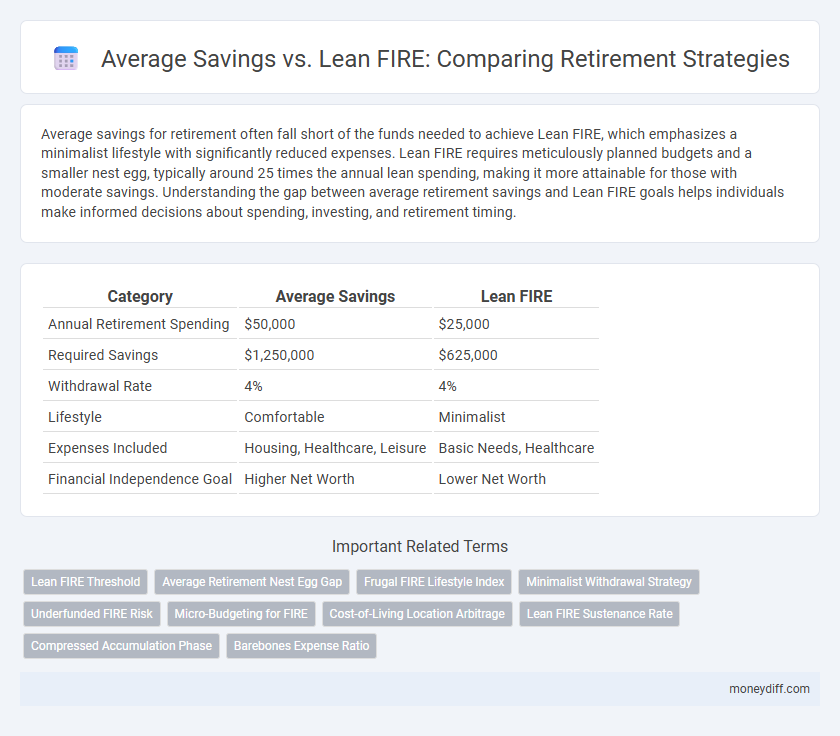

Average savings for retirement often fall short of the funds needed to achieve Lean FIRE, which emphasizes a minimalist lifestyle with significantly reduced expenses. Lean FIRE requires meticulously planned budgets and a smaller nest egg, typically around 25 times the annual lean spending, making it more attainable for those with moderate savings. Understanding the gap between average retirement savings and Lean FIRE goals helps individuals make informed decisions about spending, investing, and retirement timing.

Table of Comparison

| Category | Average Savings | Lean FIRE |

|---|---|---|

| Annual Retirement Spending | $50,000 | $25,000 |

| Required Savings | $1,250,000 | $625,000 |

| Withdrawal Rate | 4% | 4% |

| Lifestyle | Comfortable | Minimalist |

| Expenses Included | Housing, Healthcare, Leisure | Basic Needs, Healthcare |

| Financial Independence Goal | Higher Net Worth | Lower Net Worth |

Understanding Average Retirement Savings Benchmarks

Understanding average retirement savings benchmarks reveals that most Americans have around $65,000 saved by age 40, significantly lower than the recommended amount for a comfortable retirement. Lean FIRE, or Financial Independence Retire Early with minimal expenses, requires carefully calculated savings often exceeding $500,000 to sustain a frugal lifestyle without additional income. Comparing average savings to Lean FIRE goals highlights the importance of aggressive saving and spending discipline to achieve early retirement.

What Is Lean FIRE and How Does It Work?

Lean FIRE refers to achieving financial independence and retiring early with a minimalist lifestyle, focusing on significantly reduced expenses compared to average retirement savings. It works by aggressively saving and investing a higher percentage of income, often 50% or more, to reach a smaller nest egg that covers essential living costs instead of a traditional, more expansive retirement budget. This strategy prioritizes low-cost living and financial discipline to maintain sustainability with less capital than conventional retirement plans.

