Maximizing retirement income involves carefully weighing the benefits of Social Security against the potential savings from geoarbitrage, where relocating to a lower-cost area can stretch fixed incomes further. Social Security provides a reliable, inflation-indexed income stream with guaranteed lifetime payments, serving as a financial foundation during retirement. Geoarbitrage complements this by reducing living expenses, which can significantly enhance purchasing power and improve quality of life without increasing monthly income.

Table of Comparison

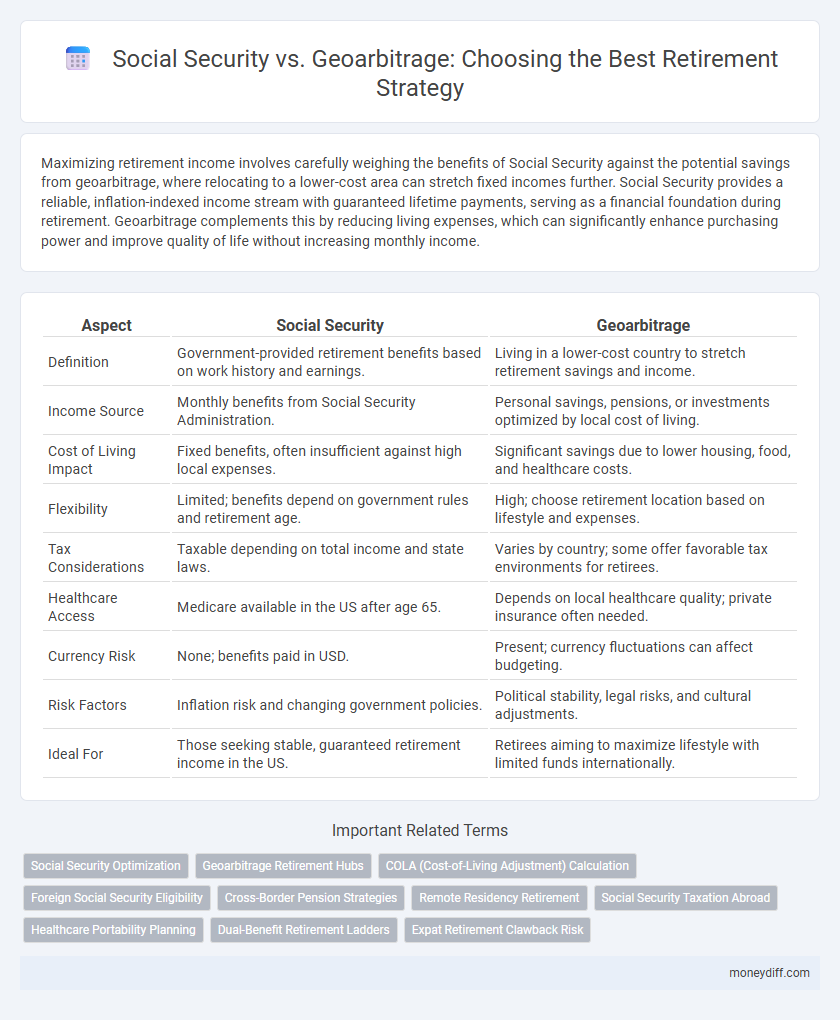

| Aspect | Social Security | Geoarbitrage |

|---|---|---|

| Definition | Government-provided retirement benefits based on work history and earnings. | Living in a lower-cost country to stretch retirement savings and income. |

| Income Source | Monthly benefits from Social Security Administration. | Personal savings, pensions, or investments optimized by local cost of living. |

| Cost of Living Impact | Fixed benefits, often insufficient against high local expenses. | Significant savings due to lower housing, food, and healthcare costs. |

| Flexibility | Limited; benefits depend on government rules and retirement age. | High; choose retirement location based on lifestyle and expenses. |

| Tax Considerations | Taxable depending on total income and state laws. | Varies by country; some offer favorable tax environments for retirees. |

| Healthcare Access | Medicare available in the US after age 65. | Depends on local healthcare quality; private insurance often needed. |

| Currency Risk | None; benefits paid in USD. | Present; currency fluctuations can affect budgeting. |

| Risk Factors | Inflation risk and changing government policies. | Political stability, legal risks, and cultural adjustments. |

| Ideal For | Those seeking stable, guaranteed retirement income in the US. | Retirees aiming to maximize lifestyle with limited funds internationally. |

Understanding Social Security: Basics and Benefits

Social Security provides a foundational source of retirement income through monthly benefits based on an individual's work history and earnings, ensuring financial stability after age 62. Understanding the benefit calculation, including factors like full retirement age and cost-of-living adjustments, is essential to maximize payout. While Social Security offers guaranteed lifetime income, geoarbitrage strategies might supplement retirement funds by reducing living costs in lower-cost regions.

