Choosing between an IRA and a Roth Mega Backdoor strategy significantly impacts retirement planning by affecting tax treatment and contribution limits. Traditional IRAs offer tax-deferred growth with contributions potentially being tax-deductible, while Roth Mega Backdoor IRAs allow for after-tax contributions with tax-free withdrawals in retirement. Incorporating a Roth Mega Backdoor can enable higher contribution limits compared to traditional IRAs, maximizing retirement savings potential.

Table of Comparison

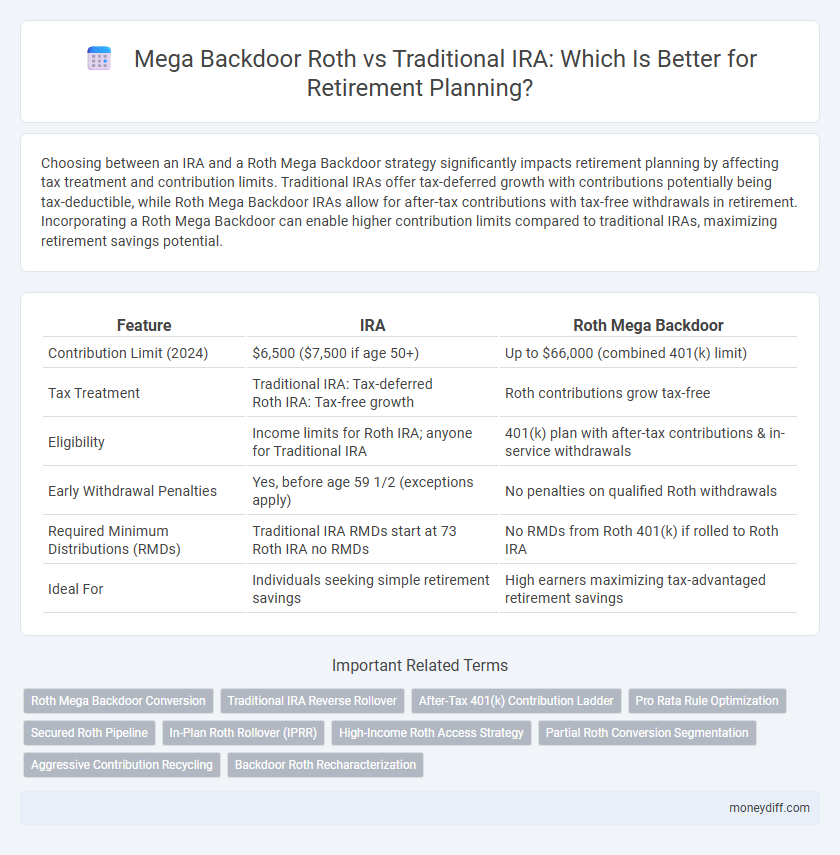

| Feature | IRA | Roth Mega Backdoor |

|---|---|---|

| Contribution Limit (2024) | $6,500 ($7,500 if age 50+) | Up to $66,000 (combined 401(k) limit) |

| Tax Treatment | Traditional IRA: Tax-deferred Roth IRA: Tax-free growth |

Roth contributions grow tax-free |

| Eligibility | Income limits for Roth IRA; anyone for Traditional IRA | 401(k) plan with after-tax contributions & in-service withdrawals |

| Early Withdrawal Penalties | Yes, before age 59 1/2 (exceptions apply) | No penalties on qualified Roth withdrawals |

| Required Minimum Distributions (RMDs) | Traditional IRA RMDs start at 73 Roth IRA no RMDs |

No RMDs from Roth 401(k) if rolled to Roth IRA |

| Ideal For | Individuals seeking simple retirement savings | High earners maximizing tax-advantaged retirement savings |

Understanding Traditional IRAs vs Roth IRAs

Traditional IRAs offer tax-deferred growth with contributions typically tax-deductible, reducing taxable income today but requiring taxes upon withdrawal in retirement. Roth IRAs provide tax-free growth and tax-free qualified withdrawals since contributions are made with after-tax dollars, benefiting those expecting higher taxes later. Understanding the different tax treatments and withdrawal rules of Traditional and Roth IRAs is essential for optimizing retirement planning strategies.

What Is the Mega Backdoor Roth IRA?

The Mega Backdoor Roth IRA is an advanced strategy that allows high-income earners to contribute after-tax dollars to their 401(k) and subsequently convert those funds to a Roth IRA, significantly exceeding standard Roth IRA contribution limits. This method enables individuals to grow retirement savings tax-free and avoid income restrictions that typically limit Roth IRA eligibility. Utilizing the Mega Backdoor Roth IRA can accelerate tax-advantaged retirement wealth accumulation beyond traditional IRA and Roth IRA contributions.

