Employer match contributions offer a powerful incentive to boost retirement savings by providing free money based on your contributions, effectively increasing your overall investment without additional cost. Solo 401(k) plans are ideal for self-employed individuals seeking higher contribution limits and greater control over their retirement funds, allowing for both employer and employee contributions. Comparing employer match benefits with Solo 401(k) options helps retirees maximize savings by leveraging available company matches or maximizing contributions through self-employment plans.

Table of Comparison

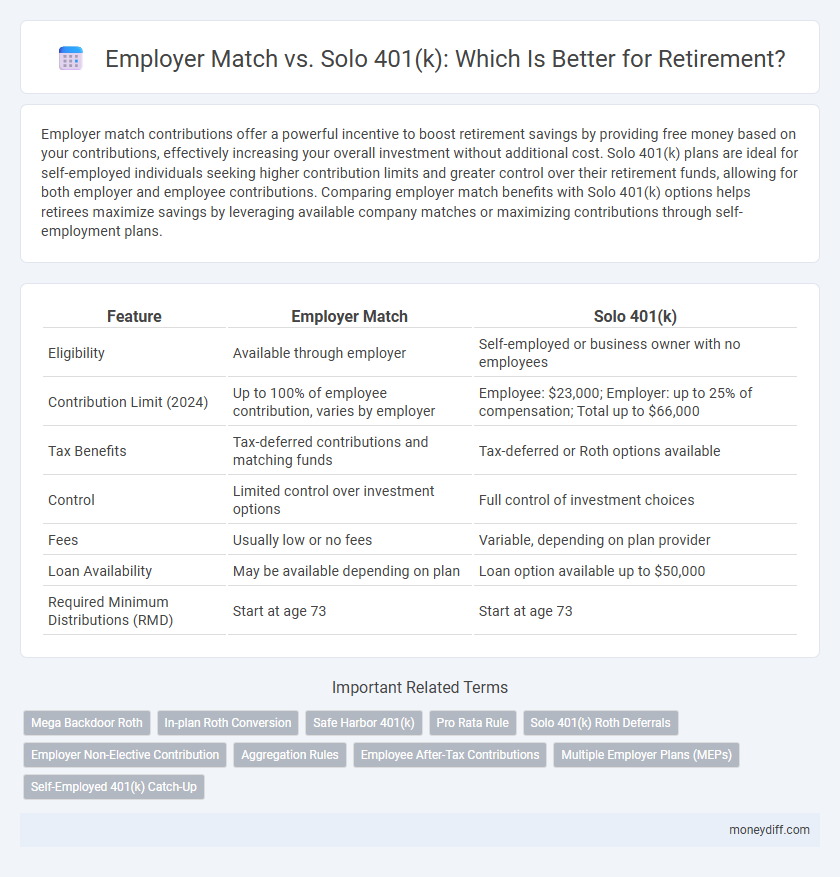

| Feature | Employer Match | Solo 401(k) |

|---|---|---|

| Eligibility | Available through employer | Self-employed or business owner with no employees |

| Contribution Limit (2024) | Up to 100% of employee contribution, varies by employer | Employee: $23,000; Employer: up to 25% of compensation; Total up to $66,000 |

| Tax Benefits | Tax-deferred contributions and matching funds | Tax-deferred or Roth options available |

| Control | Limited control over investment options | Full control of investment choices |

| Fees | Usually low or no fees | Variable, depending on plan provider |

| Loan Availability | May be available depending on plan | Loan option available up to $50,000 |

| Required Minimum Distributions (RMD) | Start at age 73 | Start at age 73 |

Understanding Employer Match in Retirement Plans

Employer match in retirement plans represents a crucial financial benefit where employers contribute a percentage of an employee's salary to their 401(k) account, effectively increasing retirement savings without additional employee cost. Understanding the value of an employer match involves evaluating the percentage matched, vesting schedules, and contribution limits, which together impact the overall retirement portfolio growth. Solo 401(k) plans, designed for self-employed individuals or business owners without employees, do not offer employer matches but provide higher contribution limits and flexible investment options, making the employer match a significant advantage primarily for traditional employee retirement savings.

What is a Solo 401(k)?

