Choosing between a 401(k) and the FIRE (Financial Independence, Retire Early) strategy depends on individual retirement goals and risk tolerance. A 401(k) offers tax advantages and employer contributions, providing a structured and reliable path for long-term savings. FIRE emphasizes aggressive saving and investing to enable early retirement, demanding discipline and a higher savings rate to achieve financial independence ahead of traditional retirement age.

Table of Comparison

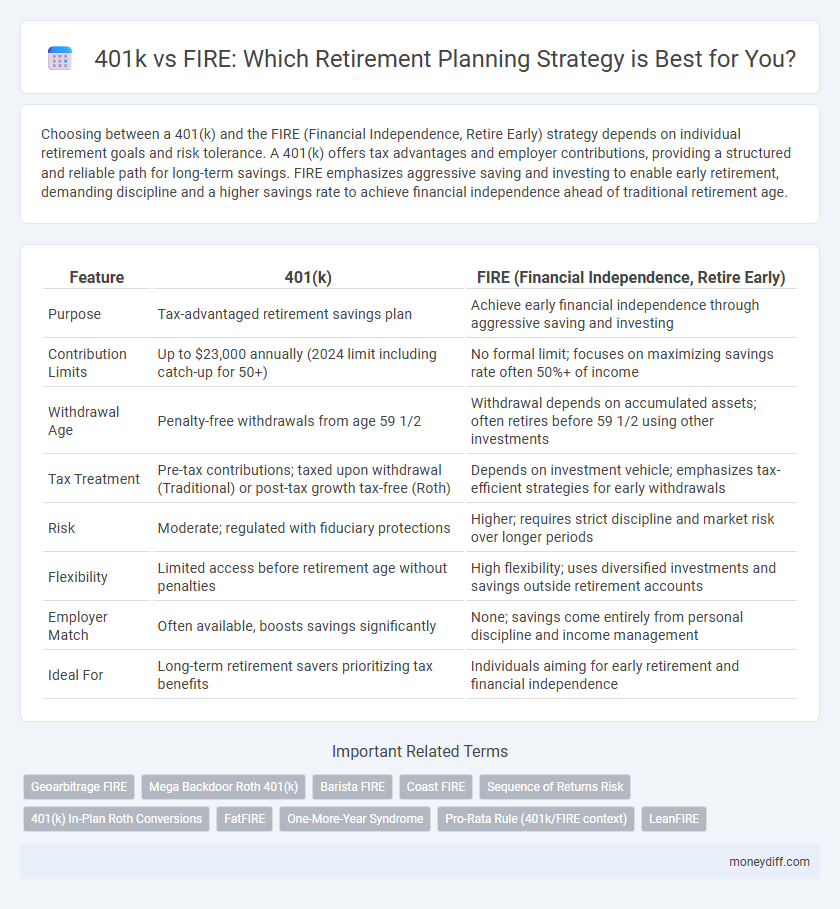

| Feature | 401(k) | FIRE (Financial Independence, Retire Early) |

|---|---|---|

| Purpose | Tax-advantaged retirement savings plan | Achieve early financial independence through aggressive saving and investing |

| Contribution Limits | Up to $23,000 annually (2024 limit including catch-up for 50+) | No formal limit; focuses on maximizing savings rate often 50%+ of income |

| Withdrawal Age | Penalty-free withdrawals from age 59 1/2 | Withdrawal depends on accumulated assets; often retires before 59 1/2 using other investments |

| Tax Treatment | Pre-tax contributions; taxed upon withdrawal (Traditional) or post-tax growth tax-free (Roth) | Depends on investment vehicle; emphasizes tax-efficient strategies for early withdrawals |

| Risk | Moderate; regulated with fiduciary protections | Higher; requires strict discipline and market risk over longer periods |

| Flexibility | Limited access before retirement age without penalties | High flexibility; uses diversified investments and savings outside retirement accounts |

| Employer Match | Often available, boosts savings significantly | None; savings come entirely from personal discipline and income management |

| Ideal For | Long-term retirement savers prioritizing tax benefits | Individuals aiming for early retirement and financial independence |

Understanding 401(k): Traditional Retirement Savings Explained

A 401(k) is a tax-advantaged retirement savings plan offered by employers, allowing employees to contribute a portion of their paycheck pre-tax, which grows tax-deferred until withdrawal. Traditional 401(k) plans often include employer matching contributions, significantly boosting retirement savings. Understanding the benefits and limitations of a 401(k) is essential for effective retirement planning compared to alternative strategies like FIRE (Financial Independence, Retire Early).

