Retirement annuities provide a steady income stream based on your contributions and investment performance, ensuring predictable cash flow throughout retirement. Longevity insurance, also known as a deferred income annuity, kicks in at a later age to protect against outliving your savings by offering guaranteed payments starting in advanced years. Combining both can enhance retirement security by balancing immediate income needs with protection against longevity risk.

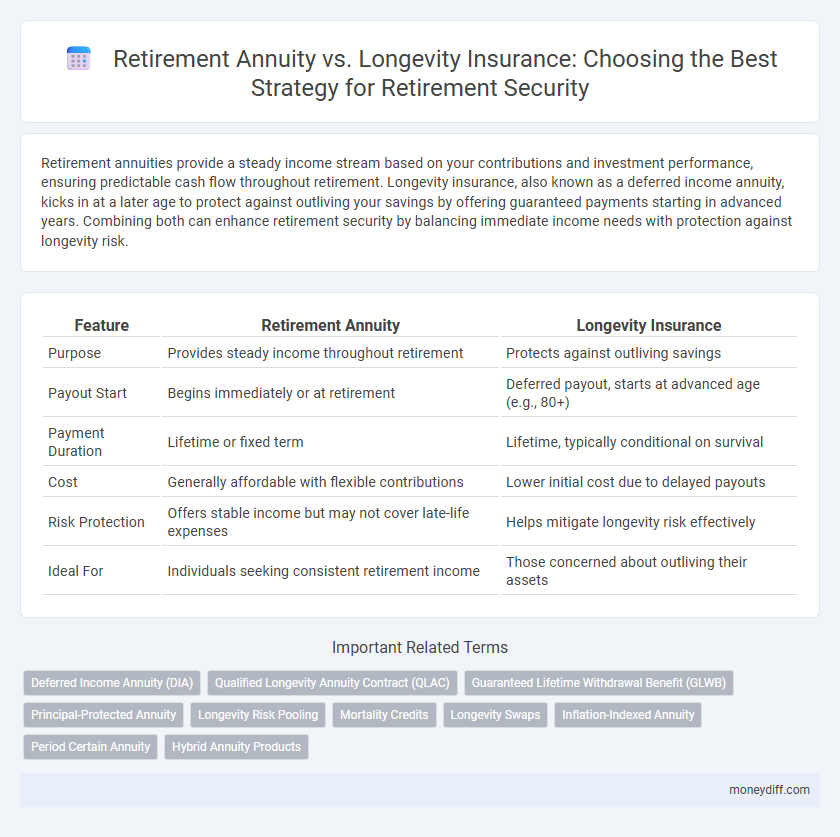

Table of Comparison

| Feature | Retirement Annuity | Longevity Insurance |

|---|---|---|

| Purpose | Provides steady income throughout retirement | Protects against outliving savings |

| Payout Start | Begins immediately or at retirement | Deferred payout, starts at advanced age (e.g., 80+) |

| Payment Duration | Lifetime or fixed term | Lifetime, typically conditional on survival |

| Cost | Generally affordable with flexible contributions | Lower initial cost due to delayed payouts |

| Risk Protection | Offers stable income but may not cover late-life expenses | Helps mitigate longevity risk effectively |

| Ideal For | Individuals seeking consistent retirement income | Those concerned about outliving their assets |

Understanding Retirement Annuities

Retirement annuities provide a steady income stream by converting a lump sum into periodic payments, ensuring financial stability throughout retirement. These products often offer tax advantages and flexible payout options tailored to individual retirement goals. Understanding the terms, fees, and payout structures of retirement annuities is crucial for maximizing retirement security.

What Is Longevity Insurance?

Longevity insurance is a specialized type of deferred annuity designed to provide guaranteed income starting at an advanced age, typically around 80 or 85, helping retirees hedge against the financial risk of outliving their savings. Unlike traditional retirement annuities that begin payouts immediately or soon after retirement, longevity insurance begins payments later in life, ensuring sustained income during the often unpredictable later years. This strategic approach offers a safety net for retirees seeking to secure financial stability throughout their extended lifespans.

Key Differences Between Annuities and Longevity Insurance

Retirement annuities provide a steady income stream for a predetermined period or lifetime, offering predictable cash flow and investment growth potential. Longevity insurance, often structured as a deferred annuity, begins payouts at an advanced age, typically 80 or 85, addressing the risk of outliving savings by focusing on late-life financial security. Key differences include timing of payouts, with annuities starting immediately or soon after retirement, while longevity insurance activates later, and the coverage scope, where annuities cover broader retirement needs, and longevity insurance targets longevity risk specifically.

How Each Option Provides Retirement Security

Retirement annuities offer a guaranteed income stream for life, ensuring consistent financial support regardless of market fluctuations, which helps retirees manage essential expenses confidently. Longevity insurance, or deferred income annuity, begins payouts later in life, typically around age 80 or 85, providing protection against outliving assets and covering healthcare or long-term care costs. Both options complement traditional retirement savings by addressing income longevity risk and sustaining financial security throughout the retirement years.

Pros and Cons of Retirement Annuities

Retirement annuities provide guaranteed income streams that reduce longevity risk and offer tax-deferred growth, making them a reliable choice for steady retirement security. However, they often lack liquidity, come with surrender charges, and may not keep pace with inflation unless linked to inflation-adjusted products. Evaluating fees, payout options, and flexibility is essential to align retirement annuities with individual financial goals and risk tolerance.

