Defined benefit plans offer a predictable income stream during retirement, minimizing sequence of returns risk by guaranteeing payouts regardless of market fluctuations. In contrast, retirees relying on investment portfolios face the sequence of returns risk, where negative returns early in retirement can significantly reduce nest egg longevity. Managing this risk requires careful withdrawal strategies and diversification to protect against market volatility impacting retirement income.

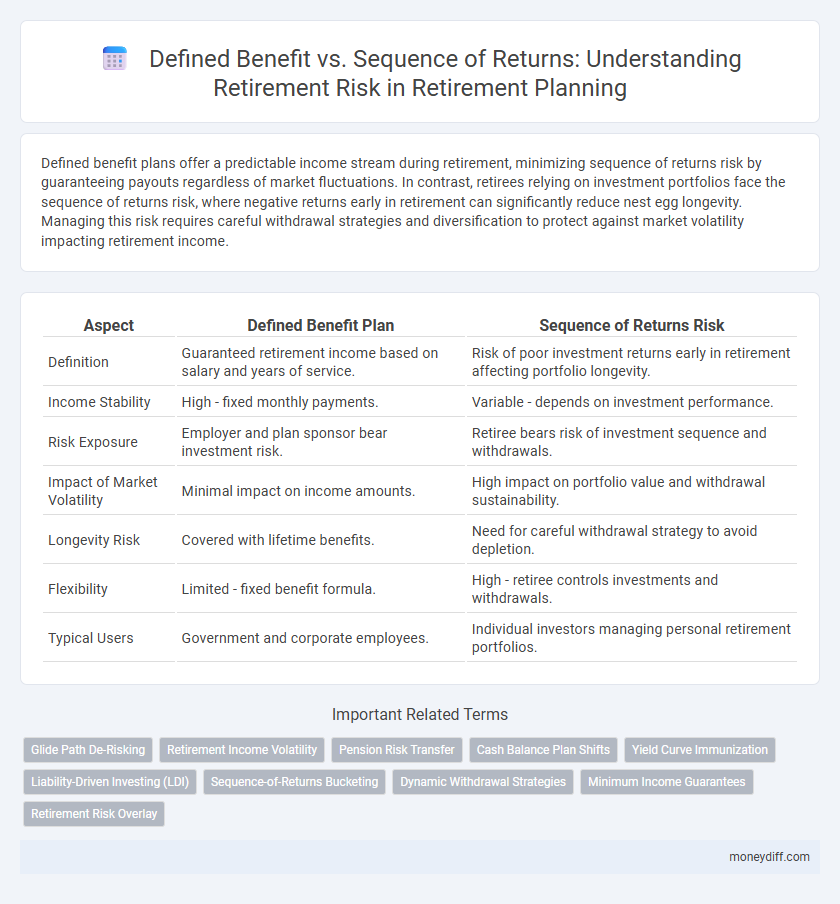

Table of Comparison

| Aspect | Defined Benefit Plan | Sequence of Returns Risk |

|---|---|---|

| Definition | Guaranteed retirement income based on salary and years of service. | Risk of poor investment returns early in retirement affecting portfolio longevity. |

| Income Stability | High - fixed monthly payments. | Variable - depends on investment performance. |

| Risk Exposure | Employer and plan sponsor bear investment risk. | Retiree bears risk of investment sequence and withdrawals. |

| Impact of Market Volatility | Minimal impact on income amounts. | High impact on portfolio value and withdrawal sustainability. |

| Longevity Risk | Covered with lifetime benefits. | Need for careful withdrawal strategy to avoid depletion. |

| Flexibility | Limited - fixed benefit formula. | High - retiree controls investments and withdrawals. |

| Typical Users | Government and corporate employees. | Individual investors managing personal retirement portfolios. |

Understanding Defined Benefit Plans in Retirement

Defined benefit plans provide retirees with a guaranteed income based on salary history and years of service, mitigating Sequence of Returns Risk by ensuring stable payouts regardless of market volatility. This guaranteed income stream reduces dependency on investment performance, offering financial security during retirement. Understanding these plans helps retirees plan effectively and avoid the risks associated with fluctuating investment returns.