What Is Geoarbitrage in Retirement?

Geoarbitrage in retirement involves relocating to a country or region with a lower cost of living to maximize Social Security benefits and stretch retirement savings. By leveraging disparities in housing, food, and healthcare expenses, retirees can increase their purchasing power and improve their quality of life. This strategy is especially effective when paired with consistent Social Security income, allowing for greater financial flexibility and longer-lasting retirement funds.

Social Security Payouts: How Much Can You Expect?

Social Security payouts vary based on lifetime earnings and age at claim, with the average monthly benefit in 2024 around $1,827. Claiming benefits at full retirement age maximizes monthly payments, while early claims reduce payouts by up to 30%. Understanding your projected Social Security income is crucial when comparing it to geoarbitrage strategies for stretching retirement savings.

Geoarbitrage Destinations: Top Countries for Retirees

Geoarbitrage enables retirees to maximize Social Security benefits by relocating to countries with lower living costs and high-quality healthcare, stretching fixed incomes further. Top geoarbitrage destinations for retirement include Portugal, Mexico, Costa Rica, and Malaysia, each offering affordable housing, excellent healthcare access, and favorable visa policies for retirees. Choosing these countries can significantly enhance retirement lifestyle and financial sustainability compared to relying solely on Social Security within the United States.

Cost of Living Comparison: Staying vs Relocating Abroad

Comparing the cost of living highlights significant savings through geoarbitrage when relocating abroad for retirement, where expenses like housing, healthcare, and daily necessities can be markedly lower than in the U.S., thereby stretching Social Security benefits further. In contrast, staying in the U.S. often means higher average monthly costs, particularly in metropolitan areas where rent, medical care, and state taxes reduce disposable income. Retirees leveraging geoarbitrage enjoy enhanced purchasing power, allowing for a more comfortable lifestyle on a fixed Social Security income compared to the constraints of staying within high-cost domestic regions.

Maximizing Social Security While Living Overseas

Maximizing Social Security benefits while living overseas involves understanding the impact of Geoarbitrage on cost of living and tax implications. Retirees can leverage lower living expenses abroad to stretch Social Security income further, but must navigate country-specific rules and U.S. tax treaties to avoid penalties and optimize withdrawals. Strategic planning of benefit claiming age and residency can significantly enhance the overall retirement income secured from Social Security.

Risks and Challenges of Geoarbitrage

Geoarbitrage in retirement carries risks such as currency fluctuations that can erode fixed incomes, and varying healthcare quality that may increase unexpected expenses. Legal and political instability in lower-cost countries may jeopardize property rights and personal safety, complicating long-term planning. Unlike Social Security's guaranteed, inflation-adjusted benefits, geoarbitrage relies heavily on external factors, making financial security less predictable.

Social Security Eligibility and International Rules

Social Security eligibility requires a minimum of 40 credits earned through U.S. work history, with benefits adjusted based on age at retirement and earnings history. International rules allow retirees to collect Social Security benefits while living abroad in many countries, though payments may be restricted or suspended in certain nations due to bilateral agreements or non-payment policies. Geoarbitrage strategies optimize retirement spending by relocating to countries with lower costs of living, but retirees must navigate complex Social Security regulations and tax treaties affecting benefit receipt and taxation.

Tax Implications: US vs International Retirement

Social Security benefits are subject to federal income tax, and in some states, further state taxation, which can reduce net retirement income for U.S. retirees. Geoarbitrage offers retirees the opportunity to minimize tax liabilities by relocating to countries with favorable tax treaties or no tax on foreign income, significantly enhancing disposable income. Understanding the complexities of U.S. taxation on Social Security and exploring international tax advantages is crucial for optimizing retirement finances.

