Asset allocation balances risk and reward by spreading investments across different asset classes, providing diversification and stability for retirement portfolios. Direct indexing offers personalized tax efficiency and greater control by mimicking index performance through individual securities, potentially boosting after-tax returns. Choosing between these strategies depends on factors like investment goals, tax considerations, and portfolio complexity during retirement planning.

Table of Comparison

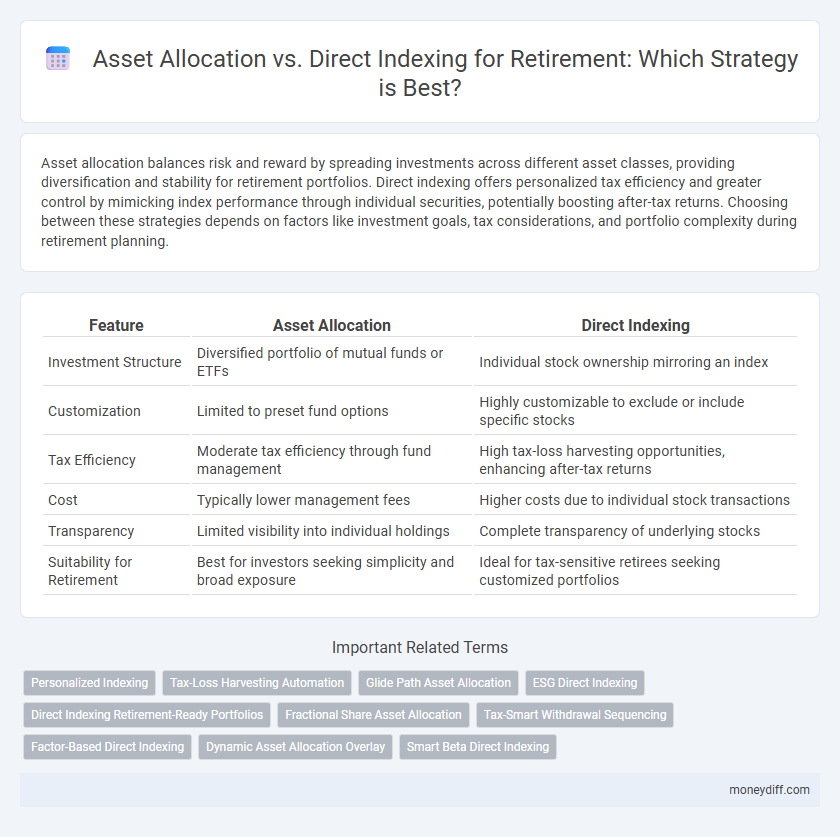

| Feature | Asset Allocation | Direct Indexing |

|---|---|---|

| Investment Structure | Diversified portfolio of mutual funds or ETFs | Individual stock ownership mirroring an index |

| Customization | Limited to preset fund options | Highly customizable to exclude or include specific stocks |

| Tax Efficiency | Moderate tax efficiency through fund management | High tax-loss harvesting opportunities, enhancing after-tax returns |

| Cost | Typically lower management fees | Higher costs due to individual stock transactions |

| Transparency | Limited visibility into individual holdings | Complete transparency of underlying stocks |

| Suitability for Retirement | Best for investors seeking simplicity and broad exposure | Ideal for tax-sensitive retirees seeking customized portfolios |

Understanding Asset Allocation in Retirement Planning

Asset allocation in retirement planning involves diversifying investments across asset classes like stocks, bonds, and cash to balance risk and return according to an individual's time horizon and risk tolerance. Direct indexing enables investors to own a customized portfolio of individual securities that replicate an index, offering potential tax advantages and personalized control over asset exposure. Comparing asset allocation with direct indexing requires understanding the trade-offs between simplicity, diversification, tax efficiency, and customization in managing retirement savings.

What is Direct Indexing and How Does It Work?

Direct indexing allows investors to own individual securities within an index rather than purchasing a mutual fund or ETF, enabling personalized asset allocation and tax-loss harvesting. This strategy works by replicating the performance of a benchmark index through the direct purchase of stocks proportional to their index weights while providing flexibility to exclude certain stocks or sectors. Investors benefit from enhanced customization, potential cost savings, and increased control over tax efficiency compared to traditional asset allocation methods.

Key Differences: Asset Allocation vs Direct Indexing

Asset allocation strategically distributes investments across asset classes like stocks, bonds, and cash to balance risk and return for retirement portfolios. Direct indexing enables personalized portfolio construction by purchasing individual securities that mirror an index, allowing for customized tax management and exclusion strategies. Unlike asset allocation's broad diversification, direct indexing offers granular control but requires more active management and higher costs, influencing retirement outcomes.

Benefits of Asset Allocation for Retirees

Asset allocation for retirees helps balance risk and return by diversifying investments across stocks, bonds, and cash, reducing the impact of market volatility on retirement income. This strategy provides steady income streams and preserves capital, crucial for sustaining long-term financial security. Unlike direct indexing, asset allocation offers simplified portfolio management and broad exposure without the complexity of individual stock selection.

Advantages of Direct Indexing for Retirement Portfolios

Direct indexing offers enhanced tax-loss harvesting opportunities compared to traditional asset allocation, allowing investors to offset gains and reduce tax liabilities during retirement. It enables personalized portfolio customization aligned with individual values, risk tolerance, and financial goals, enhancing engagement and satisfaction. Moreover, direct indexing provides greater control over capital gains realization and enables more precise exposure to market segments, optimizing retirement portfolio performance.

