Traditional savings accounts offer low-risk, steady interest returns with liquidity but often yield lower growth compared to other investment options. DeFi staking provides higher potential returns by locking digital assets in blockchain networks, though it carries increased risks such as market volatility and smart contract vulnerabilities. Balancing traditional savings with DeFi staking can optimize retirement portfolios by combining stability with growth opportunities in the evolving financial landscape.

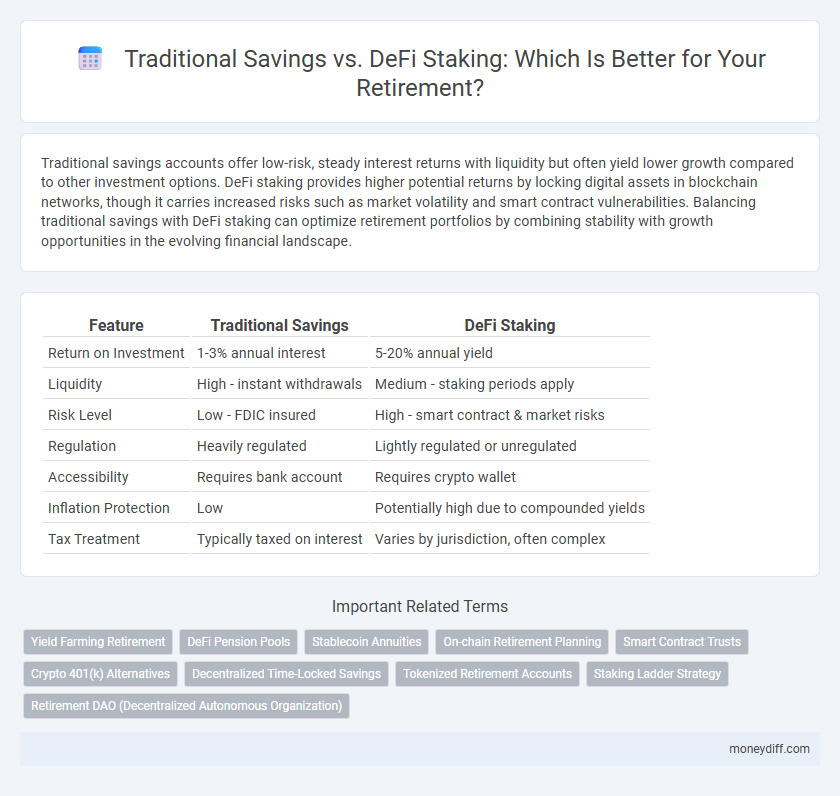

Table of Comparison

| Feature | Traditional Savings | DeFi Staking |

|---|---|---|

| Return on Investment | 1-3% annual interest | 5-20% annual yield |

| Liquidity | High - instant withdrawals | Medium - staking periods apply |

| Risk Level | Low - FDIC insured | High - smart contract & market risks |

| Regulation | Heavily regulated | Lightly regulated or unregulated |

| Accessibility | Requires bank account | Requires crypto wallet |

| Inflation Protection | Low | Potentially high due to compounded yields |

| Tax Treatment | Typically taxed on interest | Varies by jurisdiction, often complex |

Understanding Traditional Savings for Retirement

Traditional savings for retirement typically involve low-risk accounts like IRAs, 401(k)s, or savings accounts that offer steady but modest interest rates. These methods prioritize capital preservation and predictable growth, relying on established banking systems and often come with regulatory protections. Understanding the limitations in returns compared to emerging options is essential for balancing risk and long-term financial goals.

What is DeFi Staking?

DeFi staking involves locking cryptocurrency assets in decentralized finance protocols to earn rewards or interest, leveraging blockchain technology for transparent and automated income generation. Unlike traditional savings accounts, which offer fixed or low interest rates, DeFi staking provides potentially higher yields by participating in network consensus mechanisms or liquidity provision. This innovative approach enables retirees to diversify their portfolios and access more dynamic income streams beyond conventional banking systems.

Security: Bank Guarantees vs Blockchain Protocols

Traditional savings accounts offer bank guarantees backed by federal insurance programs such as the FDIC, ensuring principal protection and low risk for retirement funds. DeFi staking relies on blockchain protocols, where security depends on smart contract integrity and network consensus, introducing higher risk but potentially greater returns. Evaluating retirement options requires weighing the reliability of insured deposits against the innovative yet volatile security mechanisms of decentralized finance.

Comparing Interest Rates: Savings Accounts vs DeFi Staking

Traditional savings accounts typically offer annual interest rates averaging between 0.01% and 1.0%, providing low-risk but modest returns for retirement funds. DeFi staking platforms can yield significantly higher interest rates, often ranging from 5% to 20% or more annually, though they carry increased risks such as market volatility and smart contract vulnerabilities. Evaluating these options involves balancing the steady, insured growth of savings accounts against the potentially higher, but less predictable, returns offered by DeFi staking for retirement planning.

Accessibility and Flexibility: Traditional vs DeFi

Traditional savings accounts offer limited accessibility, often requiring physical visits to banks and operating within fixed business hours, which can delay transactions and reduce flexibility for retirement planning. DeFi staking platforms provide enhanced accessibility by enabling users worldwide to participate 24/7 through decentralized applications, allowing instant transactions and flexible adjustment of staking terms. This increased flexibility in DeFi staking supports dynamic retirement strategies by allowing more frequent reallocation of assets based on market conditions and personal financial goals.

Inflation: Impact on Savings and Staking Returns

Traditional savings accounts typically offer low interest rates that often fail to keep pace with inflation, eroding the real value of retirement funds over time. In contrast, DeFi staking can provide higher returns by leveraging blockchain protocols, but these returns come with increased volatility and risk. Understanding the inflation-adjusted yield of each option is crucial for maintaining purchasing power during retirement.

