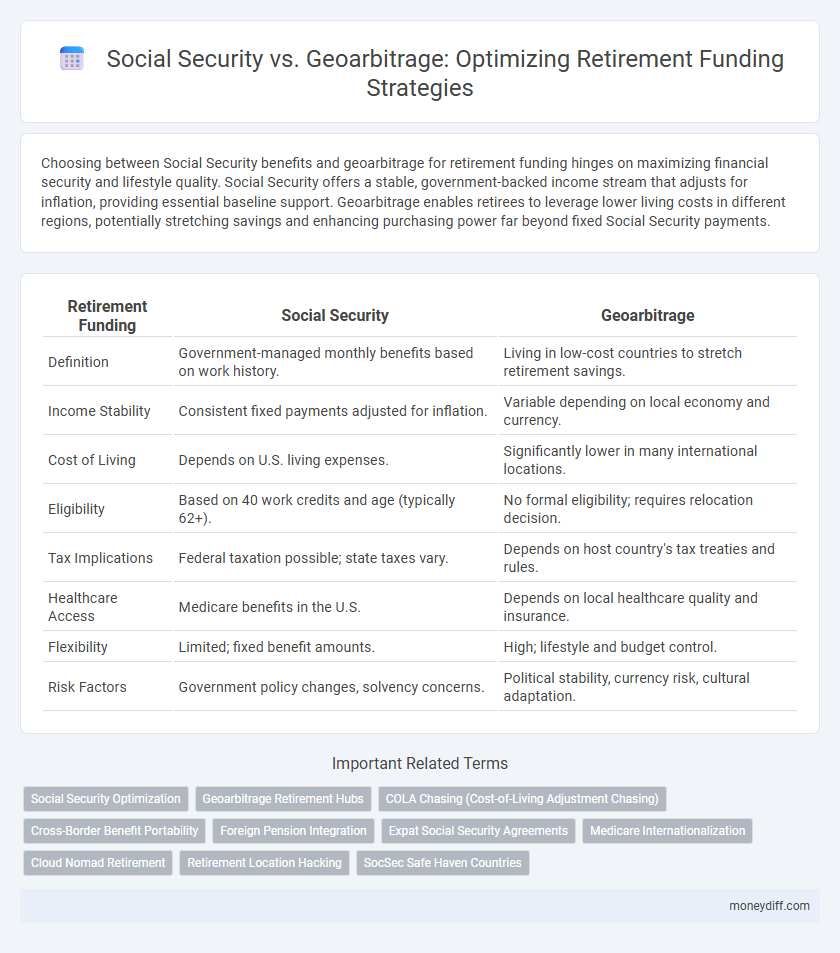

Choosing between Social Security benefits and geoarbitrage for retirement funding hinges on maximizing financial security and lifestyle quality. Social Security offers a stable, government-backed income stream that adjusts for inflation, providing essential baseline support. Geoarbitrage enables retirees to leverage lower living costs in different regions, potentially stretching savings and enhancing purchasing power far beyond fixed Social Security payments.

Table of Comparison

| Retirement Funding | Social Security | Geoarbitrage |

|---|---|---|

| Definition | Government-managed monthly benefits based on work history. | Living in low-cost countries to stretch retirement savings. |

| Income Stability | Consistent fixed payments adjusted for inflation. | Variable depending on local economy and currency. |

| Cost of Living | Depends on U.S. living expenses. | Significantly lower in many international locations. |

| Eligibility | Based on 40 work credits and age (typically 62+). | No formal eligibility; requires relocation decision. |

| Tax Implications | Federal taxation possible; state taxes vary. | Depends on host country's tax treaties and rules. |

| Healthcare Access | Medicare benefits in the U.S. | Depends on local healthcare quality and insurance. |

| Flexibility | Limited; fixed benefit amounts. | High; lifestyle and budget control. |

| Risk Factors | Government policy changes, solvency concerns. | Political stability, currency risk, cultural adaptation. |

Understanding Social Security: A Pillar of Retirement Funding

Social Security serves as a foundational source of guaranteed income for retirees, providing essential financial stability throughout retirement years. Its benefits are calculated based on lifetime earnings, ensuring a reliable monthly payment that adjusts for inflation. Understanding the nuances of Social Security, including eligibility and claiming strategies, is crucial for maximizing retirement funding and designing a secure financial plan.

