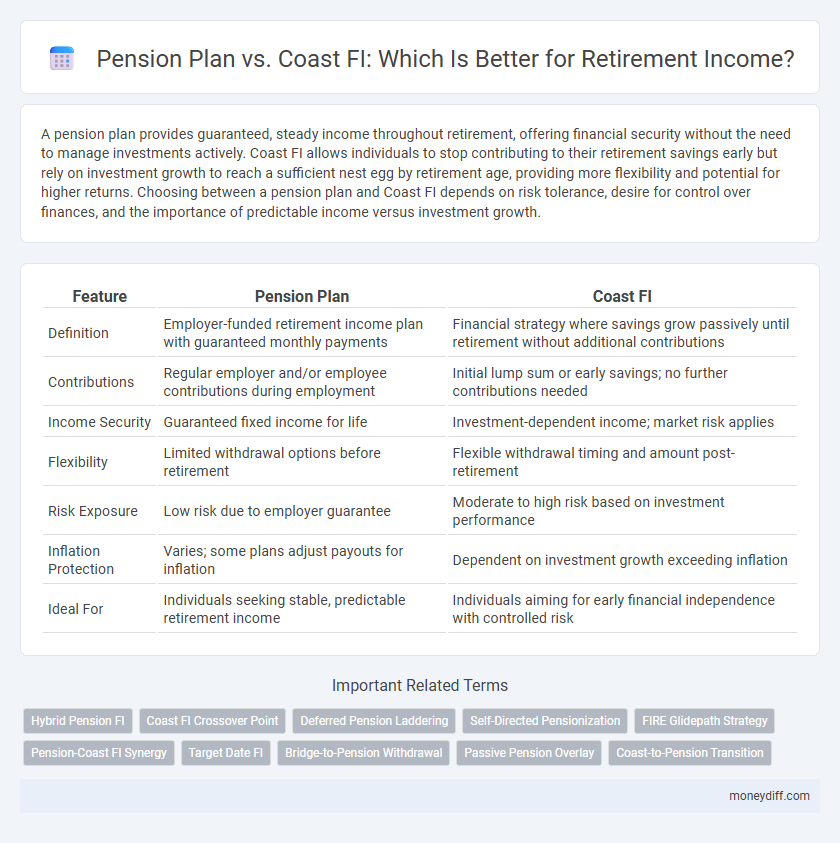

A pension plan provides guaranteed, steady income throughout retirement, offering financial security without the need to manage investments actively. Coast FI allows individuals to stop contributing to their retirement savings early but rely on investment growth to reach a sufficient nest egg by retirement age, providing more flexibility and potential for higher returns. Choosing between a pension plan and Coast FI depends on risk tolerance, desire for control over finances, and the importance of predictable income versus investment growth.

Table of Comparison

| Feature | Pension Plan | Coast FI |

|---|---|---|

| Definition | Employer-funded retirement income plan with guaranteed monthly payments | Financial strategy where savings grow passively until retirement without additional contributions |

| Contributions | Regular employer and/or employee contributions during employment | Initial lump sum or early savings; no further contributions needed |

| Income Security | Guaranteed fixed income for life | Investment-dependent income; market risk applies |

| Flexibility | Limited withdrawal options before retirement | Flexible withdrawal timing and amount post-retirement |

| Risk Exposure | Low risk due to employer guarantee | Moderate to high risk based on investment performance |

| Inflation Protection | Varies; some plans adjust payouts for inflation | Dependent on investment growth exceeding inflation |

| Ideal For | Individuals seeking stable, predictable retirement income | Individuals aiming for early financial independence with controlled risk |

Understanding Pension Plans for Retirement Income

Pension plans provide a guaranteed, steady income stream during retirement based on your years of service and salary history, offering financial security and predictability. Unlike Coast Financial Independence (Coast FI), which relies on early investment growth to cover later expenses, pension plans reduce market risk and emphasize employer commitment. Understanding the benefit formulas, vesting periods, and payout options helps retirees maximize stable income from pension plans.

