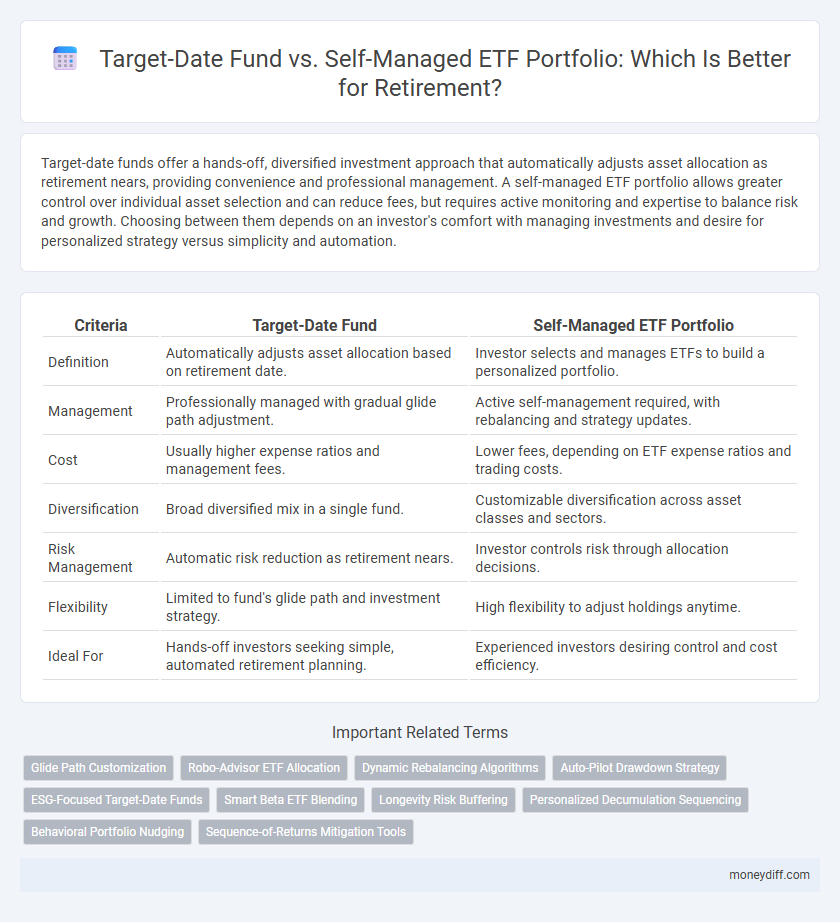

Target-date funds offer a hands-off, diversified investment approach that automatically adjusts asset allocation as retirement nears, providing convenience and professional management. A self-managed ETF portfolio allows greater control over individual asset selection and can reduce fees, but requires active monitoring and expertise to balance risk and growth. Choosing between them depends on an investor's comfort with managing investments and desire for personalized strategy versus simplicity and automation.

Table of Comparison

| Criteria | Target-Date Fund | Self-Managed ETF Portfolio |

|---|---|---|

| Definition | Automatically adjusts asset allocation based on retirement date. | Investor selects and manages ETFs to build a personalized portfolio. |

| Management | Professionally managed with gradual glide path adjustment. | Active self-management required, with rebalancing and strategy updates. |

| Cost | Usually higher expense ratios and management fees. | Lower fees, depending on ETF expense ratios and trading costs. |

| Diversification | Broad diversified mix in a single fund. | Customizable diversification across asset classes and sectors. |

| Risk Management | Automatic risk reduction as retirement nears. | Investor controls risk through allocation decisions. |

| Flexibility | Limited to fund's glide path and investment strategy. | High flexibility to adjust holdings anytime. |

| Ideal For | Hands-off investors seeking simple, automated retirement planning. | Experienced investors desiring control and cost efficiency. |

Understanding Target-Date Funds for Retirement

Target-date funds simplify retirement investing by automatically adjusting asset allocation based on a specific retirement year, reducing the need for active management. These funds typically shift from higher-risk stocks to more conservative bonds as the target date approaches, aligning with investors' decreasing risk tolerance. Understanding how target-date funds balance risk and growth can help retirees maintain a focused, long-term strategy without frequent adjustments.