Contribution Limits: IRA vs Mega Backdoor Roth

Traditional IRA contribution limits for 2024 are $6,500 annually, with a $1,000 catch-up for individuals over 50, while Mega Backdoor Roth IRA allows after-tax contributions up to a combined total of $66,000, including employer matches. The Mega Backdoor Roth strategy leverages 401(k) plans with high contribution ceilings, enabling significantly greater tax-advantaged retirement savings compared to IRAs. Understanding this difference is crucial for maximizing retirement contributions and optimizing long-term tax benefits.

Tax Benefits: Comparing Strategies

The Roth Mega Backdoor IRA allows after-tax contributions to grow tax-free, providing significant tax benefits during retirement compared to traditional IRA contributions that are often tax-deductible but taxed upon withdrawal. Traditional IRAs offer immediate tax deductions which reduce taxable income now, while Roth IRAs and Mega Backdoor Roth contributions avoid tax on qualified withdrawals, optimizing long-term tax efficiency. Contributions to a Mega Backdoor Roth can substantially increase retirement savings beyond standard IRA limits, leveraging tax-free growth on higher contributions.

Eligibility Requirements for IRAs and Mega Backdoor Roth

Traditional IRAs require individuals to have earned income and are subject to income limits on deductible contributions if covered by a workplace retirement plan, while Roth IRAs enforce stricter income phase-out ranges for eligibility to contribute directly. The Mega Backdoor Roth strategy allows high earners to contribute significantly more to a Roth account via after-tax 401(k) contributions and in-service rollovers, bypassing Roth IRA income limits. Eligibility for the Mega Backdoor Roth depends on whether the employer's 401(k) plan allows after-tax contributions and in-service distributions, making it a powerful tool for maximizing retirement savings beyond standard IRA limits.

Withdrawal Rules and Flexibility

IRA accounts require minimum distributions starting at age 73, which can limit withdrawal flexibility, whereas Roth Mega Backdoor strategies allow tax-free withdrawals without required minimum distributions during the account holder's lifetime. Roth Mega Backdoor IRAs provide greater control over taxable income in retirement by enabling contributions beyond conventional limits and accessing funds without penalties after age 59 1/2. Understanding these withdrawal rules is essential for optimizing retirement planning and managing tax implications effectively.

Long-Term Growth Potential

Roth Mega Backdoor IRAs offer higher contribution limits than traditional IRAs, enabling significantly greater long-term growth potential through tax-free compounding. While traditional IRAs provide tax-deferred growth, Roth Mega Backdoors maximize after-tax contributions, benefiting high-income earners aiming for substantial retirement savings. Choosing a Roth Mega Backdoor strategy can enhance portfolio diversification and maximize retirement income by leveraging both tax advantages and increased investment capacity.

Employer Plans and Mega Backdoor Roth

Employer plans offering the Mega Backdoor Roth strategy allow high-income earners to contribute significantly beyond standard IRA limits by making after-tax contributions and converting them to a Roth account, enabling tax-free growth and withdrawals. Traditional IRAs offer tax-deferred growth with contributions possibly being tax-deductible, but they have lower annual contribution limits and income restrictions affecting deductibility and Roth conversion options. Utilizing the Mega Backdoor Roth within employer plans maximizes retirement savings potential by leveraging higher contribution thresholds and tax efficiency compared to standard IRA contributions.

Risks and Considerations for Each Option

Contributing to a traditional IRA carries risks of required minimum distributions (RMDs) starting at age 73, potentially increasing taxable income in retirement. The Roth Mega Backdoor IRA allows for higher after-tax contributions and tax-free growth but requires careful adherence to IRS contribution limits and potential legislative changes that could impact its availability. Consider income phase-outs, employer plan restrictions, and long-term tax implications when choosing between these retirement strategies.

Deciding the Best Strategy for Your Retirement Goals

Choosing between a traditional IRA and a Roth Mega Backdoor strategy depends on your current tax bracket, future income expectations, and retirement timeline. The traditional IRA offers tax-deferred growth with potential tax deductions on contributions, while the Roth Mega Backdoor allows for substantial after-tax contributions and tax-free withdrawals, maximizing tax diversification. Evaluating your projected tax rates, contribution limits, and access to employer-sponsored plans will help determine the most effective strategy for long-term retirement wealth accumulation.