What is Coast FI? A Modern Approach to Financial Independence

Coast FI is a modern financial independence strategy where you save aggressively early on until your investments can grow passively to cover retirement needs without additional contributions. Unlike traditional pension plans that provide a fixed income based on work history and salary, Coast FI offers flexibility by allowing you to stop saving once your retirement corpus is sufficient to grow on its own. This approach leverages compound interest and market growth, enabling earlier retirement or financial freedom without relying solely on employer pensions.

Pension Plan: Guaranteed Income or Restrictive Structure?

A pension plan provides a guaranteed income stream during retirement, ensuring financial stability without market volatility risks. However, its restrictive structure often limits flexibility, tying beneficiaries to specific terms and potentially lower growth opportunities compared to other retirement strategies. Evaluating pension plans requires balancing the security of fixed payments against the desire for adaptable income sources like Coast FI approaches.

Coast FI: Flexibility and Autonomy in Retirement Planning

Coast FI offers significant flexibility and autonomy in retirement planning by allowing individuals to stop saving early while still reaching their target retirement corpus through compounded growth. Unlike traditional pension plans that provide predetermined payouts with limited control, Coast FI empowers retirees to adjust their spending, investment strategies, and retirement timing according to personal preferences and market conditions. This approach enhances financial independence and enables a customized income path tailored to evolving lifestyle needs.

Comparing Pension Plan Security vs. Coast FI Freedom

A pension plan offers guaranteed lifetime income with predictable monthly payments, providing financial security and reducing longevity risk during retirement. Coast Financial Independence (Coast FI) enables retirees to stop saving early and let investments grow until retirement, offering greater freedom and flexibility but with market risk exposure. Comparing these, pension plans emphasize stability and certainty, while Coast FI prioritizes autonomy and growth potential.

Tax Implications: Pension Plans vs. Coast FI Strategies

Pension plans typically offer tax-deferred growth with taxable withdrawals during retirement, which can result in significant income tax based on the recipient's tax bracket at withdrawal. Coast FI strategies involve accumulating enough savings early to cover future expenses without additional contributions, allowing investments to grow tax-free or tax-efficiently in vehicles like Roth IRAs or taxable accounts with long-term capital gains advantages. Understanding the timing and type of taxation on pension distributions versus the flexible, potentially lower-tax withdrawals from Coast FI accounts is crucial for maximizing after-tax retirement income.

Risks and Market Exposure: Pension Plans vs. Coast FI

Pension plans offer guaranteed income with minimal market exposure, reducing risks associated with market volatility and ensuring financial stability during retirement. In contrast, Coast FI relies heavily on market performance and investment growth, exposing retirees to risks like market downturns and inflation, which can impact the sustainability of retirement income. Understanding these risk profiles is crucial for retirees when deciding between the predictability of pension plans and the growth potential of Coast FI strategies.

Customizing Retirement Income: Which Approach Fits Your Goals?

A pension plan offers guaranteed lifetime income, providing predictable cash flow and financial security in retirement tailored to traditional, risk-averse goals. Coast FIRE relies on aggressive early savings and investment growth to cover future expenses without additional contributions, appealing to those seeking independence and flexibility. Customizing retirement income involves evaluating your risk tolerance, expected lifespan, and lifestyle aspirations to determine which approach aligns with your personalized financial objectives.

Case Study: Pension Plan vs. Coast FI in Action

The case study comparing a traditional pension plan versus Coast Financial Independence (Coast FI) reveals distinct retirement income strategies: pension plans offer guaranteed, fixed monthly benefits often based on years of service and salary history, providing predictable cash flow post-retirement. In contrast, Coast FI leverages accumulated retirement savings grown through compound interest, requiring minimal future contributions to reach financial independence, granting flexibility and control over retirement timing. Data indicates individuals utilizing Coast FI tend to retire earlier and enjoy diversified income streams, while pension recipients benefit from stability and reduced investment risk.

