Retirement drawdown involves systematically withdrawing funds from retirement savings to cover living expenses, prioritizing a steady income stream throughout retirement. The guardrails strategy, by contrast, adjusts withdrawal amounts based on portfolio performance, reducing withdrawals in down markets and increasing them when investments perform well, enhancing portfolio longevity. Comparing these approaches highlights the balance between predictable income and flexibility to adapt to market fluctuations for sustainable retirement income.

Table of Comparison

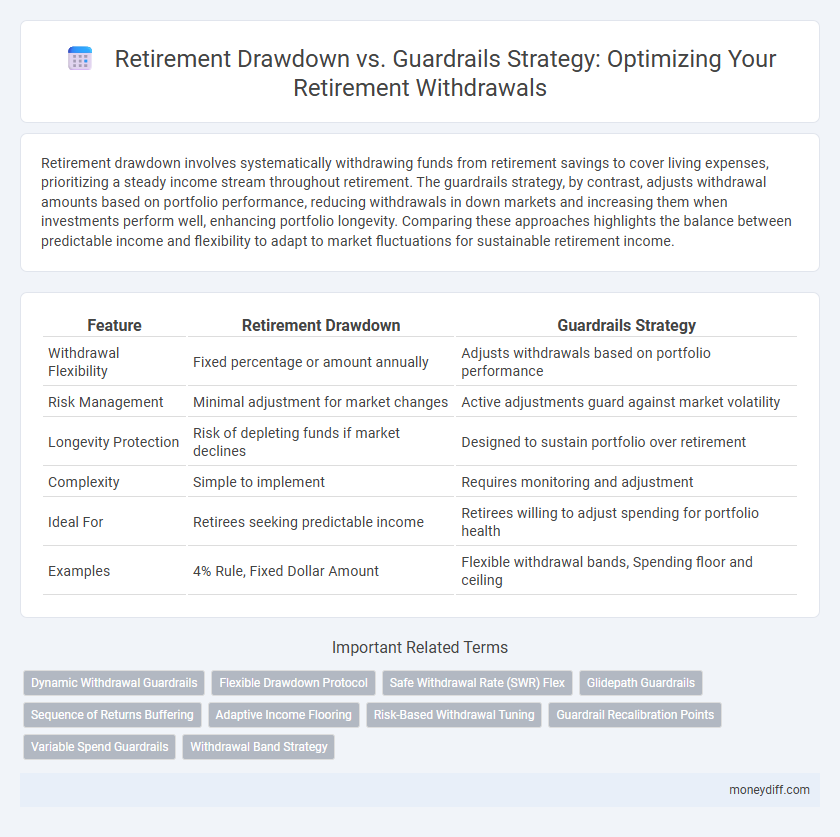

| Feature | Retirement Drawdown | Guardrails Strategy |

|---|---|---|

| Withdrawal Flexibility | Fixed percentage or amount annually | Adjusts withdrawals based on portfolio performance |

| Risk Management | Minimal adjustment for market changes | Active adjustments guard against market volatility |

| Longevity Protection | Risk of depleting funds if market declines | Designed to sustain portfolio over retirement |

| Complexity | Simple to implement | Requires monitoring and adjustment |

| Ideal For | Retirees seeking predictable income | Retirees willing to adjust spending for portfolio health |

| Examples | 4% Rule, Fixed Dollar Amount | Flexible withdrawal bands, Spending floor and ceiling |

Understanding Retirement Withdrawal Strategies

Retirement drawdown focuses on systematically withdrawing funds to sustain income throughout retirement, while the guardrails strategy employs flexible withdrawal rates that adjust based on portfolio performance and market conditions. The guardrails approach helps manage longevity risk by increasing or decreasing withdrawals within predefined limits, aiming to preserve capital during downturns. Understanding these strategies enables retirees to balance income needs with portfolio sustainability, optimizing financial security during retirement.

What Is the Traditional Drawdown Approach?

