Target-date funds offer a simplified, automated approach to retirement asset allocation by gradually adjusting the portfolio's risk based on the investor's expected retirement date. Direct indexing provides a customized strategy, allowing investors to directly own individual securities while optimizing tax efficiency and aligning with specific financial goals. Both approaches cater to different needs, with target-date funds emphasizing ease and diversification and direct indexing prioritizing personalization and tax management.

Table of Comparison

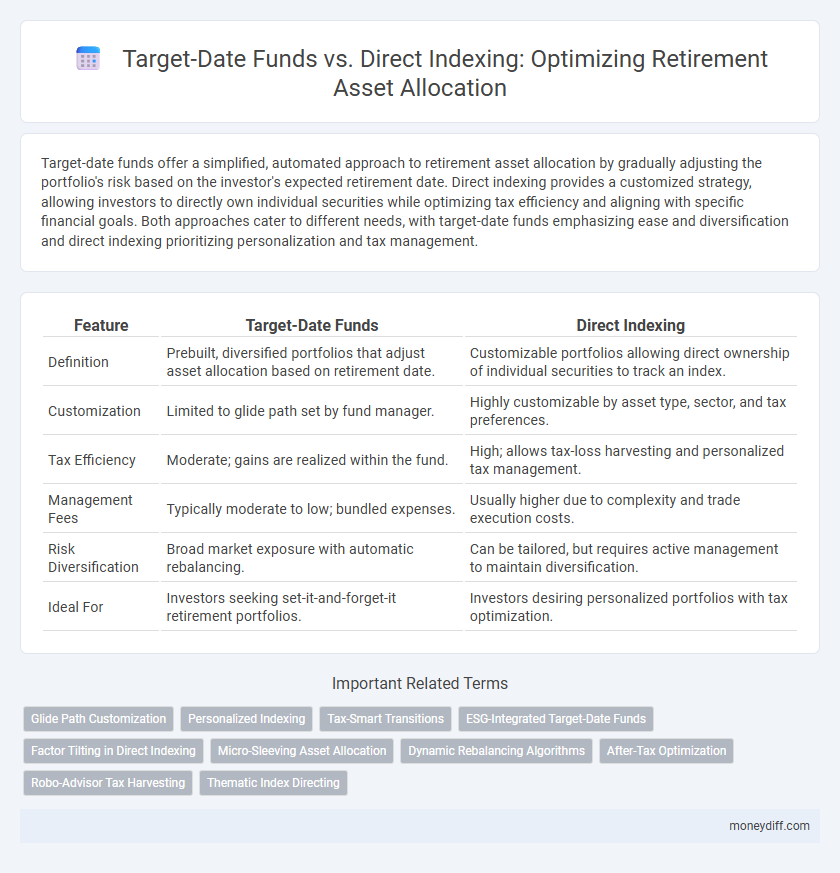

| Feature | Target-Date Funds | Direct Indexing |

|---|---|---|

| Definition | Prebuilt, diversified portfolios that adjust asset allocation based on retirement date. | Customizable portfolios allowing direct ownership of individual securities to track an index. |

| Customization | Limited to glide path set by fund manager. | Highly customizable by asset type, sector, and tax preferences. |

| Tax Efficiency | Moderate; gains are realized within the fund. | High; allows tax-loss harvesting and personalized tax management. |

| Management Fees | Typically moderate to low; bundled expenses. | Usually higher due to complexity and trade execution costs. |

| Risk Diversification | Broad market exposure with automatic rebalancing. | Can be tailored, but requires active management to maintain diversification. |

| Ideal For | Investors seeking set-it-and-forget-it retirement portfolios. | Investors desiring personalized portfolios with tax optimization. |

Understanding Target-Date Funds in Retirement Planning

Target-date funds offer automated asset allocation tailored to an investor's expected retirement date, gradually shifting from higher-risk equities to more conservative fixed-income investments. These funds provide diversification and professional management, simplifying retirement planning by adjusting risk exposure as the target date approaches. Understanding target-date funds helps investors balance growth potential and risk management within their retirement portfolios.

