Index funds offer broad market exposure with low fees, making them a cost-effective option for retirement portfolios focused on long-term growth. ESG retirement funds integrate environmental, social, and governance criteria, appealing to investors seeking to align their investments with personal values while potentially managing risk. Choosing between index funds and ESG funds depends on balancing cost efficiency with the desire for socially responsible investing.

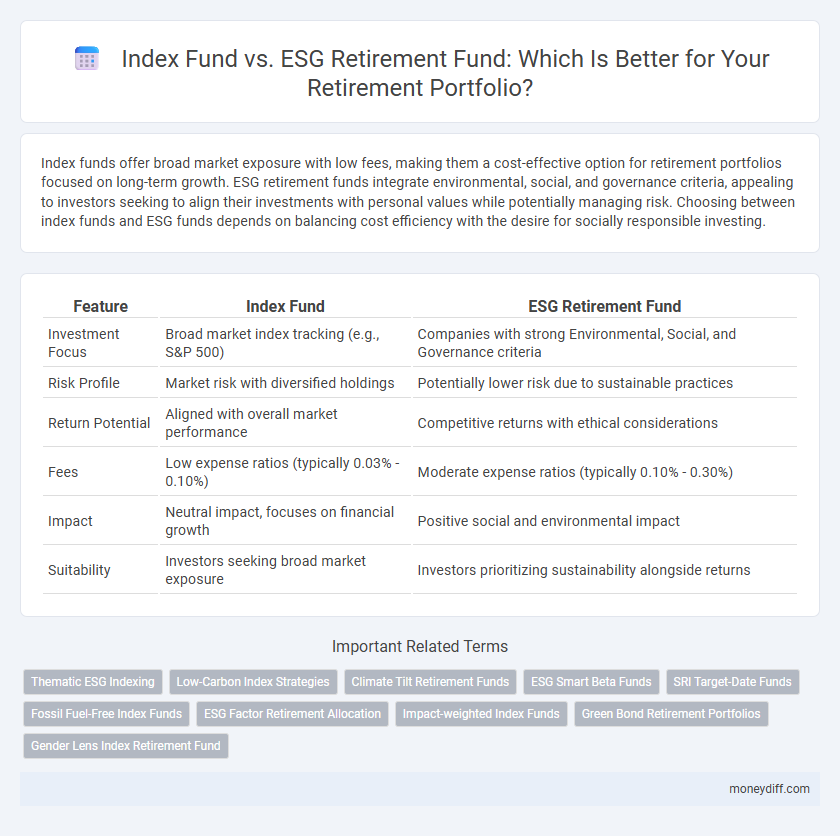

Table of Comparison

| Feature | Index Fund | ESG Retirement Fund |

|---|---|---|

| Investment Focus | Broad market index tracking (e.g., S&P 500) | Companies with strong Environmental, Social, and Governance criteria |

| Risk Profile | Market risk with diversified holdings | Potentially lower risk due to sustainable practices |

| Return Potential | Aligned with overall market performance | Competitive returns with ethical considerations |

| Fees | Low expense ratios (typically 0.03% - 0.10%) | Moderate expense ratios (typically 0.10% - 0.30%) |

| Impact | Neutral impact, focuses on financial growth | Positive social and environmental impact |

| Suitability | Investors seeking broad market exposure | Investors prioritizing sustainability alongside returns |

Understanding Index Funds: Foundation for Retirement

Index funds provide a low-cost, diversified foundation for retirement portfolios by tracking broad market indices such as the S&P 500, offering consistent growth with lower fees compared to actively managed funds. These funds enhance retirement savings through market exposure, minimizing risks associated with individual stock selection and enabling compounding returns over time. Understanding the mechanics and historical performance of index funds helps investors build a reliable retirement portfolio base before considering specialized options like ESG funds.

What Are ESG Retirement Funds?

ESG retirement funds focus on investing in companies that meet environmental, social, and governance criteria, aligning portfolio growth with sustainable and ethical practices. These funds aim to generate competitive returns while supporting responsible corporate behavior, making them appealing for socially conscious retirees. In contrast to traditional index funds, ESG funds exclude industries that negatively impact society or the environment, potentially offering lower risk through consideration of non-financial factors.

Performance Trends: Index Funds vs ESG Funds

Index funds have historically delivered consistent, broad-market returns with lower fees and minimal tracking error, making them a reliable foundation for retirement portfolios. ESG retirement funds, while increasingly popular, show mixed performance trends depending on sector allocation and ESG criteria, sometimes outperforming traditional index funds during market volatility due to their focus on sustainability and governance factors. Recent studies indicate that ESG funds may offer competitive returns without sacrificing diversification, but investors should carefully evaluate fund objectives against long-term retirement goals.

Risk Considerations in Retirement Portfolios

Index funds typically offer broad market exposure with lower volatility, making them a stable choice for retirement portfolios focused on risk management. ESG retirement funds integrate environmental, social, and governance criteria, potentially reducing exposure to companies with high regulatory or reputational risks but may face sector concentration. Diversifying between index funds and ESG funds can balance risk by combining broad market stability with targeted risk mitigation aligned to sustainable investing principles.

Fees and Expenses: Cost Comparison

Index funds generally offer lower fees and expenses compared to ESG retirement funds, making them a cost-effective choice for long-term retirement portfolios. ESG funds often incur higher management fees due to the inclusion of environmental, social, and governance criteria in their investment strategies. Investors seeking to minimize costs and maximize net returns may prefer index funds, while those prioritizing ethical considerations might accept slightly higher expenses associated with ESG funds.

