A Roth IRA Ladder allows retirees to access contributions and conversions penalty-free by strategically withdrawing funds over time, offering flexibility and tax advantages for early retirement. Substantially Equal Periodic Payments (SEPP) mandate fixed, calculated distributions for at least five years or until age 59 1/2, providing a steady income stream but with less flexibility and potential tax implications if altered. Choosing between these methods depends on your retirement timeline, income needs, and preference for withdrawal control and tax treatment.

Table of Comparison

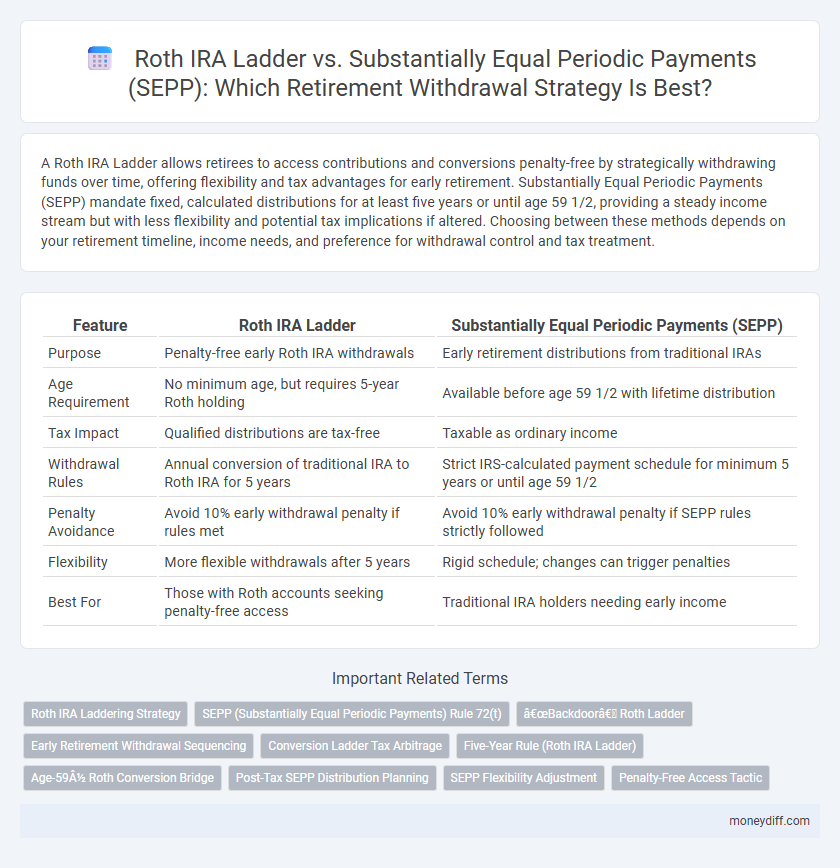

| Feature | Roth IRA Ladder | Substantially Equal Periodic Payments (SEPP) |

|---|---|---|

| Purpose | Penalty-free early Roth IRA withdrawals | Early retirement distributions from traditional IRAs |

| Age Requirement | No minimum age, but requires 5-year Roth holding | Available before age 59 1/2 with lifetime distribution |

| Tax Impact | Qualified distributions are tax-free | Taxable as ordinary income |

| Withdrawal Rules | Annual conversion of traditional IRA to Roth IRA for 5 years | Strict IRS-calculated payment schedule for minimum 5 years or until age 59 1/2 |

| Penalty Avoidance | Avoid 10% early withdrawal penalty if rules met | Avoid 10% early withdrawal penalty if SEPP rules strictly followed |

| Flexibility | More flexible withdrawals after 5 years | Rigid schedule; changes can trigger penalties |

| Best For | Those with Roth accounts seeking penalty-free access | Traditional IRA holders needing early income |

Roth IRA Ladder: Strategic Tax-Free Withdrawals

Roth IRA Ladder enables strategic tax-free withdrawals by converting traditional IRA funds to a Roth IRA gradually, avoiding early withdrawal penalties and minimizing tax impact. This method allows retirees to access funds before age 59 1/2 without incurring the 10% early distribution penalty by adhering to the five-year aging rule for each conversion. Compared to Substantially Equal Periodic Payments (SEPP), the Roth IRA Ladder offers more flexibility and potential tax advantages for managing retirement income and maximizing tax-free growth.

Substantially Equal Periodic Payments (SEPP): Early Penalty-Free Access

Substantially Equal Periodic Payments (SEPP) allow early access to retirement funds without the 10% IRS penalty by mandating consistent distributions based on IRS-approved calculation methods. This strategy requires adherence to strict rules and commitment to payments for a minimum of five years or until age 59 1/2, whichever is longer. SEPP offers a flexible alternative to the Roth IRA Ladder, providing penalty-free withdrawals from traditional IRAs or 401(k) accounts before retirement age.

