Roth IRAs offer tax-free growth and tax-free withdrawals in retirement, making them a powerful tool for long-term savings with flexible access to contributions. Barista FIRE combines a partial financial independence goal with part-time work, allowing for reduced expenses while maintaining some income and benefits, which can complement IRA savings. Choosing between Roth IRA and Barista FIRE depends on your retirement timeline, risk tolerance, and desire for continued work versus fully tax-advantaged withdrawals.

Table of Comparison

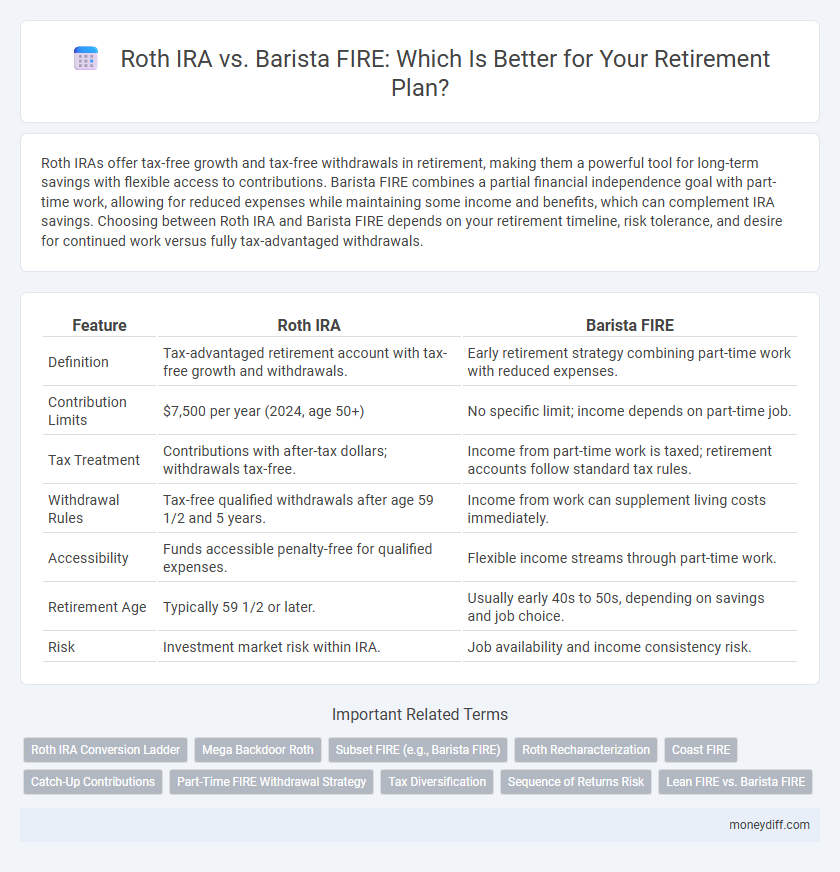

| Feature | Roth IRA | Barista FIRE |

|---|---|---|

| Definition | Tax-advantaged retirement account with tax-free growth and withdrawals. | Early retirement strategy combining part-time work with reduced expenses. |

| Contribution Limits | $7,500 per year (2024, age 50+) | No specific limit; income depends on part-time job. |

| Tax Treatment | Contributions with after-tax dollars; withdrawals tax-free. | Income from part-time work is taxed; retirement accounts follow standard tax rules. |

| Withdrawal Rules | Tax-free qualified withdrawals after age 59 1/2 and 5 years. | Income from work can supplement living costs immediately. |

| Accessibility | Funds accessible penalty-free for qualified expenses. | Flexible income streams through part-time work. |

| Retirement Age | Typically 59 1/2 or later. | Usually early 40s to 50s, depending on savings and job choice. |

| Risk | Investment market risk within IRA. | Job availability and income consistency risk. |

Understanding Roth IRA: Key Features and Benefits

A Roth IRA offers tax-free growth and tax-free withdrawals in retirement, making it a powerful tool for long-term savings with after-tax contributions. Contributions can be withdrawn anytime without penalties, providing flexibility for unexpected expenses before retirement. This retirement account allows for tax diversification, complementing other income sources under Barista FIRE strategies where part-time work supports living expenses without depleting retirement savings.