Diversification Benefits for Retirees

Index funds offer broad market exposure and low fees, providing retirees with consistent diversification across various sectors and asset classes. ESG retirement funds incorporate environmental, social, and governance criteria, appealing to investors seeking ethical investments but may concentrate holdings in specific industries or companies. Combining both fund types can enhance portfolio diversification by balancing traditional market coverage with values-driven asset selection, potentially reducing risk and aligning with retirees' financial and social goals.

Aligning Values with Investment Goals

Index funds offer broad market exposure and low fees, making them a cost-effective option for retirement portfolios focused on steady growth. ESG retirement funds prioritize companies with strong environmental, social, and governance practices, aligning investments with personal values and ethical considerations while still aiming for competitive returns. Balancing financial goals with ethical standards in ESG funds helps investors build portfolios that reflect their long-term principles and support sustainable business practices.

Historical Returns: ESG vs Index Funds

Historical returns show that traditional index funds often outperform ESG retirement funds due to their broader market exposure and lower expense ratios. ESG funds tend to have higher fees and may underperform in volatile markets because of their sector restrictions and emphasis on sustainability criteria. Investors seeking long-term growth for retirement portfolios should weigh the potential trade-offs between inclusive market returns from index funds and the ethical considerations prioritized by ESG funds.

Tax Efficiency in Retirement Accounts

Index funds generally offer higher tax efficiency within retirement accounts compared to ESG retirement funds, due to their lower turnover rates and minimal capital gains distributions. ESG funds often engage in more frequent buying and selling to align with evolving sustainability criteria, which can trigger higher taxable events even in tax-advantaged accounts like IRAs or 401(k)s. Prioritizing tax efficiency in retirement portfolios helps maximize after-tax returns and preserve wealth over the long term.

Which Fund Type Suits Your Retirement Strategy?

Index funds offer broad market exposure with low fees, making them suitable for investors seeking steady, diversified growth in retirement portfolios. ESG retirement funds emphasize environmental, social, and governance criteria, appealing to those prioritizing ethical investing alongside financial returns. Choosing between these depends on your retirement goals, risk tolerance, and personal values around sustainability and social impact.

Related Important Terms

Thematic ESG Indexing

Thematic ESG indexing integrates environmental, social, and governance factors into retirement portfolios, offering targeted exposure to sustainability-driven companies while maintaining the diversification benefits of index funds. Compared to traditional index funds, thematic ESG retirement funds align investments with ethical values and emerging market trends, potentially enhancing long-term risk-adjusted returns for socially conscious retirees.

Low-Carbon Index Strategies

Low-carbon index strategies within retirement portfolios prioritize reducing carbon exposure while maintaining diversified market returns, making them an efficient choice for sustainable long-term growth. ESG retirement funds often integrate broader environmental, social, and governance criteria, but low-carbon index funds specifically target carbon footprint reduction, appealing to investors seeking to align financial goals with climate impact mitigation.

Climate Tilt Retirement Funds

Climate tilt retirement funds integrate environmental, social, and governance (ESG) criteria by prioritizing companies with strong climate risk management, offering a targeted approach to sustainable investing within retirement portfolios. Traditional index funds provide broad market exposure but may lack the focused climate-conscious strategy that climate tilt ESG funds deliver for long-term environmental impact and potential risk mitigation.

ESG Smart Beta Funds

ESG Smart Beta retirement funds integrate environmental, social, and governance criteria with factor-based investing strategies to enhance portfolio resilience and align with ethical values. These funds target specific investment factors such as value, momentum, or quality while promoting sustainable practices, often outperforming traditional index funds during market volatility.

SRI Target-Date Funds

SRI Target-Date Funds combine the benefits of socially responsible investing (SRI) with the automatic asset rebalancing of target-date funds, making them a compelling alternative to traditional index funds in retirement portfolios. These funds prioritize environmental, social, and governance (ESG) criteria while aligning investment risk with an investor's expected retirement date, enhancing both ethical impact and long-term growth potential.

Fossil Fuel-Free Index Funds

Fossil fuel-free index funds prioritize companies with strong environmental, social, and governance (ESG) criteria by excluding fossil fuel producers, aligning retirement portfolios with sustainable investment goals and reducing carbon footprint exposure. These funds offer diversified market performance comparable to traditional index funds while supporting clean energy transitions and addressing long-term climate risks for retirement savings.

ESG Factor Retirement Allocation

ESG retirement funds integrate environmental, social, and governance criteria into portfolio allocation, aiming to align investments with ethical values while targeting competitive long-term returns. Index funds typically track broad market benchmarks, offering diversification and low fees, but may lack intentional ESG-focused screening, making ESG factor retirement allocation crucial for investors prioritizing sustainability alongside retirement growth.

Impact-weighted Index Funds

Impact-weighted index funds integrate environmental, social, and governance (ESG) criteria into traditional indexing methodologies, aiming to maximize financial returns while promoting sustainable and socially responsible outcomes. These funds offer retirement portfolios a balanced approach by aligning investment growth with positive societal impact, often outperforming conventional index funds through enhanced risk management and long-term value creation.

Green Bond Retirement Portfolios

Green bond retirement portfolios offer a sustainable investment approach, combining the steady returns of index funds with the environmental benefits of ESG criteria, specifically targeting projects that promote renewable energy and carbon reduction. Compared to traditional index funds, ESG retirement funds incorporating green bonds not only support eco-friendly initiatives but also mitigate long-term risks associated with climate change, making them a strategic choice for environmentally conscious retirees.

Gender Lens Index Retirement Fund

Gender Lens Index Retirement Funds integrate ESG criteria with gender diversity metrics, enhancing portfolio inclusivity by prioritizing companies advancing women's leadership and equality. These funds often outperform traditional Index Funds by targeting social impact alongside financial returns, appealing to investors seeking both ethical and gender-conscious retirement strategies.

Index Fund vs ESG Retirement Fund for retirement portfolios. Infographic

moneydiff.com

moneydiff.com