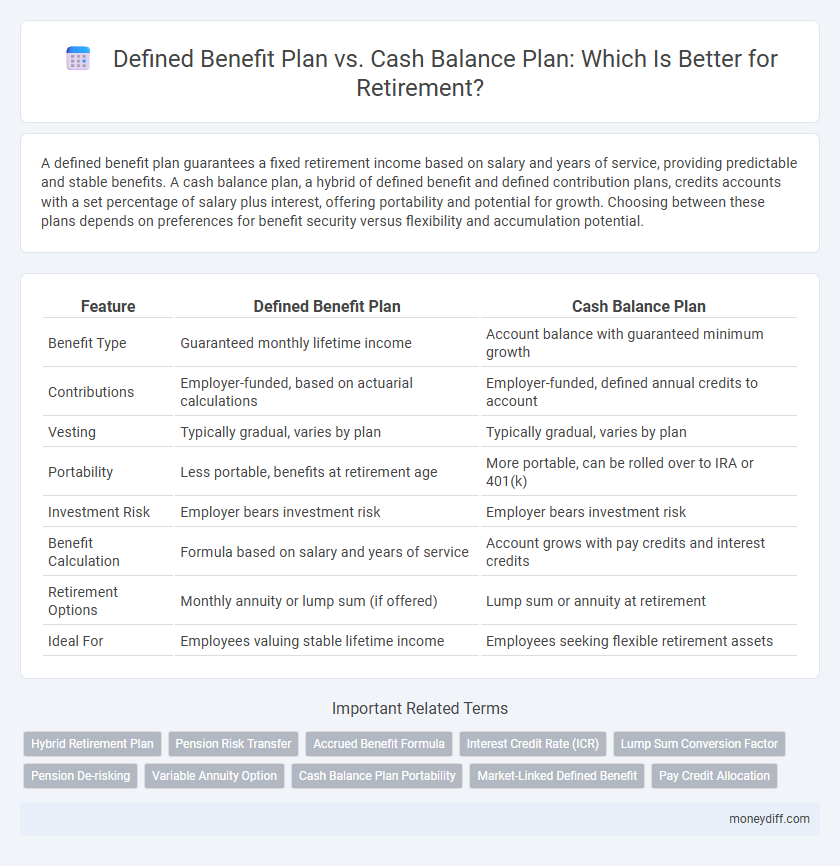

A defined benefit plan guarantees a fixed retirement income based on salary and years of service, providing predictable and stable benefits. A cash balance plan, a hybrid of defined benefit and defined contribution plans, credits accounts with a set percentage of salary plus interest, offering portability and potential for growth. Choosing between these plans depends on preferences for benefit security versus flexibility and accumulation potential.

Table of Comparison

| Feature | Defined Benefit Plan | Cash Balance Plan |

|---|---|---|

| Benefit Type | Guaranteed monthly lifetime income | Account balance with guaranteed minimum growth |

| Contributions | Employer-funded, based on actuarial calculations | Employer-funded, defined annual credits to account |

| Vesting | Typically gradual, varies by plan | Typically gradual, varies by plan |

| Portability | Less portable, benefits at retirement age | More portable, can be rolled over to IRA or 401(k) |

| Investment Risk | Employer bears investment risk | Employer bears investment risk |

| Benefit Calculation | Formula based on salary and years of service | Account grows with pay credits and interest credits |

| Retirement Options | Monthly annuity or lump sum (if offered) | Lump sum or annuity at retirement |

| Ideal For | Employees valuing stable lifetime income | Employees seeking flexible retirement assets |

Understanding Defined Benefit Plans: An Overview

Defined Benefit Plans guarantee a fixed retirement income based on salary history and years of service, offering predictable and stable benefits to employees. These plans are funded and managed by employers, who assume the investment risk and ensure promised payouts upon retirement. Understanding the structure and obligations of Defined Benefit Plans is crucial for evaluating retirement security compared to alternatives like Cash Balance Plans.

What Is a Cash Balance Plan? Key Features

A cash balance plan is a type of defined benefit retirement plan that combines features of both traditional defined benefit plans and defined contribution plans, providing employees with a guaranteed account balance that grows annually through employer contributions and interest credits. Key features include portability of the account balance upon retirement or job change, predictable benefits due to defined interest rates, and simplified benefit calculations based on hypothetical account balances rather than complex formulas. These plans offer employers greater flexibility in funding while giving employees clearer insight into their retirement savings growth.

Comparing Retirement Benefit Formulas: DB vs. Cash Balance

Defined benefit plans calculate retirement benefits based on a fixed formula incorporating salary history and years of service, providing predictable monthly payments. Cash balance plans, a type of defined benefit plan, express benefits as hypothetical individual accounts where contributions and interest credits grow annually. Comparing these formulas, cash balance plans offer more transparency and portability, while traditional DB plans emphasize lifetime income security with less emphasis on individual account balances.

Employer Sponsorship and Funding Differences

Defined benefit plans are employer-sponsored retirement plans that guarantee a fixed monthly benefit based on salary and years of service, with the employer responsible for funding the plan and managing investment risks. Cash balance plans, also employer-sponsored, function as hybrid plans where employers contribute a specified percentage of salary into individual hypothetical accounts, combining elements of defined benefit and defined contribution plans. Funding for defined benefit plans requires the employer to ensure sufficient assets to pay future benefits, while cash balance plans have clearer annual contribution requirements, making funding more predictable for employers.

Payout Options: Lifetime Annuity vs. Lump Sum

Defined benefit plans typically provide a lifetime annuity as the primary payout option, ensuring steady, guaranteed income throughout retirement based on salary and years of service. Cash balance plans often offer more flexible payout options, including lump sum distributions that allow retirees to invest their savings independently. Choosing between lifetime annuities and lump sums influences retirement income security and potential growth, depending on individual financial goals and risk tolerance.