What is FIRE? Financial Independence, Retire Early Overview

FIRE (Financial Independence, Retire Early) is a retirement strategy focused on aggressive saving and investing to achieve financial independence well before traditional retirement age. Unlike the standard 401(k) plan, which typically relies on employer contributions and tax advantages for retirement savings, FIRE emphasizes maximizing income, minimizing expenses, and building a diverse investment portfolio to generate passive income. This approach enables individuals to retire decades earlier by accumulating enough assets to cover living expenses without depending on Social Security or pensions.

Comparing Retirement Goals: 401(k) vs. FIRE

401(k) plans prioritize steady, tax-advantaged savings aimed at traditional retirement age, offering employer matches and regulated contribution limits that foster disciplined wealth accumulation. FIRE (Financial Independence, Retire Early) emphasizes aggressive saving and investment strategies designed to achieve early retirement through maximal income allocation and optimized expense management. Both approaches require tailored financial planning, but 401(k) suits long-term growth with structured benefits, whereas FIRE targets accelerated wealth-building for financial freedom at a younger age.

Contribution Strategies: Maximizing 401(k) vs. FIRE Investments

Maximizing a 401(k) involves consistent contributions up to the employer match and taking advantage of tax-advantaged growth, whereas FIRE (Financial Independence, Retire Early) emphasizes aggressive saving and diversified investments outside traditional retirement accounts. Strategic 401(k) contribution leverages compound growth through pre-tax or Roth options, while FIRE focuses on high savings rates, investment in index funds, real estate, and other assets to accelerate wealth accumulation. Balancing 401(k) contributions with FIRE investment strategies can optimize retirement readiness by combining tax benefits with flexible, growth-oriented portfolios.

Tax Advantages: 401(k) vs. FIRE Approaches

401(k) plans offer significant tax advantages through pre-tax contributions and tax-deferred growth, reducing taxable income during working years and allowing savings to compound tax-free until withdrawal. The FIRE (Financial Independence, Retire Early) strategy emphasizes maximizing taxable investment accounts, which often lack upfront tax benefits but provide flexibility and potential for long-term capital gains tax treatment. Understanding the tax implications of 401(k) withdrawals versus taxable investment income is critical for optimizing retirement planning and minimizing tax liabilities.

Investment Flexibility: 401(k) Restrictions vs. FIRE Freedom

401(k) plans offer tax advantages but come with strict regulations on contributions, withdrawals, and investment choices, limiting investment flexibility. FIRE (Financial Independence, Retire Early) strategies prioritize diverse, self-directed investments in taxable accounts, providing greater control and access to funds without age-based penalties. This freedom allows FIRE adherents to tailor their portfolios dynamically, adapting to market conditions and personal goals more effectively than traditional 401(k) constraints permit.

Withdrawal Rules: Accessing Your Money in 401(k) and FIRE

Withdrawal rules for a 401(k) plan typically require individuals to wait until age 59 1/2 to access funds penalty-free, with required minimum distributions starting at age 73. FIRE (Financial Independence, Retire Early) strategies emphasize building taxable investment accounts and other assets that offer more flexible access without age restrictions or penalties. Understanding these withdrawal constraints influences the timing and tax implications of accessing retirement savings, impacting overall retirement planning decisions.

Risk Tolerance: Assessing 401(k) Stability vs. FIRE Volatility

401(k) plans offer a structured, employer-sponsored retirement savings option with regulated contribution limits and tax advantages, providing a stable foundation for long-term growth. FIRE (Financial Independence, Retire Early) strategies often involve higher risk tolerance through aggressive investments and unconventional income streams, introducing greater volatility and uncertainty in retirement timelines. Evaluating personal risk tolerance is crucial when choosing between the predictable security of 401(k) plans and the dynamic, potentially higher-reward but volatile path of FIRE.

Lifestyle Differences: Conventional Retirement vs. Early Retirement

Conventional retirement through a 401(k) often involves a gradual transition into a stable, routine lifestyle supported by steady income and employer-sponsored benefits, typically around age 65. FIRE (Financial Independence, Retire Early) prioritizes financial freedom at a younger age, enabling a more flexible, adventure-driven lifestyle but requires aggressive saving, frugal living, and strategic investment from an earlier stage. The lifestyle differences hinge on the predictability and security of traditional retirement versus the dynamic, self-reliant, and accelerated nature of early retirement planning.

