Social Security provides a reliable, government-backed income stream critical for retirement security, while Slow FI emphasizes prolonged, disciplined saving and investment to achieve financial independence over time. Unlike Social Security, which depends on current contributions and governmental stability, Slow FI grants greater control over retirement timing and lifestyle through accumulated personal wealth. Balancing Social Security benefits with a Slow FI strategy can optimize retirement readiness and financial flexibility.

Table of Comparison

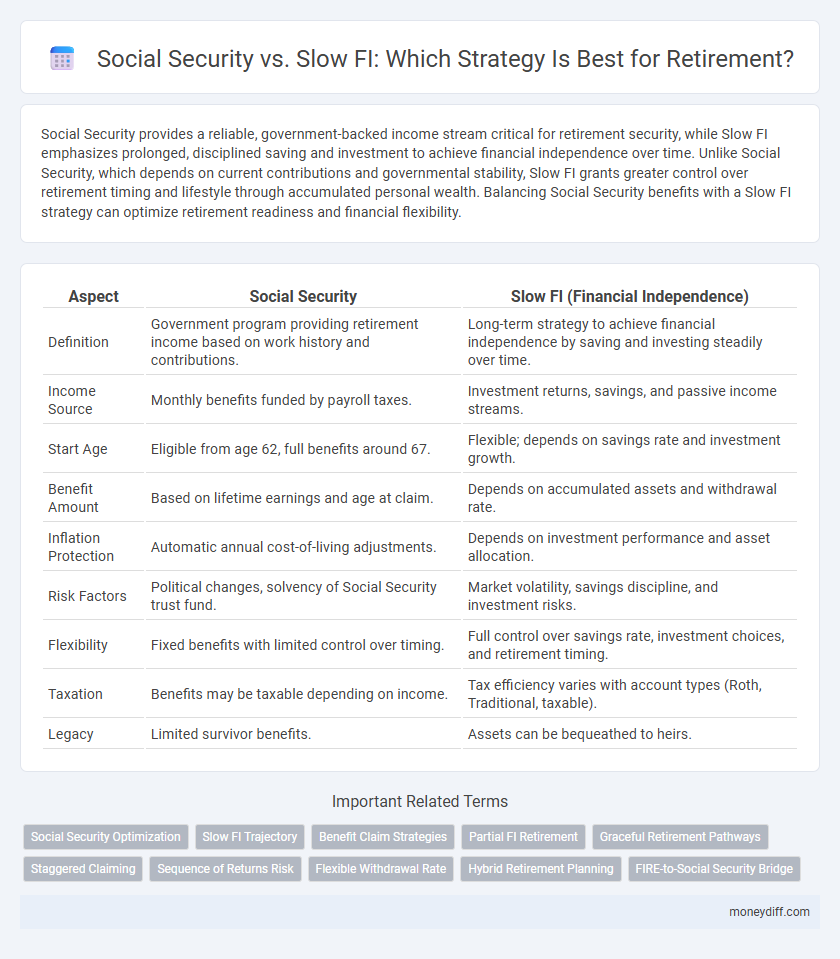

| Aspect | Social Security | Slow FI (Financial Independence) |

|---|---|---|

| Definition | Government program providing retirement income based on work history and contributions. | Long-term strategy to achieve financial independence by saving and investing steadily over time. |

| Income Source | Monthly benefits funded by payroll taxes. | Investment returns, savings, and passive income streams. |

| Start Age | Eligible from age 62, full benefits around 67. | Flexible; depends on savings rate and investment growth. |

| Benefit Amount | Based on lifetime earnings and age at claim. | Depends on accumulated assets and withdrawal rate. |

| Inflation Protection | Automatic annual cost-of-living adjustments. | Depends on investment performance and asset allocation. |

| Risk Factors | Political changes, solvency of Social Security trust fund. | Market volatility, savings discipline, and investment risks. |

| Flexibility | Fixed benefits with limited control over timing. | Full control over savings rate, investment choices, and retirement timing. |

| Taxation | Benefits may be taxable depending on income. | Tax efficiency varies with account types (Roth, Traditional, taxable). |

| Legacy | Limited survivor benefits. | Assets can be bequeathed to heirs. |

Understanding Social Security: Basics and Benefits

Social Security is a government program providing monthly income to retirees based on their work history and earnings, ensuring a safety net during retirement. Benefits depend on lifetime earnings and the age at which claims begin, with full benefits available between ages 66 and 67. Understanding eligibility, benefit calculations, and potential cost-of-living adjustments helps retirees optimize their Social Security income compared to alternatives like Slow FI (Financial Independence).