Related Important Terms

Roth Mega Backdoor Conversion

The Roth Mega Backdoor Conversion allows high-income earners to contribute after-tax dollars to a 401(k) and then convert those funds to a Roth IRA, enabling significant tax-free growth and withdrawals in retirement beyond the standard Roth IRA contribution limits. Unlike traditional IRA contributions, this strategy maximizes after-tax savings potential and circumvents income restrictions, making it a powerful tool for aggressive retirement planning and long-term tax efficiency.

Traditional IRA Reverse Rollover

A Traditional IRA Reverse Rollover enables retirees to consolidate 401(k) funds into a Traditional IRA, preserving pre-tax status while enhancing tax-deferred growth potential compared to Roth Mega Backdoor contributions, which involve after-tax dollars and potential future tax-free withdrawals. This strategy offers greater flexibility in retirement planning by allowing strategic tax deferral and control over distribution timing, compared to the immediate tax implications and contribution limits associated with Roth conversions.

After-Tax 401(k) Contribution Ladder

The After-Tax 401(k) Contribution Ladder leverages Mega Backdoor Roth strategies by enabling high earners to funnel substantial after-tax contributions into a Roth IRA, maximizing tax-free growth and withdrawal benefits. This approach surpasses traditional IRA limits, offering a strategic pathway to boost retirement savings while minimizing future tax liabilities.

Pro Rata Rule Optimization

Pro Rata Rule optimization is crucial when choosing between a traditional IRA and a Roth Mega Backdoor IRA for retirement planning, as it prevents unexpected tax liabilities by accurately calculating taxable and non-taxable portions during conversions. Utilizing the Roth Mega Backdoor strategy allows high-income earners to maximize after-tax contributions and strategically avoid the Pro Rata Rule's tax complications inherent in traditional IRA conversions.

Secured Roth Pipeline

The Secured Roth Pipeline in a Mega Backdoor Roth strategy allows high-income earners to contribute significantly beyond traditional IRA limits by converting after-tax 401(k) contributions into a Roth account, maximizing tax-free growth potential. This approach offers greater retirement savings flexibility compared to a standard IRA, which has lower contribution limits and potential income restrictions for Roth conversions.

In-Plan Roth Rollover (IPRR)

In-Plan Roth Rollovers (IPRR) allow participants to convert pre-tax 401(k) contributions into Roth accounts within the same retirement plan, offering tax-free growth and withdrawals in retirement. Unlike the Roth Mega Backdoor IRA, which requires after-tax contributions followed by external rollovers, IPRR enables seamless in-plan conversions, simplifying retirement planning and optimizing tax outcomes.

High-Income Roth Access Strategy

The Roth Mega Backdoor IRA strategy enables high-income earners to contribute significantly beyond traditional Roth IRA limits by utilizing after-tax 401(k) contributions and in-service rollovers, maximizing tax-advantaged growth. Unlike direct Roth IRA contributions restricted by income limits, this approach facilitates accelerated retirement savings with tax-free withdrawals under current IRS regulations.

Partial Roth Conversion Segmentation

Partial Roth conversion segmentation allows retirees to strategically convert traditional IRA funds into a Roth IRA over several years, optimizing tax liabilities and maximizing after-tax retirement savings. This method leverages income thresholds to minimize tax impact while benefiting from the Roth's tax-free growth and withdrawal advantages compared to the Roth Mega Backdoor strategy, which involves after-tax 401(k) contributions but may have contribution limits.

Aggressive Contribution Recycling

The Roth Mega Backdoor IRA enables high-income earners to aggressively maximize after-tax 401(k) contributions, converting them into tax-free growth, while traditional IRAs have much lower contribution limits and offer tax-deferred growth with income restrictions. Aggressive contribution recycling through the Roth Mega Backdoor strategy accelerates wealth accumulation by continuously funneling excess contributions into tax-advantaged Roth accounts, optimizing long-term retirement savings.

Backdoor Roth Recharacterization

Backdoor Roth IRAs allow high-income earners to contribute to a Roth IRA indirectly by converting nondeductible traditional IRA contributions, while Mega Backdoor Roths enable significantly larger after-tax contributions through a 401(k) plan, maximizing retirement savings potential. Recharacterization used to be an option to undo Roth conversions in a Backdoor Roth strategy but was eliminated by the Tax Cuts and Jobs Act of 2017, making it essential to carefully assess tax implications before conversion.

IRA vs Roth Mega Backdoor for retirement planning. Infographic

moneydiff.com

moneydiff.com