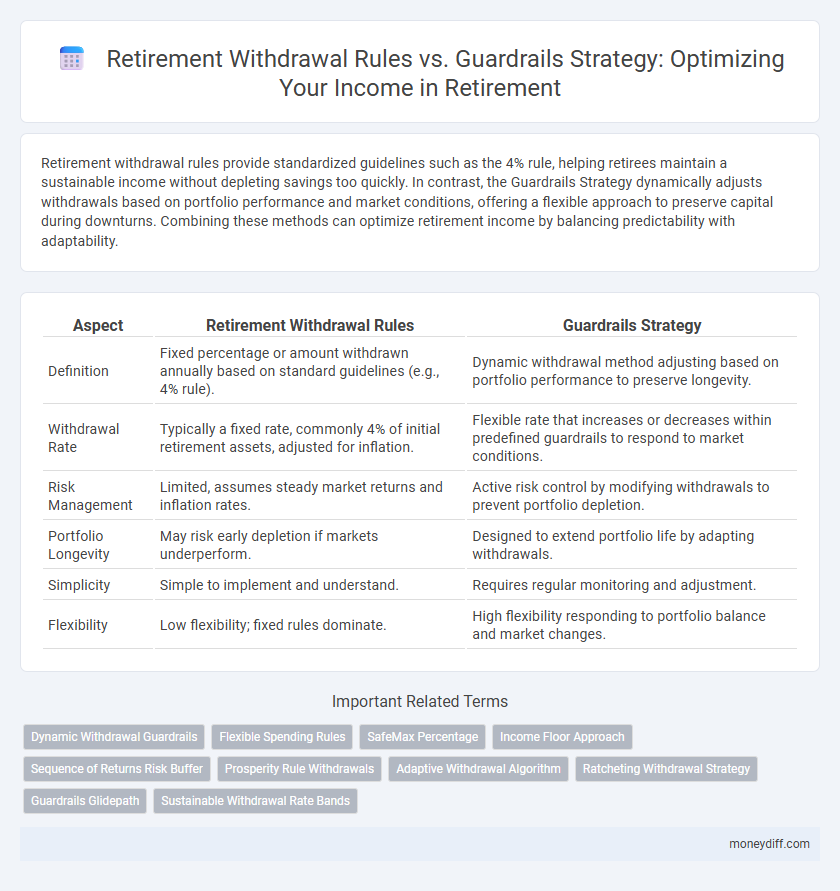

Retirement withdrawal rules provide standardized guidelines such as the 4% rule, helping retirees maintain a sustainable income without depleting savings too quickly. In contrast, the Guardrails Strategy dynamically adjusts withdrawals based on portfolio performance and market conditions, offering a flexible approach to preserve capital during downturns. Combining these methods can optimize retirement income by balancing predictability with adaptability.

Table of Comparison

| Aspect | Retirement Withdrawal Rules | Guardrails Strategy |

|---|---|---|

| Definition | Fixed percentage or amount withdrawn annually based on standard guidelines (e.g., 4% rule). | Dynamic withdrawal method adjusting based on portfolio performance to preserve longevity. |

| Withdrawal Rate | Typically a fixed rate, commonly 4% of initial retirement assets, adjusted for inflation. | Flexible rate that increases or decreases within predefined guardrails to respond to market conditions. |

| Risk Management | Limited, assumes steady market returns and inflation rates. | Active risk control by modifying withdrawals to prevent portfolio depletion. |

| Portfolio Longevity | May risk early depletion if markets underperform. | Designed to extend portfolio life by adapting withdrawals. |

| Simplicity | Simple to implement and understand. | Requires regular monitoring and adjustment. |

| Flexibility | Low flexibility; fixed rules dominate. | High flexibility responding to portfolio balance and market changes. |

Understanding Traditional Retirement Withdrawal Rules

Traditional retirement withdrawal rules often recommend the 4% rule, allowing retirees to withdraw 4% of their retirement savings annually to ensure funds last 30 years. These rules provide a straightforward framework but may not account for market volatility, inflation, or individual longevity risk. Understanding these limitations helps retirees compare traditional guidelines with the more flexible Guardrails Strategy, which adjusts withdrawals based on portfolio performance and changing financial needs.

