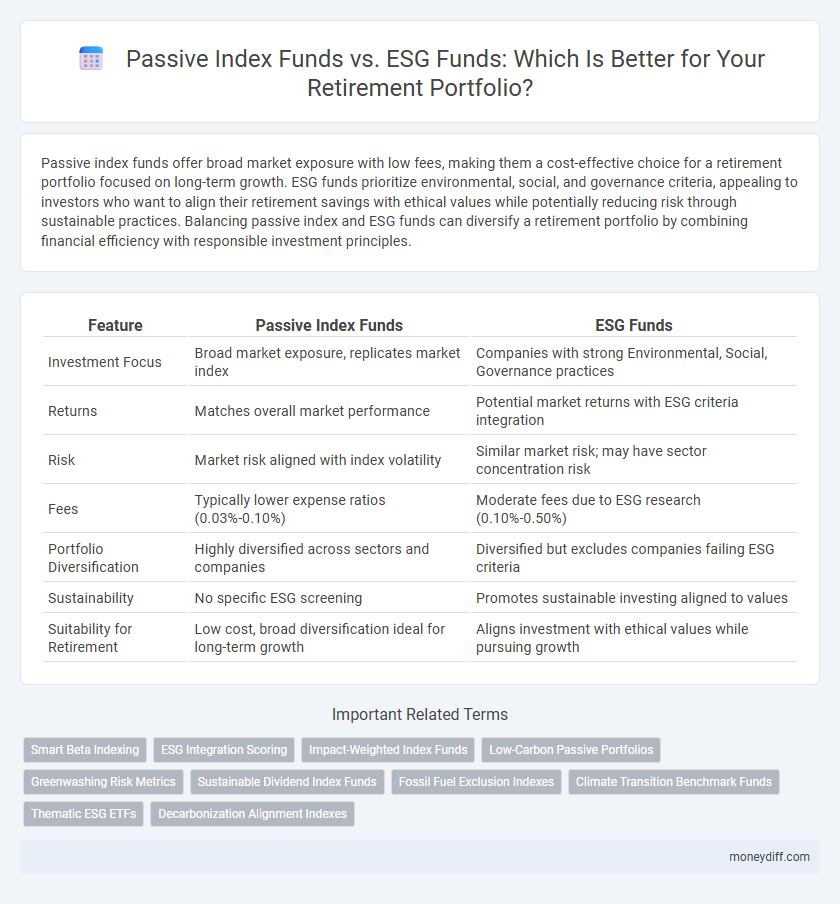

Passive index funds offer broad market exposure with low fees, making them a cost-effective choice for a retirement portfolio focused on long-term growth. ESG funds prioritize environmental, social, and governance criteria, appealing to investors who want to align their retirement savings with ethical values while potentially reducing risk through sustainable practices. Balancing passive index and ESG funds can diversify a retirement portfolio by combining financial efficiency with responsible investment principles.

Table of Comparison

| Feature | Passive Index Funds | ESG Funds |

|---|---|---|

| Investment Focus | Broad market exposure, replicates market index | Companies with strong Environmental, Social, Governance practices |

| Returns | Matches overall market performance | Potential market returns with ESG criteria integration |

| Risk | Market risk aligned with index volatility | Similar market risk; may have sector concentration risk |

| Fees | Typically lower expense ratios (0.03%-0.10%) | Moderate fees due to ESG research (0.10%-0.50%) |

| Portfolio Diversification | Highly diversified across sectors and companies | Diversified but excludes companies failing ESG criteria |

| Sustainability | No specific ESG screening | Promotes sustainable investing aligned to values |

| Suitability for Retirement | Low cost, broad diversification ideal for long-term growth | Aligns investment with ethical values while pursuing growth |

Understanding Passive Index Funds and ESG Funds

Passive index funds track broad market indices, offering low-cost, diversified exposure ideal for long-term retirement growth by minimizing fees and market timing risks. ESG funds integrate environmental, social, and governance criteria into stock selection, aligning investments with ethical values while potentially enhancing risk-adjusted returns. Understanding the differences helps retirees balance financial goals with personal values, optimizing portfolio diversification and sustainability for retirement security.