A Solo 401(k) is a retirement savings plan designed for self-employed individuals and small business owners with no full-time employees, offering higher contribution limits compared to traditional employer matches. It allows participants to contribute both as an employee and employer, maximizing tax-advantaged retirement savings up to $66,000 in 2024. This plan provides flexibility in investment options and loan provisions, making it a powerful tool for solo entrepreneurs aiming to grow retirement funds efficiently.

Contribution Limits: Employer Match vs Solo 401(k)

Employer match contributions in traditional 401(k) plans typically allow employees to receive up to 6% of their salary, with combined employee and employer contributions capped at $66,000 for 2024. Solo 401(k) plans offer higher total contribution limits, allowing self-employed individuals to contribute both as employee and employer, reaching up to $66,000 or $73,500 if age 50 or older in 2024. This structure enables solo 401(k) participants to maximize retirement savings beyond what employer matching alone can provide.

Eligibility Requirements for Each Retirement Option

Employer match programs typically require employees to contribute a portion of their salary to qualify for the employer's matching funds, with eligibility often limited to full-time employees meeting minimum service periods. Solo 401(k) plans are designed for self-employed individuals or business owners without full-time employees other than a spouse, offering broader contribution limits but requiring self-employment income to qualify. Understanding these eligibility requirements is crucial for maximizing retirement savings based on employment status and income sources.

Tax Advantages: A Comparative Analysis

Employer match contributions in a traditional 401(k) offer immediate tax-deferred growth and effectively increase overall retirement savings by maximizing employer-funded contributions. Solo 401(k) plans provide higher contribution limits, allowing self-employed individuals to reduce taxable income substantially through both employee deferrals and employer profit-sharing contributions. Comparing tax advantages, employer matches provide direct tax-deferral benefits tied to salary, while Solo 401(k)s combine tax deferral with greater contribution flexibility and higher total annual limits under IRS guidelines.

Investment Options and Flexibility

A Solo 401(k) offers broader investment options including stocks, bonds, mutual funds, and real estate, providing greater portfolio diversification and control compared to the limited offerings typically available in an employer match plan. Employer match plans generally restrict investment choices to a pre-selected menu, which may limit flexibility for optimizing retirement savings. Solo 401(k) plans also allow higher contribution limits and loan provisions, enhancing flexibility to adapt investments to changing financial goals and market conditions.

Cost and Administration Differences

Employer match contributions in traditional 401(k) plans provide a significant cost advantage by effectively increasing an employee's retirement savings without additional expenses, whereas Solo 401(k) plans require the self-employed individual to fund the entire contribution amount, impacting overall cost. Administrative responsibilities for employer-matched 401(k)s are often handled by the employer or a third-party provider, simplifying management, while Solo 401(k)s necessitate individual oversight of plan compliance, record-keeping, and filing IRS Form 5500 once assets exceed $250,000. The Solo 401(k) entails lower ongoing plan administration fees compared to traditional employer-sponsored plans, but the trade-off includes increased personal time investment and potential complexity in managing contributions and compliance.

Impact on Self-Employed and Small Business Owners

Employer match contributions significantly enhance retirement savings but are typically unavailable to self-employed individuals, making a Solo 401(k) the ideal retirement vehicle for small business owners. Solo 401(k) plans allow higher contribution limits of up to $66,000 for 2024, combining employee deferrals and employer profit-sharing contributions, thereby maximizing tax-advantaged savings. Small business owners benefit from Solo 401(k) flexibility, enabling both salary deferrals and discretionary profit-sharing, which often surpasses the growth potential offered by traditional employer match programs.

Maximizing Retirement Savings with Both Options

Maximizing retirement savings involves strategic use of both employer match programs and a Solo 401(k) plan to boost contributions efficiently. Employer matches significantly enhance total savings by providing free supplemental funds up to a specific percentage of employee contributions, effectively increasing overall investment without reducing take-home pay. The Solo 401(k) allows self-employed individuals to contribute both as employee and employer, enabling higher total annual contributions and maximizing tax-advantaged growth, making a combined approach ideal for optimizing retirement funds.