Which Is Right for You: Social Security or Geoarbitrage?

Choosing between Social Security and geoarbitrage for retirement depends on your financial goals and lifestyle preferences. Social Security offers guaranteed, inflation-adjusted income based on your work history, providing a stable foundation for retirees prioritizing security. Geoarbitrage leverages cost-of-living differences by relocating to lower-expense regions, maximizing purchasing power and potentially enhancing retirement savings if you seek flexibility and a higher standard of living.

Related Important Terms

Social Security Optimization

Maximizing Social Security benefits through strategies like delayed claiming and spousal optimization ensures a steady, inflation-adjusted income stream throughout retirement, reducing reliance on external income sources. This focused approach to Social Security optimization often provides more predictable financial security compared to geoarbitrage, which relies on relocating to lower-cost areas but can introduce variable expenses and lifestyle adjustments.

Geoarbitrage Retirement Hubs

Geoarbitrage retirement hubs like Costa Rica, Mexico, and Portugal offer significant cost-of-living advantages and favorable tax benefits compared to relying solely on Social Security income in higher-cost U.S. locations. Leveraging these global retirement destinations can maximize monthly budgets, extend investment longevity, and enhance lifestyle quality by combining lower expenses with reliable healthcare and expat-friendly communities.

COLA (Cost-of-Living Adjustment) Calculation

Social Security benefits include a Cost-of-Living Adjustment (COLA) based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which helps retirees maintain purchasing power despite inflation. Geoarbitrage strategies often rely on relocating to regions with significantly lower living costs, but without COLA protections, retirees may face financial risk if local inflation outpaces fixed income sources.

Foreign Social Security Eligibility

Foreign Social Security eligibility depends on bilateral agreements between the United States and other countries, which allow retirees to receive benefits while living abroad without forfeiting payments. Understanding the totalization agreements and eligibility requirements is crucial for leveraging Social Security income effectively in geoarbitrage retirement strategies.

Cross-Border Pension Strategies

Cross-border pension strategies leverage Social Security benefits alongside geoarbitrage to maximize retirement income by utilizing cost-of-living differences in foreign countries while maintaining access to U.S. Social Security payments. Understanding treaty agreements and tax implications between countries optimizes pension withdrawals and long-term wealth preservation for expatriates.

Remote Residency Retirement

Maximizing retirement income often involves comparing Social Security benefits with geoarbitrage strategies, where relocating to lower-cost countries can stretch fixed Social Security payments significantly further. Countries like Mexico, Costa Rica, and Portugal offer favorable climates, affordable healthcare, and lower living expenses, making remote residency retirement an attractive option for Social Security beneficiaries seeking enhanced financial security.

Social Security Taxation Abroad

Social Security benefits remain taxable by the United States even when claimed abroad, with tax treaties potentially reducing the burden depending on the foreign country's agreements. Understanding the interplay between Social Security taxation and geoarbitrage strategies is crucial for retirees aiming to maximize income while minimizing international tax liabilities.

Healthcare Portability Planning

Healthcare portability planning is essential when comparing Social Security benefits with geoarbitrage strategies, as retirees must ensure continuous access to quality medical services across different regions or countries. Evaluating the portability of healthcare coverage under Social Security against the local healthcare infrastructure and costs in alternative locations is critical for sustainable and secure retirement income management.

Dual-Benefit Retirement Ladders

Leveraging Social Security benefits alongside geoarbitrage creates a dual-benefit retirement ladder, maximizing income by drawing fixed Social Security payments while reducing living expenses through strategic relocation to lower-cost regions. This approach enhances financial sustainability, allowing retirees to stretch their retirement savings further by balancing steady government benefits with cost-efficient living environments.

Expat Retirement Clawback Risk

Retirees relying on Social Security income face potential clawback risks when geoarbitraging to countries with reciprocal tax treaties or stricter income reporting, which can reduce net benefits. Careful planning around foreign residency rules and tax obligations is essential to prevent unexpected Social Security benefit reductions during expat retirement.

Social Security vs Geoarbitrage for retirement. Infographic

moneydiff.com

moneydiff.com