Portability and Flexibility in Retirement Planning

Defined benefit plans guarantee a fixed retirement benefit based on salary and years of service but often lack portability when changing jobs. Cash balance plans combine features of defined benefit plans with defined contribution plans, offering more portability by tracking account balances that can be rolled over into IRAs or other retirement accounts. This flexibility makes cash balance plans more attractive for employees seeking adaptable retirement options amid career changes.

Employee Contribution and Investment Risk

Defined benefit plans typically require no employee contributions, placing investment risk entirely on the employer, who guarantees a specific retirement benefit. Cash balance plans combine features of defined benefit and defined contribution plans, often requiring employee contributions and crediting a hypothetical account with interest, thus sharing investment risk between employer and employee. Employees may prefer cash balance plans for greater portability and transparency, while employers benefit from predictable funding requirements.

Tax Advantages of Both Plans

Defined benefit plans offer significant tax advantages by allowing employers to make tax-deductible contributions, with earnings growing tax-deferred until retirement distributions. Cash balance plans also provide tax benefits through tax-deferred growth on employer contributions, and participants receive a guaranteed account balance reflecting interest credits. Both plans reduce current taxable income for employers while enabling employees to accumulate retirement savings with postponed tax liabilities.

Suitability: Which Plan is Right for Your Retirement?

Defined benefit plans offer retirees a predictable monthly income based on salary and years of service, ideal for those seeking financial security and stable cash flow. Cash balance plans combine features of traditional pensions and defined contributions, providing flexible retirement savings with potential for portability, suitable for workers who value plan portability and defined contribution transparency. Evaluating your career length, risk tolerance, and retirement goals will help determine which plan aligns best with your financial future.

Future Trends: The Shift from Defined Benefit to Cash Balance Plans

Future trends in retirement show a clear shift from traditional defined benefit plans toward cash balance plans, driven by employers seeking predictable costs and simplified administration. Cash balance plans offer a hybrid approach combining features of defined benefit and defined contribution plans, appealing to both employers and employees with their portability and clearer benefit statements. The transition reflects broader changes in workforce demographics and regulatory environments favoring flexibility and cost containment in retirement plan design.

Related Important Terms

Hybrid Retirement Plan

A Hybrid Retirement Plan combines features of both Defined Benefit and Cash Balance Plans, offering a guaranteed lifetime income with a personalized account balance that grows with interest credits. This structure provides employees with the security of a traditional pension and the flexibility of a defined contribution, optimizing retirement benefits and financial predictability.

Pension Risk Transfer

Defined benefit plans expose employers to significant pension risk, including investment performance and longevity risk, whereas cash balance plans offer a hybrid approach with defined contributions that help mitigate these uncertainties by providing more predictable funding requirements. Pension risk transfer strategies often favor cash balance plans due to their portability and streamlined management, reducing the employer's long-term liability and enabling more effective financial planning for retirement benefits.

Accrued Benefit Formula

A defined benefit plan calculates retirement benefits based on a fixed formula considering salary history and years of service, providing a predictable payout. In contrast, a cash balance plan credits a participant's account with a set percentage of pay plus interest, blending elements of defined benefit security with defined contribution flexibility.

Interest Credit Rate (ICR)

Defined benefit plans guarantee a fixed retirement benefit based on salary and years of service, typically using a predetermined Interest Credit Rate (ICR) to grow the participant's account balance. Cash balance plans combine features of defined benefit and defined contribution plans, crediting accounts with a set ICR annually, often tied to a market index or a fixed percentage, providing predictable growth and retirement income stability.

Lump Sum Conversion Factor

Defined benefit plans calculate retirement benefits based on a lump sum conversion factor that discounts future payments to present value, reflecting life expectancy and interest rates. Cash balance plans use a lump sum conversion factor tied to account balances and interest credits, offering more predictable, portable retirement benefits compared to traditional defined benefit structures.

Pension De-risking

Pension de-risking strategies often favor cash balance plans over defined benefit plans due to their predictable costs and reduced financial volatility for employers. Cash balance plans combine elements of defined contribution plans with traditional pension security, offering a more manageable approach to funding and long-term liability management.

Variable Annuity Option

Defined benefit plans provide a fixed retirement benefit based on salary and years of service, while cash balance plans combine features of defined benefit and defined contribution plans, offering a hypothetical account credited with a pay credit and an interest credit. The Variable Annuity Option in cash balance plans allows participants to invest credited balances in market-based funds, potentially increasing retirement income depending on investment performance.

Cash Balance Plan Portability

Cash balance plans offer superior portability compared to traditional defined benefit plans by allowing employees to carry their accrued account balances when changing jobs, facilitating smoother retirement savings transitions. These plans combine the security of a defined benefit with the flexibility of defined contribution plans, enhancing retirement preparedness for mobile workforces.

Market-Linked Defined Benefit

Market-linked defined benefit plans combine the guaranteed lifetime income of traditional defined benefit pensions with investment returns tied to market performance, offering potential for higher retirement payouts. Unlike cash balance plans, which credit a fixed interest rate or predetermined returns, market-linked defined benefit plans provide participants with benefits that grow based on equity market gains, balancing risk and reward for enhanced retirement security.

Pay Credit Allocation

Defined benefit plans allocate pay credits based on a fixed formula tied to salary and years of service, guaranteeing a specific retirement benefit amount. Cash balance plans credit pay based on a set percentage of compensation plus interest credits, combining features of defined benefit security with defined contribution flexibility.

Defined benefit plan vs Cash balance plan for retirement. Infographic

moneydiff.com

moneydiff.com