A 401k offers retirement savings through an employer with contribution limits and potential matching funds, making it suitable for employees. A Solo 401k is designed for self-employed individuals or small business owners with no full-time employees, allowing higher contribution limits and greater flexibility. Comparing 401k vs Solo401k depends on employment status and savings goals to maximize retirement benefits.

Table of Comparison

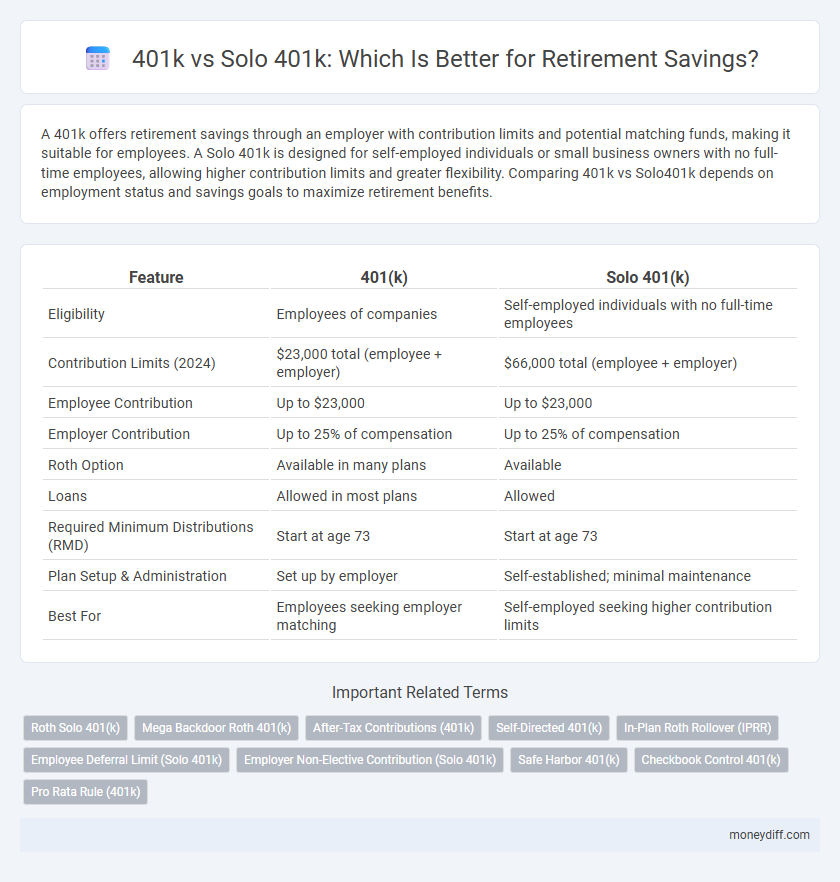

| Feature | 401(k) | Solo 401(k) |

|---|---|---|

| Eligibility | Employees of companies | Self-employed individuals with no full-time employees |

| Contribution Limits (2024) | $23,000 total (employee + employer) | $66,000 total (employee + employer) |

| Employee Contribution | Up to $23,000 | Up to $23,000 |

| Employer Contribution | Up to 25% of compensation | Up to 25% of compensation |

| Roth Option | Available in many plans | Available |

| Loans | Allowed in most plans | Allowed |

| Required Minimum Distributions (RMD) | Start at age 73 | Start at age 73 |

| Plan Setup & Administration | Set up by employer | Self-established; minimal maintenance |

| Best For | Employees seeking employer matching | Self-employed seeking higher contribution limits |

Understanding the Basics: 401k vs Solo 401k

A traditional 401(k) is an employer-sponsored retirement plan allowing employees to contribute pre-tax income with potential employer matching, while a Solo 401(k) is designed for self-employed individuals or small business owners with no full-time employees. Solo 401(k) plans offer higher contribution limits by combining employee deferral and employer profit-sharing components, maximizing retirement savings. Understanding the differences in eligibility, contribution limits, and administrative requirements is essential for optimizing retirement strategy between these plans.

Eligibility Requirements: Who Qualifies for Each Plan?

