Target Date Funds offer a hands-off investment approach by automatically adjusting asset allocation to become more conservative as retirement approaches, making them ideal for investors seeking simplicity. Decumulation Strategies focus on managing withdrawals and sequencing risk during retirement, ensuring sustainable income by balancing spending with investment performance. Choosing between these depends on whether the priority is ease of management pre-retirement or tailored income planning post-retirement.

Table of Comparison

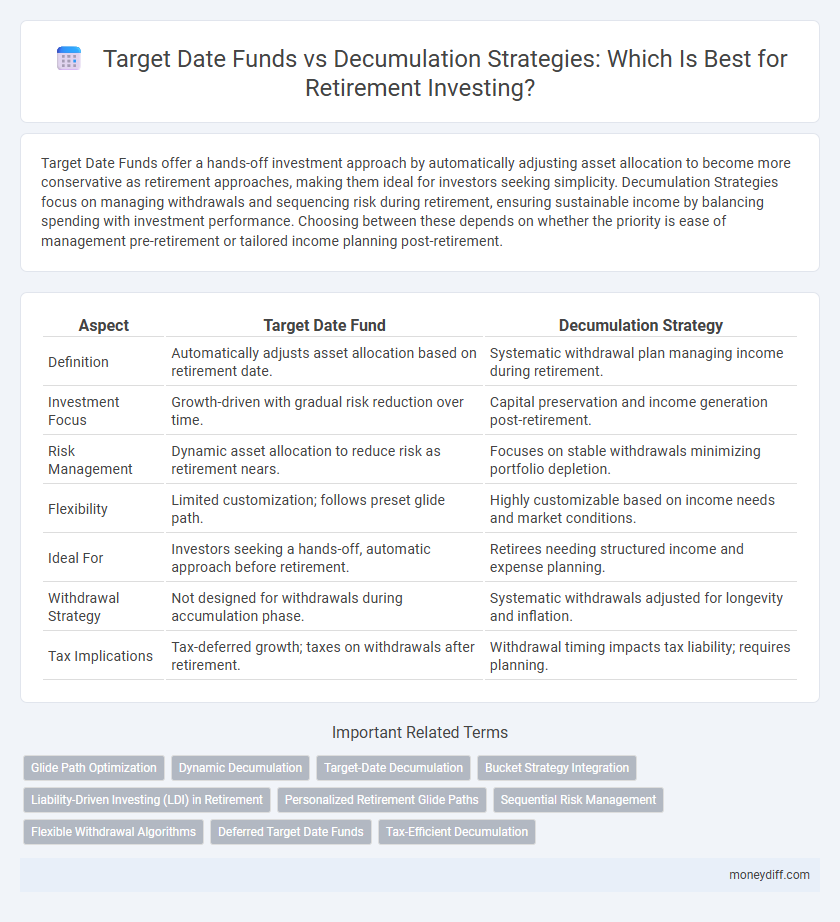

| Aspect | Target Date Fund | Decumulation Strategy |

|---|---|---|

| Definition | Automatically adjusts asset allocation based on retirement date. | Systematic withdrawal plan managing income during retirement. |

| Investment Focus | Growth-driven with gradual risk reduction over time. | Capital preservation and income generation post-retirement. |

| Risk Management | Dynamic asset allocation to reduce risk as retirement nears. | Focuses on stable withdrawals minimizing portfolio depletion. |

| Flexibility | Limited customization; follows preset glide path. | Highly customizable based on income needs and market conditions. |

| Ideal For | Investors seeking a hands-off, automatic approach before retirement. | Retirees needing structured income and expense planning. |

| Withdrawal Strategy | Not designed for withdrawals during accumulation phase. | Systematic withdrawals adjusted for longevity and inflation. |

| Tax Implications | Tax-deferred growth; taxes on withdrawals after retirement. | Withdrawal timing impacts tax liability; requires planning. |

Introduction to Target Date Funds and Decumulation Strategies

Target Date Funds are diversified investment portfolios designed to automatically adjust asset allocation based on a specified retirement year, reducing risk as the target date approaches. Decumulation strategies focus on systematic withdrawal methods to efficiently convert retirement savings into income, ensuring portfolio longevity. Understanding the differences helps retirees balance growth potential with income stability during retirement.

