The 401(k) remains a traditional retirement savings vehicle with tax advantages and employer matching, offering stability and long-term growth for most workers. The FIRE (Financial Independence, Retire Early) movement emphasizes aggressive saving, investing, and lifestyle adjustments to achieve early retirement, prioritizing financial freedom over conventional timelines. Understanding the benefits and trade-offs of both approaches helps individuals tailor their retirement strategy to personal goals and risk tolerance.

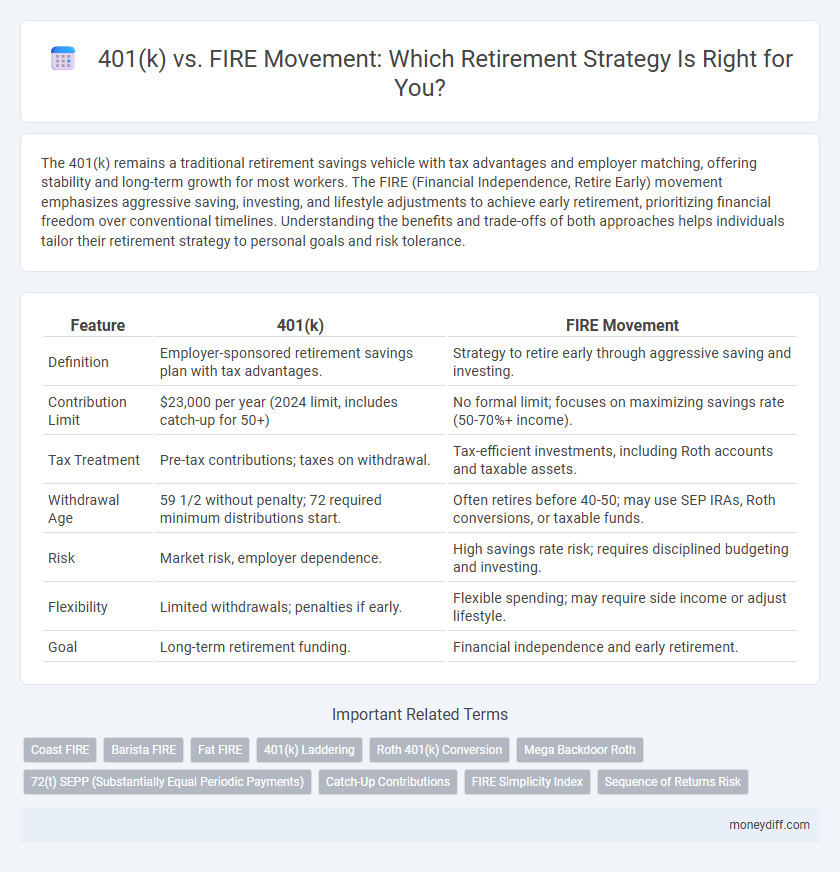

Table of Comparison

| Feature | 401(k) | FIRE Movement |

|---|---|---|

| Definition | Employer-sponsored retirement savings plan with tax advantages. | Strategy to retire early through aggressive saving and investing. |

| Contribution Limit | $23,000 per year (2024 limit, includes catch-up for 50+) | No formal limit; focuses on maximizing savings rate (50-70%+ income). |

| Tax Treatment | Pre-tax contributions; taxes on withdrawal. | Tax-efficient investments, including Roth accounts and taxable assets. |

| Withdrawal Age | 59 1/2 without penalty; 72 required minimum distributions start. | Often retires before 40-50; may use SEP IRAs, Roth conversions, or taxable funds. |

| Risk | Market risk, employer dependence. | High savings rate risk; requires disciplined budgeting and investing. |

| Flexibility | Limited withdrawals; penalties if early. | Flexible spending; may require side income or adjust lifestyle. |

| Goal | Long-term retirement funding. | Financial independence and early retirement. |

Understanding the Basics: What Is a 401(k) Plan?

A 401(k) plan is a tax-advantaged retirement savings account offered by employers in the United States, allowing employees to contribute a portion of their salary pre-tax. Contributions and investment earnings grow tax-deferred until withdrawal, typically at retirement age, encouraging long-term savings. Compared to the FIRE (Financial Independence, Retire Early) movement, which emphasizes aggressive saving and investment to retire early, a 401(k) provides structured, employer-supported growth primarily aimed at traditional retirement timelines.