Regulatory Considerations and Legal Protections

Traditional savings accounts offer established regulatory frameworks and government-backed protections such as FDIC insurance, ensuring depositor security in retirement planning. DeFi staking operates within a largely unregulated environment, exposing investors to higher risks including smart contract vulnerabilities and regulatory uncertainty. Evaluating legal protections and compliance is crucial for retirees considering DeFi as a supplement or alternative to traditional retirement savings.

Risk Factors: Volatility and Loss Potential

Traditional savings accounts offer low volatility and minimal loss potential, making them a stable option for retirement funds, but often yield modest returns. DeFi staking presents higher volatility due to market fluctuations and smart contract vulnerabilities, increasing the risk of capital loss. Evaluating the balance between security and potential gains is crucial when deciding between traditional savings and DeFi staking for retirement planning.

Setting Up: Opening a Bank Account or DeFi Wallet

Setting up traditional savings for retirement begins with opening a bank account, requiring personal identification and verification to ensure security and compliance with regulations. In contrast, DeFi staking demands creating a digital wallet, such as MetaMask or Trust Wallet, enabling direct interaction with decentralized finance platforms through private keys and seed phrases for asset control. Both methods emphasize security, but DeFi wallets offer greater autonomy and the potential for higher returns through smart contract-based staking protocols.

Which Is Better for Your Retirement Goals?

Traditional savings accounts offer low risk and easy access but typically yield lower returns, which may not keep pace with inflation over a long retirement horizon. DeFi staking presents the potential for higher rewards through cryptocurrency interest and rewards, yet it carries increased risks such as market volatility and smart contract vulnerabilities. Evaluating your retirement goals, risk tolerance, and investment time frame is crucial to determine whether the security of traditional savings or the growth potential of DeFi staking better aligns with your financial future.

Related Important Terms

Yield Farming Retirement

Traditional savings accounts offer low-interest rates that often fail to keep up with inflation, limiting growth potential for retirement funds. DeFi staking and yield farming provide higher yields through decentralized finance platforms, enhancing retirement portfolios with automated compound interest and diversified digital asset exposure.

DeFi Pension Pools

Traditional savings rely on low-interest accounts that often fail to outpace inflation, limiting long-term retirement growth, while DeFi Pension Pools offer higher yields by leveraging decentralized finance protocols and staking mechanisms, enhancing passive income potential during retirement. DeFi Pension Pools utilize smart contracts to provide transparent, automated management of retirement funds, mitigating risks through diversification across various DeFi assets and staking opportunities for optimized, secure returns.

Stablecoin Annuities

Traditional savings offer low-yield, inflation-sensitive returns, while DeFi staking in stablecoin annuities provides decentralized, high-yield income streams with enhanced liquidity and inflation protection. Leveraging stablecoin annuities in DeFi can optimize retirement portfolios through programmable smart contracts and transparent, real-time interest compounding.

On-chain Retirement Planning

Traditional savings accounts offer low interest rates and limited growth potential, whereas DeFi staking leverages blockchain technology to provide higher yields and transparent on-chain retirement planning. Utilizing smart contracts for automated, secure, and verifiable asset management enables individuals to optimize their retirement portfolios with real-time data and reduced intermediary risks.

Smart Contract Trusts

Traditional savings rely on centralized financial institutions offering fixed returns, often limited by inflation and low interest rates, while DeFi staking utilizes blockchain-based Smart Contract Trusts to provide transparent, automated, and potentially higher-yield retirement income streams. Smart Contract Trusts reduce counterparty risk by enforcing predefined rules through code, ensuring secure, trustless management of assets compared to traditional methods.

Crypto 401(k) Alternatives

Traditional savings rely on fixed interest rates and regulatory protections but often yield lower returns compared to DeFi staking, which leverages blockchain protocols for potentially higher, though riskier, rewards. Crypto 401(k) alternatives integrate decentralized finance mechanisms, enabling users to earn compound interest and governance tokens while maintaining greater control over retirement assets without intermediaries.

Decentralized Time-Locked Savings

Decentralized time-locked savings in DeFi staking offer higher yield potential and enhanced liquidity compared to traditional savings accounts, leveraging smart contracts to securely lock funds for predetermined periods while earning compounded interest. Unlike conventional retirement savings, DeFi protocols provide transparent, permissionless access and programmable withdrawal restrictions that align with long-term financial goals in retirement planning.

Tokenized Retirement Accounts

Tokenized Retirement Accounts leverage DeFi staking to offer potentially higher yields and liquidity compared to traditional savings, while maintaining decentralized control over assets. This innovative approach combines blockchain transparency with automated smart contracts, reducing reliance on intermediaries and enhancing portfolio diversification for retirement planning.

Staking Ladder Strategy

The Staking Ladder Strategy in DeFi staking offers a structured approach by dividing assets into staggered lock-up periods, enhancing liquidity and maximizing returns compared to traditional savings accounts with fixed interest rates. This method provides retirees with flexible income streams and increased yield potential through compounded interest, outperforming the typically lower, fixed returns of conventional retirement savings.

Retirement DAO (Decentralized Autonomous Organization)

Traditional savings often offer limited growth due to low interest rates and inflation risks, whereas DeFi staking within a Retirement DAO leverages blockchain technology to provide decentralized governance and potentially higher, transparent returns. Retirement DAOs empower members to collectively manage funds, optimize staking strategies, and diversify investments, enhancing long-term wealth accumulation for a secure retirement.

Traditional savings vs DeFi staking for retirement. Infographic

moneydiff.com

moneydiff.com