What Is a Self-Managed ETF Portfolio?

A self-managed ETF portfolio for retirement consists of exchange-traded funds selected and maintained by the investor, allowing personalized asset allocation aligned with individual risk tolerance and retirement goals. This approach offers greater control over investment decisions compared to target-date funds, which automatically adjust asset allocation based on a predetermined retirement date. Investors managing ETFs can optimize tax efficiency, diversification, and fees by actively rebalancing their portfolios to respond to market changes and personal circumstances.

Ease of Use: Set-and-Forget vs Hands-On Management

Target-date funds offer a set-and-forget retirement solution by automatically adjusting asset allocation based on the investor's age and retirement timeline, minimizing the need for ongoing management. Self-managed ETF portfolios provide hands-on control, allowing retirees to customize asset choices and rebalance according to personal risk tolerance and market conditions. The ease of use in target-date funds is ideal for those seeking simplicity, while self-managed ETFs suit individuals comfortable with active portfolio management.

Cost Comparison: Fees and Expenses

Target-date funds typically charge annual expense ratios ranging from 0.40% to 1.00%, which cover portfolio management and automatic rebalancing, while self-managed ETF portfolios often incur lower fees around 0.03% to 0.20%, depending on the chosen ETFs. Investors managing their own ETFs must consider trading commissions, which have decreased significantly with many brokers now offering commission-free trades. The long-term cost advantage of self-managed portfolios can result in substantial savings, but it requires active management and financial literacy compared to the hands-off approach of target-date funds.

Customization and Flexibility

Target-date funds offer automated asset allocation adjustments based on a target retirement date, providing a hands-off investment strategy with limited customization options. In contrast, a self-managed ETF portfolio allows investors to tailor asset selection, risk levels, and rebalancing frequency to match personal retirement goals and changing market conditions. This flexibility in ETF portfolios enables retirees to respond dynamically to economic shifts and individual financial needs, enhancing control over retirement savings growth.

Risk Management Strategies

Target-date funds provide automated risk management by gradually shifting asset allocation from stocks to bonds as retirement approaches, reducing volatility and preserving capital. In contrast, self-managed ETF portfolios require investors to actively adjust their asset mix and implement diversification to control risk effectively. Proper risk management in retirement planning demands consistent assessment and rebalancing tailored to individual risk tolerance and market conditions.

Rebalancing and Asset Allocation

Target-date funds automatically rebalance and adjust asset allocation over time to become more conservative as retirement approaches, providing a hands-off approach for investors. In contrast, a self-managed ETF portfolio requires regular portfolio review and manual rebalancing to maintain desired risk levels and optimize returns based on market conditions. Effective asset allocation aligned with retirement goals is critical in both strategies to manage risk and ensure sustainable income throughout retirement.

Performance: Historical Returns Analysis

Target-date funds typically offer steady historical returns by automatically adjusting asset allocation to reduce risk as the retirement date nears, reflecting a balanced exposure to equities and bonds. Self-managed ETF portfolios can deliver higher performance potential by enabling investors to tailor asset selections and exploit market opportunities but require active monitoring and expertise. Historical returns analysis shows target-date funds tend to underperform diversified, actively managed ETF portfolios over long investment horizons due to their conservative glide paths and standardized strategies.

Suitability for Different Investor Profiles

Target-date funds offer a hands-off, professionally managed solution tailored to investors seeking a simplified retirement strategy with automatic risk adjustments over time. Self-managed ETF portfolios provide greater customization and control, appealing to experienced investors comfortable with ongoing market research and active rebalancing. Suitability depends on individual preferences for convenience, risk tolerance, and investment knowledge in retirement planning.

Making the Right Choice for Your Retirement Goals

Target-date funds offer a professionally managed, automatically adjusting portfolio aligned with your expected retirement year, providing simplicity and risk management for investors seeking a hands-off approach. Self-managed ETF portfolios allow for customized asset allocation and potential cost savings, appealing to experienced investors confident in their ability to monitor and rebalance investments actively. Choosing between these options depends on your risk tolerance, investment knowledge, and desire for hands-on control versus convenience and automation in achieving your retirement objectives.

