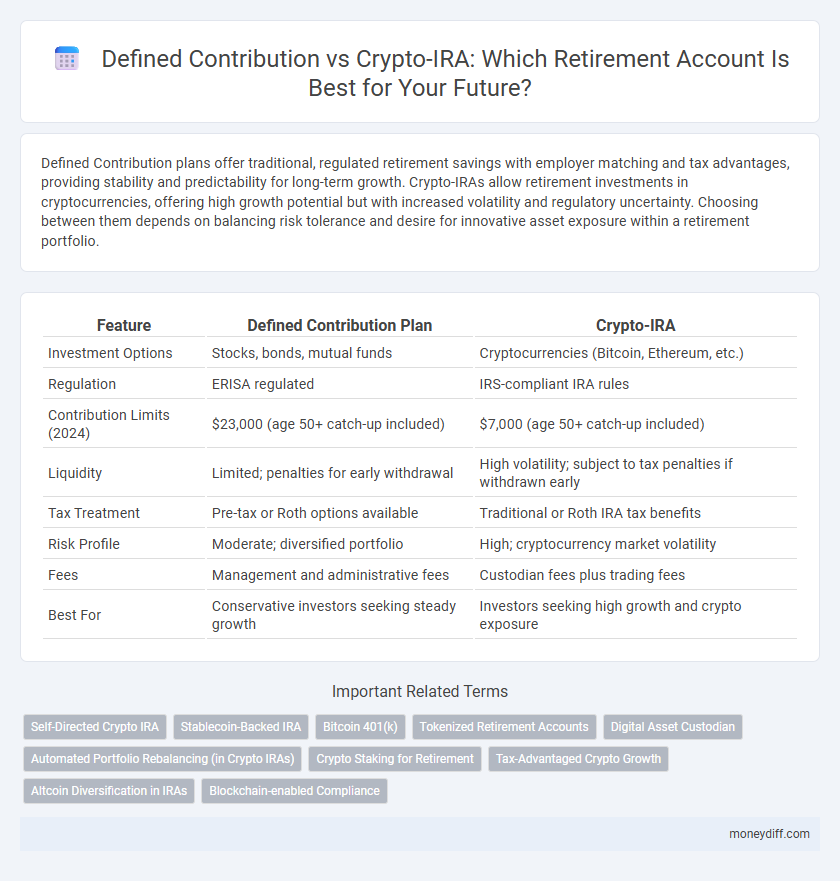

Defined Contribution plans offer traditional, regulated retirement savings with employer matching and tax advantages, providing stability and predictability for long-term growth. Crypto-IRAs allow retirement investments in cryptocurrencies, offering high growth potential but with increased volatility and regulatory uncertainty. Choosing between them depends on balancing risk tolerance and desire for innovative asset exposure within a retirement portfolio.

Table of Comparison

| Feature | Defined Contribution Plan | Crypto-IRA |

|---|---|---|

| Investment Options | Stocks, bonds, mutual funds | Cryptocurrencies (Bitcoin, Ethereum, etc.) |

| Regulation | ERISA regulated | IRS-compliant IRA rules |

| Contribution Limits (2024) | $23,000 (age 50+ catch-up included) | $7,000 (age 50+ catch-up included) |

| Liquidity | Limited; penalties for early withdrawal | High volatility; subject to tax penalties if withdrawn early |

| Tax Treatment | Pre-tax or Roth options available | Traditional or Roth IRA tax benefits |

| Risk Profile | Moderate; diversified portfolio | High; cryptocurrency market volatility |

| Fees | Management and administrative fees | Custodian fees plus trading fees |

| Best For | Conservative investors seeking steady growth | Investors seeking high growth and crypto exposure |

Understanding Defined Contribution Retirement Plans

Defined contribution retirement plans, such as 401(k)s and 403(b)s, involve employee and employer contributions invested to build retirement savings, with benefits dependent on investment performance. These plans offer tax advantages like tax-deferred growth or tax-free withdrawals in Roth options, enhancing long-term wealth accumulation. Understanding plan options, contribution limits set by the IRS, and the impact of fees is crucial for maximizing retirement outcomes compared to alternative accounts like Crypto-IRAs.

What is a Crypto-IRA?