Roth IRA Ladder vs SEPP: Key Differences Explained

Roth IRA Ladder and Substantially Equal Periodic Payments (SEPP) are two strategies for early retirement withdrawals without penalties, differentiated primarily by their flexibility and structure. Roth IRA Ladder involves systematically converting traditional IRA funds to Roth IRA over five years, allowing penalty-free withdrawal of contributions, while SEPP requires fixed, calculated distributions based on IRS-approved methods that must continue for at least five years or until age 59 1/2. Understanding the tax implications, timing constraints, and withdrawal limits is crucial for optimizing retirement income planning between these two methods.

Eligibility Requirements: Who Qualifies for Each Method?

The Roth IRA Ladder method requires account holders to be at least 59 1/2 or have met the five-year holding period for tax-free withdrawals, making it suitable for those with long-term disciplined savings. Substantially Equal Periodic Payments (SEPP) allow early access to retirement funds before age 59 1/2 without penalties, but qualification depends on following IRS-approved calculation methods for payment amounts. Understanding these eligibility criteria is crucial for choosing the right strategy to access retirement funds while minimizing tax consequences.

Tax Implications: Minimizing Your Retirement Taxes

Roth IRA Ladder allows tax-free withdrawals by converting traditional IRA funds into Roth IRAs over five years, avoiding early withdrawal penalties and reducing taxable income during retirement. Substantially Equal Periodic Payments (SEPP) require fixed distributions based on IRS formulas, potentially resulting in higher taxable income if withdrawals come from pre-tax accounts. Utilizing a Roth IRA Ladder strategically minimizes tax burdens by ensuring withdrawals remain tax-free, while SEPP may increase tax liability due to mandatory distributions from taxable traditional IRAs or 401(k)s.

Flexibility and Control: Managing Withdrawals

Roth IRA Ladder offers greater flexibility by allowing penalty-free withdrawals of contributions at any time, enabling retirees to control the timing and amount of funds accessed. Substantially Equal Periodic Payments (SEPP) require fixed, scheduled distributions based on IRS-approved calculations, limiting withdrawal adjustments without penalties. This controlled schedule in SEPPs provides predictability but reduces flexibility compared to the adaptable withdrawal strategy of a Roth IRA Ladder.

Risks and Drawbacks: What to Watch Out For

Roth IRA Ladder strategies carry the risk of market volatility impacting the timing and amounts of withdrawals, potentially delaying access to funds. Substantially Equal Periodic Payments (SEPP) require strict adherence to IRS rules, with penalties imposed for early modification or cessation of payments. Both methods present tax implications and potential liquidity constraints that retirees must carefully evaluate to avoid unexpected financial setbacks.

Suitability: Which Method Fits Your Retirement Goals?

Roth IRA Ladder suits retirees seeking penalty-free access to retirement funds before age 59 1/2 by converting traditional IRA funds into a Roth IRA and waiting five years for each conversion to mature. Substantially Equal Periodic Payments (SEPP) provide consistent early distributions from an IRA without penalties, ideal for those requiring stable income streams during early retirement. Assess your retirement goals, tax situation, and desired flexibility carefully to determine which withdrawal strategy aligns best with your financial plan.

Case Studies: Real-Life Examples of Roth IRA Ladder and SEPP

Case studies reveal that retirees using a Roth IRA ladder benefit from tax-free withdrawals and increased flexibility, enabling strategic access to retirement funds before age 59 1/2 without penalties. Conversely, individuals employing Substantially Equal Periodic Payments (SEPP) demonstrate consistent, penalty-free income streams but face rigid withdrawal schedules and potential tax liabilities on traditional IRA conversions. Analysis of these real-life examples highlights how personal financial goals and cash flow needs determine the optimal strategy for early retirement fund access.

Choosing the Best Early Withdrawal Strategy for Your Retirement

Choosing between a Roth IRA Ladder and Substantially Equal Periodic Payments (SEPP) depends on your retirement timeline and tax preferences. A Roth IRA Ladder allows penalty-free access to contributions after five years, offering tax-free growth and flexibility, while SEPP mandates fixed withdrawals based on IRS calculations, potentially locking you into a rigid schedule. Evaluating your income needs, tax bracket, and long-term financial goals helps determine which early withdrawal strategy minimizes penalties and maximizes retirement savings.