Sequence of Returns Risk: A Key Retirement Challenge

Sequence of returns risk refers to the danger that poor investment returns early in retirement can significantly reduce the longevity of a retiree's portfolio, even if average returns are strong over time. Unlike defined benefit plans that provide a guaranteed income stream, retirees relying on defined contribution plans face uncertainty because market volatility impacts withdrawal sustainability. Managing sequence of returns risk through strategies like dynamic withdrawal rates, portfolio diversification, and guaranteed income products is essential to maintaining financial security throughout retirement.

How Defined Benefit Plans Address Retirement Income Risk

Defined benefit plans mitigate retirement income risk by providing guaranteed, predictable monthly payments based on salary and years of service, reducing exposure to market volatility and sequence of returns risk. These plans ensure retirees receive steady income regardless of market downturns, eliminating the uncertainty faced by investors relying on variable annuities or drawdowns from personal savings. By shifting investment and longevity risk to the employer, defined benefit plans offer retirees financial stability throughout retirement.

Vulnerability to Sequence of Returns in Defined Contribution Plans

Defined contribution plans are highly vulnerable to sequence of returns risk because withdrawals during market downturns can significantly erode the portfolio's value, reducing the funds available for future retirement income. Unlike defined benefit plans that provide a guaranteed payout regardless of market volatility, defined contribution plans expose retirees to fluctuating returns that directly impact sustainability. Managing withdrawal rates and diversification strategies are critical to mitigating sequence of returns risk in defined contribution retirement accounts.

Comparing Income Predictability: DB vs Sequence of Returns Risk

Defined benefit (DB) plans offer predictable, lifetime income by guaranteeing a fixed payout based on salary and years of service, eliminating sequence of returns risk. In contrast, retirees relying on market-dependent withdrawals face income variability due to sequence of returns risk, where poor market performance early in retirement can significantly reduce sustainable income. Thus, DB plans provide superior income predictability and stability compared to retirement income strategies vulnerable to market timing and sequence risk fluctuations.

Portfolio Withdrawal Strategies and Sequence of Returns

Defined benefit plans provide a guaranteed income stream, reducing sequence of returns risk by ensuring stable withdrawals regardless of market fluctuations. In contrast, portfolio withdrawal strategies reliant on invested assets must carefully manage sequence of returns to avoid depleting retirement savings prematurely during market downturns. Implementing dynamic withdrawal rates or using bucket strategies can mitigate sequence of returns risk and enhance portfolio longevity.

Mitigating Sequence of Returns Risk with Annuities and DB Plans

Defined benefit (DB) plans provide retirees with guaranteed lifetime income, effectively mitigating sequence of returns risk by offering stable payouts regardless of market volatility. Annuities further reduce this risk by converting a lump sum into a steady income stream, protecting retirees from adverse market fluctuations early in retirement. Combining DB plans with annuities creates a robust strategy to safeguard retirement portfolios against unpredictable market returns.

Longevity Protection: Defined Benefit Plans vs. Investment Portfolios

Defined benefit plans provide guaranteed lifetime income, offering robust longevity protection by mitigating sequence of returns risk, which can deplete investment portfolios prematurely. Sequence of returns risk significantly impacts retirement portfolios, especially during early withdrawal years, leading to reduced sustainability of retirement savings. Compared to volatile investment portfolios, defined benefit plans ensure stable payouts regardless of market fluctuations, enhancing financial security for retirees over extended lifespans.

Practical Examples: Sequence of Returns vs DB Plan Outcomes

Defined benefit pension plans provide predictable lifetime income regardless of market fluctuations, mitigating sequence of returns risk that can severely impact retirees relying on variable investment portfolios. For example, an investor withdrawing from an IRA during a market downturn may rapidly deplete assets, whereas a DB plan continues fixed payments unaffected by negative market returns. Practical outcomes highlight how DB plans offer stability in retirement income, shielding retirees from the timing risk inherent in sequence of returns.

