Pension plans provide a guaranteed income stream based on salary and years of service, offering financial security in retirement without the need to manage withdrawals. Coast FI, on the other hand, involves reaching a savings amount early enough that, with compound interest, the remaining years of work can be coasted until retirement without additional contributions. Choosing between pension and Coast FI depends on one's risk tolerance, desire for financial independence, and confidence in managing investments over time.

Table of Comparison

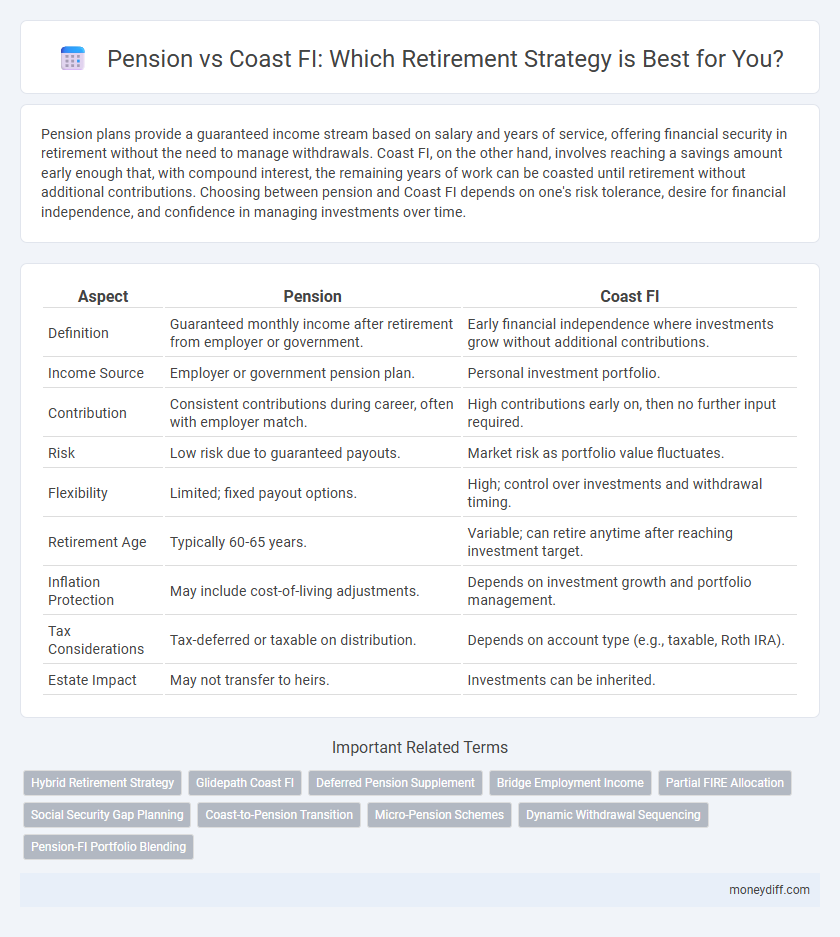

| Aspect | Pension | Coast FI |

|---|---|---|

| Definition | Guaranteed monthly income after retirement from employer or government. | Early financial independence where investments grow without additional contributions. |

| Income Source | Employer or government pension plan. | Personal investment portfolio. |

| Contribution | Consistent contributions during career, often with employer match. | High contributions early on, then no further input required. |

| Risk | Low risk due to guaranteed payouts. | Market risk as portfolio value fluctuates. |

| Flexibility | Limited; fixed payout options. | High; control over investments and withdrawal timing. |

| Retirement Age | Typically 60-65 years. | Variable; can retire anytime after reaching investment target. |

| Inflation Protection | May include cost-of-living adjustments. | Depends on investment growth and portfolio management. |

| Tax Considerations | Tax-deferred or taxable on distribution. | Depends on account type (e.g., taxable, Roth IRA). |

| Estate Impact | May not transfer to heirs. | Investments can be inherited. |

Understanding Pension Plans: Basics and Benefits

Pension plans provide a guaranteed income stream during retirement, offering financial stability through defined benefits based on salary and years of service. These plans often include survivor benefits and cost-of-living adjustments, which help protect against inflation and ensure long-term security. Understanding the structure and payouts of pension plans is crucial for effective retirement planning and comparing them to alternatives like Coast FIRE strategies.