What is Barista FIRE? Core Principles Explained

Barista FIRE is a retirement strategy that combines early retirement with part-time employment, allowing individuals to cover living expenses without fully relying on savings. Core principles include maintaining a flexible work schedule, minimizing expenses, and using part-time income to supplement withdrawals from investment accounts like Roth IRAs. This approach balances financial independence with continued social engagement and reduced financial risk compared to conventional early retirement.

Tax Advantages: Roth IRA vs Barista FIRE

Roth IRAs offer significant tax advantages by allowing contributions with after-tax dollars and enabling tax-free withdrawals during retirement, making them ideal for maximizing long-term tax savings. Barista FIRE combines part-time work with early retirement savings, providing flexibility in managing taxable income and potentially reducing tax liabilities during the transition phase. Evaluating these strategies requires understanding how Roth IRA's tax-free growth contrasts with Barista FIRE's approach to maintaining steady income while optimizing overall tax efficiency.

Contribution Strategies: Maximizing Your Roth IRA

Maximizing your Roth IRA contributions involves leveraging the annual contribution limit of $6,500 for individuals under 50, and $7,500 for those 50 and older, to benefit from tax-free growth and withdrawals. Consistent, maxed-out yearly contributions, combined with early investing in diverse assets like index funds, optimize long-term compound growth. The Barista FIRE strategy complements this by supplementing Roth IRA savings with part-time work income, reducing the need to withdraw retirement funds prematurely.

Building a Barista FIRE Lifestyle: Practical Steps

Building a Barista FIRE lifestyle involves strategically combining part-time work with tax-efficient savings like a Roth IRA to maintain financial independence while minimizing full retirement age dependency. Prioritize maximizing Roth IRA contributions annually to benefit from tax-free growth and withdrawals, complementing steady part-time income to cover essential expenses. Emphasize budget optimization, healthcare planning, and diversified income streams to sustain a flexible and low-stress retirement framework.

Withdrawal Rules: Comparing Roth IRA and Barista FIRE Flexibility

Roth IRA allows tax-free withdrawals of contributions at any time and qualified earnings after age 59 1/2 without penalties, providing significant flexibility in retirement income planning. Barista FIRE emphasizes part-time work alongside early retirement, offering a more gradual withdrawal approach but relying on continued earned income to supplement savings. While Roth IRA withdrawal rules are federally regulated and predictable, Barista FIRE depends on personal work capacity and income variability, making Roth IRA more stable for flexible access to funds.

Financial Independence Timelines: Roth IRA vs Barista FIRE

Roth IRA offers a structured tax-advantaged retirement savings vehicle with contributions growing tax-free, ideal for individuals targeting long-term financial independence with flexible withdrawal options after age 59 1/2. Barista FIRE emphasizes achieving partial financial independence early by combining savings with part-time "barista" income, allowing for a potentially faster timeline to semi-retirement without fully depending on retirement accounts. Comparing timelines, Roth IRA growth typically requires decades of consistent investing, while Barista FIRE leverages ongoing income streams, which can accelerate reaching financial independence in 10 to 15 years, depending on savings rate and lifestyle expenses.

Risks and Challenges: Roth IRA vs Barista FIRE Approaches

Roth IRAs carry the risk of contribution limits and potential tax law changes impacting future withdrawals, while Barista FIRE faces challenges such as job market instability and burnout from prolonged part-time work. Roth IRA's reliance on market performance exposes retirees to investment volatility, whereas Barista FIRE's hybrid approach depends heavily on sustaining supplemental income streams. Both strategies require careful risk management to ensure long-term financial security during retirement.

Ideal Candidates: Who Should Choose Roth IRA or Barista FIRE?

Ideal candidates for a Roth IRA are individuals with moderate to high current income who anticipate higher tax rates in retirement and want tax-free withdrawals, particularly young professionals and middle-aged workers with stable income. Barista FIRE suits those seeking early retirement while maintaining part-time work to cover living expenses, typically individuals valuing flexibility and lifestyle balance over full financial independence. People with diverse income streams and a willingness to engage in gig or freelance work are better positioned for Barista FIRE, whereas risk-averse investors prioritizing long-term tax benefits favor Roth IRAs.