Introduction to the Guardrails Withdrawal Strategy

The Guardrails Withdrawal Strategy uses adaptive spending rules to help retirees maintain financial stability by adjusting withdrawals based on portfolio performance and market conditions. Unlike fixed withdrawal rates, the strategy sets upper and lower limits--guardrails--that trigger increases or decreases in spending, preserving retirement savings while allowing flexibility. This dynamic approach helps balance income needs and longevity risk, making it a practical framework for sustainable retirement withdrawals.

Comparing Fixed Withdrawal Rules and Dynamic Approaches

Fixed withdrawal rules, such as the 4% rule, provide retirees with a predictable annual income by withdrawing a consistent percentage from their portfolio, offering simplicity and structure. Dynamic approaches adjust withdrawal rates based on market performance, longevity projections, and spending needs, enhancing portfolio sustainability and flexibility. Comparing these strategies, fixed rules prioritize ease and stability, while dynamic methods aim to optimize income potential and reduce the risk of depleting retirement savings.

Pros and Cons of Standard Withdrawal Rate Guidelines

Standard withdrawal rate guidelines, such as the 4% rule, offer a simple framework for retirees to plan sustainable income streams by limiting withdrawals to a fixed percentage of the initial portfolio value. These rules provide ease of implementation and historical backing but often lack flexibility to adapt to market volatility or changing personal circumstances. Over-reliance on static withdrawal rates may increase the risk of portfolio depletion during prolonged downturns, highlighting the need for dynamic strategies that align with retirees' evolving financial needs.

How the Guardrails Strategy Adapts to Market Changes

The Guardrails Strategy for retirement withdrawals dynamically adjusts withdrawal rates based on market performance, helping to preserve portfolio longevity during downturns while allowing increased withdrawals in strong markets. Unlike static withdrawal rules, it continuously monitors portfolio value and spending, applying pre-set thresholds or "guardrails" to prevent depleting assets too rapidly. This adaptive approach reduces the risk of running out of money by aligning spending with real-time financial conditions, enhancing retirement income sustainability.

Risk Management: Sequence of Returns in Retirement Withdrawals

Retirement withdrawal rules, such as the 4% rule, provide fixed guidelines but often lack flexibility to respond to market volatility, increasing sequence of returns risk--the risk of poor market returns early in retirement that can deplete savings faster. The Guardrails Strategy adjusts withdrawals based on portfolio performance, reducing withdrawal amounts when markets underperform to preserve capital and mitigate sequence of returns risk. Effective risk management in retirement withdrawals prioritizes dynamic adjustments, aligning spending with market conditions to sustain portfolio longevity.

Impact of Withdrawal Strategies on Portfolio Longevity

Retirement withdrawal rules, such as the 4% rule, provide a fixed guideline for annual withdrawals, aiming to preserve portfolio longevity but may lack flexibility during market fluctuations. The Guardrails Strategy adjusts withdrawal rates based on portfolio performance, reducing withdrawal amounts in down markets to extend the portfolio's lifespan. Adopting a dynamic approach like the Guardrails Strategy can significantly enhance portfolio longevity by aligning withdrawals with investment outcomes and mitigating the risk of premature depletion.

Income Flexibility: Guardrails vs. Static Withdrawals

The Guardrails Strategy offers superior income flexibility by adjusting withdrawals based on portfolio performance, reducing the risk of depleting assets prematurely. In contrast, static withdrawal rules like the 4% method maintain fixed amounts regardless of market fluctuations, which can either strain resources during downturns or underutilize funds during strong markets. This dynamic approach allows retirees to better preserve their portfolio's longevity while responding adaptively to economic changes.

Tax Implications of Different Retirement Withdrawal Methods

Retirement withdrawal rules often prioritize required minimum distributions (RMDs) that trigger taxable income based on account type, impacting overall tax liability. The guardrails strategy adjusts withdrawals dynamically to optimize tax efficiency, balancing distributions between taxable, tax-deferred, and tax-free accounts to minimize tax brackets and avoid penalties. Understanding tax implications of methods such as systematic withdrawals, Roth conversions, and bucket strategy withdrawals is essential for preserving retirement savings and managing lifetime tax exposure.