Key Features of Target Date Funds in Retirement Planning

Target Date Funds offer a diversified portfolio that automatically adjusts asset allocation based on the investor's expected retirement date, reducing risk as the target date approaches. These funds simplify retirement planning by managing the shift from growth-oriented investments to more conservative, income-generating assets, aligning with typical decumulation needs. Their glide path design helps investors maintain an appropriate balance between risk and return throughout the accumulation and decumulation phases.

Understanding Decumulation Strategies: A Retirement Essential

Decumulation strategies play a critical role in managing retirement income sustainability by determining how retirees withdraw assets from Target Date Funds and other investment vehicles. Unlike the accumulation phase, decumulation requires careful planning to balance income needs with market risks, lifespan uncertainty, and inflation. Effective decumulation ensures retirees maximize their portfolio longevity while maintaining a stable cash flow throughout retirement.

Risk Management: Target Date Funds vs Decumulation Techniques

Target Date Funds automatically adjust asset allocation over time to reduce risk exposure as investors approach retirement, using a glide path designed to balance growth and safety. Decumulation strategies emphasize dynamic withdrawal rates and asset rebalancing to manage longevity and sequence-of-returns risk during retirement income distribution. Effective risk management in retirement investing requires understanding the trade-offs between the gradual risk shift in Target Date Funds and the personalized flexibility of Decumulation Techniques.

Income Generation in Retirement: Which Strategy Delivers?

Target Date Funds automatically adjust asset allocation to reduce risk as retirement approaches, offering a hands-off approach but often prioritize capital preservation over consistent income generation. Decumulation strategies focus on systematic withdrawal plans and income-producing investments like annuities, dividend stocks, or bonds to ensure steady cash flow during retirement. Income-focused decumulation strategies generally deliver more reliable and customizable income streams compared to the one-size-fits-all glide path of Target Date Funds.

Cost and Fees: Comparing Target Date Funds and Decumulation Approaches

Target Date Funds typically charge annual expense ratios ranging from 0.10% to 0.75%, which cover asset management and automatic rebalancing, simplifying retirement investing with predictable costs. Decumulation strategies often involve variable fees, including advisor commissions, withdrawal management, and potential tax implications that can increase overall expenses over time. Investors should carefully assess the total cost impact of both options, as lower fees in Target Date Funds may enhance retirement income sustainability compared to the often higher, less transparent costs of personalized decumulation plans.

Flexibility and Customization for Retirees

Target Date Funds offer a simplified, automated investment approach with asset allocations that adjust based on a preset retirement date, providing less flexibility for retirees who require personalized income strategies. Decumulation strategies enable retirees to tailor withdrawals and asset allocations according to individual cash flow needs, risk tolerance, and lifespan considerations, enhancing customization during retirement. Investors prioritizing flexibility often prefer decumulation methods to better manage longevity risk and changing financial goals.

Suitability for Different Retirement Goals

Target Date Funds offer a diversified, age-adjusted portfolio designed for investors seeking a hands-off approach aligned with a fixed retirement date, making them suitable for accumulation phases and predictable withdrawal timing. Decumulation Strategies, tailored for managing portfolio withdrawals during retirement, prioritize income stability, tax efficiency, and risk management, aligning better with retirees focused on sustainable income streams and legacy planning. Choosing between these options depends on retirement goals, risk tolerance, and the need for personalized income management versus automated portfolio adjustment.

Drawbacks and Limitations of Each Strategy

Target Date Funds may suffer from a one-size-fits-all approach, often misaligned with individual risk tolerance or changing market conditions, potentially leading to suboptimal asset allocation during retirement. Decumulation strategies face the challenge of balancing withdrawal rates with longevity risk, where overly aggressive withdrawals can deplete savings prematurely while overly conservative rates may reduce lifestyle quality. Both strategies also encounter limitations in addressing inflation risk and unexpected healthcare expenses, which can significantly impact retirement sustainability.

Choosing the Right Approach for Your Retirement Needs

Target Date Funds automatically adjust the asset allocation to reduce risk as retirement approaches, providing a hands-off investment solution aligned with a specific retirement year. Decumulation strategies focus on how to systematically withdraw funds during retirement to optimize income and longevity of savings, requiring personalized planning based on spending needs and market conditions. Selecting between these approaches depends on your risk tolerance, desired level of management, and retirement income goals.

