A fixed withdrawal rate provides retirees with predictable income by allocating a consistent percentage of their portfolio each year, ensuring stability and easier budgeting. In contrast, a variable withdrawal rate adjusts based on market performance and portfolio value, potentially extending the longevity of savings during downturns but requiring flexibility in spending. Choosing between fixed and variable withdrawal rates depends on risk tolerance, financial goals, and the desire for income certainty versus adaptability.

Table of Comparison

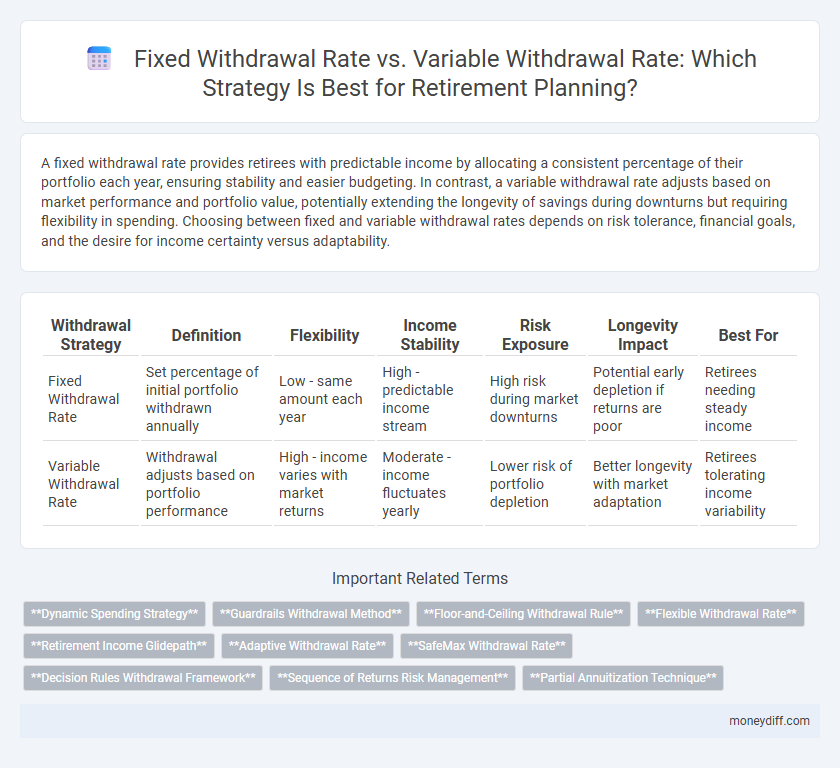

| Withdrawal Strategy | Definition | Flexibility | Income Stability | Risk Exposure | Longevity Impact | Best For |

|---|---|---|---|---|---|---|

| Fixed Withdrawal Rate | Set percentage of initial portfolio withdrawn annually | Low - same amount each year | High - predictable income stream | High risk during market downturns | Potential early depletion if returns are poor | Retirees needing steady income |

| Variable Withdrawal Rate | Withdrawal adjusts based on portfolio performance | High - income varies with market returns | Moderate - income fluctuates yearly | Lower risk of portfolio depletion | Better longevity with market adaptation | Retirees tolerating income variability |

Understanding Fixed Withdrawal Rate Strategies

Fixed withdrawal rate strategies in retirement planning involve withdrawing a predetermined, constant percentage of the initial portfolio value annually, providing predictable income and reducing the risk of depleting savings too quickly. This approach simplifies budgeting by maintaining stable withdrawals regardless of market fluctuations, but it may not adapt well to changes in investment performance or inflation. Retirees using fixed rates often pair them with conservative asset allocation to balance growth and preservation of capital over the long term.

What Is a Variable Withdrawal Rate Approach?

A variable withdrawal rate approach in retirement planning adjusts the amount withdrawn annually based on portfolio performance, inflation, and life expectancy to balance income stability with sustainability. This method helps prevent depleting savings too quickly by increasing withdrawals during strong market years and reducing them during downturns. It contrasts with fixed withdrawal rates by providing flexibility to adapt withdrawals to changing financial conditions and longevity risks.

Pros and Cons of Fixed Withdrawal Rates

Fixed withdrawal rates provide retirees with predictable income streams, simplifying budgeting and helping to avoid the risk of depleting savings too quickly. However, fixed rates may fail to account for inflation or market fluctuations, potentially eroding purchasing power over time. This rigidity can result in either over-withdrawing during market downturns or under-utilizing assets during strong market performance, impacting long-term financial security.

Advantages of Variable Withdrawal Rate Methods

Variable withdrawal rate methods offer retirees flexibility to adjust their spending based on investment performance, helping to preserve portfolio longevity during market downturns. These methods can reduce the risk of depleting retirement savings prematurely by allowing withdrawals to decrease in years of poor returns and increase during favorable market conditions. Consequently, adopting a variable withdrawal strategy aligns income with market realities, enhancing financial sustainability throughout retirement.

Comparing Flexibility: Fixed vs Variable Withdrawals

Fixed withdrawal rates provide retirees with predictable, steady income, ensuring budget stability but limiting flexibility in response to market performance or unexpected expenses. Variable withdrawal rates adjust based on portfolio returns, offering adaptability and the potential to preserve capital in down markets while allowing increased withdrawals during favorable conditions. This flexibility in variable rates can help align spending with changing financial needs and market realities throughout retirement.

Impact of Market Volatility on Withdrawal Strategies

Fixed withdrawal rates provide predictable income but may deplete retirement savings faster during market downturns, risking portfolio longevity. Variable withdrawal rates adjust spending in response to market performance, helping preserve capital during volatility and extending retirement security. Incorporating market fluctuations into withdrawal strategies enhances financial resilience and reduces the risk of outliving assets.