FIRE Movement Explained: Financial Independence, Retire Early

The FIRE movement emphasizes achieving financial independence through aggressive saving and investing, allowing individuals to retire significantly earlier than the traditional 401(k) plan timeline. Unlike 401(k) strategies tied to employer-sponsored plans with contribution limits and required minimum distributions, FIRE advocates maximizing savings rate often above 50%. This approach relies on reducing expenses, generating passive income, and leveraging investment growth to fund early retirement without dependency on conventional retirement accounts.

401(k) vs FIRE: Core Principles Compared

The 401(k) plan emphasizes disciplined, tax-advantaged retirement savings through employer contributions and long-term investment growth, typically requiring individuals to work until traditional retirement age. The FIRE (Financial Independence, Retire Early) movement prioritizes aggressive saving and investing strategies, often exceeding 50% of income, to achieve early financial independence and retire decades sooner. While 401(k) relies on steady, age-based withdrawals, FIRE depends on sufficient passive income and net worth to sustain lifestyle without employment income.

Contribution Limits: Maximizing 401(k) vs FIRE Strategies

401(k) plans impose annual contribution limits set by the IRS, currently $23,000 for those over 50 as of 2024, which can restrict the amount saved for traditional retirement. The FIRE (Financial Independence, Retire Early) movement emphasizes aggressive saving and investing beyond 401(k) limits through taxable brokerage accounts and alternative income streams. Maximizing contributions within the 401(k) offers tax advantages and employer matches, while FIRE strategies leverage high savings rates and diversified investments to achieve early retirement goals faster.

Tax Benefits: 401(k) Accounts Versus Early Withdrawal Considerations

401(k) accounts offer significant tax advantages by allowing contributions with pre-tax income, reducing taxable income during working years and enabling tax-deferred growth until retirement. The FIRE (Financial Independence, Retire Early) movement often involves early withdrawal strategies, which can trigger penalties and immediate tax liabilities, reducing overall retirement savings. Strategic planning is essential to maximize tax benefits while balancing the flexibility and risks associated with early retirement withdrawals.

Investment Approaches: Traditional 401(k) vs Aggressive FIRE Portfolios

Traditional 401(k) plans emphasize steady, tax-advantaged contributions with diversified, often conservative asset allocations designed for long-term growth and risk management. In contrast, FIRE portfolios adopt aggressive investment strategies, such as higher equity exposure and alternative assets, seeking rapid wealth accumulation for early retirement. The choice between these approaches depends on individual risk tolerance, retirement timeline, and financial goals.

Retirement Age: Standard Milestones vs Early Retirement Goals

Standard 401(k) retirement plans target age 59 1/2 for penalty-free withdrawals, aligning with traditional retirement milestones set by Social Security eligibility. The FIRE (Financial Independence, Retire Early) movement emphasizes aggressive saving and investing to achieve early retirement, often targeting ages 40 to 50 or even earlier. Retirement planning strategies differ substantially between these approaches, with 401(k) participants focusing on steady growth and FIRE adherents prioritizing rapid asset accumulation and tax-efficient withdrawal methods.

Risks and Rewards: Stability of 401(k) vs Uncertainties in FIRE

A 401(k) offers structured stability through employer contributions, tax advantages, and regulatory protections, reducing financial risks over time. The FIRE (Financial Independence, Retire Early) movement presents higher uncertainties due to aggressive saving rates, market volatility, and reliance on early withdrawal strategies, which may jeopardize long-term security. Understanding the balance between the predictable growth of a 401(k) and the potential but volatile rewards of FIRE is crucial for sustainable retirement planning.

Lifestyle Adjustments: 401(k) Savers vs FIRE Adherents

401(k) savers typically maintain traditional career paths, gradually increasing contributions while preserving a moderate lifestyle to secure steady retirement income. FIRE adherents prioritize aggressive savings and extreme frugality, often adopting minimalist habits and reducing expenses significantly to achieve early financial independence. These lifestyle adjustments influence retirement timelines, investment strategies, and overall financial flexibility in distinct ways.

Choosing Your Path: Integrating 401(k) Strategies with the FIRE Movement

Balancing traditional 401(k) contributions with the Financial Independence, Retire Early (FIRE) movement allows for a diversified retirement strategy that leverages tax advantages and aggressive savings goals. Maximizing employer matching in a 401(k) while channeling additional income into low-cost, high-growth investments accelerates wealth accumulation for early retirement. This integrated approach optimizes long-term financial security by combining structured retirement plans with the flexibility of FIRE's frugality and investment discipline.

