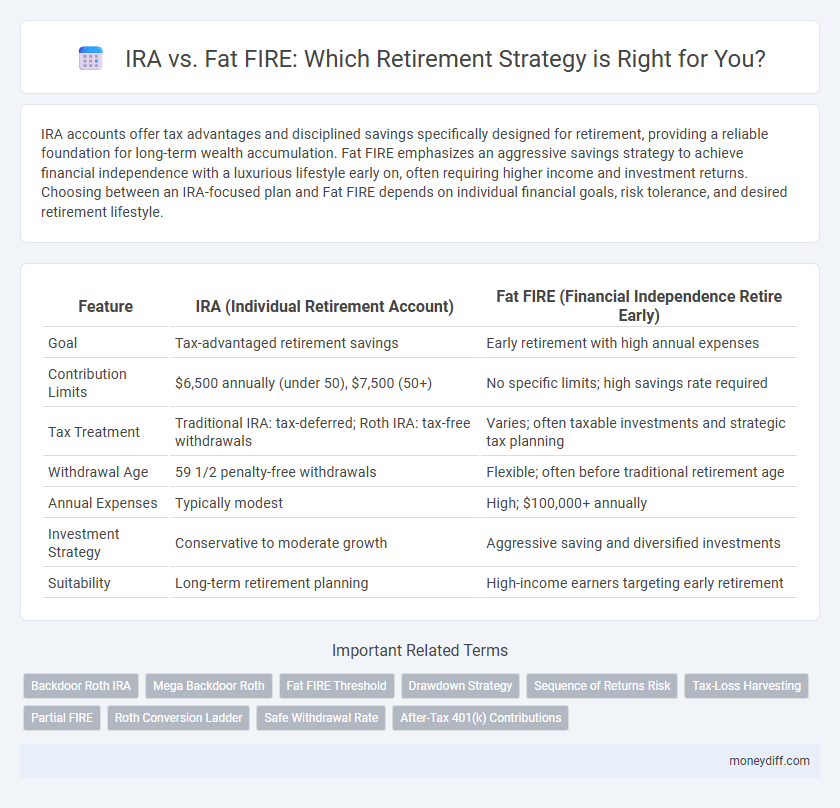

IRA accounts offer tax advantages and disciplined savings specifically designed for retirement, providing a reliable foundation for long-term wealth accumulation. Fat FIRE emphasizes an aggressive savings strategy to achieve financial independence with a luxurious lifestyle early on, often requiring higher income and investment returns. Choosing between an IRA-focused plan and Fat FIRE depends on individual financial goals, risk tolerance, and desired retirement lifestyle.

Table of Comparison

| Feature | IRA (Individual Retirement Account) | Fat FIRE (Financial Independence Retire Early) |

|---|---|---|

| Goal | Tax-advantaged retirement savings | Early retirement with high annual expenses |

| Contribution Limits | $6,500 annually (under 50), $7,500 (50+) | No specific limits; high savings rate required |

| Tax Treatment | Traditional IRA: tax-deferred; Roth IRA: tax-free withdrawals | Varies; often taxable investments and strategic tax planning |

| Withdrawal Age | 59 1/2 penalty-free withdrawals | Flexible; often before traditional retirement age |

| Annual Expenses | Typically modest | High; $100,000+ annually |

| Investment Strategy | Conservative to moderate growth | Aggressive saving and diversified investments |

| Suitability | Long-term retirement planning | High-income earners targeting early retirement |

Understanding IRA: A Traditional Retirement Approach

An Individual Retirement Account (IRA) is a tax-advantaged savings vehicle designed to help individuals accumulate funds for retirement through pre-tax contributions and tax-deferred growth. Traditional IRAs offer potential tax deductions upfront while requiring mandatory minimum distributions after age 73, providing a structured approach to retirement savings aligned with long-term financial planning. This method contrasts with Fat FIRE, which emphasizes rapid wealth accumulation and enhanced lifestyle flexibility but involves higher risk and larger capital requirements.

