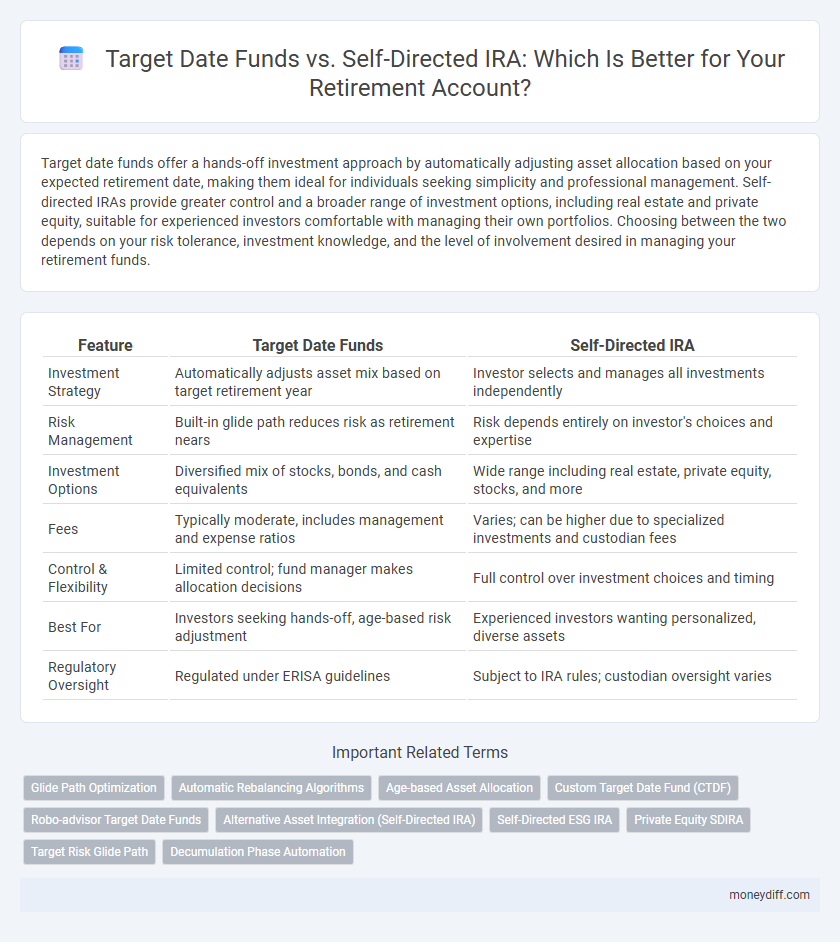

Target date funds offer a hands-off investment approach by automatically adjusting asset allocation based on your expected retirement date, making them ideal for individuals seeking simplicity and professional management. Self-directed IRAs provide greater control and a broader range of investment options, including real estate and private equity, suitable for experienced investors comfortable with managing their own portfolios. Choosing between the two depends on your risk tolerance, investment knowledge, and the level of involvement desired in managing your retirement funds.

Table of Comparison

| Feature | Target Date Funds | Self-Directed IRA |

|---|---|---|

| Investment Strategy | Automatically adjusts asset mix based on target retirement year | Investor selects and manages all investments independently |

| Risk Management | Built-in glide path reduces risk as retirement nears | Risk depends entirely on investor's choices and expertise |

| Investment Options | Diversified mix of stocks, bonds, and cash equivalents | Wide range including real estate, private equity, stocks, and more |

| Fees | Typically moderate, includes management and expense ratios | Varies; can be higher due to specialized investments and custodian fees |

| Control & Flexibility | Limited control; fund manager makes allocation decisions | Full control over investment choices and timing |

| Best For | Investors seeking hands-off, age-based risk adjustment | Experienced investors wanting personalized, diverse assets |

| Regulatory Oversight | Regulated under ERISA guidelines | Subject to IRA rules; custodian oversight varies |

Understanding Target Date Funds: A Retirement Planning Overview

Target date funds offer a diversified portfolio that automatically adjusts asset allocation based on the investor's anticipated retirement year, providing a hands-off investment strategy. These funds reduce risk over time by shifting from aggressive growth assets to more conservative investments, aligning with the decreasing risk tolerance as retirement approaches. Compared to self-directed IRAs, target date funds simplify retirement planning through professional management and built-in rebalancing tailored to long-term retirement goals.