Choosing the Right Retirement Strategy: Weighing DB Plans Against Market Risks

Defined benefit (DB) plans offer guaranteed lifetime income, reducing exposure to sequence of returns risk that can erode savings during market downturns early in retirement. In contrast, relying solely on investment portfolios subjects retirees to market volatility, making the order of returns critical to sustaining withdrawals over time. Evaluating the stability of DB benefits against the unpredictability of sequence risk is essential for selecting a retirement strategy that balances security and growth potential.

Related Important Terms

Glide Path De-Risking

Defined benefit plans offer predictable lifetime income, minimizing sequence of returns risk by providing stable retirement cash flow regardless of market volatility. Glide path de-risking strategically shifts portfolio allocation to lower-risk assets as retirement approaches, reducing exposure to market downturns and complementing sequence of returns risk management.

Retirement Income Volatility

Defined benefit plans provide predictable, stable retirement income by guaranteeing fixed payments, effectively minimizing retirement income volatility commonly associated with sequence of returns risk. In contrast, sequence of returns risk affects retirees with variable income sources, as poor market performance early in retirement can significantly reduce portfolio longevity and increase income uncertainty.

Pension Risk Transfer

Defined benefit plans mitigate retirement sequence of returns risk by providing guaranteed lifetime income, shielding retirees from market volatility impacts on withdrawal rates. Pension Risk Transfer strategies, such as annuitization or buy-outs, effectively offload longevity and investment risks from plan sponsors to insurers, enhancing retirement income security.

Cash Balance Plan Shifts

Defined benefit plans, such as Cash Balance Plans, provide a predictable retirement income by guaranteeing a specific payout, reducing sequence of returns risk compared to relying solely on market-dependent withdrawals. As employers shift toward Cash Balance Plans, employees gain more stable benefit structures that protect retirement savings from market volatility during critical withdrawal periods.

Yield Curve Immunization

Defined benefit plans provide predictable income by immunizing retirees against sequence of returns risk through a fixed yield curve-based strategy, ensuring consistent cash flows regardless of market volatility. This yield curve immunization mitigates retirement risk by matching asset durations to liabilities, preserving portfolio value and securing steady payouts over time.

Liability-Driven Investing (LDI)

Defined benefit plans prioritize predictable retirement income by aligning assets with liabilities, mitigating sequence of returns risk through Liability-Driven Investing (LDI) strategies that focus on matching cash flows to future pension obligations. LDI reduces volatility and ensures plan solvency by employing fixed-income instruments and derivatives to hedge interest rate and inflation risks inherent in retirement liabilities.

Sequence-of-Returns Bucketing

Sequence-of-Returns Bucketing mitigates retirement risk by dividing assets into short-, medium-, and long-term buckets, allowing retirees to draw income from stable short-term funds while long-term investments recover from market volatility. This strategy reduces the impact of unfavorable market returns during withdrawal phases compared to traditional Defined Benefit plans, which rely on fixed payouts but lack flexibility in managing market timing risk.

Dynamic Withdrawal Strategies

Dynamic withdrawal strategies mitigate retirement risk by adjusting withdrawals based on market performance, contrasting with the fixed income certainty of defined benefit plans and addressing the sequence of returns risk that can deplete portfolios during market downturns. These strategies enhance portfolio longevity by reducing the impact of negative returns early in retirement, ensuring a more stable income stream compared to static withdrawal methods.

Minimum Income Guarantees

Defined benefit plans provide minimum income guarantees by offering retirees a fixed, predictable payout, mitigating sequence of returns risk that can severely impact retirement savings when withdrawals coincide with market downturns. These guarantees ensure stable retirement income regardless of investment volatility, contrasting with defined contribution plans where retirees bear the full burden of market fluctuations.

Retirement Risk Overlay

Defined benefit plans provide retirees with guaranteed income, mitigating sequence of returns risk by ensuring steady payouts regardless of market volatility. Sequence of returns risk specifically affects retirees relying on investment withdrawals, as negative market returns early in retirement can disproportionately deplete their portfolio and jeopardize long-term financial security.

Defined benefit vs Sequence of returns for retirement risk. Infographic

moneydiff.com

moneydiff.com