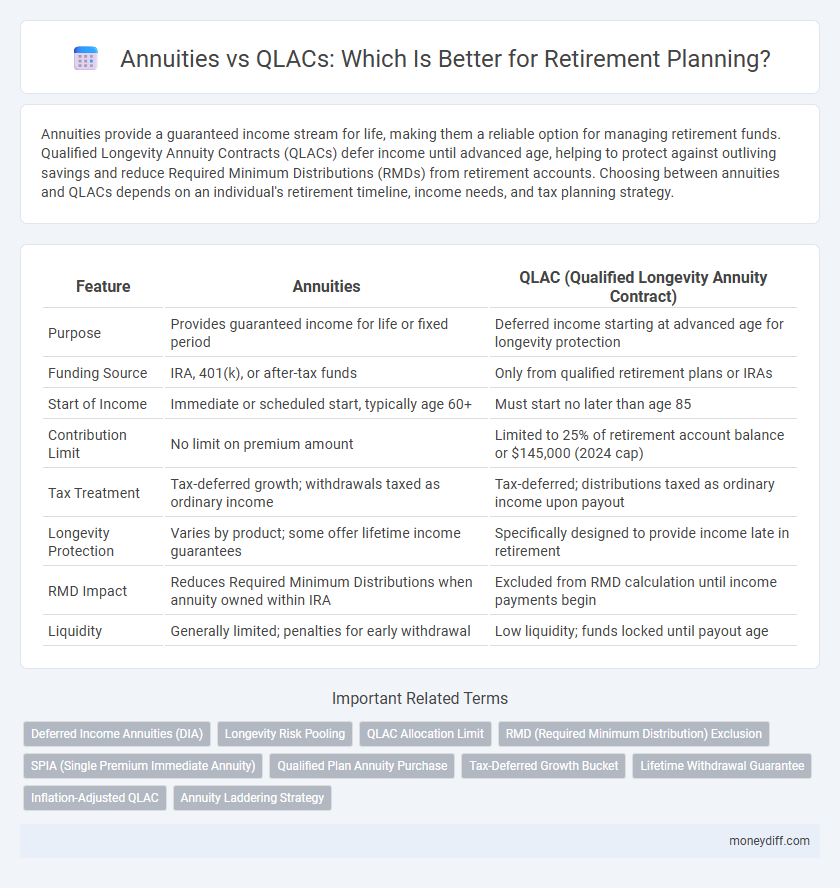

Annuities provide a guaranteed income stream for life, making them a reliable option for managing retirement funds. Qualified Longevity Annuity Contracts (QLACs) defer income until advanced age, helping to protect against outliving savings and reduce Required Minimum Distributions (RMDs) from retirement accounts. Choosing between annuities and QLACs depends on an individual's retirement timeline, income needs, and tax planning strategy.

Table of Comparison

| Feature | Annuities | QLAC (Qualified Longevity Annuity Contract) |

|---|---|---|

| Purpose | Provides guaranteed income for life or fixed period | Deferred income starting at advanced age for longevity protection |

| Funding Source | IRA, 401(k), or after-tax funds | Only from qualified retirement plans or IRAs |

| Start of Income | Immediate or scheduled start, typically age 60+ | Must start no later than age 85 |

| Contribution Limit | No limit on premium amount | Limited to 25% of retirement account balance or $145,000 (2024 cap) |

| Tax Treatment | Tax-deferred growth; withdrawals taxed as ordinary income | Tax-deferred; distributions taxed as ordinary income upon payout |

| Longevity Protection | Varies by product; some offer lifetime income guarantees | Specifically designed to provide income late in retirement |

| RMD Impact | Reduces Required Minimum Distributions when annuity owned within IRA | Excluded from RMD calculation until income payments begin |

| Liquidity | Generally limited; penalties for early withdrawal | Low liquidity; funds locked until payout age |

Understanding Annuities and QLACs: Core Differences

Annuities provide a guaranteed income stream starting immediately or within a short period, offering financial stability throughout retirement. Qualified Longevity Annuity Contracts (QLACs) are specialized deferred annuities purchased within retirement accounts, designed to begin payouts at an advanced age, typically 80 or later, helping manage longevity risk. The core difference lies in timing and tax treatment: annuities can start income early, while QLACs delay withdrawals, reducing required minimum distributions (RMDs) and enhancing long-term income security.