Which Path is Right for You? Tailoring 401(k) and FIRE to Your Needs

Choosing between a 401(k) and the FIRE (Financial Independence, Retire Early) movement depends on your financial goals, risk tolerance, and desired retirement timeline. A 401(k) offers steady growth through employer contributions and tax advantages, ideal for traditional retirement planning, while FIRE emphasizes aggressive saving and investing to achieve early financial freedom. Tailoring these strategies to your needs involves evaluating income stability, investment preferences, and lifestyle aspirations to create a personalized retirement plan.

Related Important Terms

Geoarbitrage FIRE

Geoarbitrage FIRE leverages location-independent income to maximize lifestyle and retirement savings by relocating to lower-cost areas, amplifying the value of 401(k) withdrawals and other retirement funds. Unlike traditional 401(k) plans that rely heavily on consistent contributions and market growth, Geoarbitrage FIRE emphasizes early financial independence through strategic spending and investing, enabling more flexible retirement timelines.

Mega Backdoor Roth 401(k)

Mega Backdoor Roth 401(k) contributions allow high earners to maximize tax-advantaged retirement savings beyond standard 401(k) limits, providing significant growth potential compared to traditional FIRE strategies reliant on taxable investments. Leveraging this strategy can accelerate tax-free wealth accumulation, making it a powerful tool for retirement planning alongside or instead of conventional FIRE methods.

Barista FIRE

Barista FIRE combines partial financial independence through side income with traditional retirement savings like a 401(k), allowing individuals to maintain health benefits and reduce withdrawal pressure. This approach balances steady cash flow from part-time work while leveraging tax-advantaged growth, offering a flexible path to retirement compared to solely relying on 401(k) funds or full early retirement.

Coast FIRE

Coast FIRE emphasizes achieving a sufficient 401(k) balance early, allowing investments to grow passively until retirement without additional contributions. This strategy leverages compounding in tax-advantaged accounts, reducing the need for aggressive saving compared to traditional 401(k) plans focused on continual contributions.

Sequence of Returns Risk

Sequence of returns risk critically impacts both 401(k) and FIRE retirement strategies, as early negative market returns can significantly diminish portfolio value and withdrawal sustainability. Effective retirement planning must incorporate risk mitigation techniques such as diversification, dynamic withdrawal rates, and contingency reserves to safeguard against the timing of market downturns during the crucial initial retirement years.

401(k) In-Plan Roth Conversions

401(k) In-Plan Roth Conversions enable participants to convert pre-tax contributions to after-tax Roth funds, providing tax-free growth and tax-free withdrawals in retirement. This strategy offers greater flexibility in managing tax liabilities compared to traditional FIRE (Financial Independence, Retire Early) retirement planning.

FatFIRE

FatFIRE emphasizes accumulating a high net worth and significant annual spending freedom, often exceeding $100,000 per year, contrasting with traditional 401k strategies focused on tax-advantaged growth and employer matching. This approach requires aggressive saving, diversified investments, and a lifestyle designed to support early retirement with substantial discretionary income beyond standard FIRE benchmarks.

One-More-Year Syndrome

One-More-Year Syndrome often traps individuals in traditional 401(k) plans, delaying financial independence despite the allure of the FIRE (Financial Independence, Retire Early) movement that promotes aggressive saving and investing for early retirement. This psychological barrier can prevent optimal retirement planning by fostering a reluctance to leave the conventional workforce, even when FIRE strategies provide a clear roadmap for financial freedom.

Pro-Rata Rule (401k/FIRE context)

The Pro-Rata Rule critically impacts the tax efficiency of 401k rollovers when pursuing FIRE, as it mandates proportional taxation on pre-tax and after-tax contributions during Roth conversions. Understanding this rule is essential for optimizing retirement savings strategies between traditional 401k plans and aggressive FIRE approaches to minimize unexpected tax liabilities.

LeanFIRE

LeanFIRE emphasizes achieving financial independence through minimalistic living and strategic savings, often prioritizing efficient use of a 401(k) alongside reduced expenses to retire early. While a 401(k) offers tax-advantaged growth and employer matching, LeanFIRE strategies focus on aggressive saving rates and frugality to expedite the timeline to retirement.

401k vs FIRE for retirement planning. Infographic

moneydiff.com

moneydiff.com