What is Coast FI? A Modern Retirement Strategy

Coast FI is a retirement strategy where you save aggressively early on to reach a point where your investments can grow to fund your retirement without additional contributions. Unlike relying solely on a pension, which provides a predictable income based on years of service and salary, Coast FI offers flexibility by allowing you to stop contributing and let compound interest do the work. This approach enables financial independence earlier while preserving the option to draw on a traditional pension as a backup income source.

Key Differences Between Pension and Coast FI

Pension plans provide a guaranteed income stream based on years of service and salary history, offering financial stability during retirement. Coast FI (Financial Independence) requires accumulating enough assets early on so investments grow over time to cover retirement expenses without additional contributions. The key difference lies in pension guarantees versus relying on investment growth and asset accumulation for retirement funding.

Financial Independence: How Coast FI Reframes Retirement

Pension plans provide a guaranteed income stream during retirement, offering financial stability but limited flexibility. Coast Financial Independence (Coast FI) enables individuals to stop saving early and let investments grow until retirement, reframing the concept by focusing on achieving a sufficient nest egg without additional contributions. This approach emphasizes long-term compounding and financial freedom, allowing retirees to pursue passions without dependence on traditional pension structures.

Security and Predictability: Why Pensions Appeal

Pensions offer unmatched security and predictability in retirement by providing guaranteed, lifelong income streams regardless of market fluctuations. Unlike Coast FI, which relies on investment growth and requires disciplined saving until retirement, pensions eliminate longevity risk and provide stable cash flow. This certainty appeals to retirees seeking financial peace of mind without the stress of managing market volatility.

Flexibility vs Stability: Evaluating Retirement Strategies

Pension plans provide financial stability through guaranteed lifetime income, ensuring consistent cash flow during retirement. Coast FI emphasizes flexibility by accumulating sufficient investments early to cover retirement expenses without additional contributions, allowing for more control over retirement timing and lifestyle choices. Evaluating these strategies depends on personal risk tolerance, income needs, and the desire for predictable versus adaptable financial security.

Investment Requirements: Coast FI vs Pension Planning

Coast FIRE requires accumulating enough investments early so the portfolio grows to sustain retirement without additional contributions, emphasizing disciplined saving and compound growth. Pension planning often relies on defined benefits with predictable payouts, reducing the need for aggressive investment but less flexibility in retirement income sources. Investment requirements for Coast FIRE demand higher initial capital and market risk tolerance, while pension plans offer stability with limited investment decision-making.

Risk Factors: Navigating Market Fluctuations and Job Security

Pension plans offer a stable income stream often protected from market fluctuations and job security risks, providing retirees with predictable financial support. Coast Financial Independence (Coast FI) relies more heavily on market performance and requires early investment growth to ensure funds last through retirement, making it more vulnerable to economic downturns and employment interruptions. Evaluating individual risk tolerance and career stability is crucial when choosing between pension security and the more market-dependent Coast FI strategy.

Long-Term Sustainability: Which Approach Wins?

Pension plans offer reliable, lifelong income streams backed by employer contributions and government regulations, providing strong long-term sustainability and protection against market volatility. Coast FIRE strategies require careful early savings to cover future living expenses without ongoing contributions, relying heavily on market growth and disciplined financial management to maintain sustainability. For long-term security, pensions typically outperform Coast FIRE due to guaranteed benefits and less dependency on personal investment risk.