Tax Efficiency: Comparing Strategies for Retirees

Tax efficiency is critical for retirees aiming to maximize after-tax income, with direct indexing offering distinct advantages by allowing for personalized tax-loss harvesting across individual securities. Asset allocation strategies, while important for risk management, may not optimize tax outcomes as effectively since they often involve mutual funds or ETFs with less control over realized gains and losses. Direct indexing enables tailored adjustments to capital gains timing, potentially reducing taxable events and enhancing long-term retirement portfolio sustainability.

Customization and Flexibility in Retirement Investments

Asset allocation allows retirees to diversify across broad asset classes, balancing risk and return through predefined investment categories like stocks, bonds, and cash. Direct indexing offers greater customization by enabling investors to tailor their portfolios to specific tax situations, personal values, and risk preferences, enhancing flexibility in retirement planning. This personalized approach can improve tax efficiency and alignment with individual retirement goals compared to traditional asset allocation strategies.

Risks and Considerations for Each Approach

Asset allocation for retirement involves diversifying investments across asset classes to manage market risk and ensure steady growth, but it may lead to exposure to broad market downturns and limited tax efficiency. Direct indexing offers personalized portfolio customization and potential tax-loss harvesting, reducing tax liabilities, yet it requires more active management and carries risks of concentration and higher transaction costs. Investors must weigh the trade-offs between diversification, cost, tax implications, and management complexity when choosing between asset allocation and direct indexing strategies.

Cost Comparison: Asset Allocation vs Direct Indexing

Asset allocation typically involves lower management fees through diversified mutual funds or ETFs, making it cost-effective for many retirement portfolios. Direct indexing requires higher upfront costs due to purchasing individual securities, but offers potential tax efficiency and customization that may offset expenses over time. Evaluating long-term fees, including trading costs and tax implications, is essential for retirement investors choosing between these strategies.

Choosing the Right Strategy for Your Retirement Goals

Choosing the right strategy for your retirement goals involves evaluating asset allocation and direct indexing based on individual risk tolerance and tax efficiency. Asset allocation diversifies investments across stocks, bonds, and cash to manage risk, while direct indexing offers customized portfolios by tracking specific indices for potential tax-loss harvesting benefits. Aligning your choice with retirement timelines and financial objectives optimizes long-term growth and income stability.

Related Important Terms

Personalized Indexing

Personalized indexing offers a tailored approach to retirement asset allocation by customizing portfolios to individual risk tolerance and goals, unlike traditional index funds that apply a uniform strategy. This method enhances tax efficiency and diversification, potentially improving retirement outcomes through precise exposure management.

Tax-Loss Harvesting Automation

Tax-loss harvesting automation in direct indexing offers retirees more precise control over their portfolio's tax efficiency compared to traditional asset allocation strategies, enabling personalized tax savings by systematically offsetting gains with losses at a granular security level. This method enhances after-tax returns by optimizing individual stock selections and tailored loss capture, which is often limited in broad asset allocation models.

Glide Path Asset Allocation

Glide path asset allocation gradually shifts retirement portfolios from higher-risk equities to lower-risk bonds as investors approach retirement, aiming to reduce volatility and preserve capital. Direct indexing offers personalized tax-loss harvesting and enhanced diversification but requires active management compared to the systematic, target-date approach of glide paths.

ESG Direct Indexing

ESG direct indexing offers personalized asset allocation by allowing investors to tailor their retirement portfolios to specific environmental, social, and governance criteria while directly holding underlying securities, enhancing diversification and tax efficiency. This approach contrasts traditional asset allocation by providing greater transparency, control, and alignment with individual values, making it an increasingly popular strategy for sustainable retirement investing.

Direct Indexing Retirement-Ready Portfolios

Direct indexing retirement-ready portfolios offer personalized asset allocation by enabling investors to hold individual securities aligned with their tax situations and investment goals. This strategy enhances diversification and tax efficiency compared to traditional asset allocation methods, making it a tailored approach for optimizing retirement savings.

Fractional Share Asset Allocation

Fractional share asset allocation enhances portfolio diversification by allowing investors to purchase precise percentages of various securities, optimizing risk management for retirement planning. Direct indexing complements this approach by enabling tailored tax-loss harvesting and personalized index replication, improving long-term after-tax returns.

Tax-Smart Withdrawal Sequencing

Tax-smart withdrawal sequencing in retirement benefits from asset allocation strategies that balance taxable, tax-deferred, and tax-free accounts to optimize tax efficiency and sustain portfolio longevity. Direct indexing enhances this approach by enabling personalized tax-loss harvesting and precise control over the tax impact of individual securities, thereby improving after-tax withdrawal outcomes.

Factor-Based Direct Indexing

Factor-based direct indexing enables investors to customize retirement portfolios by targeting specific risk factors such as value, momentum, and quality, potentially enhancing returns and managing volatility more effectively than traditional asset allocation. This approach allows for tax-efficient rebalancing and greater control over individual securities, aligning retirement investments with personalized financial goals and market conditions.

Dynamic Asset Allocation Overlay

Dynamic Asset Allocation Overlay enhances retirement portfolios by adjusting asset weights in response to market trends and risk tolerance, offering a flexible strategy compared to direct indexing's fixed approach focused on individual securities. This method can optimize returns and manage risk more proactively, improving long-term retirement outcomes through continuous portfolio rebalancing and tactical shifts.

Smart Beta Direct Indexing

Smart Beta direct indexing enhances retirement portfolios by combining targeted factor exposure with personalized tax efficiency, offering a more precise asset allocation strategy compared to traditional index funds. This approach enables investors to customize risk-return profiles through specific factor tilts and direct ownership of securities, optimizing long-term retirement wealth accumulation.

Asset allocation vs direct indexing for retirement. Infographic

moneydiff.com

moneydiff.com