Related Important Terms

Roth IRA Laddering Strategy

The Roth IRA Laddering Strategy involves systematically converting traditional IRA funds to a Roth IRA over several years to minimize tax impact and provide tax-free retirement income. This approach contrasts with Substantially Equal Periodic Payments, offering greater flexibility and potential tax advantages by avoiding early withdrawal penalties through strategic Roth conversions.

SEPP (Substantially Equal Periodic Payments) Rule 72(t)

The Substantially Equal Periodic Payments (SEPP) under IRS Rule 72(t) allow penalty-free early withdrawals from retirement accounts before age 59 1/2 by committing to a fixed payment schedule based on life expectancy, avoiding the 10% early withdrawal penalty. Unlike a Roth IRA ladder strategy that involves converting funds gradually over years to minimize taxes, SEPP provides immediate access to traditional IRA or 401(k) funds while maintaining tax-deferred growth, but requires strict adherence to payment rules to prevent retroactive penalties.

“Backdoor” Roth Ladder

The "Backdoor" Roth IRA Ladder enables high-income earners to convert traditional IRA contributions to a Roth IRA, bypassing income limits, and then sequentially withdraw funds tax-free after a five-year waiting period. In contrast, Substantially Equal Periodic Payments (SEPP) allow penalty-free early withdrawals from retirement accounts by committing to a fixed payment schedule, but these distributions are taxable and lack the tax-free growth advantages of a Roth Ladder.

Early Retirement Withdrawal Sequencing

Roth IRA Ladder enables early retirement by systematically converting traditional IRA funds to Roth IRAs and withdrawing contributions tax-free after five years, optimizing tax efficiency and preserving growth potential. Substantially Equal Periodic Payments (SEPP) provide a structured withdrawal schedule from retirement accounts without penalties but require strict adherence to IRS rules, limiting flexibility in early withdrawal sequencing.

Conversion Ladder Tax Arbitrage

A Roth IRA Conversion Ladder utilizes tax arbitrage by strategically converting traditional IRA funds to Roth IRAs over multiple years, minimizing tax impact and enabling early penalty-free withdrawals. In contrast, Substantially Equal Periodic Payments (SEPP) allow penalty-free distributions from retirement accounts before age 59 1/2 but lack the tax optimization and growth potential of a Roth Conversion Ladder.

Five-Year Rule (Roth IRA Ladder)

The Roth IRA Ladder strategy requires adherence to the Five-Year Rule, mandating that each conversion from a traditional IRA to a Roth IRA must be held for five tax years before penalty-free withdrawals, which ensures tax-efficient access to retirement funds. In contrast, Substantially Equal Periodic Payments (SEPP) allow penalty-free distributions from an IRA before age 59 1/2 without regard to the Five-Year Rule, but they require strict adherence to IRS calculation methods and commitment to fixed payments for five years or until age 59 1/2.

Age-59½ Roth Conversion Bridge

The Age-59 1/2 Roth conversion bridge strategy maximizes tax-free growth by converting traditional IRA funds to a Roth IRA before accessing the account without penalty, unlike Substantially Equal Periodic Payments (SEPP) which require strict compliance and potential penalties if altered. Roth IRA ladders offer flexible, penalty-free withdrawals after five years from conversions, making them more advantageous for early retirees seeking liquidity without triggering the 10% early withdrawal penalty.

Post-Tax SEPP Distribution Planning

Post-tax SEPP distribution planning with a Roth IRA ladder allows penalty-free withdrawals after five years, preserving tax advantages and providing flexibility in retirement income streams. Unlike SEPP, Roth IRA ladders avoid strict IRS rules on equal periodic payments, enabling strategic access to contributions and conversions to optimize tax efficiency.

SEPP Flexibility Adjustment

Substantially Equal Periodic Payments (SEPP) offer a rigid withdrawal schedule based on IRS-approved calculation methods, limiting flexibility once initiated, while the SEPP Flexibility Adjustment allows a one-time modification to payment amounts without penalty. Roth IRA ladders provide more adaptable access to contributions and earnings, but SEPP with flexibility adjustment can optimize retirement income planning by balancing early withdrawal penalties and cash flow needs.

Penalty-Free Access Tactic

Roth IRA Ladder allows penalty-free access to contributions and converted amounts after a five-year holding period, enabling flexible early retirement withdrawals without taxes or penalties. Substantially Equal Periodic Payments (SEPP) require a strict schedule of withdrawals based on IRS-approved methods, providing penalty-free access to traditional IRA funds but with less flexibility and potential tax implications.

Roth IRA Ladder vs Substantially Equal Periodic Payments for retirement. Infographic

moneydiff.com

moneydiff.com