A Crypto-IRA is a type of self-directed individual retirement account that allows investors to hold digital assets such as Bitcoin and Ethereum within a tax-advantaged retirement portfolio. Unlike traditional defined contribution plans like 401(k)s, a Crypto-IRA offers exposure to cryptocurrency markets, providing potential for high returns alongside increased volatility and risk. This option appeals to tech-savvy investors seeking portfolio diversification beyond stocks, bonds, and mutual funds.

Key Features of Defined Contribution Accounts

Defined Contribution accounts, such as 401(k)s and 403(b)s, offer tax-deferred growth with employer matching contributions and standardized investment options managed through established financial institutions. These plans provide regulated safeguards including IRS contribution limits, fiduciary oversight, and required minimum distributions starting at age 73, ensuring compliance and predictable retirement income. The structured nature and professional management of Defined Contribution accounts make them a reliable choice for long-term retirement planning compared to the higher volatility and regulatory uncertainties associated with Crypto-IRAs.

Crypto-IRAs: Pros and Cons

Crypto-IRAs offer high growth potential by allowing investment in cryptocurrencies like Bitcoin and Ethereum within a tax-advantaged retirement account. However, they carry significant risks including market volatility, regulatory uncertainty, and limited acceptance compared to traditional Defined Contribution plans. Investors should weigh the benefits of diversification and potential for substantial returns against the inherent instability and evolving compliance landscape of Crypto-IRAs.

Portfolio Diversification: Traditional vs Crypto Retirement

Defined Contribution plans typically offer diversified portfolios consisting of stocks, bonds, and mutual funds, providing traditional asset allocation and risk management for retirement savings. Crypto-IRA accounts allow investors to include digital assets like Bitcoin and Ethereum, enhancing potential returns through alternative investments but introducing higher volatility and regulatory uncertainty. Combining traditional retirement accounts with Crypto-IRA investments can improve portfolio diversification and balance growth potential with risk exposure.

Tax Implications: Defined Contribution vs Crypto-IRA

Defined Contribution plans offer tax-deferred growth, with contributions typically reducing taxable income in the contribution year and taxes applied upon withdrawal during retirement. Crypto-IRAs provide potential tax advantages similar to traditional IRAs, allowing for tax-deferred or tax-free growth depending on whether they are structured as Traditional or Roth IRAs, but carry additional tax complexity due to the volatile nature and IRS guidelines on cryptocurrency transactions. Understanding IRS rules on required minimum distributions, capital gains treatment, and reporting requirements is crucial when comparing the tax implications of Defined Contribution plans and Crypto-IRAs for retirement savings.

Risk Management Strategies for Retirement Accounts

Defined Contribution plans offer established regulatory protections and predictable contribution limits, enabling steady retirement savings with lower volatility risk. Crypto-IRA accounts introduce high market volatility and regulatory uncertainty, requiring proactive risk management strategies such as portfolio diversification and ongoing asset rebalancing. Effective retirement risk management balances traditional stable assets with innovative crypto exposure while aligning with individual risk tolerance and long-term financial goals.

Regulatory Considerations for Crypto-IRAs

Crypto-IRAs face evolving regulatory scrutiny from the IRS and SEC, affecting tax treatment and compliance requirements compared to traditional defined contribution plans. Unlike conventional retirement accounts regulated under ERISA, Crypto-IRAs must navigate uncertain frameworks around digital asset custody and valuation standards. Investors should assess potential regulatory risks and reporting obligations before integrating cryptocurrency into their retirement portfolios.

Fees and Costs: Traditional Accounts vs Crypto-IRAs

Defined Contribution plans like 401(k)s generally have lower administrative fees and well-established regulatory protections compared to Crypto-IRAs, which often incur higher transaction costs, wallet maintenance fees, and potential custodial expenses. Traditional retirement accounts typically feature transparent fee structures with expense ratios averaging around 0.5%, while Crypto-IRAs can experience volatile costs tied to blockchain network fees and cryptocurrency volatility. Investors must weigh these fee differences carefully, as higher ongoing expenses in Crypto-IRAs may erode long-term retirement savings growth despite potential for higher returns.

Choosing the Right Retirement Account for Your Future

Choosing between a Defined Contribution plan and a Crypto-IRA depends on risk tolerance and investment goals; Defined Contribution plans offer steady employer contributions and traditional asset options, while Crypto-IRAs provide exposure to cryptocurrency's high growth potential but with increased volatility. Diversifying retirement portfolios by blending conventional assets with digital currencies can optimize long-term growth and hedge against market fluctuations. Evaluating fees, tax implications, and regulatory factors is critical to selecting the best retirement account tailored to individual financial strategies.