What Is Geoarbitrage? Leveraging Cost of Living for Retirement

Geoarbitrage involves relocating to a lower-cost area to maximize retirement income by stretching Social Security benefits and savings further. This strategy leverages regional variations in cost of living, enabling retirees to maintain or improve their lifestyle without increasing withdrawals from their retirement funds. By carefully selecting destinations with affordable housing, healthcare, and everyday expenses, retirees can optimize their financial security and extend the longevity of their Social Security payments.

Comparing Retiree Benefits: Social Security vs Geoarbitrage

Social Security provides a guaranteed lifetime income with inflation adjustments, ensuring retirees a stable financial foundation. Geoarbitrage leverages lower cost-of-living countries to maximize retirement savings, potentially stretching income far beyond domestic benefits. Evaluating Social Security benefits alongside geoarbitrage opportunities allows retirees to optimize income security and spending power based on individual goals and risk tolerance.

Eligibility and Reliability: Social Security in Today’s Economy

Social Security provides a reliable source of retirement income with eligibility based on work credits earned through consistent employment and payroll tax contributions, making it accessible to millions of Americans. In contrast, geoarbitrage leverages cost-of-living differences by relocating to lower-cost regions but lacks guaranteed income and requires careful financial planning to ensure sustainability. Evaluating Social Security's steady benefits against geoarbitrage's variable expenses is crucial for secure retirement funding in today's economic climate.

Maximizing Social Security: Strategies for Higher Payouts

Maximizing Social Security benefits involves strategies such as delaying claims until age 70 to earn up to 8% annual delayed retirement credits, increasing monthly payouts. Coordinating spousal benefits and leveraging cost-of-living adjustments further enhance total income. Understanding earnings limits and prioritizing higher-earning years for benefit calculations also optimize Social Security for retirement funding.

Geoarbitrage Destinations: Top Places to Stretch Your Retirement Dollars

Geoarbitrage leverages lower living costs in international destinations like Portugal, Mexico, and Thailand to maximize retirement income by stretching Social Security benefits further. These countries offer affordable healthcare, favorable tax policies, and a high quality of life, making them ideal for retirees seeking financial efficiency. Strategic relocation to such geoarbitrage hotspots can significantly enhance retirement funding and overall lifestyle sustainability.

Risks and Rewards: Social Security vs Geoarbitrage Explained

Social Security provides a reliable, inflation-adjusted income backed by government guarantees, reducing longevity and market risks in retirement planning. Geoarbitrage leverages lower costs of living in foreign countries, potentially increasing spending power but exposing retirees to currency fluctuations, political instability, and healthcare variability. Balancing these risks and rewards is crucial for a diversified retirement strategy that maximizes financial security and lifestyle quality.

Integration Strategies: Combining Social Security and Geoarbitrage

Integrating Social Security benefits with geoarbitrage strategies maximizes retirement income by leveraging cost-of-living differences across regions while maintaining reliable government payouts. Retirees can optimize monthly Social Security payments, based on full benefit eligibility age, by relocating to low-cost countries or states where those fixed incomes stretch further. Combining these approaches enhances financial stability and purchasing power, enabling a longer and more comfortable retirement lifestyle.

Financial Planning Considerations for Global Retirement

Social Security provides a stable, inflation-adjusted income stream crucial for retirement security, but its value varies based on benefit schedules and cost-of-living adjustments. Geoarbitrage allows retirees to leverage currency differences and lower living costs by relocating to countries with favorable exchange rates and affordable healthcare. Financial planning must balance Social Security benefits with potential savings from geoarbitrage, ensuring compliance with residency requirements and tax implications across jurisdictions.

Future Trends: Will Social Security or Geoarbitrage Prevail?

