superior accessibility with features like unlimited electronic transfers and ATM withdrawals, compared to traditional savings accounts that often limit withdrawals to six per month. Savings accounts typically impose Federal Reserve Regulation D restrictions, making them less flexible for frequent access. For those prioritizing easy and frequent withdrawals, high-yield cash management accounts provide a clear advantage in accessibility and withdrawal limits.

Fees and Minimum Balance Requirements

Savings accounts generally have lower minimum balance requirements but may charge monthly maintenance fees if the balance falls below the threshold. High-yield cash management accounts often require a higher minimum balance yet offer fee waivers contingent on account activity or linked services. Comparing fee structures and minimum balance policies is essential to maximize returns and minimize costs in savings strategies.

Security and FDIC Insurance: How Protected Are Your Savings?

Savings accounts and high-yield cash management accounts both offer varying levels of security backed by FDIC insurance, typically protecting deposits up to $250,000 per depositor, per institution. High-yield cash management accounts often provide similar FDIC insurance coverage through partner banks, ensuring that your savings remain secure despite offering higher yields. It is essential to verify the FDIC-insured status of the financial institution or partner banks involved to ensure your funds are fully protected against losses.

Mobile Banking and Digital Tools: Ease of Managing Your Money

High-yield cash management accounts often provide advanced mobile banking features, including intuitive apps with real-time transaction alerts, budgeting tools, and seamless fund transfers that enhance user experience. Traditional savings accounts may offer basic mobile access but typically lack the comprehensive digital tools designed for proactive money management. Utilizing digital platforms embedded in high-yield accounts allows for more efficient tracking and optimization of your savings.

Suitability for Short-Term vs Long-Term Savings Goals

Savings accounts typically offer easy access and lower interest rates, making them suitable for short-term savings goals where liquidity is essential. High-yield cash management accounts provide higher returns but may have certain restrictions or limited transaction capabilities, aligning better with medium to long-term savings objectives. Evaluating factors like interest rates, accessibility, and account features helps determine the optimal choice based on individual savings timelines.

How Each Account Supports Financial Growth

Savings accounts offer stable interest rates with FDIC insurance, ensuring principal protection while providing easy access to funds for building emergency reserves. High-yield cash management accounts combine higher interest rates with flexibility and features like check-writing and debit card access, accelerating financial growth through compounding returns. Both account types support financial growth by balancing safety, liquidity, and interest earnings, but high-yield options typically maximize growth potential for diligent savers.

Which Account Is Right for You? Decision Factors to Consider

A savings account offers steady interest rates with easy access, ideal for emergency funds and short-term goals, whereas a high-yield cash management account typically provides higher returns through competitive interest rates and additional features like debit cards and check-writing capabilities, suited for higher balances and those seeking growth with liquidity. Consider factors such as interest rate competitiveness, fees, accessibility, FDIC insurance, and minimum balance requirements to determine which aligns with your financial goals and usage habits. Evaluate your savings timeline, risk tolerance, and desire for transactional capabilities to select the optimal account type.

Related Important Terms

APY Chasing

High-yield cash management accounts often offer significantly higher APYs compared to traditional savings accounts, making them more effective for maximizing interest earnings. While savings accounts typically provide lower APYs regulated by banks, cash management accounts leverage partnerships with multiple banks to deliver competitive rates that enhance overall returns.

Hybrid Savings Platforms

Hybrid savings platforms combine features of traditional savings accounts and high-yield cash management accounts, offering competitive interest rates with easy access to funds. These platforms leverage FDIC insurance coverage across multiple banks while providing integrated digital tools for efficient savings management.

Cash Sweep Programs

Cash Sweep Programs in high-yield cash management accounts automatically transfer excess funds into interest-bearing accounts, often providing higher returns than traditional savings accounts. These programs optimize liquidity and yield by leveraging multiple financial institutions, enhancing both access and income for savers.

Fintech Neobanks

Fintech neobanks typically offer high-yield cash management accounts with interest rates significantly higher than traditional savings accounts, leveraging digital platforms to reduce overhead costs and pass savings to customers. These accounts often include features such as no minimum balance, seamless mobile access, and integrated budgeting tools, making them more attractive for modern savers seeking liquidity and growth simultaneously.

Rate-Hopping

Savings accounts typically offer lower interest rates with less frequent rate changes, whereas high-yield cash management accounts provide opportunities for rate-hopping by quickly moving funds between various financial products to maximize returns. Rate-hopping strategies leverage fluctuating APYs in high-yield accounts, enabling savers to capture higher yields compared to the stable but often lower rates of traditional savings accounts.

Flexible Liquidity Buffers

Savings accounts offer reliable liquidity buffers with easy access to funds through ATMs and online transfers, but often provide lower interest rates. High-yield cash management accounts combine flexible liquidity with higher returns by allowing instant transfers and check-writing features while offering competitive APYs that outperform traditional savings accounts.

Embedded Savings Tools

Embedded savings tools in high-yield cash management accounts often include automated transfers, round-up features, and goal tracking, enabling more consistent and strategic saving compared to traditional savings accounts. These tools leverage technology to optimize saving habits and maximize interest earnings, making high-yield options more effective for long-term financial growth.

FDIC Insured Fintech Accounts

FDIC insured fintech savings accounts typically offer higher interest rates and greater flexibility compared to traditional savings accounts, making high-yield cash management accounts an attractive option for maximizing savings growth. These accounts often provide seamless digital access, no minimum balance requirements, and competitive APYs, ensuring both security and enhanced earning potential for depositors.

Micro-Yield Optimization

Savings accounts typically offer lower interest rates, averaging around 0.05% APY, limiting micro-yield optimization opportunities for small balances. High-yield cash management accounts provide significantly higher APYs, often between 3% to 5%, enabling more effective compounding and maximizing returns on incremental savings.

Automated Cash Allocation

High-yield cash management accounts offer automated cash allocation features that optimize interest earnings by dynamically distributing funds across multiple interest-bearing accounts, unlike traditional savings accounts which typically lack automation. This automated process maximizes returns and enhances liquidity management without requiring manual transfers or account monitoring.

Savings account vs High-yield cash management account for savings. Infographic

moneydiff.com

moneydiff.com