A pension plan offers a steady, employer-managed income stream, providing predictable financial security during retirement, while a self-directed IRA allows greater control over investment choices, enabling personalized growth strategies to maximize returns. Understanding the balance between guaranteed benefits from a pension and the flexibility of a self-directed IRA can help optimize retirement income according to individual risk tolerance and financial goals. Evaluating fees, tax implications, and withdrawal options is essential when deciding between these two retirement planning approaches.

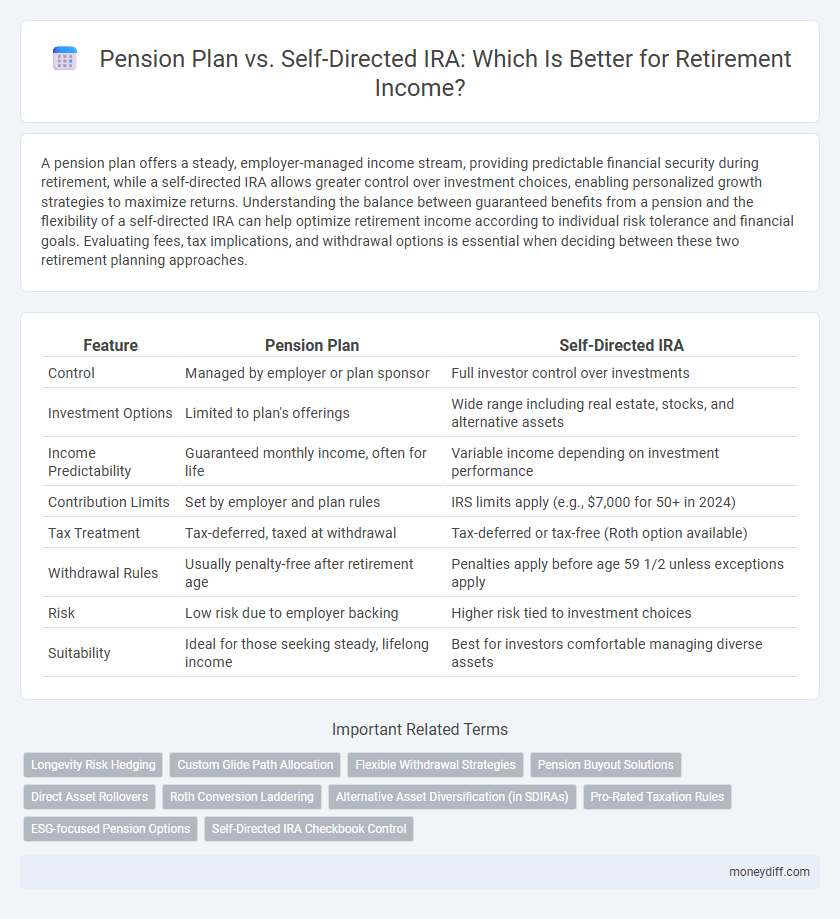

Table of Comparison

| Feature | Pension Plan | Self-Directed IRA |

|---|---|---|

| Control | Managed by employer or plan sponsor | Full investor control over investments |

| Investment Options | Limited to plan's offerings | Wide range including real estate, stocks, and alternative assets |

| Income Predictability | Guaranteed monthly income, often for life | Variable income depending on investment performance |

| Contribution Limits | Set by employer and plan rules | IRS limits apply (e.g., $7,000 for 50+ in 2024) |

| Tax Treatment | Tax-deferred, taxed at withdrawal | Tax-deferred or tax-free (Roth option available) |

| Withdrawal Rules | Usually penalty-free after retirement age | Penalties apply before age 59 1/2 unless exceptions apply |

| Risk | Low risk due to employer backing | Higher risk tied to investment choices |

| Suitability | Ideal for those seeking steady, lifelong income | Best for investors comfortable managing diverse assets |

Overview of Pension Plans and Self-Directed IRAs

Pension plans provide a fixed, employer-managed retirement income, offering financial stability through monthly payments based on salary and years of service. Self-Directed IRAs allow individuals to control investments, including real estate and private equity, giving greater flexibility and potential for higher returns. Comparing these options highlights the trade-off between guaranteed income and investment autonomy in retirement planning.

