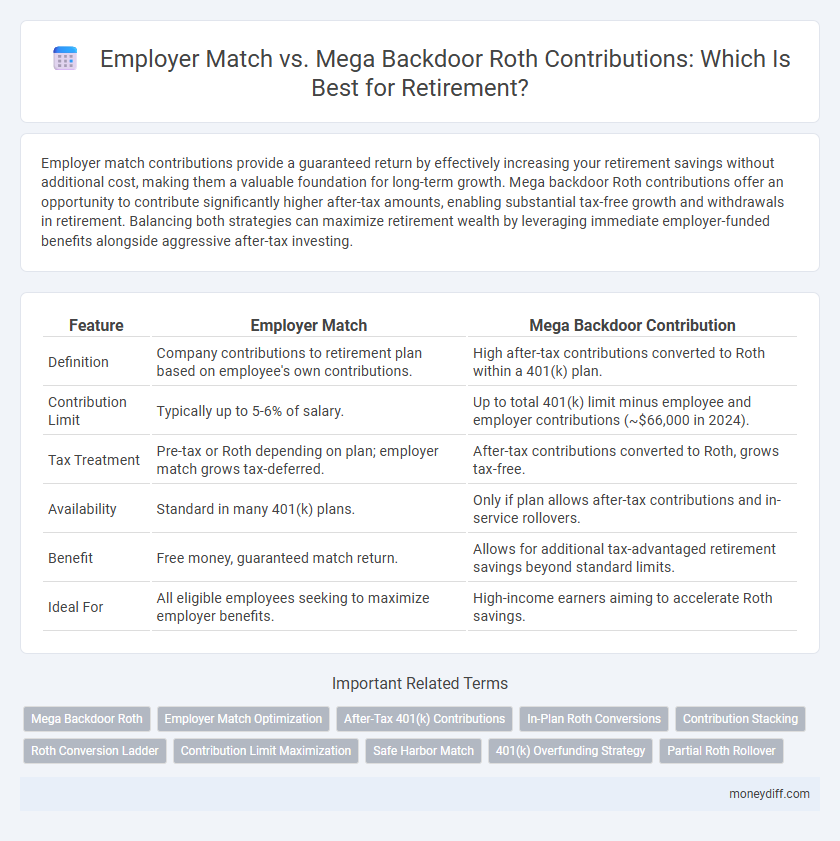

Employer match contributions provide a guaranteed return by effectively increasing your retirement savings without additional cost, making them a valuable foundation for long-term growth. Mega backdoor Roth contributions offer an opportunity to contribute significantly higher after-tax amounts, enabling substantial tax-free growth and withdrawals in retirement. Balancing both strategies can maximize retirement wealth by leveraging immediate employer-funded benefits alongside aggressive after-tax investing.

Table of Comparison

| Feature | Employer Match | Mega Backdoor Contribution |

|---|---|---|

| Definition | Company contributions to retirement plan based on employee's own contributions. | High after-tax contributions converted to Roth within a 401(k) plan. |

| Contribution Limit | Typically up to 5-6% of salary. | Up to total 401(k) limit minus employee and employer contributions (~$66,000 in 2024). |

| Tax Treatment | Pre-tax or Roth depending on plan; employer match grows tax-deferred. | After-tax contributions converted to Roth, grows tax-free. |

| Availability | Standard in many 401(k) plans. | Only if plan allows after-tax contributions and in-service rollovers. |

| Benefit | Free money, guaranteed match return. | Allows for additional tax-advantaged retirement savings beyond standard limits. |

| Ideal For | All eligible employees seeking to maximize employer benefits. | High-income earners aiming to accelerate Roth savings. |

Understanding Employer Match and Mega Backdoor Roth Contributions

Employer match contributions in a 401(k) plan provide a direct boost to retirement savings by adding a percentage of employee contributions, effectively increasing the overall investment without additional employee cost. Mega Backdoor Roth contributions allow high-income earners to contribute significantly beyond regular limits by using after-tax 401(k) contributions and converting them to a Roth account, enabling tax-free growth and withdrawals. Comparing both, employer matches offer guaranteed immediate value while mega backdoor Roth strategies maximize long-term tax advantages for higher contribution limits.

