Roth IRA offers tax-free growth and tax-free withdrawals in retirement, making it an ideal vehicle for long-term tax savings. The Roth Conversion Ladder strategy involves converting traditional IRA funds into a Roth IRA over several years to minimize tax impact and access those funds penalty-free before age 59 1/2. Choosing between a Roth IRA and a Roth Conversion Ladder depends on current tax rates, retirement timeline, and the need for early access to tax-advantaged funds.

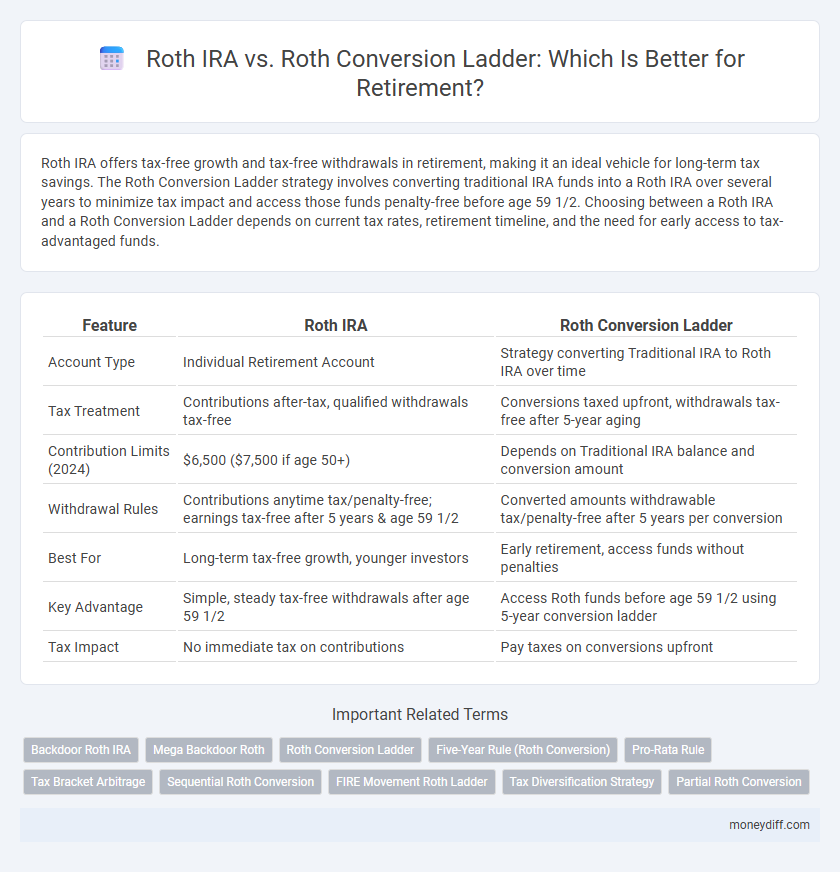

Table of Comparison

| Feature | Roth IRA | Roth Conversion Ladder |

|---|---|---|

| Account Type | Individual Retirement Account | Strategy converting Traditional IRA to Roth IRA over time |

| Tax Treatment | Contributions after-tax, qualified withdrawals tax-free | Conversions taxed upfront, withdrawals tax-free after 5-year aging |

| Contribution Limits (2024) | $6,500 ($7,500 if age 50+) | Depends on Traditional IRA balance and conversion amount |

| Withdrawal Rules | Contributions anytime tax/penalty-free; earnings tax-free after 5 years & age 59 1/2 | Converted amounts withdrawable tax/penalty-free after 5 years per conversion |

| Best For | Long-term tax-free growth, younger investors | Early retirement, access funds without penalties |

| Key Advantage | Simple, steady tax-free withdrawals after age 59 1/2 | Access Roth funds before age 59 1/2 using 5-year conversion ladder |

| Tax Impact | No immediate tax on contributions | Pay taxes on conversions upfront |

Understanding Roth IRA: Basics and Benefits

A Roth IRA offers tax-free growth and tax-free withdrawals in retirement, provided certain conditions are met, making it a powerful retirement savings tool. Contributions are made with after-tax dollars, allowing account earnings to compound without being taxed upon withdrawal. Understanding these basics highlights its benefits, such as no required minimum distributions (RMDs) and the flexibility to withdraw contributions anytime without penalties, essential for long-term retirement planning.