Key Differences Between Pension Plans and Self-Directed IRAs

Pension plans provide a fixed, employer-managed retirement income with guaranteed monthly payments based on salary and years of service, offering stability but limited investment control. Self-Directed IRAs allow individuals to actively manage a diverse range of investment options, including real estate and private equity, enabling greater flexibility and potential growth but with higher risk and responsibility. Tax treatment differs as pension plans usually provide tax-deferred benefits with employer contributions, while Self-Directed IRAs depend on the account type, such as Traditional or Roth, affecting withdrawal taxation and eligibility.

Eligibility Requirements for Each Retirement Option

Pension plans typically require employer sponsorship and often have specific employment duration or age criteria, such as minimum years of service or reaching age 55 to qualify for benefits. Self-Directed IRAs, in contrast, are available to any individual with earned income who wishes to control their own retirement investments without employer involvement. Understanding these eligibility requirements is crucial for selecting the most suitable retirement income strategy based on personal employment history and investment preferences.

Contribution Limits: Pension Plans vs Self-Directed IRAs

Pension plans often have higher contribution limits compared to self-directed IRAs, enabling employees to accumulate a larger retirement fund annually. For example, defined benefit pension plans can allow contributions based on actuarial calculations, sometimes exceeding $100,000 per year depending on age and income. Conversely, self-directed IRAs have annual contribution caps--currently $6,500 for individuals under 50 and $7,500 for those 50 and over--limiting the amount investable each year.

Investment Choices and Flexibility

Pension plans offer limited investment choices controlled by the plan provider, often focusing on conservative portfolios designed for steady retirement income. Self-Directed IRAs provide extensive flexibility, allowing investors to select diverse assets including stocks, bonds, real estate, and alternative investments, tailoring their portfolios to individual risk tolerance and financial goals. This flexibility can lead to higher growth potential but requires active management and greater knowledge of investment options.

Tax Advantages and Implications

A traditional Pension Plan offers tax-deferred growth where contributions are often made pre-tax, reducing taxable income during working years, but distributions in retirement are taxed as ordinary income. A Self-Directed IRA provides more investment flexibility with tax advantages depending on the type; Traditional IRAs offer tax-deferred growth similar to pensions, while Roth IRAs allow for tax-free withdrawals after meeting certain conditions. Understanding the tax implications of contribution limits, required minimum distributions (RMDs), and potential penalties is crucial for optimizing retirement income strategies between these two vehicles.

Withdrawal Rules and Required Minimum Distributions

Pension plans typically require participants to begin taking Required Minimum Distributions (RMDs) at age 73, with withdrawal rules often fixed or based on predefined schedules set by the plan. In contrast, self-directed IRAs mandate RMDs starting at age 73 but offer greater flexibility in withdrawal timing and amounts, allowing for strategic tax planning and control over income flow. Understanding the RMD rules and withdrawal constraints of each option is crucial for optimizing retirement income and minimizing tax liabilities.

Risks and Security: Assessing Each Option

Pension plans offer predictable, stable income with lower risk due to employer guarantees and professional fund management, ensuring security for retirement. Self-directed IRAs provide greater investment control and potential growth but carry higher risk with market volatility and less regulatory protection. Evaluating risk tolerance and the need for reliable income is crucial when choosing between a pension plan and a self-directed IRA for retirement security.

Fees and Administrative Costs Comparison

Pension plans typically have higher fees and administrative costs due to employer management and third-party service providers, which can reduce net retirement income. Self-Directed IRAs often offer lower fees and more control over investment choices, though fees vary depending on the custodian and investment types selected. Evaluating the fee structures and administrative expenses is crucial for maximizing retirement income from either option.