Choosing the Best Path: Factors to Consider for Your Retirement

Evaluating Pension versus Coast FIRE involves assessing guaranteed income stability against early financial independence potential. Key factors include expected pension benefits, personal savings rate, investment returns, and retirement lifestyle goals. Prioritizing tax implications, healthcare costs, and inflation impact ensures a well-informed retirement strategy tailored to long-term financial security.

Related Important Terms

Hybrid Retirement Strategy

A Hybrid Retirement Strategy integrates a traditional pension plan with Coast Financial Independence (Coast FI) principles, allowing retirees to secure a stable income while leveraging investment growth to potentially retire earlier. Combining guaranteed pension benefits and the flexibility of Coast FI enhances financial security and reduces reliance on continuous savings during retirement.

Glidepath Coast FI

Glidepath Coast FI accelerates retirement readiness by strategically increasing savings early and gradually reducing contributions while allowing investments to compound, contrasting traditional pensions that provide fixed income streams based on tenure and salary. This method maximizes wealth accumulation potential and flexibility, offering retirees more control over their financial independence compared to relying solely on pension benefits.

Deferred Pension Supplement

A Deferred Pension Supplement offers guaranteed lifetime income beginning at a specified future date, providing financial security without the need for large upfront savings. Coast FI, by contrast, relies on early aggressive investing to grow retirement assets passively, minimizing additional contributions while aiming for financial independence before traditional pension benefits commence.

Bridge Employment Income

Bridge employment income can effectively supplement pension benefits or Coast FI by providing interim earnings that delay asset withdrawals, enhancing overall retirement security. This income strategy reduces financial risk by extending the investment growth period, allowing for optimized cash flow management during the transition from full-time work to complete retirement.

Partial FIRE Allocation

Partial FIRE allocation optimizes retirement planning by balancing pension income with Coast Financial Independence (FIRE) strategies, allowing individuals to reduce work years while ensuring steady cash flow. Leveraging pension benefits alongside investment growth in Coast FI can maximize financial security and flexibility during early retirement phases.

Social Security Gap Planning

Addressing the Social Security gap is crucial when comparing Pension and Coast FI strategies for retirement, as pensions provide a fixed income often insufficient to cover inflation and rising healthcare costs. Coast FI relies on maximizing early investments to allow Social Security benefits to fill income gaps, emphasizing proactive gap planning to ensure a stable, tax-efficient retirement income.

Coast-to-Pension Transition

Coast FIRE enables individuals to stop saving early and let investments grow until retirement, while pension plans offer guaranteed income starting at retirement age; transitioning from Coast FIRE to pension income requires careful planning to ensure investment growth covers expenses until pension payments begin. Coordinating withdrawal strategies and monitoring market conditions during this Coast-to-Pension transition is essential to maintain financial stability throughout retirement.

Micro-Pension Schemes

Micro-pension schemes offer flexible contributions and accessibility for low-income earners, making them an essential tool for achieving Coast Financial Independence (Coast FI) compared to traditional pensions, which often require lengthy accumulation periods and fixed contribution levels. Emphasizing early and consistent micro-pension investments allows retirees to build sufficient funds that can grow independently, potentially enabling earlier retirement without relying solely on pension payouts.

Dynamic Withdrawal Sequencing

Dynamic withdrawal sequencing enhances retirement planning by optimizing income sources such as pensions and Coast FI, allowing retirees to strategically withdraw funds based on market conditions and tax implications. This approach maximizes the longevity of retirement savings while ensuring a stable cash flow, balancing guaranteed pension income with the flexibility of Coast FI assets.

Pension-FI Portfolio Blending

Pension-FI portfolio blending combines stable pension income with flexible financial independence (FI) savings to balance risk and liquidity in retirement planning. This strategy leverages pension guarantees while optimizing investment growth to support a sustainable withdrawal rate over a longer retirement horizon.

Pension vs Coast FI for retirement. Infographic

moneydiff.com

moneydiff.com