What Is a Self-Directed IRA? Key Features Explained

A Self-Directed IRA (Individual Retirement Account) allows investors to hold a wider range of assets than conventional IRAs, including real estate, private equity, and precious metals, providing greater diversification opportunities for retirement portfolios. Key features include enhanced control over investment choices, the ability to use alternative assets not typically available in mutual funds or ETFs, and adherence to IRS rules concerning prohibited transactions and required minimum distributions. Compared to Target Date Funds, which offer automated diversification and rebalancing based on a specific retirement timeline, Self-Directed IRAs require more active management and due diligence but can potentially yield higher returns through customized asset allocation.

Risk Management: Target Date Funds vs. Self-Directed IRAs

Target Date Funds provide automated risk management by gradually shifting asset allocation to more conservative investments as the retirement date approaches, reducing exposure to market volatility. Self-Directed IRAs offer greater control over investment choices but require active monitoring and expertise to manage risks effectively, exposing investors to higher potential losses if mismanaged. Understanding individual risk tolerance and investment knowledge is crucial when choosing between the structured approach of Target Date Funds and the flexible yet complex nature of Self-Directed IRAs.

Investment Flexibility: Comparing Choices in Each Account

Target date funds offer a hands-off investment approach with automatic asset allocation adjustments aligned to a specific retirement date, limiting investor control over individual holdings. Self-directed IRAs provide extensive investment flexibility, allowing account holders to diversify across stocks, bonds, real estate, and alternative assets, tailoring their portfolios based on risk tolerance and goals. While target date funds streamline decision-making, self-directed IRAs empower investors with customizable options but require active management and due diligence.

Fees and Costs: Which Option Is More Cost-Effective?

Target date funds typically charge annual expense ratios ranging from 0.10% to 0.75%, which cover portfolio management and automatic rebalancing, while self-directed IRAs may have lower fund management fees but incur additional costs such as transaction fees, custodial fees, and potential advisory charges. The cost-effectiveness of a self-directed IRA depends on the investor's ability to minimize trading expenses and manage the account independently. For most investors seeking simplicity and diversified exposure, target date funds generally offer a more predictable and streamlined fee structure, making them more cost-effective over the long term.

Portfolio Diversification: Passive vs. Active Strategies

Target date funds offer automatic portfolio diversification through passive management, adjusting asset allocation based on the investor's estimated retirement date to reduce risk over time. Self-directed IRAs enable active strategies by allowing investors to personally select a broader range of assets, including real estate, private equity, and stocks, providing more control but requiring greater expertise and effort. Diversification in target date funds is based on pre-set glide paths, while self-directed IRAs rely on the investor's ability to actively manage and rebalance their portfolio for optimal risk and return.

Hands-Off vs. Hands-On Retirement Investing Approaches

Target date funds offer a hands-off retirement investing approach by automatically adjusting asset allocation based on the investor's expected retirement date, providing simplicity and diversification. Self-directed IRAs allow hands-on investors complete control over their retirement portfolio, enabling investments in a wider range of assets like real estate, private equity, and cryptocurrencies. Choosing between these options depends on the investor's desire for active management versus ease of use and professional asset rebalancing.

Tax Advantages and Implications for Each Account

Target date funds offer tax deferral benefits within retirement accounts, allowing investments to grow tax-deferred until withdrawal, typically taxed as ordinary income during retirement. Self-directed IRAs provide more control over investment choices and can include tax-advantaged options such as Roth IRAs, where qualified withdrawals are tax-free, or traditional IRAs with tax-deductible contributions but taxable distributions. Understanding the specific tax implications, including contribution limits and required minimum distributions (RMDs), is essential for optimizing retirement savings within each account type.

Performance Potential: Historical Returns and Projections

Target date funds offer diversified portfolios that automatically adjust asset allocation based on the investor's expected retirement year, historically delivering moderate returns aligned with market trends. Self-directed IRAs provide greater flexibility to invest in a broader array of assets, including real estate and private equity, which can yield higher returns but come with increased risk and require active management. Historical performance of target date funds shows steady growth with lower volatility, whereas self-directed IRAs have exhibited a wider return range, heavily dependent on the investor's expertise and chosen investments.