How Annuities Work for Retirement Income

Annuities convert a lump sum into a steady income stream for retirees, providing guaranteed payments for life or a set period. They accumulate interest tax-deferred before payouts begin, ensuring predictable cash flow during retirement. Different types include fixed, variable, and indexed annuities, each offering varying risk and return profiles aligned with retirement income goals.

What Is a QLAC? Key Features and Benefits

A Qualified Longevity Annuity Contract (QLAC) is a specialized deferred income annuity designed to provide guaranteed income starting at an advanced age, typically 80 or older, helping retirees manage longevity risk. Key features include the ability to invest up to 25% of retirement account balances or $145,000 (whichever is less) within qualified plans, while delaying required minimum distributions (RMDs) until annuity payouts begin. Benefits of a QLAC include tax-deferred growth, predictable lifetime income, and protection against outliving savings compared to traditional annuities.

Comparing Payout Options: Annuities vs QLACs

Annuities provide guaranteed lifetime income with immediate or deferred payout options, typically offering higher initial payments but less flexibility in withdrawal terms. Qualified Longevity Annuity Contracts (QLACs) start payments later, usually at age 80 or beyond, preserving assets for late retirement and reducing required minimum distribution (RMD) burdens. Choosing between annuities and QLACs depends on balancing immediate income needs against long-term income security and tax considerations.

Tax Advantages: Annuities vs QLACs

Qualified Longevity Annuity Contracts (QLACs) offer tax-deferred growth and delay required minimum distributions (RMDs) from IRAs until age 85, providing a strategic advantage in managing taxable income during retirement. Traditional annuities also provide tax deferral on earnings but require RMDs to begin at age 73, which can increase taxable income earlier. Choosing between annuities and QLACs depends on individual tax planning goals, with QLACs favoring those seeking to minimize taxes in the early retirement years while ensuring income later.

Longevity Protection: Which Option Delivers More Security?

Annuities provide guaranteed lifetime income, offering robust longevity protection by eliminating the risk of outliving your savings, while Qualified Longevity Annuity Contracts (QLACs) focus on deferring income until advanced ages, typically 80 or 85, ensuring a financial safety net during later retirement years. QLACs also allow individuals to reduce their required minimum distributions (RMDs), preserving other retirement assets longer, whereas traditional annuities may reduce liquidity but offer immediate or near-term income streams. For maximizing longevity security, combining a QLAC within an IRA alongside other annuity products can balance early withdrawal flexibility with assured long-term income.

Flexibility and Customization: Annuities Compared to QLACs

Annuities offer greater flexibility and customization compared to Qualified Longevity Annuity Contracts (QLACs), allowing retirees to tailor payout amounts, periods, and options such as inflation adjustments or beneficiary provisions. In contrast, QLACs have more rigid terms with fixed deferral periods and payout schedules, designed primarily to address longevity risk by guaranteeing income starting at an advanced age. This inherent flexibility in annuities supports diverse financial goals and changing retirement needs, while QLACs provide a predefined safety net for income stability later in life.

Required Minimum Distribution (RMD) Impact

Qualifying Longevity Annuity Contracts (QLACs) reduce the Impact of Required Minimum Distributions (RMDs) by allowing retirees to exclude up to $145,000 of their traditional IRA balance from RMD calculations until payouts begin, thereby lowering taxable income in early retirement years. In contrast, standard annuities held within retirement accounts do not provide RMD deferral benefits, resulting in immediate RMD obligations based on the account balance. Choosing QLACs strategically minimizes RMD amounts, offering tax efficiency and improved cash flow management during retirement.

Costs and Fees: Weighing the Financial Implications

Annuities often carry higher upfront fees, administrative costs, and surrender charges compared to Qualified Longevity Annuity Contracts (QLACs), which typically have lower expenses and offer deferred income benefits. While annuities can provide immediate income streams, QLACs minimize management fees by delaying payout start dates, potentially reducing overall costs. Investors should carefully assess expense ratios, mortality and expense fees, and the impact of early withdrawals when comparing these retirement income options.

Choosing Between Annuities and QLACs: Key Factors to Consider

Choosing between annuities and Qualified Longevity Annuity Contracts (QLACs) hinges on several key factors, including income guarantees, tax treatment, and flexibility in retirement planning. Annuities offer a steady income stream with various payout options but can come with higher fees and less control over funds. QLACs provide a tax-deferral advantage by allowing a portion of retirement account balances to be excluded from required minimum distributions (RMDs), promoting longevity risk management while offering less liquidity and customization.

