The Bucket Strategy segments retirement savings into different time frames to manage risk and liquidity, ensuring funds are available when needed without market exposure. The Perpetual Withdrawal Rate approach, often set around 4%, aims to sustain a constant withdrawal amount adjusted for inflation, relying on portfolio growth to last indefinitely. Choosing between these methods depends on personal risk tolerance and financial goals, as the Bucket Strategy offers segmented control while the Perpetual Withdrawal Rate emphasizes long-term portfolio sustainability.

Table of Comparison

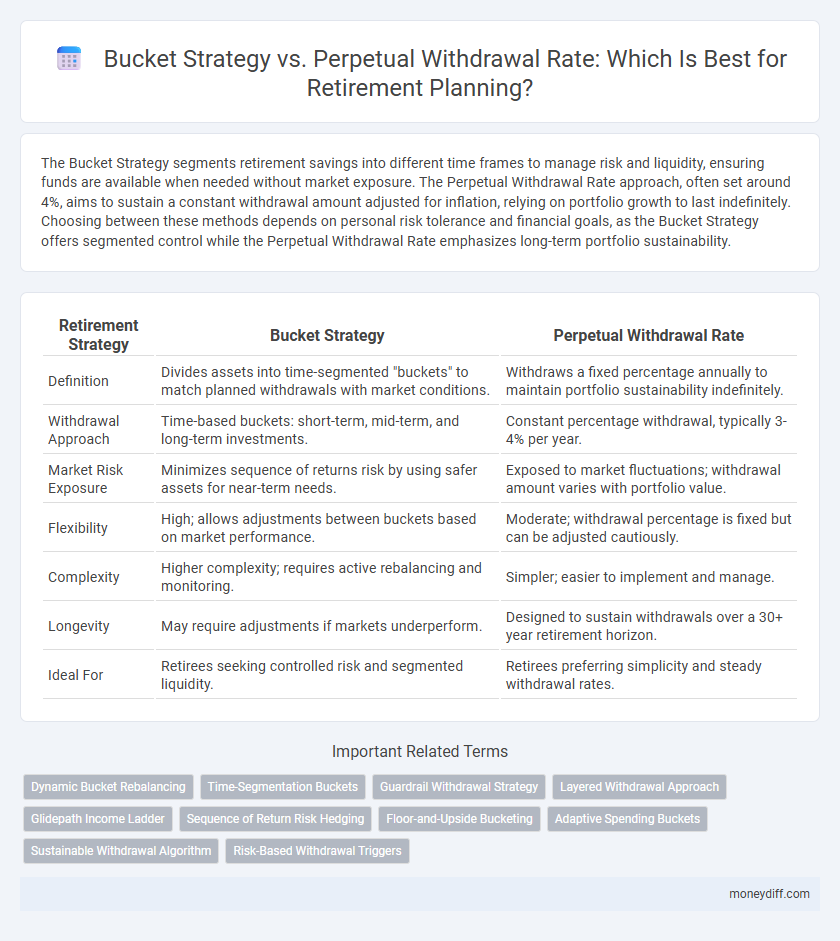

| Retirement Strategy | Bucket Strategy | Perpetual Withdrawal Rate |

|---|---|---|

| Definition | Divides assets into time-segmented "buckets" to match planned withdrawals with market conditions. | Withdraws a fixed percentage annually to maintain portfolio sustainability indefinitely. |

| Withdrawal Approach | Time-based buckets: short-term, mid-term, and long-term investments. | Constant percentage withdrawal, typically 3-4% per year. |

| Market Risk Exposure | Minimizes sequence of returns risk by using safer assets for near-term needs. | Exposed to market fluctuations; withdrawal amount varies with portfolio value. |

| Flexibility | High; allows adjustments between buckets based on market performance. | Moderate; withdrawal percentage is fixed but can be adjusted cautiously. |

| Complexity | Higher complexity; requires active rebalancing and monitoring. | Simpler; easier to implement and manage. |

| Longevity | May require adjustments if markets underperform. | Designed to sustain withdrawals over a 30+ year retirement horizon. |

| Ideal For | Retirees seeking controlled risk and segmented liquidity. | Retirees preferring simplicity and steady withdrawal rates. |

Introduction to Retirement Withdrawal Strategies

Retirement withdrawal strategies like the Bucket Strategy and Perpetual Withdrawal Rate offer distinct approaches to managing savings during retirement. The Bucket Strategy segments assets into short, medium, and long-term buckets to align withdrawals with market conditions and spending needs. The Perpetual Withdrawal Rate focuses on a fixed percentage withdrawal annually, aiming to sustain portfolio longevity over a lifetime.

