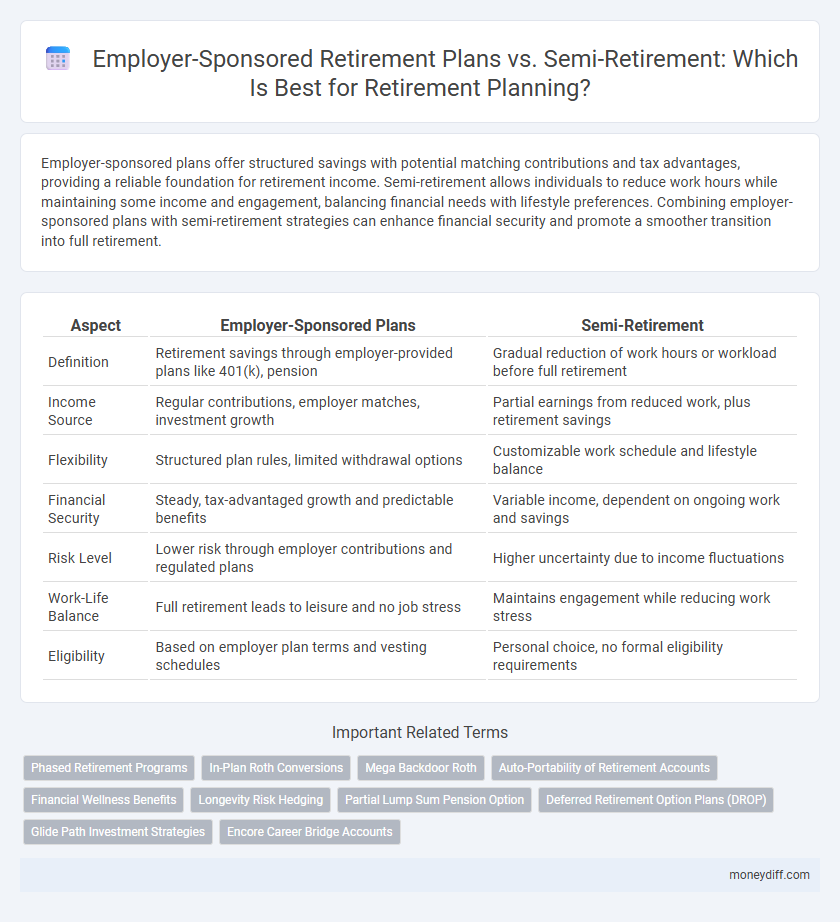

Employer-sponsored plans offer structured savings with potential matching contributions and tax advantages, providing a reliable foundation for retirement income. Semi-retirement allows individuals to reduce work hours while maintaining some income and engagement, balancing financial needs with lifestyle preferences. Combining employer-sponsored plans with semi-retirement strategies can enhance financial security and promote a smoother transition into full retirement.

Table of Comparison

| Aspect | Employer-Sponsored Plans | Semi-Retirement |

|---|---|---|

| Definition | Retirement savings through employer-provided plans like 401(k), pension | Gradual reduction of work hours or workload before full retirement |

| Income Source | Regular contributions, employer matches, investment growth | Partial earnings from reduced work, plus retirement savings |

| Flexibility | Structured plan rules, limited withdrawal options | Customizable work schedule and lifestyle balance |

| Financial Security | Steady, tax-advantaged growth and predictable benefits | Variable income, dependent on ongoing work and savings |

| Risk Level | Lower risk through employer contributions and regulated plans | Higher uncertainty due to income fluctuations |

| Work-Life Balance | Full retirement leads to leisure and no job stress | Maintains engagement while reducing work stress |

| Eligibility | Based on employer plan terms and vesting schedules | Personal choice, no formal eligibility requirements |

Understanding Employer-Sponsored Retirement Plans

Employer-sponsored retirement plans, such as 401(k)s and pensions, provide tax advantages and often include employer matching contributions that significantly boost retirement savings. These plans offer structured investment options and automatic payroll deductions, making consistent saving easier compared to self-directed strategies. Understanding the specific benefits, fees, and vesting schedules of these plans is essential for maximizing retirement income and planning a smooth transition into semi-retirement.