Choosing Your Path: Pension Plan or Coast FI for a Secure Retirement

Choosing between a pension plan and Coast Financial Independence (Coast FI) hinges on your retirement goals and risk tolerance. A pension plan offers guaranteed, predictable income backed by your employer, ensuring stable cash flow during retirement without market risk. Coast FI requires early savings growth to a point where investments can grow passively to cover retirement expenses, providing greater flexibility but demanding disciplined investing and market exposure.

Related Important Terms

Hybrid Pension FI

Hybrid Pension FI combines the stability of traditional pension plans with the flexibility of Coast Financial Independence strategies, allowing retirees to secure a guaranteed income while building sufficient investments to cover future expenses without additional contributions. This approach optimizes retirement income by balancing predictable payouts and investment growth, reducing reliance on market volatility and enhancing long-term financial security.

Coast FI Crossover Point

The Coast FI crossover point occurs when your existing retirement savings grow sufficiently to cover your future financial needs without additional contributions, contrasting with relying solely on a traditional pension plan for steady income. Reaching this point allows retirees to reduce work hours or stop saving aggressively while still ensuring a secure retirement income stream, highlighting the importance of early and consistent investment growth.

Deferred Pension Laddering

Deferred Pension Laddering offers a strategic approach for maximizing retirement income by delaying pension withdrawals to increase future benefits while creating staggered income streams from various deferred sources. This method contrasts with traditional pension plans by providing more flexibility and potential tax advantages, aligning retirement income with evolving financial needs over time.

Self-Directed Pensionization

Self-directed pensionization empowers retirees to tailor their retirement income by strategically converting investments into a sustainable payout, unlike traditional pension plans that offer predefined benefits with limited flexibility. Choosing Coast FI allows individuals to reach financial independence early by focusing on investment growth and minimal withdrawals, providing greater control over when and how to access retirement funds without relying solely on pension disbursements.

FIRE Glidepath Strategy

A Pension plan provides guaranteed lifetime income, ensuring financial stability in retirement, while the Coast FIRE Glidepath Strategy emphasizes early investing to allow savings to grow passively until retirement without additional contributions. Integrating the guaranteed income from a pension with the capital appreciation of a Coast FIRE approach can optimize cash flow and risk management in a diversified retirement income plan.

Pension-Coast FI Synergy

Combining a secure pension plan with Coast Financial Independence (Coast FI) strategies allows retirees to optimize their retirement income by leveraging predictable pension benefits while minimizing aggressive savings during early years. This synergy enhances financial flexibility, as pensions cover baseline expenses and Coast FI investments grow passively, enabling earlier or more comfortable retirement without sacrificing long-term security.

Target Date FI

Target Date Financial Independence (Target Date FI) strategically combines pension plans' steady income with Coast FI's early investment growth, enabling retirees to secure predictable cash flow while maximizing long-term compound returns. This hybrid approach optimizes retirement income by aligning asset allocation with individualized retirement timelines and leveraging guaranteed benefits alongside accumulated investment portfolios.

Bridge-to-Pension Withdrawal

Bridge-to-Pension Withdrawal strategies optimize retirement income by using Coast FI savings to cover expenses before pension benefits commence, ensuring steady cash flow without depleting pension assets prematurely. This approach balances tax efficiency and liquidity, maximizing total lifetime retirement income through strategic timing and asset allocation.

Passive Pension Overlay

A Passive Pension Overlay strategically enhances retirement income by supplementing traditional pension plans with low-cost, diversified index funds that track market performance, reducing risk and increasing flexibility. This approach balances guaranteed pension benefits with the growth potential of passive investments, optimizing long-term wealth accumulation and income stability.

Coast-to-Pension Transition

A Coast FIRE strategy enables individuals to accumulate sufficient retirement savings early, allowing their investments to grow passively while relying on a future pension plan to provide a stable income stream upon retirement. This Coast-to-Pension transition balances investment growth with guaranteed pension benefits, reducing reliance on active contributions and enhancing financial security in retirement.

Pension plan vs Coast FI for retirement income. Infographic

moneydiff.com

moneydiff.com