Key Differences Between Employer Match and Mega Backdoor Strategies

Employer match contributions are limited by a percentage of employee salary, typically up to 6%, directly boosting traditional 401(k) savings with pre-tax or Roth options. Mega backdoor contributions enable after-tax contributions beyond standard limits, allowing significant additional tax-advantaged growth by converting large sums into Roth 401(k) or Roth IRA accounts. Key differences include contribution limits, tax treatment, and the ability to accelerate retirement savings through higher contribution ceilings with mega backdoor strategies.

How Employer Match Works in Retirement Plans

Employer match in retirement plans typically involves an employer contributing a percentage of an employee's salary to their 401(k) account, often matching dollar-for-dollar up to a specific limit, such as 6% of the employee's contributions. This match is essentially free money that boosts retirement savings, making it a highly valuable benefit compared to mega backdoor Roth contributions, which involve after-tax contributions and in-service rollovers. Employer match contributions immediately increase the employee's retirement fund growth potential through compounded returns and should be maximized before considering mega backdoor strategies.

Mega Backdoor Roth: Eligibility and Contribution Limits

Mega Backdoor Roth contributions allow high-income earners to maximize retirement savings beyond standard 401(k) limits by making after-tax contributions and converting them to a Roth account. Eligibility depends on having a 401(k) plan that permits after-tax contributions and in-service withdrawals or conversions. The contribution limit for 2024 stands at $66,000, inclusive of employee deferrals, employer matches, and after-tax contributions, enabling substantial tax-advantaged growth.

Maximizing Your Employer Match Benefits

Maximizing your employer match benefits significantly boosts your retirement savings by capitalizing on free contributions that employers provide, often up to a certain percentage of your salary. Prioritizing contributions to receive the full employer match before making mega backdoor Roth contributions ensures you don't leave money on the table. Employer matches directly increase your 401(k) balance, leveraging compound growth and enhancing long-term financial security in retirement.

Steps to Implement a Mega Backdoor Roth Contribution

To implement a Mega Backdoor Roth contribution, first confirm that your 401(k) plan allows after-tax contributions and in-service withdrawals or conversions. Maximize your after-tax contributions up to the IRS limit of $66,000 in 2024, combining employee pre-tax, Roth, and employer contributions. Finally, promptly convert after-tax funds to a Roth IRA or Roth 401(k) to enable tax-free growth and withdrawals in retirement.

Tax Implications: Employer Match vs. Mega Backdoor Roth

Employer match contributions are typically made pre-tax, reducing taxable income now but taxed upon withdrawal in retirement, creating a future tax liability. Mega backdoor Roth contributions involve after-tax dollars converted to Roth, allowing tax-free growth and withdrawals, providing significant tax advantages for long-term savings. Evaluating tax implications depends on current versus expected retirement tax rates, with mega backdoor Roths potentially offering greater after-tax wealth accumulation.

Prioritizing Retirement Contributions: Which Comes First?

Employer matching contributions offer an immediate return on retirement savings by maximizing free funds up to a certain percentage of your salary, making them a priority for initial contributions. Mega backdoor Roth contributions allow for significantly higher post-tax savings and tax-free growth but require maximizing regular contribution limits first. Prioritizing employer match ensures you don't leave money on the table, while mega backdoor contributions are ideal once you've captured the full employer match and traditional contribution limits.

Common Mistakes with Employer Match and Mega Backdoor Strategies

Failing to maximize employer match contributions often results in leaving free money on the table, directly reducing overall retirement savings growth. Overlooking the eligibility requirements or contribution limits of mega backdoor Roth IRAs can lead to excess contributions, triggering penalties and tax complications. Many workers also misunderstand the timing and coordination between employer matches and after-tax contributions, undermining the compound growth potential of their retirement portfolios.

Choosing the Best Retirement Strategy for Your Financial Goals

Employer match contributions provide immediate, risk-free returns by maximizing the free money offered by your employer, making it a foundational strategy for retirement savings. Mega backdoor Roth contributions enable higher after-tax savings with tax-free growth potential, ideal for high-income earners seeking to accelerate wealth accumulation beyond standard limits. Evaluating your current tax bracket, expected retirement income, and contribution limits is essential to choosing between immediate employer matches and the long-term growth benefits of mega backdoor Roth contributions.