What is Direct Indexing for Retirement Portfolios?

Direct indexing for retirement portfolios involves purchasing the individual securities that comprise a benchmark index, allowing for personalized customization and tax optimization. This approach provides greater control over asset allocation, tax-loss harvesting, and exposure to specific sectors or factors compared to target-date funds. Investors seeking tailored strategies that align with their unique financial goals and tax situations may benefit from direct indexing as part of their retirement asset allocation.

How Target-Date Funds Manage Risk Over Time

Target-date funds manage risk over time by automatically adjusting their asset allocation to become more conservative as the target retirement date approaches, typically shifting from higher-risk equities to lower-risk bonds and cash equivalents. This gradual glide path reduces exposure to market volatility, aiming to protect retirement savings during the critical withdrawal phase. The built-in risk management strategy offers a hands-off approach, making target-date funds a popular choice for investors seeking simplified, time-focused portfolio adjustments.

Customization Benefits of Direct Indexing in Asset Allocation

Direct indexing offers superior customization benefits in retirement asset allocation compared to target-date funds by allowing investors to tailor their portfolios to specific tax situations, risk tolerances, and personal values. Investors can selectively include or exclude certain sectors or individual stocks, optimizing for tax-loss harvesting and aligning with ESG preferences. This level of personalization enhances portfolio efficiency and can lead to improved after-tax returns during retirement planning.

Fees and Costs: Target-Date Funds vs Direct Indexing

Target-date funds typically charge expense ratios ranging from 0.10% to 0.75%, encompassing portfolio management and asset allocation expenses, while direct indexing costs fluctuate based on brokerage fees, transaction costs, and software subscriptions, often starting around 0.20% to 0.50%. Direct indexing may incur higher upfront costs due to individualized portfolio construction and tax-loss harvesting services, but offers potential long-term tax efficiency and customization advantages. Investors prioritizing low fees and simplicity often prefer target-date funds, whereas those seeking tax optimization and tailored strategies might accept the higher costs associated with direct indexing.

Tax Efficiency Comparison: Target-Date Funds and Direct Indexing

Target-date funds offer simplicity with automatic rebalancing but often generate capital gains that reduce tax efficiency compared to direct indexing. Direct indexing allows for personalized tax-loss harvesting strategies by owning individual securities, enhancing after-tax returns in retirement portfolios. Studies indicate that direct indexing can improve tax efficiency by up to 30% relative to traditional target-date funds, making it a compelling choice for tax-sensitive retirees.

Portfolio Diversification: Which Strategy Excels?

Target-date funds offer broad portfolio diversification by automatically adjusting asset allocation over time, blending equities, bonds, and alternative investments to balance risk and growth. Direct indexing enables precise customization of stock holdings, providing tax-loss harvesting opportunities and tailored exposure to specific sectors or themes. Investors seeking hands-off diversification may prefer target-date funds, while those wanting granular control and personalized tax strategies may excel with direct indexing.

Hands-Off Investing: The Appeal of Target-Date Funds

Target-date funds offer a hands-off investing approach by automatically adjusting portfolio allocations based on the investor's retirement timeline, simplifying asset allocation decisions. These funds provide diversified exposure across stocks and bonds, reducing the need for active management and rebalancing as the target date approaches. Their appeal lies in convenience and professional management, making them ideal for retirees seeking steady growth with minimal oversight.

Is Direct Indexing Better for Personalized Retirement Goals?

Direct indexing offers greater customization by allowing investors to tailor their retirement portfolios based on specific tax situations, risk tolerance, and personal values, unlike target-date funds which follow a predetermined asset allocation glide path. This personalized approach can enhance tax efficiency through tax-loss harvesting and improve alignment with individual retirement goals, potentially leading to better after-tax returns. However, direct indexing requires more active management and higher costs, making it more suitable for investors seeking customized strategies over the simplicity and convenience of target-date funds.

Which Approach Fits Your Retirement Needs Best?