What Is Semi-Retirement?

Semi-retirement is a flexible approach to retirement where individuals reduce their working hours or switch to less demanding jobs instead of fully exiting the workforce. This arrangement allows for continued income and engagement while providing more personal time and gradual adjustment to retirement life. Employer-sponsored plans typically support full retirement with structured benefits, whereas semi-retirement often relies on personal savings and part-time income streams for financial security.

Key Benefits of Employer-Sponsored Plans

Employer-sponsored plans offer tax advantages, such as pre-tax contributions and tax-deferred growth, enhancing long-term retirement savings. These plans often include employer matching contributions, which effectively increase the employee's retirement funds without additional cost. Access to professional investment management and automatic payroll deductions simplifies saving consistently and growing wealth efficiently.

Pros and Cons of Semi-Retirement

Semi-retirement offers flexible work hours and reduced stress, allowing individuals to maintain income and stay socially engaged while transitioning from full-time employment. However, semi-retirement may result in lower steady income compared to employer-sponsored plans like 401(k)s or pensions, and often lacks structured benefits such as healthcare and retirement savings matching. Balancing personal fulfillment and financial stability remains a key challenge in semi-retirement planning.

Financial Security: 401(k)s and Pensions vs. Part-Time Income

Employer-sponsored plans such as 401(k)s and pensions provide structured financial security with tax advantages and employer contributions, ensuring a steady income stream during retirement. Semi-retirement, involving part-time income, offers flexibility and supplemental earnings but may lack the consistent benefits and stability of traditional plans. Balancing both approaches can optimize retirement income by combining guaranteed payments with ongoing earnings.

Flexibility and Lifestyle: Comparing Retirement Paths

Employer-sponsored retirement plans typically offer structured savings options such as 401(k)s with employer matching, providing financial security but limited flexibility in withdrawal timings and working status. Semi-retirement allows individuals to adjust their working hours or transition to less demanding roles, promoting a balanced lifestyle with more control over time and income sources. Prioritizing lifestyle preferences, semi-retirement supports gradual disengagement from work, while employer-sponsored plans emphasize long-term financial preparation.

Tax Implications: Employer Plans vs. Continued Work

Employer-sponsored retirement plans, such as 401(k)s and pensions, offer tax-deferred growth, allowing contributions to reduce taxable income during working years and taxes to be paid upon withdrawal, typically at retirement. In contrast, semi-retirement involves continued income from part-time work, subject to regular income tax rates without the benefit of tax deferral, potentially increasing annual tax liability. Understanding the differential tax implications helps optimize retirement income strategies by balancing withdrawals from employer plans with earnings from continued work.

Health Insurance Considerations in Both Options

Employer-sponsored retirement plans often include comprehensive health insurance benefits that can continue into retirement, reducing out-of-pocket expenses and ensuring access to medical care. Semi-retirement allows individuals to maintain partial employment status, retaining some employer health coverage while transitioning to reduced work hours. Careful evaluation of health insurance coverage, premiums, deductibles, and eligibility requirements is crucial when choosing between employer-sponsored plans and semi-retirement to optimize healthcare affordability and continuity.

Impact on Long-Term Savings and Investments

Employer-sponsored plans often provide structured contributions, tax advantages, and potential employer matching that significantly enhance long-term savings growth and investment compounding. Semi-retirement allows for continued income generation and flexible investment strategies, but may result in lower overall contributions and slower accumulation compared to consistent employer-sponsored plan funding. Maximizing employer-sponsored plan benefits while balancing semi-retirement income opportunities can optimize wealth preservation and retirement readiness.

Choosing the Right Path: Employer Plans or Semi-Retirement?

