A Retirement Savings Account (RSA) offers a structured, tax-advantaged way to build retirement funds through steady contributions over time, providing financial security for your golden years. The FIRE (Financial Independence, Retire Early) movement emphasizes aggressive saving and investing to achieve early retirement, often requiring significant lifestyle adjustments and higher risk tolerance. Comparing these approaches helps retirees optimize their strategies by balancing consistent growth with the potential for accelerated wealth accumulation.

Table of Comparison

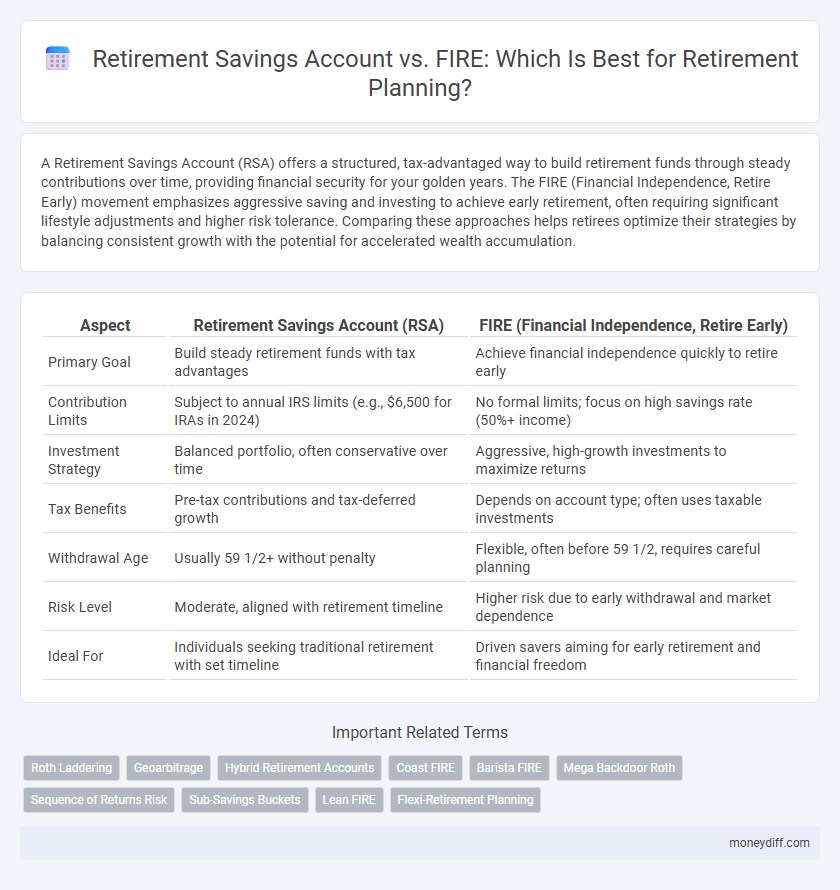

| Aspect | Retirement Savings Account (RSA) | FIRE (Financial Independence, Retire Early) |

|---|---|---|

| Primary Goal | Build steady retirement funds with tax advantages | Achieve financial independence quickly to retire early |

| Contribution Limits | Subject to annual IRS limits (e.g., $6,500 for IRAs in 2024) | No formal limits; focus on high savings rate (50%+ income) |

| Investment Strategy | Balanced portfolio, often conservative over time | Aggressive, high-growth investments to maximize returns |

| Tax Benefits | Pre-tax contributions and tax-deferred growth | Depends on account type; often uses taxable investments |

| Withdrawal Age | Usually 59 1/2+ without penalty | Flexible, often before 59 1/2, requires careful planning |

| Risk Level | Moderate, aligned with retirement timeline | Higher risk due to early withdrawal and market dependence |

| Ideal For | Individuals seeking traditional retirement with set timeline | Driven savers aiming for early retirement and financial freedom |

Understanding Retirement Savings Accounts

Retirement Savings Accounts, such as 401(k)s and IRAs, offer tax advantages and employer matching contributions, making them foundational tools for retirement planning. These accounts provide regulated structures to accumulate funds with potential tax deferral or tax-free growth, depending on the account type. Understanding contribution limits, withdrawal rules, and the impact of compounding interest is essential for maximizing long-term retirement benefits.