Related Important Terms

Glide Path Customization

Target-date funds offer a predefined glide path that automatically adjusts asset allocation based on the investor's anticipated retirement date, simplifying portfolio management but limiting customization. In contrast, self-managed ETF portfolios provide complete control over glide path design, allowing retirees to tailor risk tolerance and asset shifts to their unique financial goals and market outlook.

Robo-Advisor ETF Allocation

Target-date funds offer automated, professionally managed ETF allocation that gradually shifts toward conservative investments as retirement approaches, providing a hands-off approach for investors seeking simplicity and risk adjustment. In contrast, self-managed ETF portfolios require active decision-making and rebalancing, appealing to investors with strong market knowledge who prefer customized asset allocation and potentially lower fees.

Dynamic Rebalancing Algorithms

Target-date funds utilize dynamic rebalancing algorithms that automatically adjust asset allocation based on the investor's projected retirement date, reducing risk exposure as the target date approaches. In contrast, self-managed ETF portfolios require manual adjustments, relying on the investor's discipline and market insight to implement dynamic rebalancing strategies effectively.

Auto-Pilot Drawdown Strategy

Target-date funds automate retirement drawdowns by adjusting asset allocation and systematically reducing risk as the target date approaches, offering a hands-off approach that aligns with an auto-pilot drawdown strategy. In contrast, a self-managed ETF portfolio requires proactive rebalancing and drawdown planning but provides greater flexibility to customize withdrawal rates and tax-efficient strategies tailored to individual retirement goals.

ESG-Focused Target-Date Funds

ESG-focused target-date funds offer a diversified, professionally managed retirement solution that adjusts risk over time while integrating environmental, social, and governance criteria to align with sustainable investing goals. In contrast, a self-managed ETF portfolio requires active oversight and expertise to balance risk and maintain ESG standards, potentially resulting in greater customization but increased time commitment and complexity.

Smart Beta ETF Blending

Target-date funds offer a hands-off retirement strategy with automatic rebalancing aligned to a specific retirement date, while self-managed ETF portfolios, particularly those using Smart Beta ETF blending, provide customizable exposure to factor-based investing aimed at enhancing returns and managing risk. Smart Beta ETFs combine multiple advanced weighting strategies such as value, momentum, and low volatility to optimize retirement portfolio performance compared to traditional market-cap-weighted target-date funds.

Longevity Risk Buffering

Target-date funds offer automated rebalancing and a built-in longevity risk buffering by gradually shifting asset allocation toward conservative investments as retirement nears, reducing the risk of outliving savings. Self-managed ETF portfolios provide customization and cost-efficiency but require active management and strategic adjustments to maintain a longevity risk buffer throughout retirement.

Personalized Decumulation Sequencing

Target-date funds offer a simplified, automated approach to retirement investing with a fixed asset allocation that gradually becomes more conservative over time, but lack personalized decumulation sequencing tailored to individual cash flow needs and risk tolerance. In contrast, a self-managed ETF portfolio allows retirees to strategically sequence withdrawals and adjust asset allocations dynamically, optimizing tax efficiency and income sustainability throughout retirement.

Behavioral Portfolio Nudging

Target-date funds provide automated portfolio adjustments that leverage behavioral portfolio nudging to reduce impulsive decisions and maintain investment discipline as retirement approaches. In contrast, self-managed ETF portfolios require active behavioral self-regulation, often leading to suboptimal timing and increased risk due to emotional biases.

Sequence-of-Returns Mitigation Tools

Target-date funds automatically adjust asset allocation over time to reduce sequence-of-returns risk by strategically shifting towards lower-volatility investments as retirement approaches, providing built-in sequence-of-returns mitigation. In contrast, self-managed ETF portfolios require active rebalancing and risk management strategies, such as diversification and dynamic withdrawal plans, to effectively mitigate sequence-of-returns risk during retirement.

Target-date fund vs Self-managed ETF portfolio for retirement. Infographic

moneydiff.com

moneydiff.com