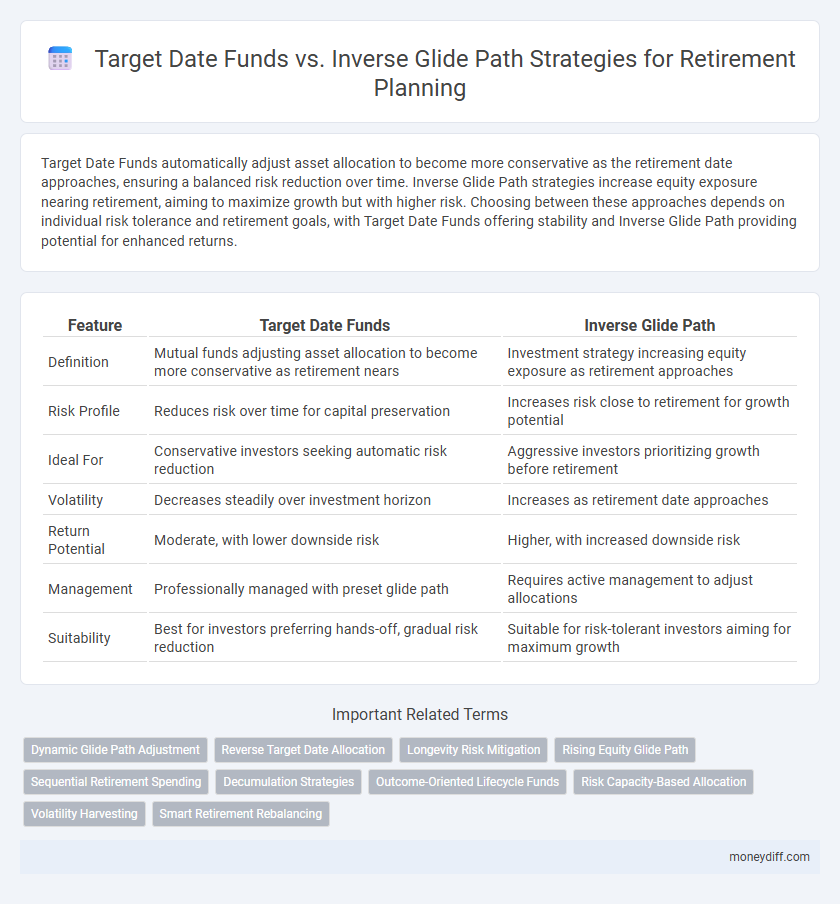

Target Date Funds automatically adjust asset allocation to become more conservative as the retirement date approaches, ensuring a balanced risk reduction over time. Inverse Glide Path strategies increase equity exposure nearing retirement, aiming to maximize growth but with higher risk. Choosing between these approaches depends on individual risk tolerance and retirement goals, with Target Date Funds offering stability and Inverse Glide Path providing potential for enhanced returns.

Table of Comparison

| Feature | Target Date Funds | Inverse Glide Path |

|---|---|---|

| Definition | Mutual funds adjusting asset allocation to become more conservative as retirement nears | Investment strategy increasing equity exposure as retirement approaches |

| Risk Profile | Reduces risk over time for capital preservation | Increases risk close to retirement for growth potential |

| Ideal For | Conservative investors seeking automatic risk reduction | Aggressive investors prioritizing growth before retirement |

| Volatility | Decreases steadily over investment horizon | Increases as retirement date approaches |

| Return Potential | Moderate, with lower downside risk | Higher, with increased downside risk |

| Management | Professionally managed with preset glide path | Requires active management to adjust allocations |

| Suitability | Best for investors preferring hands-off, gradual risk reduction | Suitable for risk-tolerant investors aiming for maximum growth |

Understanding Target Date Funds: A Retirement Staple

Target Date Funds (TDFs) are a popular retirement investment option designed to automatically adjust asset allocations based on a specified retirement year, balancing growth and risk over time. These funds typically follow a "glide path" strategy, gradually shifting from higher-risk equities to more conservative fixed-income assets as the target date approaches. Unlike the Inverse Glide Path strategy, which increases risk exposure nearer retirement, TDFs aim to protect capital while providing growth potential, making them a reliable choice for long-term retirement planning.