Related Important Terms

Glide Path Optimization

Target Date Funds optimize retirement portfolios by gradually shifting asset allocations along a predefined glide path to reduce risk as investors approach retirement. Glide path optimization enhances decumulation strategies by dynamically adjusting withdrawals and investment risk, balancing portfolio longevity with income stability during retirement.

Dynamic Decumulation

Target Date Funds automatically adjust asset allocation towards conservative investments as retirement approaches, while Dynamic Decumulation strategies actively manage withdrawals and portfolio risk to optimize income in retirement. Dynamic Decumulation incorporates factors like market conditions, longevity risk, and spending needs to provide a flexible, personalized approach compared to the fixed glide path of Target Date Funds.

Target-Date Decumulation

Target Date Decumulation funds provide a structured approach to withdrawing retirement savings by gradually reducing risk exposure while generating steady income aligned with the investor's retirement timeline. These funds optimize asset allocation through automated adjustments, balancing growth and preservation to support sustainable income throughout retirement.

Bucket Strategy Integration

Target Date Funds simplify retirement investing by automatically adjusting asset allocation toward lower risk as the target date nears, but integrating a Bucket Strategy enhances decumulation by segmenting assets into short-, medium-, and long-term buckets to manage liquidity and market volatility effectively. This combined approach balances growth and income needs, optimizing portfolio stability while addressing sequential withdrawal risk during retirement.

Liability-Driven Investing (LDI) in Retirement

Target Date Funds automate asset allocation shifts based on age but often lack specific focus on matching retirement liabilities, whereas Liability-Driven Investing (LDI) prioritizes aligning portfolio assets with predicted future income needs, providing tailored decumulation strategies that reduce longevity and inflation risks. LDI approaches dynamically manage fixed income and inflation-protected securities to hedge pension liabilities, enhancing financial security throughout retirement beyond the generic glide paths of Target Date Funds.

Personalized Retirement Glide Paths

Target Date Funds offer a predefined, broadly diversified retirement glide path tailored to a general retirement age, while personalized retirement glide paths in decumulation strategies customize asset allocation and withdrawal rates based on individual factors such as life expectancy, risk tolerance, and income needs. Personalized glide paths enhance retirement outcomes by aligning investment risk and spending patterns with an investor's unique financial goals and longevity projections.

Sequential Risk Management

Target Date Funds simplify retirement investing by automatically adjusting asset allocation to reduce risk as the target date approaches, but they may not fully address sequential risk management critical in decumulation, where retirees systematically withdraw funds. A tailored decumulation strategy incorporates withdrawal timing and market volatility to mitigate sequence of returns risk, enhancing portfolio sustainability throughout retirement.

Flexible Withdrawal Algorithms

Target Date Funds provide a simplified, auto-adjusting asset allocation approach based on a fixed retirement date, while decumulation strategies with flexible withdrawal algorithms optimize income streams by dynamically adjusting withdrawal rates to market conditions and longevity risk. Investors benefit from personalized, adaptive cash flow management in decumulation strategies, enhancing retirement sustainability compared to the static glide path of Target Date Funds.

Deferred Target Date Funds

Deferred target date funds delay asset allocation shifts toward conservative investments, allowing for extended growth potential before retirement, which contrasts with decumulation strategies that emphasize systematic withdrawal and risk reduction during retirement. This approach optimizes wealth accumulation by balancing higher equity exposure in the accumulation phase with gradual de-risking, enhancing long-term retirement outcomes.

Tax-Efficient Decumulation

Target Date Funds simplify retirement investing by automatically adjusting asset allocation as retirement nears, but may lack personalized tax-efficient decumulation strategies that optimize withdrawal timing and asset location to minimize tax liabilities. Implementing a tailored decumulation strategy leverages tax-advantaged accounts and capital gains management, enhancing after-tax retirement income sustainability compared to standard Target Date Fund approaches.

Target Date Fund vs Decumulation Strategy for retirement investing Infographic

moneydiff.com

moneydiff.com