Longevity Risks: Which Withdrawal Rate Is Safer?

A fixed withdrawal rate offers predictable income but may increase the risk of depleting assets during extended retirements, especially if market returns are poor. Variable withdrawal rates adjust spending based on portfolio performance, helping to mitigate longevity risks by preserving capital in downturns. Research suggests that a flexible withdrawal strategy aligned with market conditions generally provides a safer approach to sustaining income over a long retirement horizon.

Inflation Considerations in Retirement Withdrawals

Fixed withdrawal rates in retirement planning offer predictable income but risk reduced purchasing power over time due to inflation. Variable withdrawal rates adjust periodically, helping to maintain real income levels by accounting for inflation fluctuations and market performance. Incorporating inflation considerations into withdrawal strategies is crucial to preserve retirees' financial security and sustain their standard of living.

Customizing Withdrawal Approaches for Personal Needs

Choosing between fixed and variable withdrawal rates in retirement planning allows for customization based on personal financial goals, market conditions, and risk tolerance. Fixed withdrawal rates provide predictable income, ideal for conservative retirees prioritizing stability, while variable withdrawal rates adjust withdrawals according to portfolio performance, offering flexibility to sustain longevity and manage inflation. Tailoring withdrawal strategies to individual needs enhances retirement security by balancing income reliability with growth potential.

Choosing the Right Withdrawal Strategy for Your Retirement

Choosing the right withdrawal strategy for your retirement depends on balancing the stability of fixed withdrawal rates with the flexibility of variable withdrawal rates. Fixed withdrawal rates provide predictable income streams, helping retirees plan expenses with confidence, while variable withdrawal rates adjust according to market performance, potentially preserving retirement savings during downturns. Evaluating factors such as risk tolerance, lifespan expectations, and investment portfolio volatility is essential in selecting a strategy that sustains financial security throughout retirement.

Related Important Terms

Dynamic Spending Strategy

A dynamic spending strategy in retirement planning adjusts withdrawal rates based on portfolio performance and changing financial needs, contrasting fixed withdrawal rates that maintain a constant amount regardless of market conditions. This flexible approach helps optimize longevity of assets by reducing withdrawals during market downturns and increasing them in favorable periods, enhancing the sustainability of income streams.

Guardrails Withdrawal Method

The Guardrails Withdrawal Method adjusts withdrawals based on investment performance, maintaining a flexible variable withdrawal rate that helps preserve portfolio longevity and mitigate the risk of depletion. Unlike fixed withdrawal rates, this strategy increases or decreases distributions within preset limits, optimizing retirement income in response to market fluctuations.

Floor-and-Ceiling Withdrawal Rule

The Floor-and-Ceiling Withdrawal Rule balances security and flexibility in retirement planning by setting a minimum (floor) withdrawal to cover essential expenses while allowing a maximum (ceiling) to adjust withdrawals based on portfolio performance, reducing the risk of depleting funds too quickly. This hybrid approach optimizes income stability and growth potential compared to strictly fixed or variable withdrawal rates.

Flexible Withdrawal Rate

Flexible withdrawal rates adapt dynamically to market performance and portfolio value, reducing the risk of depleting retirement savings during market downturns by allowing retirees to decrease or increase withdrawals accordingly. This approach enhances longevity of the retirement portfolio compared to fixed withdrawal rates, which maintain constant payouts regardless of investment returns or inflation adjustments.

Retirement Income Glidepath

A retirement income glidepath adjusts withdrawal rates over time, starting with a fixed withdrawal rate to ensure steady income and shifting to a variable withdrawal rate that adapts to market performance and portfolio value. This strategy balances stability and flexibility, helping retirees sustain income throughout retirement while managing longevity and market risks.

Adaptive Withdrawal Rate

Adaptive withdrawal rate dynamically adjusts retirement income based on market performance and portfolio value, reducing the risk of depleting savings during downturns. This strategy balances spending flexibility with longevity of funds, outperforming fixed and traditional variable withdrawal methods in sustaining retirement portfolios.

SafeMax Withdrawal Rate

The SafeMax withdrawal rate is a fixed withdrawal strategy that aims to preserve portfolio longevity by limiting annual withdrawals to a conservative percentage, often around 4%, reducing the risk of depleting retirement savings. In contrast, a variable withdrawal rate adjusts annually based on market performance and portfolio value, offering flexibility but potentially increasing the risk of running out of funds during market downturns.

Decision Rules Withdrawal Framework

The Decision Rules Withdrawal Framework in retirement planning contrasts fixed withdrawal rates, which provide predictable income by withdrawing a constant percentage of the initial portfolio yearly, with variable withdrawal rates that adjust based on portfolio performance and market conditions to optimize longevity and reduce the risk of depletion. This framework leverages dynamic strategies such as the Guyton-Klinger rules or the Monte Carlo-based adaptive models to balance sustainability and flexibility in retirement income.

Sequence of Returns Risk Management

Fixed withdrawal rates provide predictable income but increase vulnerability to sequence of returns risk by depleting funds rapidly during market downturns, whereas variable withdrawal rates adjust spending based on portfolio performance, helping to preserve capital and reduce the risk of running out of money in early retirement. Effective sequence of returns risk management often incorporates dynamic spending strategies tied to market conditions to sustain portfolio longevity.

Partial Annuitization Technique

The Partial Annuitization Technique in retirement planning combines a fixed withdrawal rate from annuitized assets with a variable withdrawal rate from non-annuitized investments, optimizing income stability while preserving liquidity. This approach balances guaranteed lifetime income with flexibility to adjust spending based on market performance and personal needs.

Fixed withdrawal rate vs Variable withdrawal rate for retirement planning. Infographic

moneydiff.com

moneydiff.com