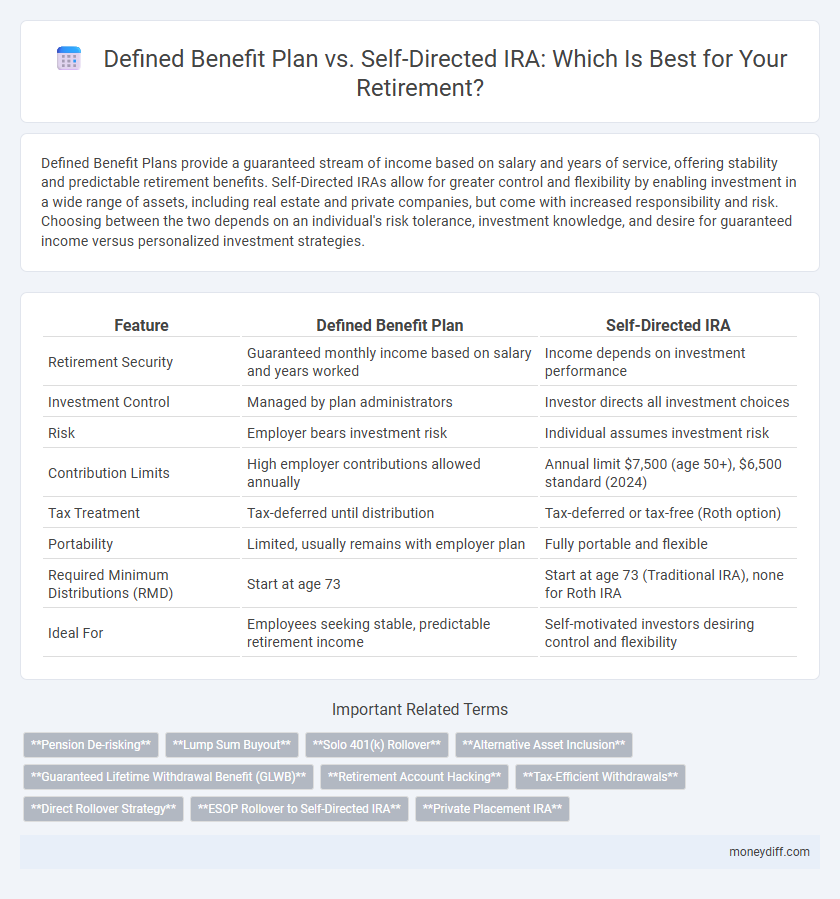

Defined Benefit Plans provide a guaranteed stream of income based on salary and years of service, offering stability and predictable retirement benefits. Self-Directed IRAs allow for greater control and flexibility by enabling investment in a wide range of assets, including real estate and private companies, but come with increased responsibility and risk. Choosing between the two depends on an individual's risk tolerance, investment knowledge, and desire for guaranteed income versus personalized investment strategies.

Table of Comparison

| Feature | Defined Benefit Plan | Self-Directed IRA |

|---|---|---|

| Retirement Security | Guaranteed monthly income based on salary and years worked | Income depends on investment performance |

| Investment Control | Managed by plan administrators | Investor directs all investment choices |

| Risk | Employer bears investment risk | Individual assumes investment risk |

| Contribution Limits | High employer contributions allowed annually | Annual limit $7,500 (age 50+), $6,500 standard (2024) |

| Tax Treatment | Tax-deferred until distribution | Tax-deferred or tax-free (Roth option) |

| Portability | Limited, usually remains with employer plan | Fully portable and flexible |

| Required Minimum Distributions (RMD) | Start at age 73 | Start at age 73 (Traditional IRA), none for Roth IRA |

| Ideal For | Employees seeking stable, predictable retirement income | Self-motivated investors desiring control and flexibility |

Overview: Defined Benefit Plan vs Self-Directed IRA

Defined Benefit Plans offer a fixed, predictable monthly income based on salary and years of service, ensuring financial stability during retirement. Self-Directed IRAs provide greater investment flexibility, allowing individuals to diversify assets including real estate, private equity, and cryptocurrencies, but with higher responsibility for managing risk. Choosing between the two depends on the need for guaranteed income versus control over investment choices and potential growth.