Choosing the Best Option: Factors to Consider for Your Retirement Plan

Choosing between target date funds and a self-directed IRA depends on your risk tolerance, investment knowledge, and retirement timeline. Target date funds offer a professionally managed, diversified portfolio that automatically adjusts asset allocation as you approach retirement age, ideal for hands-off investors. A self-directed IRA provides greater control over asset choices, including alternative investments, but requires active management and a higher level of financial expertise to optimize retirement outcomes.

Related Important Terms

Glide Path Optimization

Target date funds use glide path optimization to automatically adjust the asset allocation over time, reducing risk as retirement approaches, while self-directed IRAs provide investors full control to customize their portfolio strategy without a predefined glide path. This makes glide path optimization ideal for hands-off investors seeking a systematic approach, whereas self-directed IRAs suit those wanting personalized risk management and investment flexibility.

Automatic Rebalancing Algorithms

Target date funds utilize automatic rebalancing algorithms to adjust asset allocations gradually over time, reducing risk as the retirement date approaches, while self-directed IRAs require investors to manually manage and rebalance their portfolios. Automatic rebalancing algorithms in target date funds optimize portfolio diversification and maintain alignment with retirement goals without the need for constant investor intervention.

Age-based Asset Allocation

Target date funds automatically adjust asset allocation based on the investor's expected retirement age, gradually shifting from higher-risk equities to more conservative bonds to reduce volatility as the target date approaches. Self-directed IRAs allow individuals to personally manage their age-based asset allocation, offering greater flexibility to tailor investments but requiring more active monitoring and financial expertise.

Custom Target Date Fund (CTDF)

Custom Target Date Funds (CTDFs) offer a tailored glide path and asset allocation specific to an investor's retirement timeline, providing a dynamic, personalized alternative to generic target date funds. Unlike Self-directed IRAs, which require active management and asset selection, CTDFs automate diversification and rebalancing while aligning closely with individual risk tolerance and retirement goals.

Robo-advisor Target Date Funds

Robo-advisor target date funds offer automated, professionally managed portfolios that adjust asset allocation based on a specific retirement year, providing a hands-off investment approach compared to self-directed IRAs which require active management and more extensive knowledge of individual asset selection. These funds optimize diversification and risk management by automatically rebalancing as the retirement date approaches, making them ideal for investors seeking simplicity and tailored retirement planning without constant oversight.

Alternative Asset Integration (Self-Directed IRA)

Target date funds offer automated portfolio rebalancing aligned with retirement timelines but typically limit exposure to alternative assets, whereas self-directed IRAs provide greater flexibility to include alternative investments such as real estate, private equity, and precious metals, enhancing portfolio diversification and potential returns. Integrating alternative assets through a self-directed IRA can mitigate market volatility and create unique growth opportunities unavailable in conventional target date fund structures.

Self-Directed ESG IRA

Self-Directed ESG IRAs offer investors control over socially responsible investments, enabling portfolios to align with specific environmental, social, and governance criteria while providing diversification beyond standard Target Date Funds. Unlike Target Date Funds, which automatically adjust asset allocation based on a target retirement year, Self-Directed ESG IRAs empower holders to select individual impact-driven assets, enhancing personalized retirement strategy and potential long-term sustainability.

Private Equity SDIRA

Private Equity Self-Directed IRAs (SDIRAs) offer retirement investors the opportunity to diversify beyond traditional stocks and bonds by including alternative assets with potential for higher returns and tax advantages. Target date funds provide a hands-off, professionally managed portfolio with automatic rebalancing aligned to a specific retirement timeline, but lack the personalized control and unique asset options available in Private Equity SDIRAs.

Target Risk Glide Path

Target date funds offer a built-in risk glide path that automatically adjusts asset allocation from higher-risk equities to more conservative bonds as the retirement date approaches, optimizing growth and minimizing risk over time. Self-directed IRAs provide flexibility to tailor investments, but require active management to maintain an appropriate risk profile aligned with the investor's retirement timeline.

Decumulation Phase Automation

Target date funds offer automated asset allocation adjustments during the decumulation phase, simplifying income distribution and risk management for retirees. Self-directed IRAs provide greater control but require active decision-making for withdrawals and portfolio rebalancing, increasing the complexity of managing retirement income streams.

Target date funds vs Self-directed IRA for retirement accounts. Infographic

moneydiff.com

moneydiff.com