What is Fat FIRE? High-Spending Financial Independence Explained

Fat FIRE refers to a retirement strategy that enables individuals to achieve financial independence while maintaining a high-spending lifestyle, typically requiring an annual withdrawal of $100,000 or more. Unlike a traditional IRA, which is a tax-advantaged retirement account focused primarily on long-term savings, Fat FIRE emphasizes accumulating a larger investment portfolio that supports greater discretionary spending. This approach demands disciplined saving, strategic investment, and often high income levels to sustain elevated living expenses during retirement.

Key Differences: IRA vs Fat FIRE Retirement Strategies

IRA focuses on tax-advantaged individual retirement savings with contribution limits and required minimum distributions, ideal for steady, moderate retirement funding. Fat FIRE emphasizes achieving a high net worth to support an affluent lifestyle without strict contribution caps or mandatory withdrawals. Choosing between IRA and Fat FIRE depends on desired retirement lifestyle, investment discipline, and risk tolerance.

Financial Goals: Conservative Savings vs Aggressive Wealth-Building

IRA accounts prioritize conservative savings through tax-advantaged, steady contributions designed for long-term retirement security. Fat FIRE strategies emphasize aggressive wealth-building by targeting high income, substantial investments, and expedited financial independence. Balancing IRA's disciplined growth with Fat FIRE's ambitious goals allows tailored retirement planning based on risk tolerance and desired lifestyle.

Investment Options: IRA Accounts Compared to Fat FIRE Portfolios

IRA accounts offer tax-advantaged investment options such as stocks, bonds, mutual funds, and ETFs with contribution limits set by the IRS, ensuring steady retirement savings growth. Fat FIRE portfolios typically comprise a diverse mix of high-yield stocks, real estate, private equity, and alternative investments designed to generate substantial passive income for an early, affluent retirement. The strategic asset allocation in Fat FIRE emphasizes aggressive wealth accumulation and cash flow, whereas IRAs prioritize tax efficiency and long-term capital appreciation within regulated contribution frameworks.

Risk Tolerance: Secure Planning versus High-Risk Strategies

IRA offers a secure retirement planning approach with regulated contributions and tax advantages, aligning with low to moderate risk tolerance. Fat FIRE involves aggressive investment strategies and higher risk tolerance, aiming for early retirement with substantial lifestyle expenses. Choosing between IRA and Fat FIRE depends on balancing risk tolerance with desired retirement timelines and financial goals.

Tax Implications: IRA Benefits and Fat FIRE Considerations

Traditional and Roth IRAs offer tax advantages such as tax-deferred growth or tax-free withdrawals, while contributions may be tax-deductible depending on income and filing status. Fat FIRE strategies emphasize accumulating substantial savings to support a high-spending retirement, which can lead to higher tax liabilities if withdrawals exceed standard exemption limits. Understanding the tax treatment of IRA distributions versus the potentially larger taxable withdrawals in Fat FIRE planning is crucial for optimizing retirement income and minimizing tax burdens.

Lifestyle Impact: Standard Retiree versus Luxurious Retirement

Traditional IRA accounts typically support a standard retiree lifestyle by providing steady, tax-advantaged income focused on preserving capital and managing essential expenses. In contrast, Fat FIRE emphasizes accumulating significantly higher net worth to afford a luxurious retirement lifestyle, enabling discretionary spending on travel, dining, and premium services without financial constraints. Choosing between IRA and Fat FIRE strategies directly influences retirement quality, affecting daily living standards and long-term financial flexibility.

Withdrawal Strategies: Required Minimums vs Unlimited Spending

IRA withdrawal strategies mandate Required Minimum Distributions (RMDs) starting at age 73, which limit flexible spending and can increase tax burdens. Fat FIRE enthusiasts prioritize unlimited spending capacity, often leveraging taxable accounts or Roth IRAs that have no RMDs, allowing greater control over retirement cash flow. Balancing IRA RMDs with non-qualified assets is essential for optimizing sustainable withdrawal rates and tax efficiency during retirement.

