Employer match contributions provide a guaranteed boost to retirement savings without additional cost, effectively increasing the total investment. Self-directed retirement accounts offer greater control and flexibility in selecting investments tailored to individual goals and risk tolerance. Balancing employer match benefits with self-directed options can optimize growth potential and secure a more robust financial future.

Table of Comparison

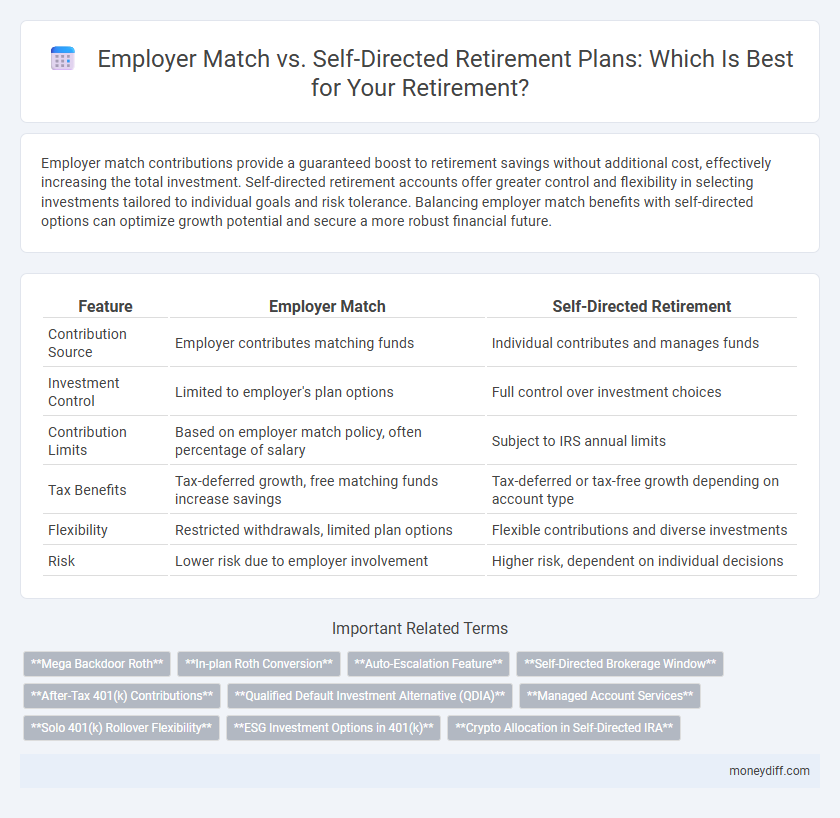

| Feature | Employer Match | Self-Directed Retirement |

|---|---|---|

| Contribution Source | Employer contributes matching funds | Individual contributes and manages funds |

| Investment Control | Limited to employer's plan options | Full control over investment choices |

| Contribution Limits | Based on employer match policy, often percentage of salary | Subject to IRS annual limits |

| Tax Benefits | Tax-deferred growth, free matching funds increase savings | Tax-deferred or tax-free growth depending on account type |

| Flexibility | Restricted withdrawals, limited plan options | Flexible contributions and diverse investments |

| Risk | Lower risk due to employer involvement | Higher risk, dependent on individual decisions |

Understanding Employer Match in Retirement Plans

Employer match in retirement plans is a crucial benefit where employers contribute a specific amount to an employee's retirement savings, often matching a percentage of the employee's contributions up to a set limit. This match effectively increases retirement savings without additional cost to the employee, providing free money that significantly boosts long-term investment growth. Understanding the terms, such as vesting schedules and contribution limits, ensures employees maximize this benefit before considering self-directed retirement strategies.

What Is a Self-Directed Retirement Account?