The Fundamentals of the FIRE Movement

The Fundamentals of the FIRE Movement emphasize aggressive saving and investing strategies to achieve financial independence decades earlier than traditional retirement timelines. Unlike a conventional Retirement Savings Account, which relies on steady contributions and compounding growth over several decades, FIRE advocates for maximizing savings rates up to 70% of income and investing primarily in low-cost index funds to rapidly build a substantial investment portfolio. This approach demands disciplined budgeting and a minimalist lifestyle to accelerate wealth accumulation and enable early retirement.

Key Differences Between Traditional Accounts and FIRE

Retirement Savings Accounts, such as 401(k)s and IRAs, offer tax advantages and structured contributions aimed at long-term growth with employer matching and required minimum distributions. FIRE (Financial Independence, Retire Early) emphasizes aggressive saving and investing outside traditional accounts to achieve early retirement through diverse income streams and flexible withdrawal strategies. Key differences include tax treatment, withdrawal age, contribution limits, and the pace of wealth accumulation tailored to either traditional retirement timelines or accelerated financial independence goals.

Pros and Cons of Retirement Savings Accounts

Retirement Savings Accounts, such as 401(k)s and IRAs, offer tax advantages and employer matching contributions that significantly boost long-term retirement funds. These accounts provide structured, regulated growth with penalties for early withdrawal, encouraging disciplined saving but reducing liquidity and flexibility. Compared to the FIRE (Financial Independence, Retire Early) movement, Retirement Savings Accounts emphasize gradual accumulation with tax deferral, whereas FIRE relies on aggressive investing and early asset liquidation.

Benefits and Limitations of FIRE Strategies

FIRE (Financial Independence, Retire Early) strategies emphasize aggressive saving and investing to achieve early retirement, offering the benefit of financial freedom and flexibility long before traditional retirement age. However, FIRE requires a high savings rate, disciplined budgeting, and may expose individuals to market volatility and uncertain long-term healthcare costs. In contrast, traditional Retirement Savings Accounts, such as 401(k)s and IRAs, provide structured tax advantages and employer contributions but often depend on longer working years and offer less flexibility in retirement timing.

Tax Implications: Accounts vs. FIRE

Retirement Savings Accounts offer structured tax advantages such as tax-deferred growth in Traditional IRAs and 401(k)s or tax-free withdrawals in Roth accounts, directly impacting retirement income tax liability. FIRE (Financial Independence, Retire Early) strategies often rely on a mix of taxable brokerage accounts, Roth conversions, and tax-efficient withdrawal plans to minimize taxes before and during early retirement. Understanding tax implications is crucial for optimizing retirement funds, as accounts provide standardized tax benefits, whereas FIRE approaches demand proactive tax strategy management to sustain financial independence.

Flexibility and Accessibility in Retirement Planning

Retirement Savings Accounts offer structured contributions and tax advantages but often limit early access to funds without penalties, impacting flexibility. FIRE (Financial Independence, Retire Early) strategies emphasize aggressive saving and investing for unrestricted access, allowing greater control over retirement timing and lifestyle. Choosing between them depends on prioritizing tax benefits versus financial independence with accessible liquidity.

Risk Management for Retirement Savings and FIRE

Retirement savings accounts offer structured risk management through regulated contributions and insured growth, ensuring steady wealth accumulation with lower exposure to market volatility. FIRE (Financial Independence, Retire Early) strategies involve higher risk tolerance by leveraging aggressive investment returns and frugality to expedite retirement, requiring careful planning to mitigate market downturns and longevity risk. Balancing these approaches depends on individual risk appetite and time horizon, as traditional accounts prioritize security while FIRE demands proactive risk assessment and contingency planning.

Long-Term Growth Potential: Which Approach Wins?

Retirement Savings Accounts, such as 401(k)s and IRAs, offer tax advantages and compound growth with employer contributions, making them reliable vehicles for long-term wealth accumulation. The FIRE (Financial Independence, Retire Early) movement emphasizes aggressive saving and investing, typically in diversified portfolios with higher risk tolerance, aiming for rapid asset growth and early retirement. While Traditional Retirement Savings Accounts provide steady growth and tax benefits, the FIRE approach often delivers higher long-term growth potential through increased savings rates and investment in growth-focused assets.

Choosing the Best Retirement Path for Your Goals

Retirement Savings Accounts offer structured tax advantages and employer contributions, making them ideal for steady, long-term growth aligned with traditional retirement timelines. FIRE (Financial Independence, Retire Early) emphasizes aggressive saving, investing, and frugal living to achieve early retirement, appealing to those seeking financial freedom well before standard retirement ages. Evaluating your risk tolerance, desired retirement age, and lifestyle goals helps determine whether a conventional Retirement Savings Account or the FIRE strategy better suits your retirement planning needs.