Combining Roth IRA and Barista FIRE for Optimal Retirement Planning

Combining a Roth IRA with the Barista FIRE strategy enhances retirement flexibility by leveraging tax-free growth and part-time income to reduce financial stress. The Roth IRA allows contributions with post-tax dollars, ensuring tax-free withdrawals, while Barista FIRE offers a sustainable semi-retired lifestyle with lower income requirements. Integrating these approaches optimizes retirement security by balancing tax advantages and manageable expenses.

Related Important Terms

Roth IRA Conversion Ladder

Roth IRA Conversion Ladder offers a tax-efficient strategy for accessing retirement funds early by converting traditional IRA assets into Roth IRAs over several years, minimizing tax impact and allowing penalty-free withdrawals after five years. This approach contrasts with Barista FIRE, which relies on part-time work income to bridge the gap before full retirement, providing more flexibility but less tax advantage than a well-executed Roth IRA Conversion Ladder.

Mega Backdoor Roth

Mega Backdoor Roth contributions enable high-income earners to maximize Roth IRA savings by funneling after-tax 401(k) contributions into a Roth account, surpassing traditional Roth IRA limits. This strategy offers greater tax-free growth potential compared to Barista FIRE, which relies on partial early retirement with supplemental income, making Mega Backdoor Roth ideal for aggressive retirement funding.

Subset FIRE (e.g., Barista FIRE)

Barista FIRE, a subset of FIRE, emphasizes part-time work to cover essential expenses while maintaining a smaller Roth IRA for tax-advantaged growth and flexibility. This approach balances moderate savings with reduced full-time employment, optimizing tax benefits and lifestyle sustainability in retirement.

Roth Recharacterization

Roth IRA recharacterization allows investors to correct or reverse contributions between traditional and Roth IRAs, optimizing tax efficiency and retirement savings growth. Compared to Barista FIRE, which emphasizes semi-retirement income through part-time work, leveraging Roth recharacterization provides greater flexibility in managing tax liabilities and maximizing after-tax retirement funds.

Coast FIRE

Coast FIRE leverages early contributions to a Roth IRA, allowing investments to grow tax-free until retirement without additional savings. Barista FIRE combines part-time work income with Roth IRA withdrawals, providing financial flexibility while achieving a semi-retired lifestyle.

Catch-Up Contributions

Roth IRA catch-up contributions allow individuals aged 50 and over to add an extra $1,000 annually beyond the standard $6,500 limit, maximizing tax-free growth potential for retirement savings. In contrast, Barista FIRE strategies emphasize maintaining part-time work post-retirement to supplement income without relying heavily on accelerated catch-up contributions.

Part-Time FIRE Withdrawal Strategy

The Roth IRA offers tax-free withdrawals after age 59 1/2, making it ideal for a Part-Time FIRE withdrawal strategy by providing flexible, penalty-free access to retirement funds during transitional work phases. Barista FIRE complements this approach by enabling early retirees to work part-time in lower-stress jobs while tapping into Roth IRA distributions strategically to cover living expenses without depleting retirement savings prematurely.

Tax Diversification

Roth IRA offers tax-free growth and withdrawals, providing tax diversification by locking in tax advantages upfront. Barista FIRE complements this strategy through part-time income, reducing the need to draw down taxable accounts early and allowing more flexibility in managing tax liabilities during retirement.

Sequence of Returns Risk

Roth IRA offers tax-free growth and withdrawals, reducing Sequence of Returns Risk by allowing contributions to compound without early taxation, crucial during market downturns. Barista FIRE mitigates Sequence of Returns Risk through part-time income, providing a financial buffer that supports portfolio longevity despite volatile market returns.

Lean FIRE vs. Barista FIRE

Barista FIRE emphasizes supplementing retirement income through part-time work while maintaining employer benefits, making it a hybrid between full retirement and continued employment, whereas Lean FIRE relies solely on minimalist living and aggressive savings to achieve early, fully independent retirement. Choosing Barista FIRE can offer more financial flexibility and reduce risk by balancing income streams compared to the stricter budgeting and asset depletion typical in Lean FIRE strategies.

Roth IRA vs Barista FIRE for retirement. Infographic

moneydiff.com

moneydiff.com