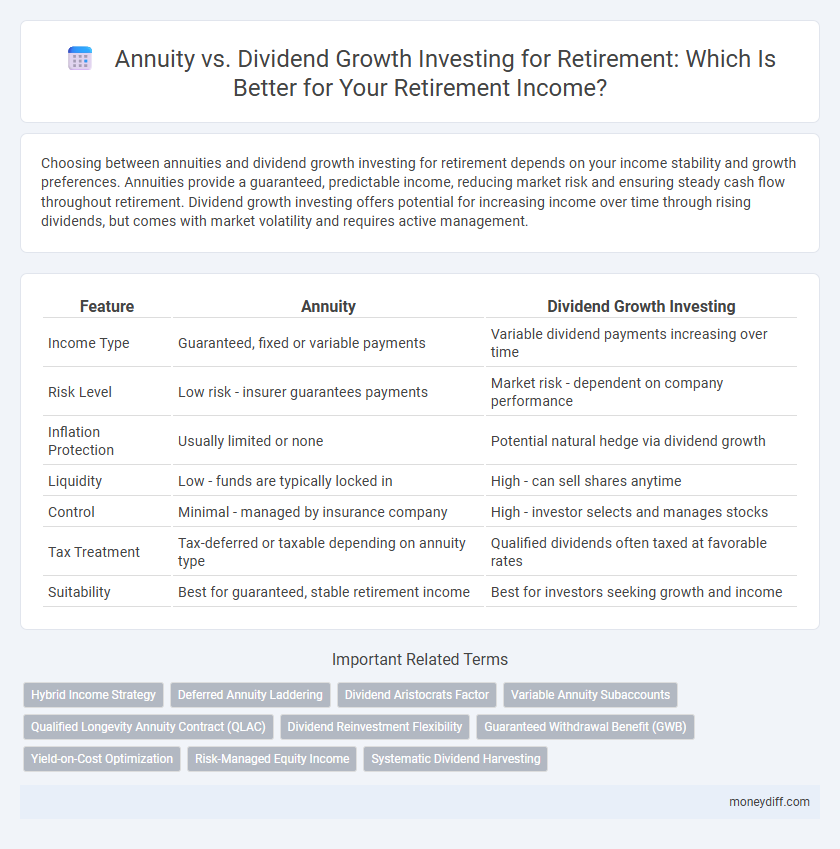

Choosing between annuities and dividend growth investing for retirement depends on your income stability and growth preferences. Annuities provide a guaranteed, predictable income, reducing market risk and ensuring steady cash flow throughout retirement. Dividend growth investing offers potential for increasing income over time through rising dividends, but comes with market volatility and requires active management.

Table of Comparison

| Feature | Annuity | Dividend Growth Investing |

|---|---|---|

| Income Type | Guaranteed, fixed or variable payments | Variable dividend payments increasing over time |

| Risk Level | Low risk - insurer guarantees payments | Market risk - dependent on company performance |

| Inflation Protection | Usually limited or none | Potential natural hedge via dividend growth |

| Liquidity | Low - funds are typically locked in | High - can sell shares anytime |

| Control | Minimal - managed by insurance company | High - investor selects and manages stocks |

| Tax Treatment | Tax-deferred or taxable depending on annuity type | Qualified dividends often taxed at favorable rates |

| Suitability | Best for guaranteed, stable retirement income | Best for investors seeking growth and income |

Introduction to Retirement Income Strategies

Annuity and dividend growth investing are two popular retirement income strategies offering distinct benefits. Annuities provide guaranteed lifetime income, ensuring financial stability and protection against longevity risk. Dividend growth investing focuses on building a portfolio of stocks with increasing dividends, generating inflation-adjusted income and potential capital appreciation.

Understanding Annuities: Basics and Types

Annuities provide a steady stream of income during retirement by converting a lump sum into periodic payments, offering financial predictability. There are several types of annuities, including fixed, variable, and indexed, each with distinct risk and return profiles tailored to different investor needs. Understanding these types helps retirees balance guaranteed income against potential growth, essential for effective retirement planning.

Dividend Growth Investing Explained

Dividend growth investing involves purchasing stocks of companies with a consistent history of increasing dividend payouts, providing a growing income stream that can outpace inflation over time. This strategy offers potential capital appreciation alongside reinvested dividends, enhancing portfolio value during retirement years. Unlike fixed annuity payments, dividend growth investing allows retirees to benefit from market growth and company earnings, making it a flexible and inflation-resistant source of retirement income.

Pros and Cons of Annuities for Retirement

Annuities provide a steady, guaranteed income stream during retirement, reducing longevity risk and offering tax-deferred growth, which can be crucial for financial stability. However, they often come with high fees, limited liquidity, and less potential for inflation-adjusted returns compared to dividend growth investing. While annuities ensure income certainty, they may lack the flexibility and growth potential that dividend-paying stocks provide for long-term wealth accumulation.

Benefits and Risks of Dividend Growth Investing

Dividend growth investing offers the benefit of a growing income stream that can outpace inflation, providing retirees with increasing cash flow over time. Risks include market volatility impacting dividends and the potential for companies to cut dividends during economic downturns, which can reduce income reliability. This strategy also requires diligent stock selection and ongoing portfolio management to mitigate risks and maximize income growth potential.