Related Important Terms

Self-Directed Crypto IRA

A Self-Directed Crypto IRA offers investors greater control and diversification by enabling direct investments in cryptocurrencies like Bitcoin and Ethereum compared to traditional Defined Contribution plans, which primarily focus on stocks and bonds. This retirement option provides tax advantages and the potential for high returns, but requires active management and carries higher volatility risks than typical employer-sponsored accounts.

Stablecoin-Backed IRA

Stablecoin-backed IRAs offer a unique blend of digital asset growth potential and stability by pegging investments to assets like USD Coin (USDC), reducing volatility compared to traditional cryptocurrencies in defined contribution plans. This approach provides diversification and inflation-resistant advantages within retirement portfolios, potentially enhancing long-term asset preservation and retirement income stability.

Bitcoin 401(k)

A Bitcoin 401(k) combines the tax advantages of a traditional 401(k) with the growth potential of Bitcoin, offering a modern alternative to conventional defined contribution plans that typically invest in stocks and bonds. Unlike standard defined contribution accounts, Bitcoin 401(k)s provide exposure to cryptocurrency assets, allowing diversification and potential for higher returns in retirement portfolios.

Tokenized Retirement Accounts

Tokenized Retirement Accounts leverage blockchain technology to offer enhanced transparency, security, and fractional ownership compared to traditional Defined Contribution plans like 401(k)s, enabling diversified portfolios with digital assets including cryptocurrencies. These innovative accounts facilitate real-time asset valuation and reduced intermediaries, positioning them as a modern alternative for retirement savings with potential for higher returns and increased liquidity.

Digital Asset Custodian

Digital Asset Custodians provide secure storage and management solutions for Crypto-IRAs, offering robust protection against cyber threats and regulatory compliance, which contrasts with the traditional brokerage services managing Defined Contribution plans. Compared to Defined Contribution accounts, Crypto-IRAs managed by specialized custodians enable investors to diversify into digital assets, potentially enhancing retirement portfolio growth through blockchain technology exposure.

Automated Portfolio Rebalancing (in Crypto IRAs)

Automated portfolio rebalancing in Crypto IRAs leverages blockchain technology to dynamically adjust asset allocations based on market trends, enhancing risk management and maximizing growth potential. Unlike traditional Defined Contribution plans, which often rely on periodic manual adjustments, Crypto IRAs provide real-time, algorithm-driven rebalancing that aligns with an investor's retirement goals and risk tolerance.

Crypto Staking for Retirement

Crypto-IRAs offer retirement account holders opportunities to earn passive income through crypto staking, which involves locking digital assets to support blockchain operations and receiving rewards, potentially outperforming traditional Defined Contribution plans that rely on conventional market investments. By integrating staking strategies within a Crypto-IRA, investors can diversify their retirement portfolios, potentially enhancing the growth and compounding of assets over time compared to the fixed or volatile returns commonly experienced in Defined Contribution accounts.

Tax-Advantaged Crypto Growth

Defined Contribution plans offer traditional tax-deferred growth, while Crypto-IRAs provide tax-advantaged opportunities for potentially higher returns through cryptocurrency investments. Crypto-IRAs enable tax-efficient compounding by allowing gains to grow tax-deferred or tax-free, depending on the account type, enhancing retirement savings with the volatility and growth potential of digital assets.

Altcoin Diversification in IRAs

Altcoin diversification in Crypto-IRAs offers a broader range of digital assets compared to traditional Defined Contribution plans, potentially enhancing portfolio growth through exposure to emerging blockchain technologies. Unlike standard retirement accounts limited to conventional stocks and bonds, Crypto-IRAs allow investors to include various altcoins, increasing opportunities for higher returns and risk management in retirement planning.

Blockchain-enabled Compliance

Defined Contribution plans offer regulated, tax-advantaged retirement savings with established compliance frameworks, while Crypto-IRAs leverage blockchain-enabled compliance to provide transparent, immutable transaction records and enhanced security for digital asset investments. Blockchain technology in Crypto-IRAs ensures real-time auditing and regulatory adherence, reducing fraud risk and improving trust in retirement account management.

Defined Contribution vs Crypto-IRA for retirement accounts. Infographic

moneydiff.com

moneydiff.com