Key Features & Structure of Defined Benefit Plans

Defined Benefit Plans guarantee a fixed retirement income based on salary history and years of service, providing predictable financial security. These plans are employer-sponsored and funded primarily by the employer, with the investment risks borne by the plan provider rather than the employee. Contributions are tax-deductible for employers, and benefits are calculated through actuarial valuations to ensure sufficient funding for future payouts.

Understanding Self-Directed IRAs and Their Flexibility

Self-Directed IRAs offer unparalleled flexibility by allowing investors to diversify retirement portfolios beyond traditional stocks and bonds, including real estate, private equity, and precious metals. Unlike Defined Benefit Plans with fixed benefit formulas and limited investment options, Self-Directed IRAs empower individuals to tailor their investment strategies according to personal risk tolerance and retirement goals. This control enables greater growth potential and adaptability in response to changing market conditions and individual financial needs.

Investment Options: Traditional vs Alternative Assets

Defined Benefit Plans primarily invest in traditional assets such as stocks, bonds, and mutual funds offering predictable returns and professional management. Self-Directed IRAs provide access to alternative assets like real estate, precious metals, and private equity, enabling greater diversification and potential for higher returns. Investors seeking more control and unique opportunities often favor Self-Directed IRAs, while those prioritizing stability typically choose Defined Benefit Plans.

Contribution Limits and Funding Rules

Defined Benefit Plans allow for higher contribution limits based on actuarial calculations, enabling substantial tax-deferred retirement savings but require mandatory annual funding by employers to meet future obligations. Self-Directed IRAs have lower annual contribution limits set by the IRS--$7,000 for individuals aged 50 and above in 2024--and offer flexible funding sources with no employer mandate, providing more personal control over investment choices. The defined benefit plan's funding rules emphasize predictable employer contributions, whereas Self-Directed IRAs rely solely on individual contributions subject to IRS limits and penalties for excess funding.

Tax Advantages and Implications Comparison

Defined Benefit Plans offer predictable, tax-deferred retirement income with employer contributions typically tax-deductible, while self-directed IRAs provide greater investment flexibility but require individual management of tax-advantaged growth. Contributions to Defined Benefit Plans are often higher, allowing for larger tax-deferred accumulation, whereas self-directed IRAs impose annual contribution limits but benefit from tax-free growth on qualified withdrawals. Understanding the IRS rules on required minimum distributions and early withdrawal penalties is crucial for maximizing tax advantages between these two retirement options.

Risk Management: Guarantees vs Market Exposure

Defined Benefit Plans offer guaranteed retirement income, providing stable and predictable payouts regardless of market performance, which significantly reduces longevity and investment risks. In contrast, Self-Directed IRAs expose retirees to market volatility, as returns depend on investment choices, potentially leading to higher growth but also increased risk of loss. Effective risk management in retirement planning involves balancing the certainty of defined benefits with the flexibility and growth potential of self-directed accounts.

Administrative Complexity and Compliance

Defined Benefit Plans involve higher administrative complexity and stringent compliance requirements due to actuarial valuations, annual filings, and fiduciary responsibilities mandated by ERISA and IRS regulations. Self-Directed IRAs offer greater flexibility with fewer administrative burdens but still require adherence to IRS rules regarding prohibited transactions and contribution limits. Choosing between the two depends on the participant's capacity to manage regulatory obligations and the desired level of control over investment decisions.

Suitability for Different Retirement Goals

Defined Benefit Plans offer predictable, lifetime income suited for individuals prioritizing financial stability and long-term security in retirement, often favored by employees in stable industries with steady income. Self-Directed IRAs provide greater investment flexibility and control, appealing to retirees seeking diversified portfolios and the ability to invest in alternative assets like real estate or private equity. Suitability depends on risk tolerance and retirement goals, with defined benefit plans emphasizing guaranteed payouts and Self-Directed IRAs catering to those aiming for higher growth potential and personalized investment strategies.