Employer-sponsored retirement plans such as 401(k)s and pensions offer structured savings with tax advantages and employer contributions, providing financial security and predictable income streams. Semi-retirement allows individuals to reduce work hours while maintaining some income, flexibility, and engagement, which can improve work-life balance and delay full withdrawal from the workforce. Choosing the right path depends on individual financial goals, health status, and lifestyle preferences, requiring careful evaluation of benefits, risks, and long-term sustainability.

Related Important Terms

Phased Retirement Programs

Phased retirement programs enable employees to gradually reduce work hours while maintaining access to employer-sponsored benefits, blending steady income with partial retirement. These programs offer a strategic alternative to full retirement by extending workforce participation while securing retirement plan contributions and healthcare coverage.

In-Plan Roth Conversions

In-plan Roth conversions within employer-sponsored retirement plans offer tax diversification by allowing pre-tax savings to be converted to after-tax Roth funds, enhancing long-term tax-free growth potential. Semi-retirement provides flexibility in income during transition, but leveraging in-plan Roth conversions strategically can optimize retirement income streams by balancing tax liabilities before full retirement.

Mega Backdoor Roth

Employer-sponsored plans offer structured contributions and tax advantages, but the Mega Backdoor Roth strategy within these plans enables high earners to maximize after-tax contributions and accelerate tax-free growth potential. Semi-retirement allows flexible income sources but may lack the substantial, tax-efficient savings boost provided by leveraging the Mega Backdoor Roth in 401(k) plans.

Auto-Portability of Retirement Accounts

Employer-sponsored plans with auto-portability features enable seamless transfer of retirement accounts between jobs, preserving accumulated benefits and reducing administrative burdens. Semi-retirement offers flexible income while maintaining eligibility for these portable accounts, supporting smoother financial transitions without disrupting long-term savings growth.

Financial Wellness Benefits

Employer-sponsored plans provide structured financial wellness benefits, including matching contributions, tax advantages, and access to professional investment management, which enhance long-term retirement savings. Semi-retirement offers flexible income sources and reduced work hours, helping individuals balance cash flow while gradually transitioning from full-time employment to retirement.

Longevity Risk Hedging

Employer-sponsored plans, such as 401(k)s and pensions, provide structured, often inflation-adjusted income streams that help mitigate longevity risk by ensuring steady payouts throughout retirement. Semi-retirement offers flexibility and reduced spending but may expose individuals to longevity risk due to uncertain income and potential depletion of retirement savings over an extended retirement period.

Partial Lump Sum Pension Option

Employer-sponsored plans often include a Partial Lump Sum Pension Option (PLSPO), allowing retirees to withdraw a portion of their pension as a lump sum while receiving reduced monthly payments, providing financial flexibility during semi-retirement. Semi-retirement benefits from PLSPO by enabling individuals to supplement income through part-time work or other sources while managing cash flow and tax implications effectively.

Deferred Retirement Option Plans (DROP)

Deferred Retirement Option Plans (DROP) enable employees in employer-sponsored retirement plans to continue working while their retirement benefits accumulate in an interest-bearing account, effectively bridging full retirement and semi-retirement. This strategy maximizes pension payouts by deferring benefit distribution while maintaining income, contrasting with semi-retirement where individuals reduce work hours but often rely on partial benefits without the compounded accrual advantage of DROP.

Glide Path Investment Strategies

Employer-sponsored plans commonly implement glide path investment strategies that gradually shift asset allocation from higher-risk equities to more conservative bonds as retirement approaches, optimizing growth and reducing risk. Semi-retirement allows individuals to adjust income streams and investment risk profiles dynamically, complementing glide paths by providing flexible financial management aligned with changing retirement goals.

Encore Career Bridge Accounts

Employer-sponsored plans, such as 401(k) and pension schemes, provide structured savings and tax advantages crucial for long-term financial security, while semi-retirement emphasizes gradual workforce disengagement with flexible income sources. Encore Career Bridge Accounts specifically support individuals transitioning to second careers by offering financial resources and training funds, bridging the gap between full retirement and continued professional engagement.

Employer-sponsored plans vs Semi-retirement for retirement. Infographic

moneydiff.com

moneydiff.com