Emerging future trends suggest a growing reliance on geoarbitrage as retirees seek cost-effective living by relocating to countries with lower expenses and favorable tax policies, thereby maximizing their retirement funds beyond the constraints of Social Security. Social Security faces sustainability challenges due to demographic shifts like an aging population and shrinking workforce, which may reduce benefit payouts and increase uncertainty for future retirees. Consequently, geoarbitrage offers a flexible and potentially more reliable strategy for retirement income amidst evolving economic and policy landscapes.

Related Important Terms

Social Security Optimization

Maximizing Social Security benefits involves strategic claiming at full retirement age or later to increase monthly payments, significantly enhancing long-term retirement income streams. Prioritizing Social Security optimization reduces reliance on geoarbitrage, providing a stable, inflation-indexed foundation critical for financial security in retirement planning.

Geoarbitrage Retirement Hubs

Geoarbitrage retirement hubs like Medellin, Chiang Mai, and Lisbon offer significant cost-of-living advantages compared to typical Social Security benefits, enabling retirees to stretch fixed incomes further. These locations provide affordable housing, lower healthcare costs, and vibrant expatriate communities, creating optimized environments for maximizing retirement funds beyond relying solely on Social Security payments.

COLA Chasing (Cost-of-Living Adjustment Chasing)

Social Security provides automatic Cost-of-Living Adjustments (COLA) tied to inflation, ensuring steady income growth in retirement, whereas geoarbitrage requires relocating to lower-cost areas to effectively manage expenses without guaranteed COLA increases. Prioritizing Social Security COLA protects purchasing power, while geoarbitrage demands ongoing cost monitoring and flexible budgeting to sustain retirement funding.

Cross-Border Benefit Portability

Social Security benefits offer reliable, inflation-indexed income with established legal protections, while geoarbitrage leverages lower living costs abroad to stretch retirement savings further. Cross-border benefit portability ensures retirees can receive Social Security payments regardless of residence, enhancing financial flexibility alongside geoarbitrage strategies.

Foreign Pension Integration

Maximizing retirement funding through Social Security benefits combined with geoarbitrage strategies involves carefully integrating foreign pensions to optimize income streams and tax efficiencies. Navigating international pension agreements and leveraging cost-of-living differences abroad enhances retirement security while minimizing taxation on combined Social Security and foreign pension distributions.

Expat Social Security Agreements

Expat Social Security Agreements enable retirees to receive benefits from their home country while living abroad, maximizing retirement income through coordinated contributions and payouts. Geoarbitrage leverages lower living costs in foreign countries, but understanding bilateral Social Security agreements is critical to optimize benefit eligibility and avoid dual taxation during retirement funding.

Medicare Internationalization

Social Security provides stable retirement income tied to U.S. residency, but geoarbitrage leverages lower-cost countries where Medicare internationalization enables access to affordable healthcare abroad. Maximizing retirement funding involves balancing guaranteed Social Security benefits with cost-efficient international medical care options to extend savings.

Cloud Nomad Retirement

Cloud Nomad Retirement leverages geoarbitrage by combining remote work income with relocation to low-cost countries, maximizing disposable income while delaying or supplementing Social Security benefits. This strategy enhances financial resilience by reducing living expenses and increasing savings potential, outperforming traditional reliance solely on Social Security for retirement funding.

Retirement Location Hacking

Leveraging Geoarbitrage by relocating to lower-cost countries can dramatically extend Social Security benefits, allowing retirees to maximize their fixed income and achieve a higher standard of living. Strategic Retirement Location Hacking focuses on destinations with favorable tax policies, affordable healthcare, and strong expat communities to optimize Social Security income sustainability.

SocSec Safe Haven Countries

Social Security benefits provide a reliable income stream in retirement, especially when paired with geoarbitrage by retiring in Social Security Safe Haven countries like Mexico, Costa Rica, or Portugal, where cost of living is significantly lower and healthcare is accessible. Maximizing Social Security payments while leveraging lower expenses abroad enhances financial security and extends retirement savings.

Social Security vs Geoarbitrage for retirement funding. Infographic

moneydiff.com

moneydiff.com