Choosing the Best Fit for Your Retirement Strategy

Defined Benefit Plans provide guaranteed lifetime income based on salary and years of service, appealing to those seeking predictable retirement funds with employer management. Self-Directed IRAs offer greater control over investment choices, including real estate and private equity, suited for individuals comfortable with active portfolio management and risk. Evaluating risk tolerance, desired income stability, and investment expertise is essential to select the best fit for your personalized retirement strategy.

Related Important Terms

Pension De-risking

Defined Benefit Plans offer pension de-risking by providing predictable lifetime income and shifting investment risk to the employer, whereas Self-Directed IRAs place investment decisions and risks entirely on the individual. Pension de-risking strategies in Defined Benefit Plans include annuitization and lump-sum buyouts, reducing the sponsor's exposure to market volatility and longevity risk.

Lump Sum Buyout

A lump sum buyout offers a defined benefit plan participant a one-time payment representing the present value of future retirement benefits, enabling immediate control over retirement assets. In contrast, a self-directed IRA inherently provides flexibility for lump sum withdrawals, allowing retirees to manage and invest funds independently without fixed monthly payments.

Solo 401(k) Rollover

A Solo 401(k) rollover from a defined benefit plan to a self-directed IRA offers retirees enhanced control over diverse investment options and potential for higher growth through real estate, private equity, and alternative assets. This strategic move allows consolidation of retirement funds into a flexible Solo 401(k), optimizing tax advantages and facilitating personalized retirement planning.

Alternative Asset Inclusion

Defined Benefit Plans typically offer limited alternative asset options, primarily focusing on traditional investments like stocks and bonds, whereas Self-Directed IRAs enable investors to include a broader range of alternative assets such as real estate, private equity, precious metals, and cryptocurrencies for greater portfolio diversification. This flexibility in Self-Directed IRAs allows participants to tailor their retirement portfolios to match their risk tolerance and investment expertise, potentially enhancing returns and hedging against market volatility.

Guaranteed Lifetime Withdrawal Benefit (GLWB)

A Defined Benefit Plan ensures a Guaranteed Lifetime Withdrawal Benefit (GLWB) by providing a fixed, predictable income stream throughout retirement, reducing longevity risk. In contrast, a Self-Directed IRA lacks inherent GLWB, relying on market performance and careful withdrawal strategies to sustain funds over a lifetime.

Retirement Account Hacking

Defined Benefit Plans offer guaranteed lifetime income based on a fixed formula using salary and years of service, making them a stable foundation for retirement account hacking strategies that focus on predictable cash flow. In contrast, Self-Directed IRAs provide higher flexibility and investment control, enabling savvy investors to diversify retirement portfolios with alternative assets such as real estate, private equity, and precious metals to maximize growth potential.

Tax-Efficient Withdrawals

Defined Benefit Plans offer predictable, often higher tax-deferred growth with guaranteed lifetime income, while Self-Directed IRAs provide flexible investment choices and potential for tax-free withdrawals through Roth conversions. Strategic tax planning maximizes benefits by balancing required minimum distributions in Defined Benefit Plans against the control over taxable events in Self-Directed IRAs.

Direct Rollover Strategy

A Direct Rollover Strategy enables seamless transfer of funds from a Defined Benefit Plan to a Self-Directed IRA without triggering taxes or penalties, preserving retirement savings growth. This approach optimizes control over investment choices while maintaining the tax-deferred status of retirement assets.

ESOP Rollover to Self-Directed IRA

An ESOP rollover to a Self-Directed IRA allows individuals to transfer employer stock into a diversified retirement account, enhancing control over investments and potentially reducing risk compared to a traditional Defined Benefit Plan. This strategy leverages the flexibility of Self-Directed IRAs for tax-advantaged growth while maintaining retirement income security outside employer-managed plans.

Private Placement IRA

A Private Placement IRA combines the tax advantages of a self-directed IRA with access to alternative investments like real estate, private equity, and promissory notes, offering more diversification than traditional defined benefit plans. Unlike defined benefit plans which promise a fixed payout, a Private Placement IRA allows individuals greater control and potential for growth by directly managing retirement assets within private markets.

Defined Benefit Plan vs Self-Directed IRA for retirement. Infographic

moneydiff.com

moneydiff.com