Key Differences Between Passive Index and ESG Investing

Passive index funds track a broad market index, offering low-cost, diversified exposure with minimal active management, ideal for long-term retirement growth. ESG funds integrate environmental, social, and governance criteria, actively selecting companies that meet specific sustainability standards, which may impact portfolio risk and returns differently than traditional indexes. Understanding these key differences helps retirees balance financial goals with ethical considerations when building a retirement portfolio.

Performance Comparison: Historical Returns

Passive index funds have historically delivered consistent, market-matching returns with low fees, making them a reliable choice for long-term retirement growth. ESG funds, while increasingly popular, have shown mixed historical performance due to varying sector exposures and evolving sustainability criteria. Investors seeking stable, predictable returns often prefer passive index funds, though ESG funds may offer competitive results in portfolios emphasizing environmental and social responsibility.

Costs and Fees: What Retirees Should Know

Passive index funds typically offer lower expense ratios, averaging around 0.05% to 0.20%, making them cost-effective options for retirees seeking to minimize fees and maximize returns. ESG funds often charge higher fees, ranging from 0.25% to 0.50%, due to the additional costs of ethical screening and active management, which may impact long-term portfolio growth. Retirees should weigh these cost differences carefully, as lower fees in passive index funds can significantly enhance retirement savings over time compared to the potentially higher expenses of ESG funds.

Risk Factors in Passive Index vs ESG Funds

Passive index funds typically offer broad market exposure with lower volatility due to diversified holdings, resulting in comparatively lower risk for retirement portfolios. ESG funds may face higher risk levels because their investment universe is narrower and influenced by evolving environmental, social, and governance criteria that can affect sector allocation and performance stability. Investors should weigh the stable, market-tracking risk profile of passive index funds against the potential volatility and thematic risks inherent in ESG-focused investments when constructing retirement portfolios.

Aligning Retirement Goals with Investment Principles

Passive index funds offer broad market exposure, low fees, and consistent returns ideal for long-term retirement savings, while ESG funds incorporate environmental, social, and governance criteria that align investments with ethical values without sacrificing diversification. Choosing between these fund types depends on balancing risk tolerance, expected returns, and the importance of supporting sustainable business practices in retirement goals. Integrating ESG funds into a retirement portfolio can enhance alignment with personal principles while maintaining growth potential, making them suitable for socially conscious investors seeking financial security.

Diversification Benefits for Retirement Portfolios

Passive index funds offer broad market exposure and low fees, making them a reliable foundation for retirement portfolios seeking diversification across various sectors and asset classes. ESG funds incorporate environmental, social, and governance criteria, providing diversification through companies with sustainable practices that may reduce long-term risks associated with regulatory changes and social trends. Combining passive index funds with ESG funds can enhance portfolio resilience by balancing traditional market coverage with values-driven investments tailored for sustainable retirement growth.

Socially Responsible Investing: Pros and Cons

Passive index funds offer broad market exposure with low fees and consistent long-term growth, making them a reliable foundation for retirement portfolios. ESG funds integrate environmental, social, and governance criteria, appealing to investors prioritizing ethical impact but may involve higher costs and potential performance variability. Balancing diversification, fees, and personal values is crucial when integrating socially responsible investing into retirement strategies.

Tax Considerations for Retirees

Tax considerations heavily influence the choice between passive index funds and ESG funds within a retirement portfolio. Passive index funds often generate lower capital gains distributions, resulting in reduced taxable events, which is beneficial for retirees managing income in tax-advantaged accounts. ESG funds, while aligning with ethical investing goals, may have higher turnover rates that potentially increase tax liabilities, necessitating careful evaluation of tax-efficient fund structures and account types.