Eligibility for a traditional 401(k) typically requires employment with a company that offers the plan, making it suitable for full-time employees. A Solo 401(k) is designed for self-employed individuals or small business owners with no full-time employees other than themselves and their spouse. Understanding these distinctions helps optimize retirement savings based on employment status and business ownership.

Contribution Limits: Comparing 401k and Solo 401k

401(k) plans have an annual employee contribution limit of $22,500 for 2024, with a total contribution cap, including employer matches, of $66,000. Solo 401(k) plans, designed for self-employed individuals, allow contributions both as employee and employer, enabling a combined limit up to $66,000 or $73,500 if age 50 or older. This dual contribution feature often makes the Solo 401(k) more advantageous for maximizing retirement savings compared to traditional 401(k) plans.

Employer Matching: Traditional 401k vs Solo 401k

Employer matching contributions significantly enhance retirement savings in traditional 401(k) plans, where employers typically match a percentage of employee contributions up to a limit, boosting overall investment growth. Solo 401(k) plans, designed for self-employed individuals without employees, do not include employer matching since the participant acts as both employer and employee but allow higher total contribution limits combining employee deferrals and employer profit-sharing components. Understanding the differences in employer matching potential and contribution limits is crucial for optimizing retirement savings strategies based on employment status and business structure.

Investment Options: Flexibility and Choices

A 401(k) plan typically offers a curated selection of mutual funds and target-date funds managed by the employer's plan provider, limiting investment choices to pre-approved options. Solo 401(k) plans provide greater flexibility by allowing participants to invest in a wider range of assets, including individual stocks, bonds, ETFs, and real estate, catering to self-employed individuals or small business owners. The expanded investment options in a Solo 401(k) enable a more personalized portfolio strategy, potentially enhancing retirement savings growth through diverse asset allocation.

Tax Advantages: Deferrals and Roth Options

A traditional 401(k) offers tax-deferred contributions, reducing taxable income in the contribution year, while a Solo 401(k) provides the same deferral benefits with the added advantage of higher contribution limits for self-employed individuals. Both plans offer Roth options, allowing after-tax contributions with tax-free qualified withdrawals in retirement, which can help diversify tax strategies. The Solo 401(k) uniquely enables catch-up contributions and employer profit-sharing components, maximizing tax-advantaged retirement savings.

Administrative Responsibilities and Costs

401(k) plans typically require less administrative responsibility and lower costs for employees since employers handle most compliance and record-keeping tasks, making them more straightforward for standard retirement savings. Solo 401(k) plans, designed for self-employed individuals or small business owners with no employees, involve greater administrative duties such as annual filings (Form 5500) once plan assets exceed $250,000, increasing complexity and potential costs. Understanding these differences helps retirees and self-employed individuals choose the most cost-effective and manageable retirement savings vehicle based on their business structure and regulatory obligations.

Loan and Withdrawal Rules: Accessing Your Funds

The 401(k) plan permits loans up to 50% of the vested balance or $50,000, whichever is less, with repayments typically required within five years. Solo 401(k) plans offer similar loan options but provide more flexibility for self-employed individuals, allowing funds to be accessed without triggering penalties if certain conditions are met. Withdrawals from both plans before age 59 1/2 generally incur a 10% early withdrawal penalty, except for qualified exceptions such as disability or first-time home purchase.

Suitability for Different Retirement Goals

A 401(k) is ideal for employees seeking steady retirement savings through employer-sponsored plans, while a Solo 401(k) suits self-employed individuals or small business owners aiming for higher contribution limits and greater control. Solo 401(k) plans offer flexibility to maximize contributions, beneficial for accelerated retirement goals or higher income brackets. Traditional 401(k)s provide consistent growth opportunities and often include employer matching, supporting long-term, moderate-growth retirement strategies.

Choosing the Right Plan: Key Considerations for Retirement Savers

Choosing between a traditional 401(k) and a Solo 401(k) depends on your employment status and contribution goals. Solo 401(k) plans are ideal for self-employed individuals or business owners with no employees, offering higher contribution limits up to $66,000 annually in 2024, combining employee deferrals and employer contributions. Traditional 401(k) plans suit employees with employer-sponsored options, providing tax advantages and potential matching contributions, making understanding eligibility and maximum contributions crucial for optimizing retirement savings.