What is the Bucket Strategy?

The Bucket Strategy divides retirement assets into multiple segments or "buckets" based on time horizons, ensuring short-term needs are met with low-risk investments while allowing long-term funds to remain invested for growth. This approach minimizes the risk of having to sell investments during market downturns, providing a psychological and financial buffer. Compared to the Perpetual Withdrawal Rate, which seeks a fixed sustainable withdrawal percentage, the Bucket Strategy offers more flexibility by aligning asset allocation with spending timelines.

Understanding the Perpetual Withdrawal Rate

The Perpetual Withdrawal Rate (PWR) is a retirement strategy designed to provide a steady income stream by withdrawing a fixed percentage from a diversified investment portfolio, aiming to sustain funds indefinitely. Unlike the Bucket Strategy, which segments assets into time-specific buckets for short-, medium-, and long-term needs, PWR relies on market growth to replenish withdrawals over time. Understanding PWR involves recognizing its emphasis on balancing withdrawal rates with investment returns to minimize the risk of portfolio depletion during retirement.

Key Differences Between Bucket Strategy and Perpetual Withdrawal Rate

Bucket Strategy segments retirement savings into multiple time-based portfolios, allowing for tailored investment risk and liquidity over short, medium, and long-term needs. Perpetual Withdrawal Rate focuses on a fixed, sustainable annual withdrawal percentage from a single portfolio, aiming to maintain portfolio longevity throughout retirement. The key difference lies in the Bucket Strategy's compartmentalization approach versus the Perpetual Withdrawal Rate's steady, uniform withdrawal from an aggregated investment pool.

Pros and Cons of the Bucket Strategy

The Bucket Strategy divides retirement savings into separate accounts or "buckets" based on time horizons, offering a clear framework for managing short-term and long-term financial needs. This approach provides psychological comfort and reduces sequence of returns risk by ensuring funds for immediate expenses are insulated from market volatility. However, the Bucket Strategy can be complex to manage, often requiring frequent adjustments and potentially lower growth due to conservative allocations in short-term buckets.

Benefits and Drawbacks of the Perpetual Withdrawal Rate

The Perpetual Withdrawal Rate offers a sustainable income by adjusting withdrawals based on portfolio performance, reducing the risk of depleting assets prematurely during retirement. Its benefit lies in promoting longevity of funds while maintaining flexibility, but the primary drawback is potential income variability, which can challenge retirees seeking predictable cash flow. Unlike the Bucket Strategy, which segments assets for short- and long-term needs, the Perpetual Withdrawal Rate lacks a clear delineation between risk zones, potentially increasing exposure to market volatility.

Risk Tolerance and Suitability: Which Strategy Fits You?

The Bucket Strategy offers a structured approach by dividing retirement savings into short-, medium-, and long-term funds, making it suitable for retirees with low risk tolerance who prefer predictable income streams. The Perpetual Withdrawal Rate method assumes a fixed percentage withdrawal from a diversified portfolio, appealing to investors with higher risk tolerance comfortable with market fluctuations. Choosing the right approach depends on individual risk tolerance, time horizon, and income stability preferences to ensure a sustainable retirement plan.

Impact of Market Volatility on Both Strategies

The Bucket Strategy segments retirement savings into short-, medium-, and long-term buckets to reduce the impact of market volatility by preserving funds for immediate needs in low-risk assets. The Perpetual Withdrawal Rate relies on a fixed percentage withdrawal from a diversified portfolio, which can be more vulnerable to market downturns as it assumes portfolio growth to sustain withdrawals. Market volatility can disrupt the Perpetual Withdrawal Rate by depleting assets during downturns, whereas the Bucket Strategy offers a buffer by shielding short-term funds from market swings.

Case Studies: Real-World Applications and Outcomes

Case studies comparing the Bucket Strategy and Perpetual Withdrawal Rate reveal distinct advantages in managing retirement income. Retirees using the Bucket Strategy often experience reduced sequence-of-returns risk by segmenting assets into short-, medium-, and long-term buckets, enhancing cash flow reliability. Conversely, perpetual withdrawal rate approaches, such as the 4% rule, provide simplicity but may face challenges adapting to market volatility, as demonstrated in longitudinal outcomes of retiree cohorts.