Key Differences: Average Savings vs. Lean FIRE

Average retirement savings typically range between $200,000 and $300,000 by age 60, reflecting traditional accumulation for a comfortable retirement lifestyle. Lean FIRE, or Financial Independence Retire Early, emphasizes minimalistic living, requiring significantly lower savings--often around $500,000 or less--due to reduced annual expenses and frugal budgeting. The key difference lies in lifestyle expectations and withdrawal rates, with Lean FIRE focusing on sustaining retirement with lean spending, while average savings target more conventional retirement standards and potentially higher cost of living adjustments.

Financial Independence Timeline: Lean FIRE vs. Traditional Paths

Average savings for traditional retirement typically require accumulating 20-25 times annual expenses, aiming for financial independence in 30-40 years. Lean FIRE accelerates this timeline by minimizing living expenses, often enabling independence within 10-20 years through aggressive saving and frugality. This approach hinges on lean budgeting strategies and optimizing investment returns to sustain a lower cost of living post-retirement.

Required Savings Rates for Lean FIRE

Achieving Lean FIRE requires significantly lower annual savings rates compared to traditional retirement targets, typically around 15-20% of income depending on individual lifestyle choices and expenses. This reduction in required savings stems from a minimalist approach to spending, often targeting an annual withdrawal rate of 3-4%, which allows for a smaller nest egg while maintaining financial independence. Understanding these savings rates is crucial for early retirees aiming for Lean FIRE, as they directly impact the time needed to accumulate sufficient funds for retirement.

Budgeting Strategies for Lean FIRE Retirement

Budgeting strategies for Lean FIRE retirement emphasize minimizing expenses to achieve financial independence with substantially lower savings compared to the average retirement corpus of $1.2 million. Prioritizing essential spending categories such as housing, food, and transportation while leveraging frugal living techniques can reduce the target retirement savings to approximately $300,000 to $500,000. Strategic allocation of funds toward low-cost index funds and consistent expense tracking ensures sustainability of a lean retirement lifestyle.

Adjusting Lifestyle Expectations: Lean FIRE vs. Average Retiree

Average retirees typically save enough to maintain a comfortable lifestyle with some discretionary spending, while Lean FIRE advocates prioritize aggressive savings to reach financial independence with minimal expenses. Adjusting lifestyle expectations under Lean FIRE requires significant budget discipline and a focus on essential needs, contrasting with the average retiree's tendency to plan for moderate luxury and higher consumption. Embracing Lean FIRE involves reshaping daily habits and financial goals to sustain retirement on a leaner income, influencing savings rates and retirement timelines.

Assessing Risk Tolerance in Lean FIRE Planning

Assessing risk tolerance in Lean FIRE planning is crucial because lean retirees rely heavily on minimal savings and sustained income streams, increasing vulnerability to market volatility and unexpected expenses. Average savings for traditional retirement often cushion these risks, but Lean FIRE requires a precise evaluation of investment strategies, spending habits, and emergency funds to maintain financial stability over a potentially extended retirement period. Understanding personal risk tolerance helps tailor asset allocation and withdrawal rates, ensuring that lean retirement goals remain achievable without jeopardizing long-term security.

Tools and Resources for Tracking Progress Toward Lean FIRE

Utilize dedicated financial apps like Personal Capital and You Need A Budget (YNAB) to monitor expenditure and calculate progress toward Lean FIRE goals accurately. Spreadsheet templates customized for Lean FIRE, available on platforms like Google Sheets and Excel, allow for detailed tracking of savings rates, investment growth, and expense reduction strategies. Online communities and forums such as Reddit's r/LeanFIRE offer shared tools, calculators, and peer support to optimize lean retirement planning and maintain disciplined savings habits.