Related Important Terms

Mega Backdoor Roth

Mega Backdoor Roth contributions allow high-income earners to maximize after-tax 401(k) contributions beyond standard limits, enabling tax-free growth and withdrawals in retirement, while employer match contributions typically adhere to lower limits and are taxed upon distribution. Leveraging Mega Backdoor Roth strategies can significantly enhance retirement savings by converting substantial after-tax contributions into Roth accounts, bypassing traditional pre-tax caps and reducing future tax liabilities.

Employer Match Optimization

Maximizing employer match contributions leverages free funds that significantly boost retirement savings without additional personal cost, making it the most efficient first step in retirement planning. Prioritizing employer match ensures an immediate return on investment, outperforming complex strategies like mega backdoor Roth contributions in terms of guaranteed growth and simplicity.

After-Tax 401(k) Contributions

Employer match contributions directly increase retirement savings without reducing take-home pay, maximizing the immediate benefit of pre-tax or Roth 401(k) deferrals. Mega backdoor contributions leverage after-tax 401(k) contributions, allowing high earners to significantly boost retirement funds by converting large sums into a Roth account, compounding tax-free growth over time.

In-Plan Roth Conversions

Employer match contributions provide immediate tax advantages and boost retirement savings, but Mega Backdoor Roth contributions enable significantly higher after-tax Roth conversions within the plan, maximizing tax-free growth potential. In-Plan Roth Conversions allow participants to strategically convert after-tax balances to Roth accounts, enhancing long-term tax diversification and retirement income flexibility.

Contribution Stacking

Employer match contributions offer immediate return and guaranteed growth, while mega backdoor Roth IRA contributions enable higher after-tax savings with tax-free growth potential; combining both strategies maximizes overall retirement savings through effective contribution stacking. Leveraging employer matches first, then utilizing mega backdoor contributions, optimizes total annual contributions beyond standard limits, enhancing long-term financial security.

Roth Conversion Ladder

Employer match contributions maximize immediate retirement savings through tax-advantaged growth, while mega backdoor Roth contributions enable higher after-tax contributions with potential for Roth conversions, accelerating tax-free withdrawals via a Roth Conversion Ladder. Strategic use of both options optimizes retirement income by combining employer-funded benefits with scalable, tax-efficient Roth account growth.

Contribution Limit Maximization

Employer match contributions maximize retirement savings by leveraging free money up to a specific percentage of salary, while mega backdoor Roth contributions enable higher after-tax contributions beyond standard limits, significantly increasing total retirement fund accumulation. Combining both strategies optimizes contribution limit maximization, enhancing tax-advantaged growth and long-term wealth building.

Safe Harbor Match

Safe Harbor Match contributions guarantee employer matching funds that fully vest immediately, maximizing retirement savings with assured tax advantages and no risk of forfeiture. Mega backdoor contributions allow high-income earners to accelerate tax-advantaged savings via after-tax 401(k) contributions and in-service rollovers, but lack the guaranteed employer match and immediate vesting benefits of Safe Harbor plans.

401(k) Overfunding Strategy

Maximizing employer match contributions in a 401(k) ensures immediate, risk-free returns on investments, while utilizing the mega backdoor Roth strategy allows for substantial tax-advantaged after-tax contributions beyond standard limits. Overfunding a 401(k) through the mega backdoor approach can significantly boost retirement savings potential by leveraging higher contribution thresholds and facilitating tax-free growth.

Partial Roth Rollover

Partial Roth rollovers allow employees to strategically convert pre-tax 401(k) funds into after-tax Roth accounts, optimizing tax efficiency compared to relying solely on employer matches, which often have contribution limits tied to salary percentages. Mega backdoor Roth contributions enable high-income earners to maximize after-tax contributions beyond standard limits, making partial Roth rollovers a flexible tool for diversifying retirement portfolios with tax-advantaged growth.

Employer match vs mega backdoor contributions for retirement. Infographic

moneydiff.com

moneydiff.com