Choosing the Right Withdrawal Approach for Your Retirement

Choosing the right withdrawal approach for retirement depends on balancing income stability and portfolio longevity. The Bucket Strategy allocates assets into time-specific segments to provide predictable cash flow and reduce market risk in early retirement years. In contrast, the Perpetual Withdrawal Rate method emphasizes a sustainable percentage withdrawal, aiming to maintain portfolio value indefinitely by adjusting spending based on market performance.

Related Important Terms

Dynamic Bucket Rebalancing

Dynamic Bucket Rebalancing in retirement planning enhances the Bucket Strategy by adjusting asset allocation across time-based segments to mitigate sequence of returns risk and maintain liquidity for short-term needs. This approach contrasts with the Perpetual Withdrawal Rate method, which relies on a fixed percentage, offering less flexibility to adapt to market fluctuations and changing withdrawal requirements.

Time-Segmentation Buckets

Time-Segmentation Buckets in the Bucket Strategy allocate retirement savings into distinct time frames to manage market risk and liquidity, contrasting with the Perpetual Withdrawal Rate approach that relies on a fixed percentage withdrawal to sustain a portfolio indefinitely. This segmentation optimizes cash flow stability by ensuring short-term needs are met with low-risk assets while allowing long-term growth through exposure to equities, reducing sequence of returns risk.

Guardrail Withdrawal Strategy

The Guardrail Withdrawal Strategy adjusts spending based on portfolio performance, reducing the risk of depleting retirement funds compared to the fixed rates used in Bucket Strategy and Perpetual Withdrawal Rate methods. This dynamic approach maintains sustainability by setting upper and lower withdrawal limits tied to asset value fluctuations, providing retirees with a flexible income stream that adapts to market conditions.

Layered Withdrawal Approach

The Bucket Strategy segments retirement savings into time-based layers, matching low-risk assets for near-term expenses and growth assets for long-term needs to reduce sequence of returns risk. The Perpetual Withdrawal Rate method emphasizes sustainable annual withdrawals, adjusting for portfolio performance, while the Layered Withdrawal Approach combines both by structuring withdrawals through defined asset buckets aligned with withdrawal horizons and dynamic adjustments.

Glidepath Income Ladder

The Glidepath Income Ladder combines the Bucket Strategy's short-term security with the Perpetual Withdrawal Rate's long-term sustainability by gradually shifting asset allocation from conservative to growth investments over time. This approach optimizes retirement income by ensuring liquidity in early years while supporting portfolio longevity through dynamic adjustments aligned with market conditions.

Sequence of Return Risk Hedging

The Bucket Strategy mitigates sequence of return risk by segmenting retirement funds into time-specific buckets, ensuring short-term liquidity while allowing longer-term investments to grow uninterrupted. In contrast, the Perpetual Withdrawal Rate approach continuously adjusts withdrawals based on portfolio performance, offering dynamic flexibility but potentially higher exposure to sequence risk during market downturns.

Floor-and-Upside Bucketing

Floor-and-Upside Bucketing in retirement compares favorably to the Perpetual Withdrawal Rate by dividing assets into a guaranteed income "floor" and a growth-oriented "upside" bucket, ensuring stable essential expenses are covered while allowing for portfolio growth. This strategy enhances risk management by isolating longevity risk in the fixed-income floor, reducing sequence of returns risk compared to a single withdrawal rate applied uniformly across the portfolio.

Adaptive Spending Buckets

Adaptive Spending Buckets optimize retirement income by segmenting assets into time-based buckets that adjust spending according to market performance and longevity risk, enhancing flexibility over Perpetual Withdrawal Rate strategies. This approach balances short-term liquidity with long-term growth, reducing sequence-of-returns risk while maintaining sustainable spending throughout retirement.

Sustainable Withdrawal Algorithm

The Sustainable Withdrawal Algorithm integrates the Bucket Strategy and Perpetual Withdrawal Rate by dynamically adjusting withdrawal amounts based on market conditions and portfolio performance to optimize longevity. This approach balances short-term liquidity from bucket allocations with long-term growth expectations, reducing sequence-of-return risk while maintaining a reliable income stream throughout retirement.

Risk-Based Withdrawal Triggers

The Bucket Strategy manages retirement funds by allocating assets into distinct time-based segments, reducing sequence of returns risk through scheduled withdrawals from low-risk buckets during market downturns. In contrast, the Perpetual Withdrawal Rate adjusts distributions dynamically based on portfolio performance and risk thresholds, employing risk-based withdrawal triggers to preserve capital and sustain income over an uncertain retirement horizon.

Bucket Strategy vs Perpetual Withdrawal Rate for retirement. Infographic

moneydiff.com

moneydiff.com