Related Important Terms

Roth Laddering

Retirement Savings Accounts, such as Traditional and Roth IRAs, offer tax advantages but require careful withdrawal timing, whereas the FIRE (Financial Independence, Retire Early) approach emphasizes aggressive savings and investment to retire quickly, often utilizing Roth laddering to minimize penalties by gradually converting Traditional IRA funds to Roth IRAs. Roth laddering enables tax-efficient access to retirement funds before age 59 1/2 by spacing conversions over multiple years, enhancing flexibility within FIRE strategies while optimizing long-term tax benefits.

Geoarbitrage

Retirement Savings Accounts offer structured tax advantages and consistent growth for long-term financial security, while the FIRE (Financial Independence, Retire Early) movement leverages aggressive savings and geoarbitrage to accelerate wealth accumulation by minimizing living expenses through relocation to lower-cost regions. Geoarbitrage enhances FIRE strategies by maximizing purchasing power and reducing retirement spending, enabling earlier financial freedom compared to traditional retirement planning through standard savings accounts.

Hybrid Retirement Accounts

Hybrid retirement accounts combine the tax advantages of traditional Retirement Savings Accounts with the flexibility and early withdrawal options characteristic of FIRE strategies, enabling optimized retirement planning through diversified financial vehicles. By integrating features such as tax-deferred growth, penalty-free access, and customizable contribution limits, hybrid accounts offer a balanced approach to retirement savings, catering to both long-term security and early financial independence goals.

Coast FIRE

A Retirement Savings Account (RSA) offers a structured and tax-advantaged way to accumulate funds for retirement, while Coast FIRE emphasizes achieving enough early savings so investments grow independently without additional contributions. Coast FIRE allows individuals to stop saving aggressively once their portfolio can grow to support retirement, contrasting with traditional RSA strategies that depend on continuous contributions until retirement age.

Barista FIRE

Retirement Savings Accounts offer structured tax advantages and steady growth ideal for long-term security, while Barista FIRE emphasizes achieving financial independence early with modest expenses supplemented by part-time work. Barista FIRE strategically balances reduced savings with continued income streams, making it a flexible alternative to fully retiring through traditional Retirement Savings Accounts alone.

Mega Backdoor Roth

Mega Backdoor Roth strategies enable high-income earners to contribute significantly beyond standard Roth IRA limits, accelerating tax-free retirement growth compared to traditional Retirement Savings Accounts. Unlike typical accounts, combining Mega Backdoor Roth contributions with FIRE (Financial Independence, Retire Early) tactics offers enhanced flexibility and faster wealth accumulation for early retirement planning.

Sequence of Returns Risk

Retirement Savings Accounts typically provide structured tax advantages and employer contributions that can buffer Sequence of Returns Risk by promoting steady growth and disciplined withdrawals. Conversely, the FIRE (Financial Independence, Retire Early) strategy involves aggressive early savings and drawsdowns, increasing vulnerability to market volatility and Sequence of Returns Risk during the initial post-retirement years.

Sub-Savings Buckets

Retirement Savings Accounts offer structured tax advantages and employer contributions, creating disciplined saving through dedicated sub-savings buckets like emergency funds, long-term investments, and healthcare reserves. FIRE (Financial Independence, Retire Early) emphasizes aggressively funding multiple sub-savings buckets to accelerate wealth building, including high-yield investment portfolios, side income reserves, and flexible spending funds for early retirement.

Lean FIRE

A Retirement Savings Account offers structured tax advantages and long-term growth through diversified investments, making it a reliable foundation for retirement planning. Lean FIRE emphasizes aggressive savings and frugality, targeting financial independence with minimal expenses, allowing early retirement by maximizing savings rates and minimizing living costs.

Flexi-Retirement Planning

Retirement Savings Accounts offer structured, tax-advantaged growth tailored for long-term security, while the FIRE (Financial Independence, Retire Early) movement emphasizes aggressive saving and investment to achieve early financial freedom. Flexi-Retirement Planning blends these approaches, allowing individuals to customize withdrawal strategies and investment options for more adaptive, goal-oriented retirement outcomes.

Retirement Savings Account vs FIRE for retirement planning Infographic

moneydiff.com

moneydiff.com