What is Slow FI? Principles and Approach

Slow Financial Independence (Slow FI) emphasizes gradual wealth accumulation through consistent savings and mindful living rather than rapid wealth pursuit. It prioritizes long-term financial stability by aligning spending habits with personal values and maintaining a balanced work-life approach. Principles include sustainable budgeting, avoiding lifestyle inflation, and integrating retirement planning with Social Security benefits to ensure steady income streams over time.

Eligibility and Timing: Social Security vs. Slow FI

Eligibility for Social Security hinges on earning sufficient work credits, typically requiring 10 years of employment, with full benefits available from ages 66 to 67 depending on birth year. Slow Financial Independence (Slow FI) relies on consistent saving and investing over decades, allowing retirement at any chosen age once passive income meets living expenses. Timing differs as Social Security benefits increase the longer claims are delayed, whereas Slow FI offers flexible retirement timing but demands disciplined, long-term financial planning.

Income Security: Predictability and Flexibility Compared

Social Security offers predictable, inflation-adjusted monthly income backed by government guarantees, ensuring stable cash flow throughout retirement. Slow FI (Financial Independence) provides flexibility by allowing retirees to tailor withdrawal rates and investment strategies but carries market risk and income variability. Balancing these options helps optimize income security by combining guaranteed payments with adaptable financial resources.

Longevity Planning: Which Strategy Lasts Longer?

Social Security provides guaranteed lifetime income indexed for inflation, ensuring financial stability throughout extended retirement periods. Slow FI (Financial Independence) relies on accumulating substantial assets and withdrawing cautiously to sustain longevity, but its success depends on market performance and withdrawal discipline. For longevity planning, Social Security often outlasts Slow FI strategies by reducing risks related to sequence of returns and longevity uncertainty.

Early Retirement: Pros and Cons of Each Path

Early retirement through Social Security relies on meeting age and earnings requirements to maximize benefits, offering a steady, inflation-adjusted income stream but with limited flexibility before full retirement age. Slow Financial Independence (FI) emphasizes disciplined savings and investment growth over time, providing greater control and potential for earlier withdrawal but requiring careful management of market risks and expenses. Each path balances security and autonomy differently, influencing the timing and lifestyle of retirement.

Risk Factors: Inflation, Market Volatility, and Policy Changes

Social Security provides a guaranteed income stream protected against market volatility and inflation adjustments, offering a stable foundation for retirement planning. Slow Financial Independence (Slow FI) strategies heavily rely on market performance, exposing retirees to risks from inflation eroding purchasing power and unpredictable market downturns. Policy changes affecting Social Security benefits can pose long-term risks, but diversified Slow FI portfolios must manage both regulatory shifts and economic fluctuations to sustain retirement income.

Lifestyle Choices: Freedom vs. Stability in Retirement

Social Security offers a stable, government-backed income stream that ensures financial security and a predictable lifestyle during retirement. Slow Financial Independence (Slow FI) emphasizes gradual wealth building, allowing individuals more freedom to choose flexible work options or leisure activities before fully retiring. Balancing these approaches enables retirees to enjoy both financial stability and the freedom to tailor their retirement lifestyle according to personal preferences.

Combining Social Security and Slow FI: A Hybrid Approach

Combining Social Security benefits with a Slow Financial Independence (FI) strategy creates a balanced retirement plan that maximizes long-term security and cash flow flexibility. This hybrid approach allows individuals to gradually reduce work hours while accumulating investments, supplementing income with Social Security payouts to maintain lifestyle stability. Leveraging Social Security's inflation protection alongside slow FI's capital growth enhances financial resilience throughout retirement.