Which is Right for You? Choosing Between IRA and Fat FIRE

Choosing between an IRA and Fat FIRE depends on your retirement goals and lifestyle preferences. An IRA offers tax-advantaged savings with controlled risk, ideal for those seeking steady growth and early retirement options within regulatory limits. Fat FIRE suits individuals aiming for a high-expense lifestyle post-retirement, requiring aggressive saving and investing strategies to achieve substantial financial independence before traditional retirement age.

Related Important Terms

Backdoor Roth IRA

Backdoor Roth IRA allows high-income earners to bypass income limits and contribute to a Roth IRA, enabling tax-free growth and withdrawals in retirement, which contrasts with Fat FIRE strategies that prioritize aggressive saving and high expenses in early retirement. Integrating a Backdoor Roth IRA into a Fat FIRE plan can optimize tax advantages and enhance long-term financial flexibility.

Mega Backdoor Roth

The Mega Backdoor Roth strategy allows high earners to contribute significantly more to their Roth IRA by utilizing after-tax 401(k) contributions and in-service rollovers, accelerating tax-free growth compared to traditional IRA limits. This approach aligns well with Fat FIRE goals by enabling substantial retirement savings at high income levels, maximizing after-tax retirement wealth and financial independence.

Fat FIRE Threshold

The Fat FIRE threshold typically requires an annual retirement income of $100,000 or more, far exceeding traditional Individual Retirement Account (IRA) savings focused on moderate withdrawal rates. Achieving Fat FIRE demands aggressive investment strategies and significant asset accumulation beyond standard IRA contributions to sustain a luxurious retirement lifestyle.

Drawdown Strategy

An IRA drawdown strategy involves systematic withdrawals subject to required minimum distributions starting at age 73, optimizing tax efficiency and preserving long-term growth potential. In contrast, Fat FIRE requires a larger portfolio enabling higher inflation-adjusted annual withdrawals, demanding careful asset allocation to sustain lifestyle without exhausting funds prematurely.

Sequence of Returns Risk

IRA investments face sequence of returns risk during retirement withdrawals, meaning negative returns early on can drastically reduce portfolio longevity. Fat FIRE strategies mitigate this risk by maintaining larger, more diversified portfolios and flexible spending, allowing retirees to better withstand market volatility over time.

Tax-Loss Harvesting

Tax-loss harvesting in an IRA allows investors to offset gains within a tax-advantaged account, but it does not provide immediate tax deductions unlike taxable accounts often utilized in Fat FIRE strategies. Fat FIRE approaches leverage taxable investment accounts to maximize tax-loss harvesting benefits, optimizing after-tax returns for a higher retirement spending level.

Partial FIRE

Partial FIRE combines the disciplined savings strategy of an IRA with a lifestyle budget that covers most expenses without fully retiring, offering financial flexibility and reduced withdrawal risk. Unlike Fat FIRE, which demands substantially higher assets for luxury retirement, Partial FIRE balances moderate income needs with sustainable portfolio growth to support early semi-retirement.

Roth Conversion Ladder

Roth Conversion Ladder offers tax-efficient withdrawal strategy by gradually converting traditional IRA funds into Roth IRA, enabling penalty-free access to retirement savings before age 59 1/2. This method complements Fat FIRE goals by providing tax-free income streams and flexibility while maintaining a higher spending level for early retirees.

Safe Withdrawal Rate

IRA accounts typically follow a conventional safe withdrawal rate of 4%, ensuring a steady income throughout retirement, whereas Fat FIRE requires a more aggressive withdrawal strategy due to higher lifestyle expenses, often around 3-3.5% to preserve long-term portfolio sustainability. Understanding the differences in withdrawal rates between traditional IRA assets and Fat FIRE plans is crucial for managing retirement funds effectively.

After-Tax 401(k) Contributions

After-tax 401(k) contributions offer a strategic advantage for Fat FIRE enthusiasts by allowing higher savings beyond traditional pre-tax limits, enabling significant tax diversification in retirement portfolios. Unlike traditional IRAs, these contributions can be converted to Roth accounts, providing potential tax-free growth and optimized withdrawal strategies to sustain a lavish Fat FIRE lifestyle.

IRA vs Fat FIRE for retirement. Infographic

moneydiff.com

moneydiff.com