What is an Inverse Glide Path Strategy?

An Inverse Glide Path strategy in retirement investing increases equity exposure as retirement approaches, contrasting with traditional Target Date Funds that reduce risk over time by shifting to bonds. This approach aims to capitalize on potential market growth during the later years of retirement to combat inflation and longevity risk. Investors should carefully evaluate their risk tolerance and financial goals before choosing an Inverse Glide Path strategy.

Comparing Risk Profiles: Target Date Funds vs Inverse Glide Path

Target Date Funds gradually reduce risk by shifting allocations from equities to bonds as the retirement date approaches, aiming for a balanced risk profile over time. Inverse Glide Path strategies, conversely, increase equity exposure nearing retirement, targeting higher returns but with elevated risk and potential volatility. Investors prioritizing capital preservation typically favor Target Date Funds, while those seeking growth with higher risk tolerance may consider Inverse Glide Path approaches.

Asset Allocation Over Time: Contrasting Approaches

Target Date Funds adopt a gradually conservative asset allocation strategy by increasing bond exposure and reducing equities as the target retirement date approaches, optimizing risk reduction over time. In contrast, the Inverse Glide Path model emphasizes higher equity exposure as retirement nears to maximize growth potential, reflecting a more aggressive risk profile. Understanding these opposing asset allocation trajectories helps investors align their retirement portfolios with their risk tolerance and income needs.

Performance Trends: Which Strategy Delivers Better Results?

Target date funds typically offer stable, diversified portfolios that gradually reduce risk as retirement approaches, showing consistent positive performance over long-term investment horizons. Inverse glide path strategies, which increase equity exposure closer to retirement, may deliver higher returns in strong bull markets but carry elevated risk and volatility. Historical data suggests target date funds outperform inverse glide path strategies in terms of risk-adjusted returns and downside protection during market downturns.

Addressing Longevity Risk in Retirement Portfolios

Target Date Funds typically reduce equity exposure as retirement approaches, potentially increasing longevity risk by limiting growth potential in later years. Inverse Glide Path strategies increase equity allocation post-retirement, aiming to combat longevity risk through enhanced growth opportunities. Addressing longevity risk effectively requires balancing investment risks and returns to ensure sufficient portfolio growth throughout an extended retirement horizon.

Cost Implications: Fees and Expenses to Consider

Target Date Funds typically charge an annual expense ratio ranging from 0.10% to 1.00%, covering active management and asset allocation, which can erode retirement savings over time. Inverse Glide Path strategies often involve lower management fees but may incur higher trading costs and tax implications due to more frequent portfolio adjustments. Evaluating the total cost--including fund fees, transaction expenses, and potential tax liabilities--is critical for optimizing retirement investment outcomes.

Behavioral Finance: Investor Reactions to Each Strategy

Target Date Funds appeal to investors due to their automatic risk reduction over time, aligning with common behavioral tendencies toward seeking simplicity and reducing decision fatigue. Inverse Glide Path strategies, conversely, may trigger increased anxiety as risk exposure rises near retirement, conflicting with typical investor risk aversion and leading to potential suboptimal reactions such as premature withdrawals or panic selling. Behavioral finance studies show that Target Date Funds tend to retain investor commitment better by matching gradual risk adjustment with psychological comfort during retirement planning.

Who Should Choose Inverse Glide Path Over Target Date Funds?

Investors with higher risk tolerance and longer time horizons may benefit from an inverse glide path, which increases equity exposure as retirement approaches, contrasting with the conservative shift of target date funds. Those seeking potentially higher returns and willing to actively manage market volatility might prefer the inverse glide path strategy. Retirees expecting a strong investment bounce-back or with additional income streams can find this approach more aligned with their financial goals than the traditional target date fund's gradual risk reduction.

Making the Right Choice for Your Retirement Goals

Target Date Funds offer a streamlined investment strategy that automatically adjusts asset allocation to become more conservative as retirement approaches, aligning with typical risk tolerance changes over time. Inverse Glide Path strategies invert this model by increasing risk exposure closer to retirement, potentially benefiting those with unique income streams or higher risk tolerance. Choosing the right approach requires careful assessment of your retirement timeline, risk capacity, and income needs to ensure alignment with long-term financial goals.