Choosing the Best Withdrawal Approach for Your Retirement Goals

Retirement withdrawal rules, such as the 4% rule, provide a simple guideline for sustainable income but may lack flexibility against market volatility or changing expenses. The Guardrails Strategy adjusts withdrawals annually based on portfolio performance and spending needs, promoting longevity of assets while accommodating lifestyle shifts. Selecting the best approach depends on individual retirement goals, risk tolerance, and income stability requirements to balance growth potential with financial security.

Related Important Terms

Dynamic Withdrawal Guardrails

Dynamic Withdrawal Guardrails adapt retirement withdrawals based on portfolio performance, adjusting spending limits to maintain sustainability and reduce the risk of depleting assets prematurely. This strategy contrasts with fixed withdrawal rules by providing flexibility through spending corridors that tighten or relax depending on market returns and portfolio longevity projections.

Flexible Spending Rules

Flexible spending rules allow retirees to adjust withdrawal amounts based on market performance, reducing the risk of depleting assets too quickly. The guardrails strategy sets predefined thresholds that trigger increased or decreased withdrawals, ensuring sustainability and adapting spending to changing portfolio values.

SafeMax Percentage

The Retirement Withdrawal Rules typically recommend a SafeMax Percentage around 4% to sustain portfolio longevity, whereas the Guardrails Strategy adapts withdrawal rates dynamically based on market performance to prevent premature depletion. Leveraging SafeMax as a base, the Guardrails approach adjusts withdrawals within preset upper and lower bounds, balancing income stability with portfolio risk management.

Income Floor Approach

The Income Floor Approach establishes a guaranteed base income from reliable sources such as Social Security and pensions, providing retirees with financial security before tapping into investment portfolios. This strategy contrasts with Retirement Withdrawal Rules by prioritizing essential expenses coverage first, thereby reducing the risk of depleting assets during market downturns.

Sequence of Returns Risk Buffer

Retirement withdrawal rules, typically based on fixed percentages or age milestones, offer structured withdrawal limits but can expose portfolios to sequence of returns risk, potentially depleting assets prematurely. The Guardrails Strategy dynamically adjusts withdrawals within predefined bands, providing a buffer against market volatility by reducing withdrawals during downturns and preserving portfolio longevity.

Prosperity Rule Withdrawals

Prosperity Rule Withdrawals emphasize adaptive withdrawal rates based on portfolio performance, contrasting traditional fixed-percentage Retirement Withdrawal Rules that risk depleting assets prematurely. This Guardrails Strategy dynamically adjusts spending to preserve long-term wealth, balancing immediate income needs with sustained financial prosperity throughout retirement.

Adaptive Withdrawal Algorithm

The Adaptive Withdrawal Algorithm in retirement adjusts withdrawal rates based on portfolio performance and longevity risk, contrasting traditional Retirement Withdrawal Rules that follow fixed percentages like the 4% rule. This dynamic approach uses Guardrails Strategy to modify spending, preserving assets during market downturns and enabling sustainable income throughout retirement.

Ratcheting Withdrawal Strategy

The Ratcheting Withdrawal Strategy in retirement adjusts withdrawal amounts based on portfolio performance, increasing withdrawals during strong market years while maintaining previous withdrawal levels during downturns, providing a flexible alternative to fixed Withdrawal Rules. This approach balances income stability with growth potential, reducing the risk of depleting retirement assets prematurely compared to rigid Guardrails Strategies.

Guardrails Glidepath

The Guardrails Glidepath strategy for retirement withdrawals dynamically adjusts spending based on market performance, aiming to preserve portfolio longevity by reducing withdrawals during downturns and increasing them in bull markets. This approach contrasts traditional fixed withdrawal rules by providing a flexible, rules-based system that helps retirees maintain sustainable income while adapting to changing financial conditions.

Sustainable Withdrawal Rate Bands

Retirement withdrawal rules typically recommend a fixed percentage, such as the 4% rule, to maintain portfolio longevity, whereas the Guardrails Strategy adjusts withdrawals dynamically within sustainable withdrawal rate bands to adapt to market fluctuations and preserve capital. This adaptive approach enhances retirement income stability by modifying spending based on portfolio performance, aligning withdrawals with evolving financial conditions and reducing the risk of depleting retirement savings prematurely.

Retirement Withdrawal Rules vs Guardrails Strategy for retirement withdrawals Infographic

moneydiff.com

moneydiff.com