A self-directed retirement account allows investors to manage their retirement funds with greater control over investment choices, including real estate, private equity, and precious metals, beyond traditional stocks and bonds. Unlike employer match programs that contribute fixed amounts based on employee contributions, self-directed accounts enable personalized strategies tailored to individual financial goals and risk tolerance. This flexibility makes self-directed retirement accounts ideal for experienced investors seeking diversified portfolios and proactive management of their retirement savings.

Contribution Limits: Employer Match vs Self-Directed

Employer match contributions in retirement plans typically do not count toward the employee's annual contribution limit, allowing for higher total savings compared to self-directed accounts where contributions are solely limited by IRS caps. Employer matches can significantly increase retirement funds without reducing the employee's maximum allowable contribution of $22,500 for 401(k) plans in 2024. In self-directed retirement accounts such as IRAs, both employee and employer contributions are combined to adhere strictly to lower annual limits, currently $6,500 for individuals under 50.

Tax Advantages: Comparing Both Strategies

Employer match contributions provide immediate tax advantages by reducing taxable income and growing tax-deferred until withdrawal, while self-directed accounts offer greater control over investments with potential tax benefits depending on the account type, such as Roth IRAs or traditional IRAs. Employer matches represent free money with pre-tax benefits but limit investment choices; self-directed retirement plans allow for diversified tax strategies including tax-free growth in Roth accounts or tax deductions in traditional accounts. Evaluating tax advantages involves considering employer match eligibility, investment preferences, and long-term tax implications to optimize retirement savings.

Investment Flexibility and Control

Employer match programs provide a structured, often limited selection of investment options, restricting flexibility for retirement portfolios. Self-directed retirement accounts offer greater control, enabling investors to diversify across a wide range of assets such as stocks, bonds, real estate, and alternative investments. This increased investment flexibility allows for tailored strategies aligned with individual risk tolerance and financial goals.

Risk Management: Employer-Sponsored vs Self-Directed

Employer-sponsored retirement plans offer structured risk management through diversified investment options and professional oversight, reducing the impact of market volatility for participants. Self-directed retirement accounts provide greater control and flexibility but require individuals to actively manage investments and bear the full risk of poor decisions. Balancing employer match contributions with self-directed strategies can optimize growth while mitigating exposure to concentrated market risks.

Fees and Hidden Costs Analysis

Employer match programs often come with lower fees and reduced administrative costs compared to self-directed retirement accounts, which may incur higher expense ratios and maintenance charges. Hidden costs in self-directed plans can include transaction fees, trading commissions, and penalties for early withdrawals, significantly impacting account growth over time. Analyzing fee structures and potential hidden expenses is crucial to maximizing retirement savings and ensuring long-term financial efficiency.

Long-Term Growth Potential

Employer match contributions provide an immediate return on investment, effectively boosting retirement savings by capturing free money that compounds tax-deferred over time. Self-directed retirement accounts offer greater control and diversification, allowing for tailored investment strategies that can adapt to market conditions and personal risk tolerance. Maximizing employer matches while strategically allocating additional funds to self-directed options can optimize long-term growth potential and enhance retirement readiness.

Suitability: Which Option Fits Your Retirement Goals?

Employer match contributions provide a guaranteed return on investment, maximizing your retirement savings with minimal risk and making them ideal for those seeking steady growth and employer support. Self-directed retirement accounts offer greater flexibility and control over investment choices, suitable for individuals comfortable with managing diverse assets tailored to their unique financial goals. Evaluating risk tolerance, investment knowledge, and long-term objectives helps determine whether employer matches or self-directed plans best align with your retirement strategy.

Making the Right Choice for Your Financial Future

Employer match contributions provide immediate, risk-free returns often amounting to 50-100% of the employee's contribution, significantly boosting retirement savings. Self-directed retirement accounts offer greater investment flexibility, allowing individuals to tailor portfolios with stocks, bonds, or alternative assets to align with personal risk tolerance and long-term goals. Evaluating employer match benefits against the autonomy of self-directed accounts helps optimize growth potential and secure a financially stable retirement.