Related Important Terms

Dynamic Glide Path Adjustment

Target Date Funds typically use a traditional declining glide path to reduce risk as retirement approaches, while Inverse Glide Path strategies employ dynamic glide path adjustment that may increase equity exposure near retirement for higher growth potential; this adaptive approach aims to better align asset allocation with changing market conditions and individual risk tolerance during retirement planning. Dynamic glide path adjustment leverages real-time market data and personal financial factors to optimize portfolio performance and withdrawal strategies throughout retirement years.

Reverse Target Date Allocation

Reverse Target Date Allocation, unlike traditional Target Date Funds that gradually shift investments from stocks to bonds approaching retirement, increases equity exposure as the investor ages to potentially boost returns in later years. This inverse glide path strategy aims to maximize growth during retirement but carries higher market risk compared to the conservative approach of standard Target Date Funds.

Longevity Risk Mitigation

Target Date Funds automatically adjust asset allocation to become more conservative as retirement approaches, helping mitigate longevity risk by reducing exposure to market volatility over time. Inverse Glide Path strategies increase equity exposure as retirement nears, aiming to combat inflation and market returns erosion but potentially heightening short-term portfolio risk during retirement.

Rising Equity Glide Path

Target Date Funds with a Rising Equity Glide Path gradually increase stock exposure as retirement approaches, aiming to enhance growth potential during later years. This contrasts with Inverse Glide Path strategies, which reduce equity allocation over time, potentially limiting upside in volatile markets close to retirement.

Sequential Retirement Spending

Target Date Funds gradually reduce equity exposure as retirement approaches, addressing sequence of returns risk by smoothing portfolio volatility to better support sequential retirement spending. Inverse Glide Path strategies increase equity exposure during retirement, aiming to enhance portfolio growth and mitigate the impact of early negative returns on sequential withdrawal sustainability.

Decumulation Strategies

Target Date Funds typically follow a traditional glide path, gradually shifting allocations from equities to bonds as retirement approaches to reduce risk during decumulation. In contrast, Inverse Glide Path strategies increase equity exposure in decumulation, aiming to enhance portfolio growth and longevity by counteracting sequence of returns risk during retirement withdrawals.

Outcome-Oriented Lifecycle Funds

Outcome-oriented lifecycle funds, including Target Date Funds (TDFs), automatically adjust portfolio risk and asset allocation to match a retiree's timeline, optimizing wealth growth and capital preservation as retirement approaches. Inverse Glide Path strategies differ by increasing equity exposure near retirement to enhance income potential but may introduce higher volatility, making TDFs generally more suitable for risk-averse investors seeking a balanced, goal-driven retirement plan.

Risk Capacity-Based Allocation

Target Date Funds typically use a standard glide path that gradually reduces risk by shifting from equities to bonds as retirement approaches, while an Inverse Glide Path adjusts allocations based on individual risk capacity, often increasing equity exposure for retirees with higher risk tolerance to pursue growth. Risk capacity-based allocation customizes portfolio risk levels to personal financial situations, potentially improving retirement outcomes compared to one-size-fits-all Target Date Funds.

Volatility Harvesting

Target Date Funds typically follow a declining risk approach aligned with an inverse glide path, gradually shifting from equities to bonds as retirement nears, while volatility harvesting strategies exploit market fluctuations by systematically rebalancing between asset classes to capture gains from price volatility. Volatility harvesting can enhance returns by leveraging mean reversion in asset prices, potentially outperforming traditional inverse glide path funds in volatile markets.

Smart Retirement Rebalancing

Target Date Funds automatically adjust asset allocation towards conservative investments as retirement approaches, while an Inverse Glide Path strategy increases risk exposure for early retirees seeking aggressive growth. Smart Retirement Rebalancing leverages these methods by dynamically optimizing portfolio shifts based on market conditions and individual risk tolerance to enhance long-term retirement outcomes.

Target Date Funds vs Inverse Glide Path for retirement. Infographic

moneydiff.com

moneydiff.com