The traditional drawdown approach in retirement involves systematically withdrawing a fixed percentage or amount from retirement savings annually to cover living expenses. This method emphasizes simplicity and predictability but may not adapt well to fluctuating market conditions or changes in spending needs. It risks depleting funds too quickly if withdrawals are not adjusted based on investment performance or longevity.

Introducing the Guardrails Withdrawal Strategy

The Guardrails Withdrawal Strategy for retirement withdrawals adjusts spending based on portfolio performance, ensuring sustainable income while managing sequence-of-returns risk. This approach uses predetermined upper and lower bounds to increase or decrease withdrawals, maintaining a balance between financial security and lifestyle needs. By dynamically responding to market fluctuations, the Guardrails Strategy helps retirees preserve their nest egg and avoid premature depletion.

Key Differences: Drawdown vs Guardrails Methods

Retirement Drawdown strategy involves systematically withdrawing a fixed or gradually increasing amount from retirement savings to provide steady income, whereas the Guardrails strategy uses dynamic adjustments to withdrawal rates based on market performance and portfolio balance. Drawdown relies on a predetermined plan with less flexibility, potentially risking depletion during market downturns, while Guardrails aim to preserve capital by increasing or decreasing withdrawals within set limits. Key differences include the rigidity of Drawdown versus the adaptive, responsive nature of Guardrails, which helps manage longevity and sequence of returns risks more effectively.

Pros and Cons of the Drawdown Strategy

The Retirement Drawdown strategy allows retirees to withdraw a fixed percentage or amount annually from their savings, providing flexibility and the potential for higher spending in good market years. Its main advantage is simplicity and control over income, but it carries the risk of depleting the portfolio too quickly during market downturns or longevity risk without built-in safeguards. Drawback includes lack of automatic adjustment mechanisms to protect against sequence of returns risk, potentially leading to insufficient funds in later retirement years.

Advantages and Limitations of Guardrails Strategies

Guardrails strategies for retirement withdrawals offer the advantage of flexibility by adjusting spending based on portfolio performance, helping retirees avoid depleting assets prematurely. These strategies provide a systematic approach to balance income stability with investment risk, potentially extending portfolio longevity. However, guardrails require ongoing monitoring and may result in variable income, which can challenge retirees accustomed to fixed withdrawal amounts.

Evaluating Flexibility in Retirement Withdrawals

Retirement drawdown strategies prioritize consistent income streams by systematically withdrawing from savings to cover expenses, while guardrails strategies adjust withdrawals based on market performance and portfolio health. Evaluating flexibility in retirement withdrawals involves balancing the need for predictable cash flow with the ability to adapt spending to preserve longevity of assets. Guardrails offer dynamic adjustments that can help mitigate sequence-of-returns risk, whereas drawdown methods provide simplicity but less responsiveness to financial market fluctuations.

Managing Market Volatility: Drawdown vs Guardrails

Managing market volatility during retirement requires comparing traditional drawdown strategies with guardrails approaches. Drawdown strategies involve systematic withdrawals without adjustment, potentially risking portfolio depletion during bear markets. Guardrails strategies set pre-defined thresholds to adjust spending or asset allocation, providing a structured response to market fluctuations and helping preserve portfolio longevity.

Which Withdrawal Strategy Suits Your Retirement Plan?

Retirement Drawdown involves systematically withdrawing a fixed percentage from your savings, offering predictable income but with less flexibility during market fluctuations. The Guardrails Strategy adjusts withdrawals based on portfolio performance, aiming to sustain longevity and growth while minimizing the risk of depleting funds. Choosing a withdrawal strategy depends on your risk tolerance, income needs, and market outlook to ensure a balanced and sustainable retirement plan.

Maximizing Retirement Income: Choosing the Right Approach

Retirement drawdown focuses on systematically withdrawing a fixed percentage or amount from retirement savings, ensuring steady income but risking depletion during market downturns. The guardrails strategy adjusts withdrawals based on portfolio performance, increasing income when markets do well and reducing it during downturns to preserve capital. Choosing the right approach depends on balancing income stability with longevity risk, optimizing withdrawal rates to maximize retirement income while safeguarding assets against market volatility.

