Social Security provides a steady, government-backed retirement income that adjusts for inflation, ensuring long-term financial stability. Gig economy side hustles offer flexible opportunities to supplement Social Security benefits but often lack consistent earnings and benefits like healthcare or retirement contributions. Balancing Social Security with gig work can enhance retirement income, but relying solely on side hustles may pose financial risks due to income variability.

Table of Comparison

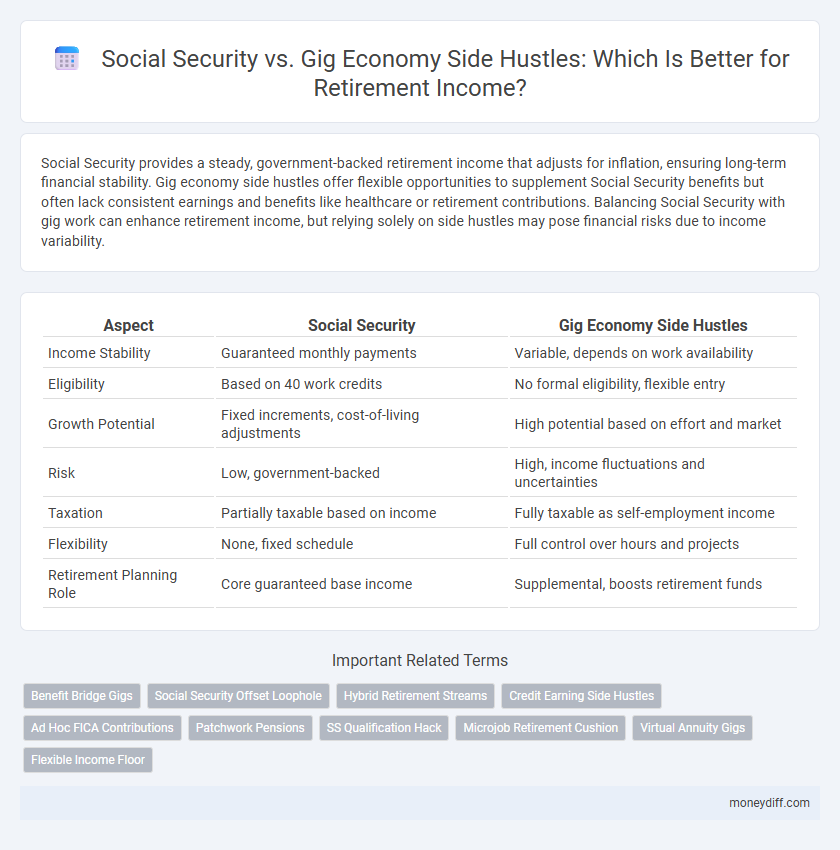

| Aspect | Social Security | Gig Economy Side Hustles |

|---|---|---|

| Income Stability | Guaranteed monthly payments | Variable, depends on work availability |

| Eligibility | Based on 40 work credits | No formal eligibility, flexible entry |

| Growth Potential | Fixed increments, cost-of-living adjustments | High potential based on effort and market |

| Risk | Low, government-backed | High, income fluctuations and uncertainties |

| Taxation | Partially taxable based on income | Fully taxable as self-employment income |

| Flexibility | None, fixed schedule | Full control over hours and projects |

| Retirement Planning Role | Core guaranteed base income | Supplemental, boosts retirement funds |

Understanding Social Security: The Basics

Social Security provides a foundational source of retirement income based on your earnings history and the age at which you claim benefits. Understanding how lifetime earnings, work credits, and full retirement age influence your monthly payments is crucial for effective retirement planning. Supplementing Social Security with gig economy side hustles can offer additional income flexibility and financial security during retirement.

Gig Economy Side Hustles: An Emerging Retirement Trend

Gig economy side hustles are becoming a significant source of supplemental income for retirees, offering flexible work opportunities that adapt to individual lifestyles. This trend leverages online platforms and app-based jobs, enabling retirees to boost their Social Security benefits with additional earnings. Embracing gig work can enhance financial security while promoting active engagement during retirement years.

Social Security Eligibility and Payouts Explained

Social Security eligibility requires a minimum of 40 work credits, typically earned through about 10 years of employment, ensuring consistent contributions from workers including gig economy participants. The payout amount depends on the lifetime average earnings, with benefits calculated on highest 35 years of indexed earnings to provide a stable retirement income. Gig economy side hustles can supplement Social Security by increasing total annual earnings but may not qualify independently for Social Security benefits without sufficient reported income.

Pros and Cons of Relying on Social Security

Relying on Social Security for retirement income offers guaranteed, inflation-adjusted monthly benefits backed by the federal government, providing a stable foundation for retirees. However, it may not fully cover living expenses due to benefit limits and potential future funding uncertainties caused by demographic shifts and economic pressures. Supplementing Social Security with gig economy side hustles can enhance financial security, but gig income lacks the predictability and legal protections of Social Security benefits.

Benefits and Risks of Gig Economy Income in Retirement

Gig economy side hustles offer retirees flexible income streams that can supplement Social Security benefits but often lack consistent earnings and retirement-specific protections like employer-sponsored health insurance or pension plans. While gig work allows continued engagement and supplemental cash flow, it introduces risks such as income volatility, self-employment tax burdens, and limited access to traditional retirement savings options like 401(k)s. Balancing gig income with Social Security ensures diversification but requires careful management to mitigate unpredictability and maintain long-term financial stability during retirement.