Related Important Terms

Deferred Income Annuities (DIA)

Deferred Income Annuities (DIAs) provide a guaranteed lifetime income stream starting at a future date, offering retirees a reliable way to manage longevity risk compared to Qualified Longevity Annuity Contracts (QLACs), which are limited by IRS guidelines on purchase amounts and deferral periods within qualified accounts. DIAs offer greater flexibility outside of retirement accounts, allowing higher investment amounts and customizable deferral options to maximize retirement income security.

Longevity Risk Pooling

Annuities provide longevity risk pooling by pooling funds among participants, ensuring a guaranteed income for life regardless of how long an individual lives, while Qualified Longevity Annuity Contracts (QLACs) specifically defer a portion of retirement savings to start payouts at an advanced age, reducing the risk of outliving assets later in life. Both strategies mitigate longevity risk but differ in timing and flexibility, with annuities offering immediate or near-term income and QLACs targeting income security in the later retirement years.

QLAC Allocation Limit

Qualified Longevity Annuity Contracts (QLACs) impose a federal allocation limit of the lesser between $145,000 or 25% of the retirement account balance, restricting the amount retirees can invest to defer required minimum distributions (RMDs) until age 85. This limit contrasts with traditional annuities, which often allow larger investment amounts without such strict federal caps, influencing strategic retirement income planning.

RMD (Required Minimum Distribution) Exclusion

Qualified Longevity Annuity Contracts (QLACs) offer a unique advantage by allowing retirees to exclude up to $150,000 (indexed for inflation) from their Required Minimum Distributions (RMDs), effectively delaying taxable income and preserving assets longer compared to traditional annuities. This RMD exclusion can significantly enhance retirement income planning by reducing early tax burdens and providing guaranteed lifetime income starting at an advanced age.

SPIA (Single Premium Immediate Annuity)

Single Premium Immediate Annuities (SPIAs) provide retirees with a guaranteed, fixed income stream starting immediately after a lump-sum payment, making them a reliable option for predictable retirement cash flow. Unlike Qualified Longevity Annuity Contracts (QLACs), which begin payouts later in life to hedge longevity risk, SPIAs focus on immediate income, helping cover essential expenses in early retirement years.

Qualified Plan Annuity Purchase

Qualified Plan Annuity Purchase (QPAP) allows retirees to convert a portion of their qualified retirement plan assets into a lifetime annuity, providing guaranteed income and reducing longevity risk without immediately triggering taxable events. Compared to Qualified Longevity Annuity Contracts (QLACs), QPAP offers more flexibility in terms of investment size limits and income scheduling, making it a strategic option for retirees seeking stable, predictable income streams from their retirement plans.

Tax-Deferred Growth Bucket

Annuities offer tax-deferred growth by allowing earnings to accumulate without annual taxation until withdrawals begin, providing a steady income stream during retirement. Qualified Longevity Annuity Contracts (QLACs) also provide tax-deferred growth but specialize in delaying required minimum distributions (RMDs) beyond age 72, optimizing longevity risk management within the tax-deferred growth bucket.

Lifetime Withdrawal Guarantee

Annuities provide a lifetime withdrawal guarantee by offering fixed or variable income payments for life, ensuring consistent cash flow regardless of market conditions. QLACs (Qualified Longevity Annuity Contracts) also enable lifetime income but specifically delay withdrawals until a later age, typically 80 or above, allowing retirees to secure guaranteed income that starts later in retirement.

Inflation-Adjusted QLAC

Inflation-adjusted Qualified Longevity Annuity Contracts (QLACs) provide a strategic advantage over traditional annuities by offering income that grows with inflation, preserving purchasing power throughout retirement. This built-in inflation protection helps retirees maintain financial security against rising living costs, a feature often absent in fixed annuities.

Annuity Laddering Strategy

Annuity laddering strategy involves purchasing multiple annuities at different times to stagger income streams, enhancing flexibility and managing longevity risk effectively. Integrating Qualified Longevity Annuity Contracts (QLACs) within this ladder diversifies income sources, allowing deferred income to start later in retirement while preserving required minimum distributions (RMD) thresholds.

Annuities vs QLAC for retirement. Infographic

moneydiff.com

moneydiff.com