Suitability: Choosing the Right Plan for Your Retirement Income

A Pension Plan offers predictable, steady retirement income with employer management and fewer investment decisions, making it suitable for individuals seeking low-risk, hands-off options. In contrast, a Self-Directed IRA provides greater control over investment choices, allowing diversification into assets like real estate or stocks, ideal for those comfortable with managing their own portfolio and seeking potentially higher returns. Assessing risk tolerance, investment knowledge, and desired income stability is crucial in selecting the most appropriate retirement plan for long-term financial security.

Related Important Terms

Longevity Risk Hedging

A Pension Plan offers guaranteed lifetime income, effectively hedging longevity risk by ensuring consistent payouts regardless of lifespan. In contrast, a Self-Directed IRA provides flexibility and control over investments but requires careful management to avoid outliving retirement savings.

Custom Glide Path Allocation

Custom Glide Path Allocation in Pension Plans offers a pre-set, professionally managed investment strategy that gradually reduces risk as retirement approaches, ensuring stable income streams. Self-Directed IRAs provide greater control and flexibility to tailor asset allocations, enabling investors to customize their glide path based on evolving financial goals and market conditions.

Flexible Withdrawal Strategies

A Pension Plan offers predictable, fixed monthly income but limits withdrawal flexibility, often requiring distributions at set ages, while a Self-Directed IRA provides greater control over withdrawal timing and amounts, enabling personalized tax-efficient strategies. Investors seeking adaptable retirement income should consider the Self-Directed IRA's ability to tailor withdrawals according to market conditions and personal cash flow needs.

Pension Buyout Solutions

Pension Buyout Solutions offer a lump-sum payout option that allows retirees to convert traditional pension plans into a self-directed IRA, providing greater control over investment choices and potential for higher returns. This strategy balances guaranteed income security with flexible asset management, making it a viable alternative to conventional pension distributions for diversified retirement income planning.

Direct Asset Rollovers

Direct asset rollovers enable seamless transfer of funds from a pension plan to a self-directed IRA, preserving tax advantages and expanding investment flexibility beyond traditional stocks and bonds. Opting for a self-directed IRA after a pension plan rollover allows retirees to diversify retirement income by including real estate, precious metals, and private equity, enhancing portfolio control and growth potential.

Roth Conversion Laddering

A Pension Plan provides predictable, guaranteed income streams based on years of service and salary, while a Self-Directed IRA offers flexibility and control over investment choices, crucial for personalized retirement strategies. Roth Conversion Laddering within a Self-Directed IRA allows for tax-efficient withdrawals by converting traditional IRA assets to a Roth IRA incrementally, minimizing tax burdens and enhancing long-term retirement income.

Alternative Asset Diversification (in SDIRAs)

Self-Directed IRAs (SDIRAs) allow for alternative asset diversification beyond traditional stocks and bonds, including real estate, private equity, and precious metals, which can enhance retirement income stability and growth potential. Pension plans typically offer limited investment options, making SDIRAs a strategic choice for investors seeking to balance risk and increase portfolio resilience through non-traditional assets.

Pro-Rated Taxation Rules

Pension plans typically follow pro-rated taxation rules based on years of service and contributions, ensuring tax liability aligns with the amount vested upon withdrawal. Self-Directed IRAs offer greater control over investments but require careful management of pro-rated tax rules during distributions to optimize retirement income and minimize tax penalties.

ESG-focused Pension Options

ESG-focused pension plans integrate environmental, social, and governance criteria to align retirement income with sustainable investing principles, offering professional management and fiduciary oversight. Self-directed IRAs provide greater control to invest directly in ESG assets but require individual research and active portfolio management to ensure alignment with personal sustainability goals.

Self-Directed IRA Checkbook Control

Self-Directed IRAs with checkbook control offer unparalleled flexibility, allowing investors to directly manage alternative assets like real estate or private equity within their retirement accounts, unlike traditional pension plans that limit investment options. This control can enhance diversification and potentially increase retirement income, but requires active management and compliance with IRS regulations to avoid penalties.

Pension Plan vs Self-Directed IRA for retirement income Infographic

moneydiff.com

moneydiff.com