Related Important Terms

Dynamic Withdrawal Guardrails

Dynamic Withdrawal Guardrails adjust retirement withdrawals based on market performance and portfolio sustainability, helping to minimize the risk of outliving assets while maintaining flexible income streams. This strategy contrasts with fixed drawdown plans by incorporating real-time portfolio data and market conditions to dynamically modulate withdrawal rates for long-term financial security.

Flexible Drawdown Protocol

The Flexible Drawdown Protocol adapts withdrawal amounts based on portfolio performance, enhancing sustainability compared to rigid guardrails strategies that enforce fixed percentage limits. This approach dynamically balances income needs with market conditions to optimize retirement fund longevity and reduce the risk of portfolio depletion.

Safe Withdrawal Rate (SWR) Flex

The Retirement Drawdown strategy typically relies on a fixed Safe Withdrawal Rate (SWR), often around 4%, to ensure portfolio longevity, whereas the Guardrails Strategy employs a flexible SWR that adjusts withdrawals based on portfolio performance, helping to mitigate the risk of depleting assets too early. This SWR Flex approach adapts withdrawals upward or downward within predefined limits, balancing income stability and portfolio sustainability throughout retirement.

Glidepath Guardrails

The Glidepath Guardrails strategy dynamically adjusts retirement withdrawals based on portfolio performance and market conditions, reducing risk of depletion compared to fixed percentage drawdowns. By setting predefined upper and lower boundaries, this approach helps maintain a sustainable withdrawal rate tailored to changing asset values and longevity projections.

Sequence of Returns Buffering

The Sequence of Returns Buffering in retirement drawdown helps mitigate the risk of withdrawing funds during market downturns by adjusting withdrawal amounts based on portfolio performance, unlike traditional Guardrails Strategy which relies on fixed thresholds to trigger spending adjustments. This dynamic approach enhances portfolio longevity by preserving capital during negative return periods and allowing higher withdrawals during favorable market cycles.

Adaptive Income Flooring

The Retirement Drawdown strategy focuses on systematic withdrawals based on a fixed percentage, while the Guardrails Strategy uses Adaptive Income Flooring to adjust withdrawals dynamically, preserving portfolio longevity by setting minimum income thresholds that adapt to market fluctuations. Adaptive Income Flooring ensures retirees maintain a stable income floor, protecting against market downturns and reducing the risk of depleting retirement savings prematurely.

Risk-Based Withdrawal Tuning

Risk-based withdrawal tuning in retirement drawdown strategies adjusts the withdrawal amount based on market performance and portfolio risk, aiming to optimize income sustainability and minimize the probability of portfolio depletion. The guardrails approach sets predefined upper and lower withdrawal boundaries that trigger adjustments, providing a systematic method to balance spending needs with long-term financial security.

Guardrail Recalibration Points

Guardrail Recalibration Points are critical in the Guardrails Strategy, allowing retirees to adjust withdrawal rates based on portfolio performance and market conditions to sustain longevity. These recalibration points help prevent premature depletion of retirement savings by tightening or loosening spending boundaries, ensuring a flexible yet disciplined approach to drawdowns.

Variable Spend Guardrails

Variable Spend Guardrails strategy adjusts retirement withdrawals based on portfolio performance, helping to protect against running out of funds while allowing spending flexibility. This approach dynamically modifies annual withdrawals within predefined limits, balancing income stability and longevity of retirement savings.

Withdrawal Band Strategy

The Withdrawal Band Strategy in retirement drawdown optimizes income by setting upper and lower withdrawal limits, ensuring portfolio sustainability while adapting to market fluctuations. This approach balances spending needs with longevity risk, reducing the chance of depleting assets prematurely compared to fixed withdrawal rates.

Retirement Drawdown vs Guardrails Strategy for retirement withdrawals. Infographic

moneydiff.com

moneydiff.com