Deciding Which Retirement Path Fits Your Goals

Average savings for retirement typically range from $200,000 to $1 million, depending on age and lifestyle, while Lean FIRE advocates achieving financial independence with roughly 25 to 50 percent less than traditional savings targets by drastically reducing expenses. Lean FIRE emphasizes minimalist living and lower annual spending, often around $30,000 or less, to retire earlier with a smaller nest egg compared to average savings strategies requiring $1 million or more. Choosing between average savings and Lean FIRE depends on individual goals like desired retirement age, lifestyle preferences, and risk tolerance for maintaining financial security with reduced spending.

Related Important Terms

Lean FIRE Threshold

The Lean FIRE threshold typically requires savings equal to 20 to 25 times annual living expenses, significantly lower than average retirement savings that often target 25 to 30 times annual income. Achieving Lean FIRE emphasizes strict budgeting and minimalistic lifestyle choices to maintain financial independence on a leaner retirement portfolio.

Average Retirement Nest Egg Gap

The average retirement nest egg in the U.S. falls significantly short of the Lean FIRE target, with typical savings around $200,000 compared to the estimated $500,000 needed for a frugal early retirement. This considerable gap highlights the challenge many face in bridging the difference between current savings and the Lean FIRE benchmark to maintain financial independence during retirement.

Frugal FIRE Lifestyle Index

The Frugal FIRE Lifestyle Index emphasizes that average retirement savings often exceed Lean FIRE requirements, reflecting a spectrum where Lean FIRE demands significantly lower funds due to minimalistic spending habits. Individuals pursuing Lean FIRE typically target savings around 20-30% of the average retirement nest egg, prioritizing essential expenses while maintaining financial independence early.

Minimalist Withdrawal Strategy

The Minimalist Withdrawal Strategy emphasizes lean FIRE principles by targeting average savings that sustain essential expenses rather than traditional higher retirement savings benchmarks. This approach prioritizes ultra-frugal living and precise expense tracking to maximize the longevity of savings with minimal withdrawals.

Underfunded FIRE Risk

Average retirement savings often fall short of Lean FIRE targets, increasing the risk of becoming underfunded during retirement years. Underfunded FIRE risk highlights the necessity of aligning savings strategies with realistic post-retirement living expenses and market volatility.

Micro-Budgeting for FIRE

Micro-budgeting for Lean FIRE emphasizes minimizing expenses to align retirement savings with a frugal lifestyle, often requiring significantly lower average savings than traditional retirement plans. This approach prioritizes detailed expense tracking and strict financial discipline to achieve financial independence with a leaner savings target, usually around 25-50% of the average retirement nest egg.

Cost-of-Living Location Arbitrage

Average retirement savings often fall short of Lean FIRE goals, making Cost-of-Living Location Arbitrage a strategic approach to stretch funds further. Choosing retirement destinations with lower expenses allows retirees to maintain financial independence while reducing monthly outlays and preserving capital longevity.

Lean FIRE Sustenance Rate

The Lean FIRE sustenance rate typically requires maintaining annual expenses at 25 to 30 times less than average retirement savings, enabling early retirees to live frugally without depleting their funds quickly. This low-expense approach contrasts with average savings strategies that demand larger nest eggs to cover higher spending levels during retirement.

Compressed Accumulation Phase

The compressed accumulation phase in retirement planning emphasizes rapidly increasing savings to reach Lean FIRE, which requires significantly lower savings compared to the traditional average retirement nest egg. Leveraging aggressive investment strategies and strict budgeting during this short time frame allows individuals to minimize the accumulation period while achieving financial independence with minimal living expenses.

Barebones Expense Ratio

Average retirement savings often fall short of covering the Barebones Expense Ratio crucial for Lean FIRE, which typically demands a strict budget around 25-30% of conventional retirement expenses. Achieving Lean FIRE requires precise management of essential costs, emphasizing minimalism and prioritizing necessary spending to sustain financial independence on limited resources.

Average savings vs Lean FIRE for retirement. Infographic

moneydiff.com

moneydiff.com