Choosing the Right Fund for Your Retirement Plan

Selecting the right fund for your retirement plan involves comparing passive index funds and ESG funds based on long-term growth and personal values. Passive index funds offer broad market exposure with low fees, ideal for steady, diversified growth over decades. ESG funds prioritize environmental, social, and governance criteria, aligning investments with ethical standards while potentially delivering competitive returns, making them suitable for investors seeking impact alongside financial goals.

Related Important Terms

Smart Beta Indexing

Smart Beta indexing enhances retirement portfolios by blending passive index funds with factor-based strategies that target specific risk factors and improved returns, offering a cost-efficient alternative to traditional passive ESG funds. ESG funds focus primarily on environmental, social, and governance criteria, while Smart Beta strategies systematically tilt holdings to exploit market inefficiencies, potentially delivering superior risk-adjusted returns over long-term retirement horizons.

ESG Integration Scoring

Passive index funds offer broad market exposure and lower fees, making them a popular choice for retirement portfolios, while ESG funds incorporate Environmental, Social, and Governance (ESG) integration scoring to align investments with sustainability criteria. ESG integration scoring evaluates companies based on their ESG performance, allowing retirement investors to target portfolios that balance financial returns with ethical impact and risk management.

Impact-Weighted Index Funds

Impact-weighted index funds integrate environmental, social, and governance (ESG) criteria into traditional passive index strategies, offering retirement portfolios aligned with sustainability goals while maintaining broad market exposure. These funds provide a quantifiable impact measurement, enabling retirees to balance financial returns with meaningful social and environmental contribution.

Low-Carbon Passive Portfolios

Low-carbon passive portfolios, primarily composed of broad-market index funds with a carbon footprint tilt, offer cost-effective diversification and consistent long-term growth for retirement savings. ESG funds integrate environmental, social, and governance criteria, emphasizing sustainability and ethical practices, which may enhance risk-adjusted returns while aligning retirement portfolios with low-carbon objectives.

Greenwashing Risk Metrics

Passive index funds offer broad market exposure with low fees but may inadvertently include companies with poor environmental practices, increasing greenwashing risk. ESG funds apply specific environmental, social, and governance criteria, using advanced risk metrics to reduce greenwashing exposure and align retirement portfolios with sustainable investment goals.

Sustainable Dividend Index Funds

Sustainable Dividend Index Funds combine the benefits of passive investing with a focus on environmental, social, and governance (ESG) criteria, offering a retirement portfolio balance that prioritizes steady income and socially responsible growth. These funds typically invest in companies with strong dividend histories that also meet rigorous ESG standards, enhancing long-term portfolio resilience and aligning retirement savings with sustainability goals.

Fossil Fuel Exclusion Indexes

Passive index funds excluding fossil fuel companies offer retirement portfolios stable, long-term growth by minimizing exposure to volatile energy sectors. ESG funds that prioritize fossil fuel exclusion align investments with sustainable values while potentially reducing environmental risk, enhancing portfolio resilience amid shifting regulatory landscapes.

Climate Transition Benchmark Funds

Climate Transition Benchmark Funds, a subset of ESG funds, integrate rigorous climate-related criteria to align retirement portfolios with net-zero emission goals while maintaining index fund diversification benefits. These funds actively support companies transitioning to low-carbon economies, offering retirees a sustainable investment option that balances long-term growth with climate risk mitigation.

Thematic ESG ETFs

Thematic ESG ETFs offer targeted exposure to sustainable sectors like clean energy and social impact, making them a compelling option for retirement portfolios seeking both growth and ethical alignment. Passive index funds provide broad market diversification with lower fees, but may lack the focused impact and innovation-driven potential found in thematic ESG investments.

Decarbonization Alignment Indexes

Passive index funds typically offer broad market exposure with low fees, while ESG funds, particularly those aligned with Decarbonization Alignment Indexes, prioritize companies demonstrating strong environmental performance and carbon reduction strategies. Incorporating decarbonization-focused ESG funds in a retirement portfolio can enhance sustainability goals and potentially mitigate long-term climate-related financial risks compared to traditional passive index funds.

Passive Index Funds vs ESG Funds for retirement portfolio Infographic

moneydiff.com

moneydiff.com