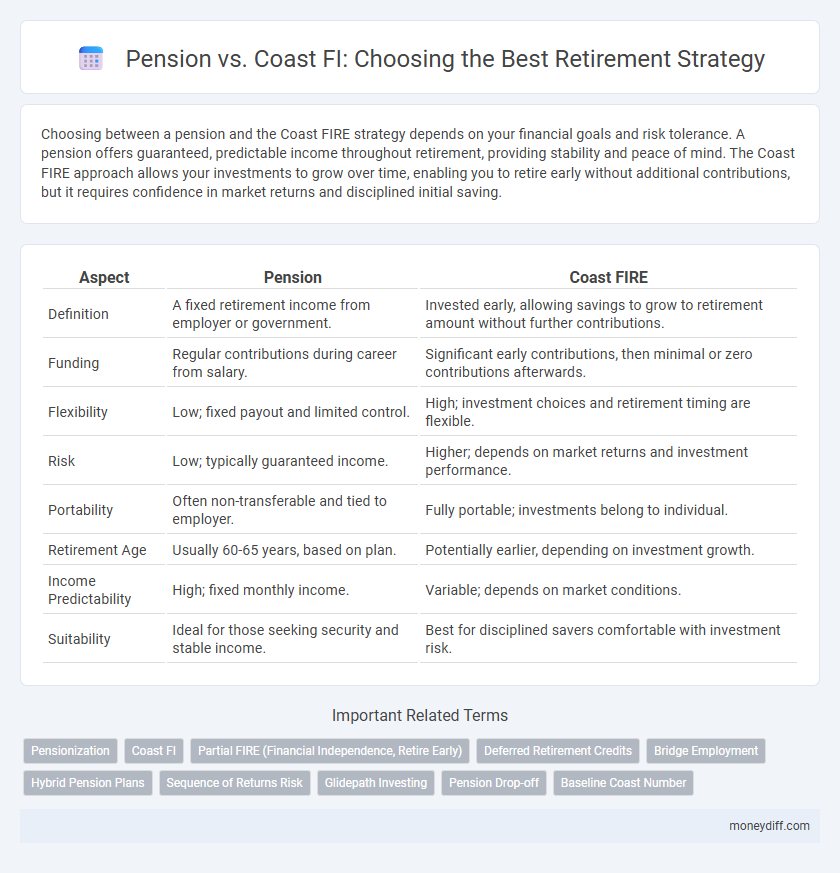

Choosing between a pension and the Coast FIRE strategy depends on your financial goals and risk tolerance. A pension offers guaranteed, predictable income throughout retirement, providing stability and peace of mind. The Coast FIRE approach allows your investments to grow over time, enabling you to retire early without additional contributions, but it requires confidence in market returns and disciplined initial saving.

Table of Comparison

| Aspect | Pension | Coast FIRE |

|---|---|---|

| Definition | A fixed retirement income from employer or government. | Invested early, allowing savings to grow to retirement amount without further contributions. |

| Funding | Regular contributions during career from salary. | Significant early contributions, then minimal or zero contributions afterwards. |

| Flexibility | Low; fixed payout and limited control. | High; investment choices and retirement timing are flexible. |

| Risk | Low; typically guaranteed income. | Higher; depends on market returns and investment performance. |

| Portability | Often non-transferable and tied to employer. | Fully portable; investments belong to individual. |

| Retirement Age | Usually 60-65 years, based on plan. | Potentially earlier, depending on investment growth. |

| Income Predictability | High; fixed monthly income. | Variable; depends on market conditions. |

| Suitability | Ideal for those seeking security and stable income. | Best for disciplined savers comfortable with investment risk. |

Pension vs Coast Retirement: An Overview

Pension retirement guarantees a fixed income stream based on years of service and salary history, providing financial stability and predictable cash flow throughout retirement. Coast retirement means saving enough early on so your assets can grow without additional contributions, allowing you to "coast" to retirement while maintaining your current lifestyle. Comparing pension vs coast retirement strategies highlights the trade-off between guaranteed income security and investment-driven growth flexibility.

Defining Traditional Pension Systems

Traditional pension systems provide retirees with a guaranteed income based on years of service and salary history, ensuring financial stability throughout retirement. These defined benefit plans are typically funded by employer contributions and are managed to provide a predictable monthly payment. Unlike pension alternatives such as retirement coast strategies, traditional pensions focus on steady, lifelong income rather than relying on accrued personal savings.

What Is Coast Retirement?

Coast retirement is a strategy where you save aggressively early in your career until your investments grow enough to fund your retirement without additional contributions. Unlike relying solely on a traditional pension, coast retirement emphasizes building a substantial investment portfolio that grows over time, allowing you to stop saving and still retire comfortably. This method provides flexibility and independence from employer pension plans, making it a popular choice for those seeking financial freedom.

Key Differences: Pension vs Coast Retirement

Pension retirement guarantees a fixed income stream based on salary and years of service, offering financial security without market risk. Coast retirement requires accumulating enough savings early on so future contributions are unnecessary, relying heavily on investment growth and market performance. Pension plans provide predictable benefits, whereas coast retirement demands disciplined saving and risk tolerance for potential higher returns.

Financial Security: Which Approach Wins?

Pension plans provide guaranteed monthly income, offering predictable financial security during retirement, whereas the Coast retirement strategy relies on early investments growing over time, reducing the need for future contributions. Pension benefits are less susceptible to market fluctuations, making them a safer choice for retirees seeking stable cash flow. In contrast, the Coast approach requires disciplined investing and market risk tolerance but can yield higher long-term returns, potentially enhancing overall retirement savings.

