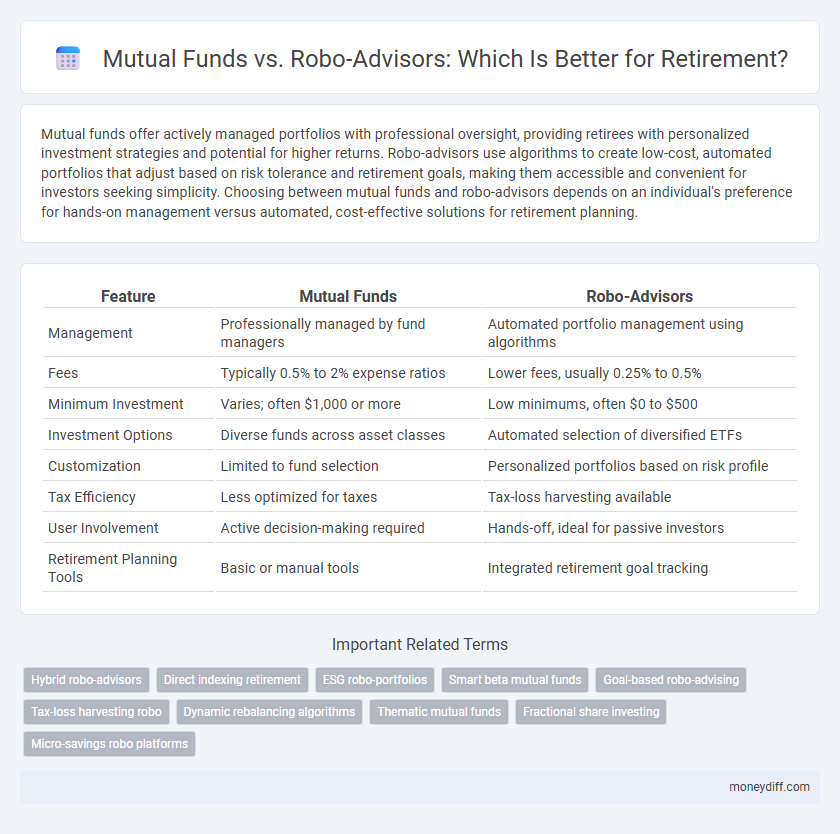

Mutual funds offer actively managed portfolios with professional oversight, providing retirees with personalized investment strategies and potential for higher returns. Robo-advisors use algorithms to create low-cost, automated portfolios that adjust based on risk tolerance and retirement goals, making them accessible and convenient for investors seeking simplicity. Choosing between mutual funds and robo-advisors depends on an individual's preference for hands-on management versus automated, cost-effective solutions for retirement planning.

Table of Comparison

| Feature | Mutual Funds | Robo-Advisors |

|---|---|---|

| Management | Professionally managed by fund managers | Automated portfolio management using algorithms |

| Fees | Typically 0.5% to 2% expense ratios | Lower fees, usually 0.25% to 0.5% |

| Minimum Investment | Varies; often $1,000 or more | Low minimums, often $0 to $500 |

| Investment Options | Diverse funds across asset classes | Automated selection of diversified ETFs |

| Customization | Limited to fund selection | Personalized portfolios based on risk profile |

| Tax Efficiency | Less optimized for taxes | Tax-loss harvesting available |

| User Involvement | Active decision-making required | Hands-off, ideal for passive investors |

| Retirement Planning Tools | Basic or manual tools | Integrated retirement goal tracking |

Understanding Mutual Funds and Robo-Advisors

Mutual funds pool money from multiple investors to invest in diversified portfolios managed by professional fund managers, offering a range of asset classes for long-term retirement growth. Robo-advisors use algorithms and automated platforms to create personalized investment strategies with low fees, providing convenience and continuous portfolio rebalancing tailored to individual retirement goals. Comparing performance, cost structures, and control levels helps retirees choose between the hands-on management of mutual funds and the tech-driven efficiency of robo-advisors.