Pros and Cons of Longevity Insurance

Longevity insurance offers a focused approach to retirement security by providing guaranteed income starting at an advanced age, typically around 80 or 85, which helps protect against outliving savings. Its primary advantage lies in mitigating longevity risk without requiring large upfront premiums, but this benefit comes with the downside of no payouts if the insured dies early, potentially resulting in a total loss of paid premiums. While longevity insurance complements other retirement income sources, its inflexibility and delayed benefits may limit suitability for those needing more immediate or flexible income options.

Cost Considerations for Annuities vs Longevity Insurance

Retirement annuities typically involve higher upfront costs and ongoing fees that can erode returns over time, whereas longevity insurance often requires lower premiums but activates only at advanced ages, offering cost-efficient risk management for outliving assets. Annuities may include surrender charges and administrative expenses, while longevity insurance focuses on affordability through delayed benefit commencement. Evaluating these cost structures is crucial for optimizing retirement security and ensuring sustainable income throughout retirement.

Suitability: Who Should Choose an Annuity or Longevity Insurance?

Retirement annuities are ideal for individuals seeking guaranteed income throughout retirement, especially those preferring predictable cash flow and risk-averse investment strategies. Longevity insurance suits retirees aiming to protect against outliving their savings by providing income that begins later in life, typically after age 80. High-net-worth individuals and those with other sources of steady income may benefit from longevity insurance to hedge longevity risk without compromising current liquidity.

Tax Implications for Each Option

Retirement annuities typically offer tax-deductible contributions with taxes deferred until withdrawal, allowing potential growth in a tax-advantaged account, whereas longevity insurance premiums are paid with after-tax dollars and provide tax-free income streams upon payout. Tax deferral in retirement annuities can result in higher taxable income during retirement, affecting Social Security taxation and Medicare premiums. Longevity insurance reduces this risk by delivering tax-free benefits starting at an advanced age, which can optimize retirement income and minimize overall tax liabilities.

Making the Right Choice for Your Retirement Plan

Retirement annuities provide guaranteed income streams based on accumulated contributions, ensuring steady cash flow throughout retirement. Longevity insurance, designed to begin payouts at advanced ages like 80 or 85, offers protection against outliving assets by covering long-term care and inflation risks. Evaluating factors such as life expectancy, premium costs, and financial goals helps determine the optimal retirement product to secure lifelong financial stability.

Related Important Terms

Deferred Income Annuity (DIA)

A Deferred Income Annuity (DIA) offers guaranteed lifetime income starting at a future date, providing a reliable hedge against outliving retirement savings compared to traditional retirement annuities. Longevity insurance through a DIA specifically addresses longevity risk by deferring payouts until advanced ages, ensuring sustained financial security in later retirement years.

Qualified Longevity Annuity Contract (QLAC)

A Qualified Longevity Annuity Contract (QLAC) provides a secure income stream beginning late in retirement, reducing the risk of outliving assets compared to traditional retirement annuities that start payouts earlier. By deferring distributions until age 85, QLACs offer tax advantages and help maintain required minimum distributions (RMDs) limits, enhancing long-term retirement security.

Guaranteed Lifetime Withdrawal Benefit (GLWB)

Guaranteed Lifetime Withdrawal Benefit (GLWB) in retirement annuities provides assured income streams regardless of market volatility, ensuring retirees do not outlive their savings. Longevity insurance, while focused on late-life financial protection, typically starts payouts later and may lack the flexible, continuous income feature that GLWB offers throughout retirement.

Principal-Protected Annuity

Retirement security hinges on choosing between a Principal-Protected Annuity, which guarantees the original investment while providing steady income, and Longevity Insurance, designed to offer payments later in life to combat outliving savings. Principal-Protected Annuities minimize risk by preserving capital and delivering predictable returns, making them a preferred option for retirees seeking stable, long-term financial stability.

Longevity Risk Pooling

Longevity insurance provides retirees with pooled risk protection by spreading the financial impact of outliving assets across a large group, enhancing retirement security beyond traditional retirement annuities. Unlike fixed payout annuities, longevity insurance activates only when the insured surpasses a certain age, optimizing cost-efficiency and addressing longevity risk pooling more effectively.

Mortality Credits

Retirement annuities leverage mortality credits by pooling longevity risk among participants, enhancing sustainable income streams through the redistribution of funds from deceased members to survivors. Longevity insurance provides targeted protection against outliving assets by activating payouts only upon reaching advanced ages, but typically lacks the continuous mortality credit benefits inherent in annuity structures.

Longevity Swaps

Longevity swaps offer a sophisticated risk management tool by transferring the risk of retirees living longer than expected from pension funds to capital market investors, enhancing retirement security beyond traditional retirement annuities. This financial instrument provides a hedge against longevity risk, ensuring stable income streams and reducing the uncertainty associated with individual lifespan variability in retirement planning.

Inflation-Indexed Annuity

Inflation-indexed annuities provide a reliable income stream that adjusts with the cost of living, ensuring retirement security against inflation's eroding effects. Unlike longevity insurance, which activates only at advanced ages for survival protection, inflation-indexed annuities offer consistent purchasing power throughout retirement.

Period Certain Annuity

Period certain annuities provide guaranteed income for a fixed number of years, offering a reliable safety net but limited protection against lifespan uncertainty compared to longevity insurance, which specifically addresses the risk of outliving assets. Choosing between a retirement annuity and longevity insurance depends on balancing upfront cost, guaranteed payout duration, and the need for lifetime income security in retirement planning.

Hybrid Annuity Products

Hybrid annuity products combine the benefits of retirement annuities and longevity insurance by offering guaranteed lifetime income with flexible withdrawal options, addressing both income stability and longevity risk. These products optimize retirement security through diversified payout structures and built-in features that adapt to changing financial needs as retirees age.

Retirement Annuity vs Longevity Insurance for retirement security Infographic

moneydiff.com

moneydiff.com