Choosing the Right Plan for Your Retirement Goals

Choosing between an employer match and a Solo 401(k) depends on your employment status and retirement objectives. Employer matches provide immediate, risk-free contributions, maximizing savings through free funds, while Solo 401(k) plans offer higher contribution limits ideal for self-employed individuals aiming to boost retirement assets aggressively. Assessing your income type, desired contribution level, and long-term financial goals ensures you select the most effective plan for tax advantages and optimal retirement growth.

Related Important Terms

Mega Backdoor Roth

Maximizing retirement savings through an employer match leverages pre-tax contributions and immediate company funds, while a Solo 401(k) with Mega Backdoor Roth allows high after-tax contributions converted to Roth, significantly increasing tax-free growth potential. The Mega Backdoor Roth strategy in a Solo 401(k) is ideal for high earners seeking to bypass regular Roth limits, optimizing long-term retirement wealth accumulation.

In-plan Roth Conversion

In-plan Roth conversions within a Solo 401(k) allow for tax-free growth and withdrawals by converting pre-tax contributions to after-tax funds, offering greater tax strategy flexibility compared to traditional employer match plans that typically lack conversion options. Leveraging a Solo 401(k) with in-plan Roth conversion can maximize retirement savings by combining higher contribution limits and tax diversification, enhancing long-term portfolio growth.

Safe Harbor 401(k)

Safe Harbor 401(k) plans provide employers with a streamlined way to maximize employee contributions through mandatory employer matching or non-elective contributions, ensuring compliance with IRS nondiscrimination rules. Compared to Solo 401(k) plans, Safe Harbor options benefit employees by guaranteeing employer matches and higher contribution limits, making them ideal for businesses with multiple employees seeking both tax advantages and retirement security.

Pro Rata Rule

The Pro Rata Rule impacts Solo 401(k) participants who also contribute to employer-sponsored plans by requiring the aggregation of contributions, potentially affecting tax deductions and contribution limits. Employer match plans offer clearer contribution guidelines without pro rata complications, making them simpler for maximizing retirement savings if multiple plans are involved.

Solo 401(k) Roth Deferrals

Solo 401(k) Roth deferrals offer tax-free growth and tax-free withdrawals in retirement, contrasting with traditional employer matches that are pre-tax and taxable upon distribution. For self-employed individuals, maximizing Solo 401(k) Roth contributions can optimize long-term retirement savings by leveraging after-tax contributions and tax-free compounding.

Employer Non-Elective Contribution

Employer non-elective contributions, often made regardless of employee deferral, provide a guaranteed boost to retirement savings that complements solo 401(k) plans, which rely solely on individual contributions. This automatic employer-funded value enhances total retirement assets, making employer non-elective contributions a distinct advantage over solo 401(k) setups that lack external funding.

Aggregation Rules

Employer match contributions in a traditional 401(k) are subject to aggregation rules that combine all plans an employee participates in, impacting annual limits and contribution tracking. Solo 401(k) plans offer independent contribution limits without aggregation constraints, providing greater flexibility for self-employed individuals to maximize their retirement savings.

Employee After-Tax Contributions

Employee after-tax contributions in a Solo 401(k) enable higher retirement savings limits compared to employer match options tied to traditional 401(k) plans, allowing more tax-efficient growth and flexibility. While employer matches provide immediate return benefits, after-tax contributions in a Solo 401(k) offer the advantage of potential tax-free Roth conversions and greater control over retirement fund allocations.

Multiple Employer Plans (MEPs)

Multiple Employer Plans (MEPs) enable small businesses to pool resources, providing employees with employer match benefits often comparable to Solo 401(k) plans but with lower administrative costs and enhanced compliance support. While Solo 401(k)s offer higher individual contribution limits for self-employed individuals, MEPs are advantageous for businesses seeking collective retirement solutions with streamlined fiduciary responsibilities and potentially better investment options.

Self-Employed 401(k) Catch-Up

Self-employed individuals aged 50 or older can contribute an extra $7,500 catch-up contribution to a Solo 401(k) in 2024, boosting total savings beyond the standard $22,500 limit. Unlike employer match options available in traditional 401(k) plans, the Solo 401(k) enables higher personal contribution limits and catch-up benefits ideal for maximizing retirement funds independently.

Employer match vs Solo 401k for retirement. Infographic

moneydiff.com

moneydiff.com