Key Differences Between Mutual Funds and Robo-Advisors

Mutual funds offer a diverse range of professionally managed investment portfolios pooling money from multiple investors, while robo-advisors provide automated, algorithm-driven financial planning with minimal human intervention. Mutual funds often involve higher fees due to active management and may require minimum investments, whereas robo-advisors typically offer lower-cost, personalized asset allocation with automatic rebalancing. Investors seeking retirement solutions should consider factors like cost structure, level of human oversight, and customization when comparing mutual funds and robo-advisors for long-term portfolio growth.

Cost Comparison: Fees and Expenses

Mutual funds often come with expense ratios averaging 0.5% to 1.5%, which can erode retirement savings over time. Robo-advisors typically charge lower fees, around 0.25% or less, due to automated portfolio management and reduced overhead costs. Evaluating these expense differences is crucial for maximizing long-term retirement portfolio growth and minimizing cost-related drag.

Investment Strategy and Management Styles

Mutual funds offer actively managed portfolios with professional fund managers selecting diversified assets to align with retirement goals, emphasizing human oversight and strategic adjustments. Robo-advisors utilize algorithm-driven investment strategies, providing automated portfolio management with low fees, continuous rebalancing, and tax-efficient optimization tailored to retirement timelines. Investors seeking personalized financial expertise may prefer mutual funds, while those prioritizing cost-effective, hands-off management might opt for robo-advisors in their retirement planning.

Accessibility and Ease of Use

Mutual funds offer wide accessibility through traditional brokerage platforms, allowing retirees to invest with varying minimum amounts and professional management. Robo-advisors provide unparalleled ease of use with automated portfolio management, low fees, and user-friendly digital interfaces tailored for effortless retirement planning. Both options cater to different levels of investor expertise, with robo-advisors simplifying decision-making and mutual funds offering more control over specific asset selections.

Customization and Personalization for Retirement Goals

Mutual funds offer professional management with varying risk levels and asset mixes but provide limited personalization for individual retirement objectives. Robo-advisors leverage algorithms to tailor portfolios based on specific retirement goals, risk tolerance, and timelines, offering automated adjustments and personalized investment strategies. This customization enhances alignment with evolving retirement needs, making robo-advisors a flexible choice for personalized retirement planning.

Performance and Historical Returns

Mutual funds have a long track record of delivering consistent historical returns, often benefiting from active management to outperform market benchmarks in retirement portfolios. Robo-advisors utilize algorithm-driven strategies to optimize asset allocation and rebalance automatically, aiming to maximize long-term retirement performance with lower fees. Historical data shows that while mutual funds can offer high returns, robo-advisors provide competitive performance by reducing costs and minimizing emotional decision-making in retirement investing.

Risk Management and Diversification

Mutual funds offer professional portfolio management with built-in diversification across various asset classes, reducing risk through experienced fund managers' strategies. Robo-advisors leverage algorithms to optimize asset allocation, automatically rebalancing portfolios to maintain target risk levels tailored to individual retirement goals. Both options provide efficient risk management and diversification, but robo-advisors offer cost-effective, tech-driven adjustments while mutual funds rely on human expertise for dynamic decision-making.

Tax Efficiency for Retirement Investors

Mutual funds often distribute capital gains annually, potentially generating taxable events that reduce retirement savings growth, whereas robo-advisors leverage tax-loss harvesting to offset gains and enhance tax efficiency. Robo-advisors utilize algorithm-driven strategies to optimize asset allocation and minimize tax liabilities, providing a tailored approach for long-term retirement planning. Investors seeking tax-efficient growth may benefit from robo-advisor platforms that systematically manage portfolio taxes while maintaining diversified mutual fund holdings.