Related Important Terms

Coast FIRE

Coast FIRE leverages early aggressive 401(k) contributions, allowing investments to grow passively until traditional retirement age without additional savings, contrasting with FIRE's emphasis on extreme early withdrawal and lifestyle changes. This strategy optimizes tax-advantaged 401(k) growth while maintaining financial flexibility, appealing to those seeking a balanced approach between traditional retirement planning and radical early retirement.

Barista FIRE

Barista FIRE emphasizes achieving partial financial independence by maintaining a part-time job, such as in service roles, while drawing from a 401(k) and other savings to support lifestyle costs, balancing prudent retirement planning with ongoing income. This approach contrasts with traditional FIRE, which aims for complete early retirement primarily funded by 401(k) distributions and investment returns.

Fat FIRE

Fat FIRE emphasizes achieving financial independence with a high annual spending level, typically $100,000 or more, enabling a luxurious retirement lifestyle, whereas traditional 401(k) plans focus on steady, employer-sponsored contributions with tax advantages but often lower withdrawal flexibility. Individuals pursuing Fat FIRE prioritize aggressive saving, diverse investments beyond 401(k)s, and income-generating assets to accelerate early retirement while maintaining elevated spending power.

401(k) Laddering

401(k) laddering involves strategically timing withdrawals from multiple 401(k) accounts or various retirement assets to minimize taxes and penalties while ensuring steady income during retirement. Compared to the FIRE (Financial Independence, Retire Early) movement's emphasis on aggressive saving and early retirement, 401(k) laddering offers a structured approach to leverage traditional retirement accounts for sustainable financial security.

Roth 401(k) Conversion

Roth 401(k) conversions offer significant tax advantages within the FIRE (Financial Independence, Retire Early) movement by allowing tax-free withdrawals during early retirement, unlike traditional 401(k) plans that impose taxes upon distribution. This strategy optimizes retirement savings growth and provides greater flexibility for early retirees managing taxable income and investment gains.

Mega Backdoor Roth

The Mega Backdoor Roth strategy enables high-income earners to contribute up to $66,000 annually to a Roth IRA through after-tax 401(k) contributions and in-service rollovers, offering significant tax-free growth potential compared to traditional 401(k) plans. This approach aligns with FIRE (Financial Independence, Retire Early) goals by accelerating tax-advantaged savings beyond standard contribution limits, facilitating earlier and more flexible retirement options.

72(t) SEPP (Substantially Equal Periodic Payments)

The 72(t) SEPP (Substantially Equal Periodic Payments) rule allows early withdrawal from 401(k) plans without penalties by mandating consistent distributions over a set period, offering a strategic advantage for those pursuing the FIRE (Financial Independence, Retire Early) movement. FIRE adherents leverage 72(t) SEPP to access retirement funds before the traditional age of 59 1/2, optimizing liquidity while avoiding the 10% early withdrawal penalty inherent in standard 401(k) withdrawals.

Catch-Up Contributions

Catch-up contributions allow individuals aged 50 and above to accelerate their 401(k) savings beyond standard limits, providing a significant advantage for those pursuing traditional retirement plans. The FIRE movement emphasizes aggressive savings and investment early on, making catch-up contributions less critical but still beneficial for extending financial independence timelines.

FIRE Simplicity Index

The FIRE Simplicity Index evaluates financial independence readiness by measuring savings rate, investment diversification, and withdrawal flexibility, offering a streamlined alternative to traditional 401(k) plans that often involve complex employer-sponsored rules and limited asset choices. FIRE advocates prioritize aggressive savings and minimalist living to accelerate retirement timelines, contrasting the conventional 401(k) approach centered on steady contributions and tax-advantaged growth over decades.

Sequence of Returns Risk

Sequence of Returns Risk significantly impacts both 401(k) plans and the FIRE movement, but it poses a greater threat to early retirees relying on FIRE due to prolonged withdrawal periods during market downturns. Managing this risk through diversified portfolios and flexible withdrawal strategies is crucial for sustaining retirement savings in both approaches.

401(k) vs FIRE movement for retirement. Infographic

moneydiff.com

moneydiff.com