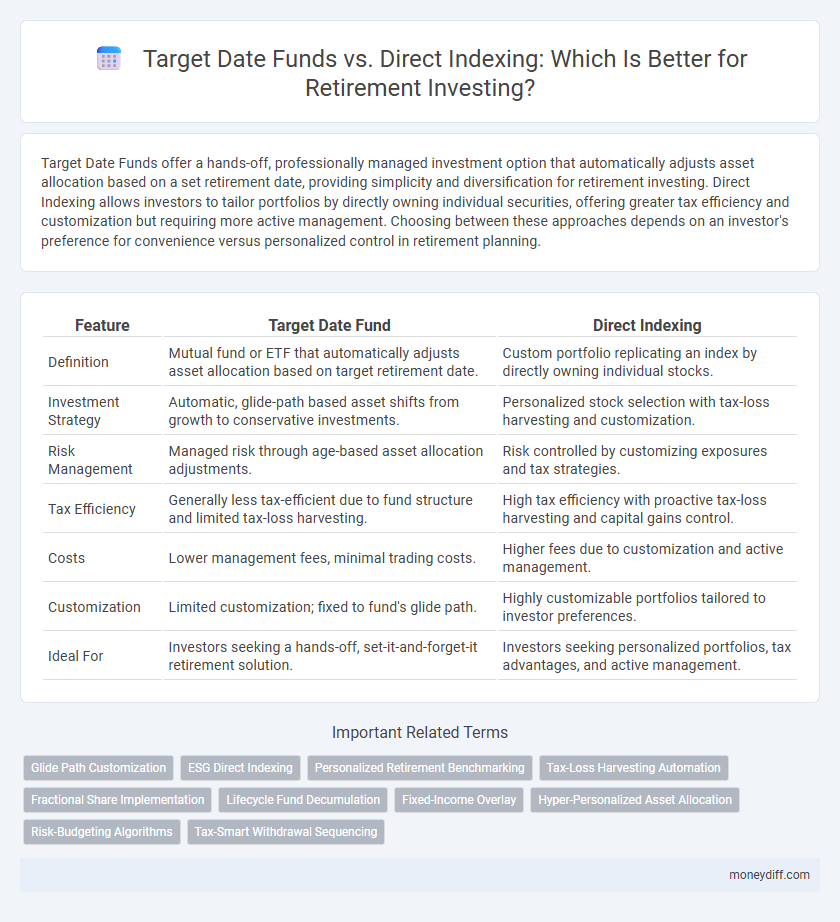

Target Date Funds offer a hands-off, professionally managed investment option that automatically adjusts asset allocation based on a set retirement date, providing simplicity and diversification for retirement investing. Direct Indexing allows investors to tailor portfolios by directly owning individual securities, offering greater tax efficiency and customization but requiring more active management. Choosing between these approaches depends on an investor's preference for convenience versus personalized control in retirement planning.

Table of Comparison

| Feature | Target Date Fund | Direct Indexing |

|---|---|---|

| Definition | Mutual fund or ETF that automatically adjusts asset allocation based on target retirement date. | Custom portfolio replicating an index by directly owning individual stocks. |

| Investment Strategy | Automatic, glide-path based asset shifts from growth to conservative investments. | Personalized stock selection with tax-loss harvesting and customization. |

| Risk Management | Managed risk through age-based asset allocation adjustments. | Risk controlled by customizing exposures and tax strategies. |

| Tax Efficiency | Generally less tax-efficient due to fund structure and limited tax-loss harvesting. | High tax efficiency with proactive tax-loss harvesting and capital gains control. |

| Costs | Lower management fees, minimal trading costs. | Higher fees due to customization and active management. |

| Customization | Limited customization; fixed to fund's glide path. | Highly customizable portfolios tailored to investor preferences. |

| Ideal For | Investors seeking a hands-off, set-it-and-forget-it retirement solution. | Investors seeking personalized portfolios, tax advantages, and active management. |

Understanding Target Date Funds for Retirement

Target Date Funds are designed to automatically adjust the asset allocation to become more conservative as the retirement date approaches, simplifying long-term retirement investing. These funds typically combine a mix of stocks, bonds, and other assets based on the target retirement year, providing diversification and professional management in a single investment. Their ease of use and automated rebalancing make them a popular choice for investors seeking a hands-off approach to building a retirement portfolio.