Which is Right for You? Assessing Personal Goals and Values

Choosing between Social Security and Slow FI for retirement hinges on your personal goals, financial values, and risk tolerance. Social Security offers a guaranteed income stream backed by the government, ideal for those prioritizing stability and minimal management, while Slow FI emphasizes disciplined saving and investing to achieve financial independence at a self-determined pace. Assessing factors like desired retirement age, lifestyle expectations, and willingness to navigate market fluctuations helps determine which approach aligns best with your long-term retirement vision.

Related Important Terms

Social Security Optimization

Maximizing Social Security benefits through delayed claiming until age 70 significantly increases monthly retirement income, providing a guaranteed, inflation-adjusted cash flow that often surpasses early withdrawals. Strategic Social Security optimization complements Slow FI approaches by securing a reliable foundation of lifetime income, reducing dependence on portfolio withdrawals and enhancing overall retirement sustainability.

Slow FI Trajectory

Slow FI enables retirees to gradually build financial independence over decades, relying less on Social Security benefits and more on consistent savings and moderate investments. This steady approach reduces withdrawal risks and provides greater flexibility in retirement timing and lifestyle choices.

Benefit Claim Strategies

Maximizing Social Security benefits involves strategic claim timing, typically delaying until age 70 to increase monthly payouts, while Slow FI emphasizes prolonged saving and investment growth to replace income before Social Security starts. Combining these approaches can optimize retirement income by balancing immediate cash flow needs with higher guaranteed benefits later.

Partial FI Retirement

Partial FI retirement allows individuals to reduce working hours and supplement income through Social Security benefits, optimizing the balance between financial independence and secure cash flow. Leveraging Social Security alongside Slow FI strategies enhances retirement stability by providing guaranteed income while gradually increasing passive income streams.

Graceful Retirement Pathways

Choosing Social Security ensures a steady, inflation-adjusted income stream that supports basic needs, while Slow FI emphasizes prolonged saving and investment accumulation for a flexible, self-directed retirement. Combining both strategies promotes graceful retirement pathways by balancing guaranteed benefits with personal financial autonomy.

Staggered Claiming

Staggered claiming of Social Security benefits allows retirees to maximize monthly payments by delaying claims until full retirement age or beyond, while Slow FI strategies emphasize gradual asset withdrawal to sustain long-term financial independence. Combining staggered Social Security with Slow FI ensures a diversified income stream, reducing longevity risk and optimizing retirement cash flow.

Sequence of Returns Risk

Social Security provides a stable, inflation-adjusted income stream that mitigates Sequence of Returns Risk by ensuring consistent cash flow regardless of market volatility. In contrast, Slow FI strategies require careful market timing and asset allocation to manage withdrawal rates, increasing exposure to adverse returns early in retirement.

Flexible Withdrawal Rate

A flexible withdrawal rate in retirement planning allows individuals to adjust their spending based on investment performance and life circumstances, which can optimize longevity of savings compared to relying solely on Social Security benefits. Slow FI strategies emphasize sustainable withdrawal rates that adapt over time, potentially providing greater financial independence and flexibility than the fixed, often inflation-adjusted payouts from Social Security.

Hybrid Retirement Planning

Hybrid retirement planning leverages Social Security benefits as a stable income foundation while pursuing Slow Financial Independence (Slow FI) to gradually build supplemental savings and investments, ensuring diversified income streams and reducing longevity risk. Balancing Social Security's guaranteed payments with the flexible withdrawal strategies of Slow FI enhances financial resilience and lifestyle freedom throughout retirement.

FIRE-to-Social Security Bridge

Utilizing Slow FIRE as a bridge to Social Security retirement benefits allows individuals to retire early with partial financial independence while maximizing eventual Social Security payouts by delaying claims until full retirement age or beyond. This strategy balances immediate access to personal savings with long-term guaranteed income, optimizing overall retirement security and cash flow management.

Social Security vs Slow FI for retirement. Infographic

moneydiff.com

moneydiff.com