Comparing Income Predictability: Annuity vs Dividend Growth

Annuities provide a guaranteed, fixed income stream for retirement, offering unparalleled income predictability and protection against market volatility. Dividend growth investing generates income that can increase over time with company earnings but carries the risk of dividend cuts during economic downturns, resulting in less predictable cash flow. For retirees prioritizing stable and reliable income, annuities outperform dividend growth stocks in predictability, though dividend growth investing offers potential for inflation-beating income increases.

Tax Implications: Annuity vs Dividend Stocks

Annuities offer tax-deferred growth, enabling retirees to delay income tax payments until withdrawals, which can help manage taxable income in retirement. Dividend growth stocks provide qualified dividends typically taxed at lower capital gains rates, but dividends are taxable in the year they are received, potentially increasing annual tax liability. Understanding the timing and tax treatment of income from annuities versus dividend stocks is crucial for optimizing after-tax retirement income.

Flexibility and Liquidity Considerations

Annuities provide guaranteed income but often come with limited flexibility and restricted access to funds, potentially locking investors into long-term contracts with surrender charges. Dividend growth investing offers greater liquidity, enabling retirees to adjust their portfolio or access cash more readily while benefiting from potential dividend increases over time. Evaluating personal cash flow needs and risk tolerance is essential when balancing the trade-offs between the structured payouts of annuities and the adaptable nature of dividend growth investments for retirement income.

Suitability for Different Retirement Goals

Annuities offer guaranteed income streams, making them suitable for retirees seeking predictable cash flow and risk reduction. Dividend growth investing provides potential for income increases and capital appreciation, aligning with retirees aiming for wealth accumulation and inflation protection. Choosing between annuities and dividend growth investments depends on individual retirement goals, risk tolerance, and need for income stability.

Making the Right Choice: Annuity or Dividend Growth Investing?

Choosing between annuities and dividend growth investing for retirement hinges on risk tolerance and income stability preferences. Annuities provide guaranteed income streams, reducing longevity risk but often sacrificing liquidity and growth potential. Dividend growth investing offers inflation-adjusted income with potential capital appreciation, requiring active management and market risk acceptance.

Related Important Terms

Hybrid Income Strategy

A Hybrid Income Strategy combines the steady, guaranteed payments from annuities with the potential for capital appreciation and dividend growth from equities, optimizing portfolio income and inflation protection during retirement. This approach balances the risk and reward dynamics by leveraging annuity stability alongside dividend reinvestment growth to support long-term financial security.

Deferred Annuity Laddering

Deferred annuity laddering offers retirees a structured approach to generating predictable income streams by staggering annuity start dates, reducing interest rate risk and providing liquidity over time. This strategy contrasts with dividend growth investing, which relies on increasing stock dividends but may expose retirees to market volatility and dividend cuts.

Dividend Aristocrats Factor

Dividend Aristocrats, known for their consistent and increasing dividend payments over 25+ years, offer a compelling growth-oriented alternative to traditional annuities in retirement portfolios. Their potential for capital appreciation and dividend growth can outpace inflation, providing retirees with a rising income stream that annuities, with fixed returns, often lack.

Variable Annuity Subaccounts

Variable annuity subaccounts offer tax-deferred growth and diversified investment options that align with dividend growth investing strategies, providing retirees with both potential income streams and portfolio appreciation. Unlike traditional annuities, subaccounts allow investors to target dividend-paying stocks, enhancing long-term retirement income through compounding dividends and capital gains.

Qualified Longevity Annuity Contract (QLAC)

Qualified Longevity Annuity Contracts (QLACs) provide a unique retirement income strategy by deferring annuity payments until advanced age, reducing required minimum distributions and securing lifetime income. Compared to dividend growth investing, QLACs offer guaranteed longevity protection without market volatility, making them a valuable tool for supplementing retirement portfolios focused on stable, predictable cash flow.

Dividend Reinvestment Flexibility

Dividend growth investing offers greater reinvestment flexibility by allowing retirees to adjust the timing and amount of dividend reinvestments according to market conditions or income needs, enhancing portfolio growth potential. In contrast, annuities provide fixed payouts with limited ability to reinvest, reducing adaptability to changing financial goals or inflation.

Guaranteed Withdrawal Benefit (GWB)

Guaranteed Withdrawal Benefit (GWB) in annuities offers retirees a secure, predictable income stream regardless of market fluctuations, providing financial stability during retirement. In contrast, dividend growth investing relies on increasing dividend payouts but carries market risk, making GWB annuities a preferred choice for risk-averse individuals seeking consistent retirement income.

Yield-on-Cost Optimization

Yield-on-cost optimization in retirement favors dividend growth investing by steadily increasing income streams that outpace inflation, whereas annuities provide fixed payments that may lose purchasing power over time. Investors prioritizing long-term yield enhancement often choose dividend growth stocks for adaptable, tax-advantaged income compared to the static returns of annuities.

Risk-Managed Equity Income

Risk-managed equity income strategies balance the stability of annuities with the growth potential of dividend growth investing, providing retirees with a diversified income stream that adapts to market fluctuations. Annuities offer guaranteed payments, while dividend growth stocks contribute inflation-adjusted income and capital appreciation, mitigating longevity and market risk in retirement portfolios.

Systematic Dividend Harvesting

Systematic Dividend Harvesting optimizes retirement income by strategically reinvesting dividends from dividend growth stocks to enhance compound growth and generate a rising income stream, outperforming fixed annuity payouts over time. This method leverages dividend growth investing's potential for capital appreciation and increasing cash flows, providing retirees with flexible, inflation-adjusted income compared to the static nature of annuities.

Annuity vs Dividend growth investing for retirement. Infographic

moneydiff.com

moneydiff.com