Flexibility and Lifestyle Choices

Pension plans offer stable, predictable income but often limit flexibility, tying retirees to fixed payout schedules that may restrict lifestyle adaptations. Coast retirement strategies allow individuals to stop saving early while letting investments grow, providing greater freedom to customize retirement timing and spending habits. Embracing Coast approaches empowers retirees to adjust lifestyle choices dynamically, balancing financial independence with personal preferences.

Investment Strategies for Each Path

Pension plans offer guaranteed lifetime income, reducing investment risk and requiring minimal active management, making them ideal for conservative retirees prioritizing stability. The Coast retirement strategy focuses on aggressive early investments, allowing growth without additional contributions, suitable for those comfortable with market volatility and seeking financial independence. Tailoring asset allocation is crucial: pensions favor fixed-income and low-risk assets, while the Coast approach benefits from diversified portfolios with higher equity exposure for long-term capital appreciation.

Risks and Limitations to Consider

Pension plans offer stable, predictable income but face risks such as plan insolvency and inflation eroding purchasing power. Coast retirement strategies require disciplined early savings but are vulnerable to market volatility and unexpected expenses reducing the principal. Both approaches demand careful evaluation of longevity risk, healthcare costs, and changes in tax policies to ensure financial security in retirement.

Who Should Choose Pension vs Coast Retirement?

Individuals with stable, lifelong income needs and a preference for predictability should choose pension retirement plans, which provide guaranteed monthly payments throughout retirement. Those who have already accumulated sufficient retirement savings and want to stop contributing while maintaining their lifestyle may prefer coast retirement, allowing their investments to grow passively until retirement. Risk tolerance and financial discipline play key roles in determining whether pension or coast retirement strategies best suit one's long-term goals.

Conclusion: Making the Right Retirement Decision

Choosing between pension and coast retirement strategies depends on individual financial goals, risk tolerance, and retirement timeline. A pension offers steady, guaranteed income, ideal for those valuing security, while the coast method emphasizes early savings growth to reduce work years. Evaluating personal circumstances and projecting future expenses ensures the optimal approach for a financially stable retirement.

Related Important Terms

Pensionization

Pensionization involves converting retirement savings into a steady pension income, ensuring consistent cash flow throughout retirement compared to the coast retirement strategy, which focuses on accumulating savings without additional contributions. This approach prioritizes financial stability by guaranteeing a predictable income stream, reducing the risk of outliving assets.

Coast FI

Coast Financial Independence (Coast FI) allows individuals to stop contributing to retirement savings early while their investments grow passively until retirement, contrasting with traditional pension plans that require continuous contributions and often provide fixed income benefits. Choosing Coast FI offers greater flexibility and control over retirement funds, leveraging compound interest to potentially achieve higher wealth accumulation without reliance on employer-provided pensions.

Partial FIRE (Financial Independence, Retire Early)

Partial FIRE strategies balance pension benefits with the Coast FIRE approach, where you accumulate enough investments early to let growth fund your retirement without additional contributions. Leveraging pension security alongside a Coast FIRE portfolio reduces reliance on early withdrawals, providing financial stability and flexibility during your semi-retirement years.

Deferred Retirement Credits

Deferred Retirement Credits (DRCs) increase Social Security benefits by approximately 8% per year beyond full retirement age, making them a crucial factor when deciding between claiming a pension early or opting to coast until a higher benefit age. Choosing to defer Social Security claims maximizes lifetime income potential, especially when coordinated with pension plans that may reduce benefits if claimed before full retirement age.

Bridge Employment

Bridge employment serves as a strategic approach to extend working years between full-time career retirement and claiming a pension, effectively enhancing financial stability. Choosing bridge employment allows retirees to delay pension withdrawals, potentially increasing future benefits while easing the transition from full-time work to retirement.

Hybrid Pension Plans

Hybrid pension plans combine the security of traditional defined benefit pensions with the flexibility of defined contribution plans, offering retirees both predictable income and potential for growth. This approach mitigates longevity risk while allowing for investment adjustments, making it an optimal strategy compared to relying solely on pension or coast retirement methods.

Sequence of Returns Risk

Sequence of Returns Risk critically impacts retirement outcomes by influencing the sustainability of pension withdrawals versus the Coast FIRE strategy, which relies on accumulating a sufficient nest egg early to coast to retirement without additional contributions. Pensions provide a stable income stream, mitigating sequence risk by guaranteeing payments regardless of market volatility, while Coast FIRE investors remain vulnerable to unfavorable market returns early in retirement, potentially requiring adjustments to spending or savings plans.

Glidepath Investing

Glidepath investing strategically adjusts asset allocation over time, balancing growth and risk to optimize retirement outcomes, particularly when comparing pension benefits to the Coast FIRE strategy. Pension plans offer guaranteed income streams that reduce longevity risk, while Coast FIRE relies on early investment growth, with glidepath principles ensuring portfolios become more conservative as retirement approaches.

Pension Drop-off

Pension drop-off significantly impacts retirement income security, as reductions in defined benefit plans lead many retirees to rely on alternative strategies like Coast FIRE, which emphasizes early saving to cover future expenses without ongoing contributions. Understanding the trade-offs between steady pension income and the flexibility of Coast FIRE empowers individuals to optimize retirement funding and mitigate risks associated with pension discontinuation.

Baseline Coast Number

The Baseline Coast Number represents the lump sum required today to cover all future retirement expenses without additional contributions, serving as a critical benchmark in comparing Pension and Coast strategies. While a pension guarantees steady income, achieving the Coast Number allows retirees to stop saving early and let investments grow passively, providing greater flexibility and potential for growth.

Pension vs Coast for retirement. Infographic

moneydiff.com

moneydiff.com