Choosing the Right Option for Your Retirement Portfolio

Choosing between mutual funds and robo-advisors for your retirement portfolio depends on your investment preferences and risk tolerance. Mutual funds offer professional management and diversification but may come with higher fees and less customization. Robo-advisors provide automated, low-cost portfolio management with algorithm-driven asset allocation, making them ideal for hands-off investors seeking convenience and efficiency.

Related Important Terms

Hybrid robo-advisors

Hybrid robo-advisors combine the automated portfolio management of traditional robo-advisors with access to human financial advisors, offering personalized strategies for retirement planning that mutual funds alone may not provide. This approach optimizes retirement savings by blending algorithm-driven investment with tailored advice, enhancing portfolio diversification and risk management.

Direct indexing retirement

Direct indexing retirement strategies offer personalized portfolio construction by purchasing individual securities, providing tax-loss harvesting advantages that can improve after-tax returns compared to traditional mutual funds and robo-advisors. Unlike mutual funds and robo-advisors, direct indexing enables retirees to tailor investments according to specific financial goals and risk tolerance, optimizing retirement income streams.

ESG robo-portfolios

Mutual funds offer diversified retirement investment options with professional management, but ESG robo-advisors provide automated, algorithm-driven portfolios that prioritize environmental, social, and governance criteria for socially responsible investing. ESG robo-portfolios combine low fees and personalized asset allocation, optimizing retirement savings aligned with ethical values and long-term financial goals.

Smart beta mutual funds

Smart beta mutual funds offer a strategy-driven approach by systematically selecting and weighting stocks based on factors like value, momentum, or volatility, appealing to retirement investors seeking enhanced risk-adjusted returns. Compared to robo-advisors, which provide automated portfolio management with algorithmic adjustments, smart beta funds deliver targeted exposure to specific market inefficiencies, potentially boosting long-term retirement income.

Goal-based robo-advising

Goal-based robo-advisors tailor retirement investment strategies by automatically adjusting mutual fund allocations to align with specific milestones and risk tolerance, enhancing personalized portfolio management. This technology leverages algorithms and data-driven insights to optimize returns while minimizing risk, making it an efficient alternative to traditional mutual fund investing for retirement planning.

Tax-loss harvesting robo

Robo-advisors offer automated tax-loss harvesting, optimizing retirement portfolios by systematically selling losing investments to offset gains and reduce tax liabilities. Mutual funds typically lack this feature, making robo-advisors a more tax-efficient choice for maximizing after-tax retirement returns.

Dynamic rebalancing algorithms

Dynamic rebalancing algorithms in robo-advisors provide automated, real-time portfolio adjustments based on market conditions, optimizing retirement savings growth and risk management. Mutual funds typically offer periodic rebalancing, potentially missing short-term market shifts, making robo-advisors more efficient for personalized, adaptive retirement investment strategies.

Thematic mutual funds

Thematic mutual funds offer targeted investment opportunities by focusing on specific sectors or trends, making them ideal for investors aiming for diversified, long-term retirement growth aligned with emerging market themes. Robo-advisors enhance retirement portfolios by automating asset allocation and rebalancing, but integrating thematic mutual funds can provide strategic exposure to high-potential industries within these automated platforms.

Fractional share investing

Fractional share investing enables retirement portfolios to diversify more efficiently by allowing investors to purchase precise amounts of mutual funds or robo-advisor-managed ETFs regardless of share price. Robo-advisors often enhance fractional investing with algorithmic portfolio rebalancing and automatic dividend reinvestment, offering a seamless, low-cost approach compared to traditional mutual fund purchases with minimum investment thresholds.

Micro-savings robo platforms

Micro-savings robo-advisors for retirement offer automated portfolio management with low minimum investments, making consistent contributions accessible and reducing the complexity compared to traditional mutual funds. These platforms leverage algorithms to optimize asset allocation, often resulting in lower fees and personalized risk adjustments tailored to individual retirement goals.

Mutual funds vs robo-advisors for retirement. Infographic

moneydiff.com

moneydiff.com