What Is Direct Indexing in Retirement Investing?

Direct indexing in retirement investing involves purchasing individual securities that mimic the composition of a broad market index, allowing for enhanced tax-loss harvesting and personalized portfolio customization based on specific financial goals and risk tolerance. Unlike target date funds, which automatically adjust asset allocation over time toward a predefined retirement date, direct indexing empowers investors with greater control over security selection and potential tax efficiency. This strategy is particularly beneficial for high-net-worth retirees seeking tailored investment approaches and optimized after-tax retirement income.

Key Differences: Target Date Funds vs Direct Indexing

Target Date Funds offer a simplified, one-stop investment solution by automatically adjusting asset allocation based on a specific retirement year, providing diversification and professional management. Direct Indexing enables investors to buy individual securities of an index, allowing for tax-loss harvesting, personalized customization, and potentially lower costs but requires more active management. The choice depends on investor preferences for ease of use versus control over tax strategies and portfolio customization in retirement investing.

Risk Management: Which Approach Fits Your Retirement Goals?

Target Date Funds offer automated risk management by gradually shifting asset allocation to more conservative investments as retirement approaches, providing a hands-off strategy ideal for investors seeking simplicity. Direct Indexing allows for personalized risk control through tax-loss harvesting and customized portfolio construction, catering to investors who want active management tailored to specific financial goals. Choosing between them depends on one's comfort with managing portfolio risks and the desire for customization versus convenience in retirement planning.

Cost Comparison: Fees in Target Date Funds and Direct Indexing

Target Date Funds typically charge expense ratios ranging from 0.10% to 0.50%, reflecting active management and simplified diversification, whereas Direct Indexing platforms often impose higher fees, including management fees around 0.25% to 0.50% plus trading costs due to individualized portfolio construction. Investors seeking cost efficiency might find Target Date Funds more attractive for low-fee, hassle-free investing, but Direct Indexing provides potential tax benefits that can offset higher expenses over time. Understanding fee structures and associated costs is crucial when comparing these retirement investment options to optimize net returns.

Tax Efficiency for Retirement Investors

Target Date Funds offer a diversified, professionally managed portfolio that automatically adjusts asset allocation to reduce risk as retirement approaches but often lack the personalized tax-loss harvesting opportunities found in Direct Indexing. Direct Indexing allows retirement investors to own individual securities within an index, enabling customized tax management strategies such as strategic tax-loss harvesting and capital gains deferral, which can improve after-tax returns. For tax efficiency, Direct Indexing provides greater control over realized gains and losses, making it a superior choice for investors seeking to minimize tax drag in retirement portfolios.

Customization: Personalizing Your Retirement Portfolio

Target Date Funds offer a convenient, age-based asset allocation but lack the flexibility for personalized adjustments to individual risk tolerance or specific investment preferences. Direct Indexing enables retirees to customize their portfolio by directly owning individual securities, allowing for tailored tax management, sector weighting, and exclusion of unwanted industries. This customization enhances alignment with personal retirement goals and ethical values while maintaining broad market exposure.

Portfolio Diversification: How Each Strategy Performs

Target Date Funds offer built-in portfolio diversification by automatically adjusting asset allocation based on the investor's retirement timeline, typically balancing stocks, bonds, and other asset classes to reduce risk as the target date approaches. Direct Indexing allows investors to hold a customized portfolio of individual securities that can mimic market indices while enabling specific tax-loss harvesting and personalization, potentially enhancing diversification through tailored exposure to sectors or factors. While Target Date Funds provide a hands-off, diversified approach aligned with retirement goals, Direct Indexing offers greater control and flexibility to optimize portfolio diversification according to individual preferences and tax considerations.

Rebalancing Your Retirement Investments

Target date funds simplify retirement investing by automatically rebalancing portfolios to adjust asset allocation as the target date approaches, ensuring risk aligns with investment horizons. Direct indexing offers personalized rebalancing based on specific tax-loss harvesting opportunities and individual preferences, potentially enhancing after-tax returns. Efficient rebalancing in both strategies helps maintain portfolio alignment with retirement goals and manage market fluctuations effectively.