Related Important Terms

Mega Backdoor Roth

Maximizing retirement savings through the Mega Backdoor Roth strategy allows high-income earners to contribute after-tax dollars to a 401(k) and convert them to a Roth IRA, bypassing conventional contribution limits. Employer match programs provide free contributions but lack the high contribution thresholds and tax-free growth potential that self-directed Mega Backdoor Roth conversions offer for long-term retirement wealth accumulation.

In-plan Roth Conversion

In-plan Roth conversions during retirement planning allow individuals to convert pre-tax employer contributions into after-tax Roth funds, offering tax-free growth and withdrawals, which contrasts with self-directed retirement accounts where individuals manage investments but may lack employer match incentives. Choosing between employer match benefits and self-directed control involves evaluating the immediate value of matched contributions against the long-term tax advantages of Roth conversions within an employer-sponsored plan.

Auto-Escalation Feature

The auto-escalation feature in employer match plans systematically increases employee contributions over time, maximizing retirement savings with minimal effort, whereas self-directed accounts lack this built-in mechanism, requiring individuals to manually adjust their contribution rates. Leveraging auto-escalation amplifies compound growth potential by ensuring consistent increases in investment contributions aligned with income growth and employer match thresholds.

Self-Directed Brokerage Window

A Self-Directed Brokerage Window offers retirement savers greater control by allowing investments beyond standard employer plan options, including stocks, bonds, and ETFs. This flexibility enables personalized portfolio diversification and the potential for higher returns compared to relying solely on employer match contributions.

After-Tax 401(k) Contributions

After-tax 401(k) contributions offer a unique advantage in self-directed retirement accounts by allowing individuals to contribute beyond traditional pre-tax and Roth limits, enabling significant tax-deferred growth and potential for tax-free withdrawals through in-service rollovers to Roth IRAs. Employer match contributions, typically pre-tax, provide immediate vested funds and reduce taxable income but do not benefit from the same post-tax contribution flexibility or mega backdoor Roth strategies available with after-tax contributions.

Qualified Default Investment Alternative (QDIA)

Qualified Default Investment Alternative (QDIA) provides a strategic option for employer-sponsored retirement plans by automatically investing participant contributions in diversified portfolios, balancing risk and growth potential. Employer match contributions often leverage QDIA to simplify investment decisions, whereas self-directed accounts require individual knowledge and risk tolerance to optimize retirement outcomes.

Managed Account Services

Managed Account Services in retirement planning offer personalized investment strategies that optimize employer match benefits by tailoring contributions and asset allocations to maximize long-term growth and tax efficiency. These services provide professional oversight, reducing the risk and complexity for self-directed investors while enhancing the value of employer-sponsored retirement plans.

Solo 401(k) Rollover Flexibility

Solo 401(k) plans offer unmatched rollover flexibility, allowing participants to easily transfer employer match contributions or self-directed funds into diverse investment options, maximizing retirement growth potential. This flexibility provides a strategic advantage over traditional employer match plans by enabling greater control and customization of retirement assets.

ESG Investment Options in 401(k)

Employer match programs often include ESG investment options within 401(k) plans, providing employees with an opportunity to grow retirement savings aligned with environmental, social, and governance principles while benefiting from free matching contributions. Self-directed 401(k) accounts offer greater flexibility to select a broader range of ESG funds or individual socially responsible assets, empowering investors to tailor portfolios that meet specific sustainability criteria beyond employer offerings.

Crypto Allocation in Self-Directed IRA

Crypto allocation in self-directed IRAs offers greater diversification and potential growth compared to traditional employer match plans, enabling investors to hold assets like Bitcoin and Ethereum tax-deferred or tax-free. Unlike employer matches that typically limit portfolios to stocks and bonds, self-directed IRAs empower investors to tailor their retirement strategy with alternative assets, enhancing risk-adjusted returns over the long term.

Employer Match vs Self-Directed for retirement. Infographic

moneydiff.com

moneydiff.com