What Is a Roth Conversion Ladder?

A Roth Conversion Ladder is a strategic method of converting traditional IRA or 401(k) funds into a Roth IRA incrementally over several years to minimize tax impact and create tax-free retirement income. This approach allows individuals to access converted funds penalty-free after a five-year waiting period, providing flexibility and control over taxable income in retirement. Using a Roth Conversion Ladder can optimize retirement tax strategy by leveraging the benefits of tax-free withdrawals and potentially reducing required minimum distributions.

Key Differences: Roth IRA vs. Roth Conversion Ladder

A Roth IRA allows for direct contributions with tax-free growth and qualified tax-free withdrawals after age 59 1/2, whereas a Roth Conversion Ladder strategically converts traditional IRA funds into a Roth IRA over several years to minimize taxes and access funds earlier. The Roth Conversion Ladder imposes a five-year waiting period on each conversion before penalty-free withdrawals can occur, offering flexibility for earlier retirement access compared to a standard Roth IRA. Understanding these differences is critical for retirement planning, balancing tax implications, withdrawal timing, and access to funds during retirement.

Tax Implications: Choosing the Right Strategy

Roth IRA contributions grow tax-free, allowing qualified withdrawals without income tax, making it ideal for long-term tax-free retirement income. The Roth conversion ladder involves converting traditional IRA funds to a Roth IRA in stages, triggering income tax at conversion but enabling penalty-free withdrawals after five years, offering more flexible access to funds before age 59 1/2. Evaluating current tax brackets, future income expectations, and required minimum distributions helps determine whether direct Roth IRA contributions or a Roth conversion ladder minimizes overall tax liabilities.

Early Retirement: Accessing Funds Without Penalties

A Roth IRA allows early retirees to withdraw contributions at any time without penalties, providing immediate access to funds. The Roth Conversion Ladder strategy enables penalty-free access to converted amounts after a five-year waiting period, combining tax advantages with strategic withdrawal timing. Utilizing both methods can optimize early retirement cash flow while minimizing tax liabilities and penalties.

Required Minimum Distributions: Roth IRA vs. Conversion Ladder

Roth IRAs do not have Required Minimum Distributions (RMDs) during the original account holder's lifetime, allowing tax-free growth and withdrawals without mandatory annual withdrawals. In contrast, funds moved through a Roth conversion ladder involve paying taxes upfront during conversion, and once in the Roth IRA, they are also free from RMDs, but the conversion process requires careful timing to avoid penalties. Understanding the absence of RMDs in Roth IRAs versus the staged, taxable nature of Roth conversion ladders is crucial for maximizing retirement tax efficiency.

Building a Tax-Free Retirement Income

A Roth IRA offers tax-free growth and qualified withdrawals, making it a powerful tool for building tax-free retirement income. The Roth Conversion Ladder strategy involves gradually converting traditional IRA funds to a Roth IRA over several years, spreading out tax liability and enabling earlier access to tax-free earnings. This method maximizes tax efficiency by balancing current tax rates with future tax-free distributions, supporting a flexible and optimized retirement income plan.

Eligibility and Contribution Rules Compared

Roth IRA eligibility requires individuals to have earned income and fall within specific income limits, with a maximum annual contribution of $6,500 for those under 50 and $7,500 for those 50 and older as of 2024. The Roth conversion ladder strategy involves converting traditional IRA or 401(k) funds into a Roth IRA progressively over several years, bypassing contribution limits but triggering income taxes on converted amounts. Unlike direct Roth IRA contributions, the conversion ladder allows early retirement access to funds without penalties after a five-year holding period per conversion.

Long-Term Growth Potential: Which Strategy Wins?

Roth IRAs offer tax-free growth and withdrawals after age 59 1/2, making them ideal for long-term growth with compounding returns unchecked by taxes. The Roth Conversion Ladder allows for early access to converted funds penalty-free after five years, balancing accessibility and growth but potentially triggering higher taxes during conversion years. For maximizing long-term growth potential, maintaining a Roth IRA without frequent conversions typically provides superior compounding benefits and tax efficiency.