Target-date funds offer a simplified, professionally managed approach with automatic rebalancing aligned to your expected retirement year, making them ideal for hands-off investors seeking diversification. Direct indexing allows personalized portfolio customization by directly owning underlying securities, providing tax-loss harvesting benefits and greater control for experienced investors aiming to optimize after-tax returns. Evaluating your comfort with portfolio management, tax considerations, and desire for customization helps determine whether target-date funds or direct indexing best fit your retirement asset allocation strategy.

Related Important Terms

Glide Path Customization

Target-date funds offer a pre-set glide path automatically adjusting asset allocation as retirement approaches, simplifying portfolio management for investors, while direct indexing allows for granular glide path customization through personalized asset selection and tax optimization strategies. Tailoring the glide path in direct indexing can enhance retirement outcomes by aligning risk tolerance and investment goals more precisely than generic target-date fund allocations.

Personalized Indexing

Target-date funds offer a hands-off, age-adjusted asset allocation, but personalized indexing in retirement allows individual investors to directly customize their portfolios based on specific goals, risk tolerance, and tax preferences. This approach enhances diversification and tax efficiency by tailoring asset selection to personal financial situations instead of relying on broad, pre-set fund compositions.

Tax-Smart Transitions

Target-date funds offer automated, diversified asset allocation with gradual risk reduction aligned to retirement timelines, simplifying tax management through systematic rebalancing. Direct indexing enables customized portfolios with tax-loss harvesting opportunities, enhancing tax efficiency by capturing specific security losses to offset gains, optimizing after-tax retirement outcomes.

ESG-Integrated Target-Date Funds

ESG-integrated Target-Date Funds offer a streamlined retirement asset allocation by automatically adjusting portfolio risk while incorporating environmental, social, and governance criteria to align investments with sustainable values. Direct Indexing provides customization advantages but requires active management, making ESG Target-Date Funds a practical choice for retirees seeking diversified, socially responsible growth with minimal oversight.

Factor Tilting in Direct Indexing

Direct indexing allows for precise factor tilting by enabling investors to overweight desired factors such as value, momentum, or low volatility within individual securities, enhancing retirement portfolio customization. Target-date funds offer a hands-off approach with automatic asset allocation shifts but lack the granular factor exposure and tax efficiency benefits present in direct indexing strategies.

Micro-Sleeving Asset Allocation

Target-Date Funds offer a simplified, automated asset allocation that adjusts risk based on the investor's retirement timeline, while Direct Indexing with micro-sleeving enables personalized tax-loss harvesting and tailored exposure to specific sectors or factors. Micro-sleeving allows investors to break down their portfolio into separate sleeves within a single account, optimizing diversification and tax efficiency beyond traditional target-date strategies.

Dynamic Rebalancing Algorithms

Dynamic rebalancing algorithms in target-date funds automatically adjust asset allocations based on a predetermined glide path, ensuring a gradual shift towards lower-risk investments as retirement approaches. In contrast, direct indexing with dynamic rebalancing customizes portfolio adjustments by individually managing securities to optimize tax efficiency and market exposure, enhancing personalized retirement asset allocation strategies.

After-Tax Optimization

Target-date funds provide automatic rebalancing and diversification but often lack personalized tax-loss harvesting, limiting after-tax optimization benefits. Direct indexing allows investors to strategically manage capital gains and losses within individual securities, enhancing after-tax efficiency and potentially increasing retirement portfolio returns.

Robo-Advisor Tax Harvesting

Target-date funds offer automated asset allocation with gradual risk reduction, while direct indexing allows for customized portfolios and enhanced tax-loss harvesting through robo-advisors, optimizing after-tax retirement returns. Robo-advisors utilize direct indexing strategies to actively manage tax-loss harvesting at the individual security level, outperforming traditional target-date funds in tax efficiency.

Thematic Index Directing

Thematic index directing in retirement asset allocation allows investors to customize portfolios around specific economic, environmental, or technological themes, enhancing targeted exposure compared to the broad diversification of target-date funds. This approach supports alignment with personal values and market trends while potentially improving risk-adjusted returns through focused sector allocation.

Target-Date Funds vs Direct Indexing for retirement asset allocation Infographic

moneydiff.com

moneydiff.com