Choosing Between Target Date Funds and Direct Indexing for Retirement

Target Date Funds provide a simplified, diversified investment approach that automatically adjusts asset allocation based on the investor's retirement timeline, ideal for hands-off retirement planning. Direct Indexing offers personalized portfolio customization with potential tax-loss harvesting benefits, appealing to investors seeking tailored control and tax efficiency. Choosing between these strategies depends on individual preferences for convenience versus customization, risk tolerance, and tax optimization goals in retirement investing.

Related Important Terms

Glide Path Customization

Target Date Funds offer a preset glide path that automatically adjusts asset allocation based on age, simplifying retirement investing but limiting customization. Direct Indexing allows retirees to tailor their glide path with precise control over asset exposure, enhancing personalized risk management and tax efficiency.

ESG Direct Indexing

Target Date Funds offer a diversified, professionally managed portfolio that automatically adjusts risk over time, while ESG Direct Indexing enables investors to customize their retirement investments by directly owning individual stocks aligned with specific environmental, social, and governance criteria. ESG Direct Indexing provides enhanced tax efficiency, greater portfolio transparency, and a stronger ability to reflect personal values compared to traditional Target Date Funds.

Personalized Retirement Benchmarking

Target Date Funds provide automated asset allocation aligned with retirement timelines but lack the customization of Direct Indexing, which allows investors to tailor portfolios based on personal values and tax situations. Personalized retirement benchmarking through Direct Indexing offers enhanced control over risk exposure and potential tax efficiency, creating a more precise measure of retirement progress compared to standard Target Date Fund benchmarks.

Tax-Loss Harvesting Automation

Target Date Funds offer built-in tax-loss harvesting automation through professional management that continuously adjusts asset allocation based on retirement timelines, optimizing tax efficiency without active investor involvement. Direct Indexing provides more granular tax-loss harvesting opportunities by allowing investors to customize portfolios and realize losses across numerous individual securities, potentially maximizing tax benefits in volatile markets.

Fractional Share Implementation

Fractional share implementation in target date funds simplifies retirement investing by automatically rebalancing diversified portfolios aligned with an investor's expected retirement year. Direct indexing leverages fractional shares to customize tax-efficient portfolios, offering greater control over individual stock selection and personalized tax-loss harvesting strategies.

Lifecycle Fund Decumulation

Target Date Funds offer a simplified, age-based allocation that automatically shifts from growth to income assets during lifecycle decumulation, providing ease of management and consistent risk adjustment. In contrast, Direct Indexing allows for personalized tax-loss harvesting and enhanced diversification but requires active management, which can be more complex during retirement income withdrawal phases.

Fixed-Income Overlay

Target Date Funds typically incorporate a fixed-income overlay to gradually increase bond allocations, providing retirees with managed risk and steady income streams. In contrast, Direct Indexing allows investors to customize fixed-income exposure within their portfolios, optimizing tax efficiency and aligning bond selections with personal retirement income goals.

Hyper-Personalized Asset Allocation

Target Date Funds offer a predefined asset allocation that automatically adjusts based on your retirement timeline, while Direct Indexing enables hyper-personalized asset allocation by allowing investors to tailor their portfolios to individual preferences, tax strategies, and specific risk tolerances. This customization in Direct Indexing can enhance diversification and tax efficiency, potentially improving retirement outcomes compared to the one-size-fits-all approach of Target Date Funds.

Risk-Budgeting Algorithms

Target Date Funds utilize risk-budgeting algorithms to automatically adjust asset allocation based on a predefined retirement date, balancing growth potential with risk reduction as the target date approaches. Direct Indexing offers personalized risk management by allowing investors to leverage risk-budgeting techniques to tailor exposures at the individual security level, enhancing tax efficiency and control over portfolio volatility.

Tax-Smart Withdrawal Sequencing

Target Date Funds offer a simplified, professionally managed retirement strategy with automatic asset reallocation but may lack flexibility in tax-smart withdrawal sequencing, whereas Direct Indexing provides personalized tax-loss harvesting opportunities and tailored asset sales to optimize tax efficiency during retirement. Strategic withdrawal sequencing in Direct Indexing can minimize capital gains taxes and preserve portfolio value more effectively compared to the fixed glide paths of Target Date Funds.

Target Date Fund vs Direct Indexing for retirement investing. Infographic

moneydiff.com

moneydiff.com