Related Important Terms

Roth Solo 401(k)

A Roth Solo 401(k) offers higher contribution limits and tax-free growth benefits compared to a traditional 401(k), making it ideal for self-employed individuals and small business owners aiming to maximize retirement savings. Contributions to a Roth Solo 401(k) are made with after-tax dollars, allowing qualified withdrawals to be tax-free in retirement, providing a strategic advantage over a traditional 401(k) for long-term tax planning.

Mega Backdoor Roth 401(k)

A Mega Backdoor Roth 401(k) strategy allows high-income earners to contribute after-tax dollars beyond regular 401(k) limits, then convert those funds to Roth tax-free growth, a feature typically available in Solo 401(k) plans but often restricted in traditional 401(k)s. Utilizing a Solo 401(k) for the Mega Backdoor Roth enables self-employed individuals to maximize their retirement savings with higher contribution limits and tax-efficient Roth conversions.

After-Tax Contributions (401k)

After-tax contributions to a traditional 401(k) allow employees to invest additional funds beyond pre-tax limits, enabling greater retirement savings growth potential through tax-deferred earnings. Solo 401(k) plans also permit after-tax contributions, but typically cater to self-employed individuals or small business owners, offering higher overall contribution limits combined with flexible investment options.

Self-Directed 401(k)

Self-Directed 401(k) plans offer greater investment control and flexibility compared to traditional 401(k)s, allowing individuals to directly invest in real estate, private equity, and other alternative assets for diversified retirement savings. Solo 401(k)s, designed for self-employed individuals and small business owners without employees, combine high contribution limits with self-direction benefits, maximizing retirement growth potential.

In-Plan Roth Rollover (IPRR)

The In-Plan Roth Rollover (IPRR) option within Solo 401(k) plans allows participants to convert pre-tax contributions to Roth balances without leaving the plan, enabling tax-free growth and withdrawals in retirement. Compared to traditional 401(k)s, Solo 401(k)s often provide greater flexibility and higher contribution limits, making IPRRs a powerful strategy to maximize tax-efficient retirement savings.

Employee Deferral Limit (Solo 401k)

The Solo 401k offers a higher employee deferral limit of up to $22,500 for 2024, plus an additional $7,500 catch-up contribution for those aged 50 or older, allowing self-employed individuals to maximize retirement savings more effectively than traditional 401k plans. This increased deferral capability significantly enhances tax-deferred growth potential compared to standard employee 401k options.

Employer Non-Elective Contribution (Solo 401k)

The Solo 401(k) plan allows self-employed individuals to make Employer Non-Elective Contributions up to 25% of their compensation, providing a higher potential retirement savings limit compared to traditional 401(k) plans. This feature maximizes tax-advantaged growth and boosts overall retirement funds for sole proprietors and small business owners.

Safe Harbor 401(k)

Safe Harbor 401(k) plans offer automatic employer contributions that fully vest immediately, providing significant advantages compared to Solo 401(k) plans by helping small businesses avoid annual nondiscrimination testing and maximize tax benefits. These features make Safe Harbor 401(k)s particularly beneficial for business owners seeking reliable retirement savings growth with simplified compliance requirements.

Checkbook Control 401(k)

Checkbook Control 401(k), a type of Solo 401(k), offers entrepreneurs enhanced autonomy by allowing direct access to retirement funds via a personal checking account, enabling swift, self-directed investments without custodian delays. This control contrasts with traditional 401(k) plans, providing unmatched flexibility for diverse asset allocation and tax-advantaged growth in retirement savings.

Pro Rata Rule (401k)

The Pro Rata Rule impacts traditional 401(k) plans by requiring a proportional distribution of non-Roth and Roth balances during rollovers or conversions, potentially increasing tax liabilities on retirement savings. Solo 401(k) plans often provide more streamlined tax handling without the complexities of the Pro Rata Rule, making them advantageous for self-employed individuals aiming to minimize taxes and maximize retirement contributions.

401k vs Solo401k for retirement savings. Infographic

moneydiff.com

moneydiff.com