Comparing Income Stability: Social Security vs Side Hustles

Social Security offers a consistent, inflation-adjusted monthly income backed by the federal government, ensuring reliable financial support throughout retirement. In contrast, gig economy side hustles provide flexible earning opportunities but often come with unpredictable income streams and lack of benefits. Balancing the steady payout of Social Security with supplementary gig income can enhance overall financial stability in retirement.

Tax Implications for Social Security and Gig Income

Social Security benefits are subject to federal income tax if combined income exceeds specific thresholds, potentially reducing net retirement income. Gig economy earnings are treated as self-employment income, requiring payment of both income tax and self-employment tax, which can significantly impact overall tax liability. Proper tax planning is essential to balance Social Security income and gig earnings to optimize after-tax retirement funds.

Flexibility and Lifestyle: Finding Your Retirement Fit

Social Security provides a reliable, steady income stream during retirement, offering financial stability and peace of mind for essential expenses. Gig economy side hustles deliver unmatched flexibility, enabling retirees to tailor work hours and projects to fit personal lifestyle preferences and social commitments. Balancing Social Security benefits with gig work allows retirees to optimize income while maintaining an active, fulfilling lifestyle aligned with their retirement goals.

Maximizing Social Security While Working a Side Hustle

Maximizing Social Security benefits while working a gig economy side hustle requires strategic planning to balance earned income and benefit thresholds. Understanding the annual earnings limit, which is $21,240 in 2024 for those under full retirement age, helps avoid Social Security benefit reductions while supplementing income through flexible gig work. Combining Social Security with side hustle earnings from platforms like Uber or Etsy enhances overall retirement income without jeopardizing long-term benefit eligibility.

Planning a Sustainable Retirement Income Strategy

Balancing Social Security benefits with gig economy side hustles creates a diversified retirement income strategy that enhances financial stability and mitigates risks associated with relying solely on one source. Integrating consistent gig economy earnings can supplement Social Security, offsetting inflation and unexpected expenses during retirement. Careful planning ensures that side hustles align with long-term goals, allowing for sustainable income streams that adapt to changing personal and economic circumstances.

Related Important Terms

Benefit Bridge Gigs

Benefit Bridge Gigs provide a flexible supplementary income stream that can enhance retirement savings beyond traditional Social Security benefits, allowing retirees to maintain financial stability and increase disposable income. Leveraging gig economy opportunities through Benefit Bridge optimizes earning potential while accommodating the gradual withdrawal from the workforce.

Social Security Offset Loophole

Social Security benefits can be reduced if earnings from gig economy side hustles exceed the annual limit, a loophole known as the Social Security Offset that affects retirees under full retirement age. Careful income planning is essential to maximize retirement income without triggering benefit reductions tied to self-employment earnings.

Hybrid Retirement Streams

Combining Social Security benefits with gig economy side hustles creates hybrid retirement income streams that enhance financial stability and flexibility. Leveraging part-time freelance work alongside guaranteed Social Security payments diversifies revenue sources, reducing reliance on a single income and optimizing retirement cash flow.

Credit Earning Side Hustles

Gig economy side hustles can significantly boost Social Security retirement benefits by increasing credited earnings, as Social Security calculates benefits based on lifetime earnings covered by Social Security taxes. Consistently reporting gig income ensures higher credits, enhancing monthly Social Security payments and providing a more secure retirement income stream.

Ad Hoc FICA Contributions

Ad hoc FICA contributions from gig economy side hustles offer flexible Social Security credits that can boost retirement income, especially for workers with irregular earnings. These contributions ensure self-employed individuals in the gig economy accumulate Social Security benefits comparable to traditional employment, enhancing long-term financial security.

Patchwork Pensions

Patchwork Pensions blend Social Security benefits with diversified gig economy side hustles to enhance retirement income stability. Leveraging multiple income streams reduces reliance on Social Security alone, mitigating risks associated with fluctuating gig earnings and Social Security policy changes.

SS Qualification Hack

Maximizing retirement income often involves a strategic combination of Social Security benefits and gig economy side hustles, with the Social Security Qualification Hack enabling eligibility for benefits by accumulating the required 40 credits through part-time gig work. Leveraging gig economy earnings not only supplements income but can also accelerate Social Security qualification, optimizing total retirement income streams.

Microjob Retirement Cushion

Microjob retirement cushions from gig economy side hustles provide flexible income streams that can supplement Social Security benefits, helping to bridge income gaps during retirement. This diversification reduces reliance on fixed Social Security payments and enhances financial security by leveraging short-term, task-based work platforms.

Virtual Annuity Gigs

Social Security offers a baseline retirement income, but virtual annuity gigs in the gig economy provide flexible, supplemental earnings that can enhance financial security during retirement. Leveraging online platforms for steady, skill-based tasks creates a reliable income stream, bridging gaps left by traditional Social Security benefits.

Flexible Income Floor

Social Security provides a steady, inflation-adjusted income floor crucial for retirement stability, while gig economy side hustles offer flexibility and potential to supplement or elevate this base income. Balancing guaranteed Social Security benefits with the variable earnings from gig work can optimize financial security and adapt to changing retirement needs.

Social Security vs Gig Economy Side Hustles for retirement income Infographic

moneydiff.com

moneydiff.com