Making the Best Choice: Suitability for Your Retirement Goals

Choosing between a Roth IRA and a Roth Conversion Ladder depends on your retirement timeline and tax strategy. Roth IRA contributions grow tax-free and provide penalty-free withdrawals after age 59 1/2, ideal for long-term growth and tax diversification. The Roth Conversion Ladder allows access to converted funds penalty-free after five years, offering flexibility for early retirement or bridging income gaps while managing tax liabilities.

Related Important Terms

Backdoor Roth IRA

Backdoor Roth IRA enables high-income earners to contribute indirectly to a Roth IRA by first making nondeductible contributions to a traditional IRA and then converting those funds to a Roth IRA, bypassing income limits. Compared to a Roth Conversion Ladder, which involves progressively converting traditional IRA funds to Roth IRAs over several years to minimize taxes and access principal early, the Backdoor Roth IRA primarily serves as a strategic entry method for retirement tax diversification.

Mega Backdoor Roth

The Mega Backdoor Roth strategy allows high-income earners to contribute up to $66,000 annually into a Roth IRA via after-tax 401(k) contributions and in-service rollovers, bypassing standard Roth IRA income limits. Utilizing a Roth Conversion Ladder provides a tax-efficient method to access these funds early by converting traditional IRAs to Roth IRAs incrementally, minimizing penalties and optimizing retirement tax planning.

Roth Conversion Ladder

The Roth Conversion Ladder strategically converts traditional IRA funds into a Roth IRA over several years, allowing tax-free withdrawals after five years and age 59 1/2, optimizing retirement income flexibility. This method minimizes upfront taxes compared to a lump-sum Roth IRA conversion and provides early access to tax-free funds before standard retirement age.

Five-Year Rule (Roth Conversion)

The Five-Year Rule for Roth Conversions requires each conversion amount to remain in the Roth IRA for at least five years before tax-free withdrawals can be made, crucial for avoiding penalties during early retirement. Understanding this timeline is essential when using a Roth Conversion Ladder to strategically access converted funds without incurring taxes or penalties.

Pro-Rata Rule

The Pro-Rata Rule affects Roth conversions by requiring a proportional calculation of pre-tax and after-tax funds in all traditional IRAs, which can increase taxable income during a Roth Conversion Ladder strategy. Understanding this rule is crucial for retirees to optimize tax efficiency between Roth IRAs and Roth Conversion Ladders for retirement income planning.

Tax Bracket Arbitrage

Roth IRA contributions grow tax-free and qualified withdrawals avoid income tax, making them ideal for those expecting higher tax brackets in retirement, while Roth Conversion Ladders enable strategic tax bracket arbitrage by converting traditional IRA funds to Roth IRAs during low-income years, minimizing immediate tax liability. This method leverages timing to smooth taxable income and reduce overall taxes paid in retirement by spreading conversions across multiple years.

Sequential Roth Conversion

Sequential Roth Conversion enables gradual tax-efficient movement of traditional IRA funds into a Roth IRA, reducing tax spikes in retirement. Utilizing a Roth Conversion Ladder strategically accesses these funds penalty-free after a five-year waiting period, optimizing retirement income flexibility.

FIRE Movement Roth Ladder

The Roth Conversion Ladder is a strategic tool within the FIRE movement that allows early retirees to convert traditional IRA funds to a Roth IRA gradually, enabling penalty-free access to retirement savings before age 59 1/2. Unlike a standard Roth IRA, this method leverages a five-year waiting period for each conversion, providing tax-free withdrawals and greater financial flexibility during early retirement.

Tax Diversification Strategy

Roth IRA offers tax-free growth and withdrawals, making it ideal for long-term retirement savings, while the Roth Conversion Ladder optimizes tax diversification by strategically converting traditional IRA funds over several years to minimize tax impact. Implementing a Roth Conversion Ladder provides flexibility in managing taxable income during retirement and enhances tax diversification by spreading out conversions to avoid higher tax brackets.

Partial Roth Conversion

Partial Roth conversion allows retirees to move specific amounts from a traditional IRA to a Roth IRA annually, optimizing tax efficiency and avoiding higher tax brackets. This strategy, integral to the Roth conversion ladder, facilitates tax-free withdrawals during retirement by spreading conversions over several years.

Roth IRA vs Roth Conversion Ladder for retirement. Infographic

moneydiff.com

moneydiff.com