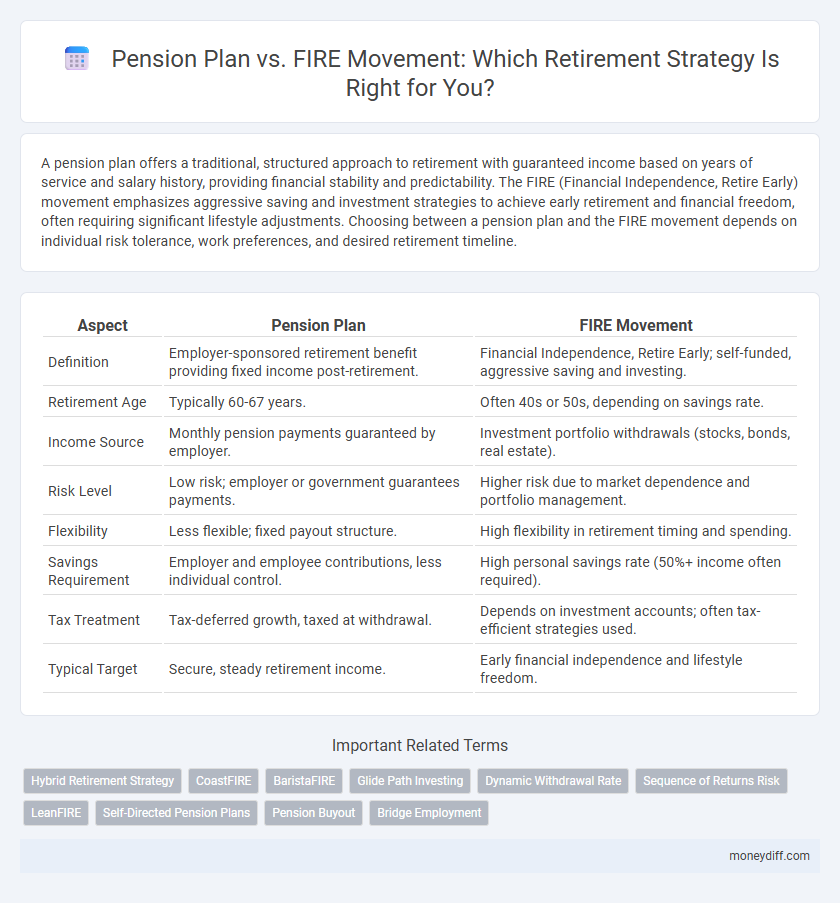

A pension plan offers a traditional, structured approach to retirement with guaranteed income based on years of service and salary history, providing financial stability and predictability. The FIRE (Financial Independence, Retire Early) movement emphasizes aggressive saving and investment strategies to achieve early retirement and financial freedom, often requiring significant lifestyle adjustments. Choosing between a pension plan and the FIRE movement depends on individual risk tolerance, work preferences, and desired retirement timeline.

Table of Comparison

| Aspect | Pension Plan | FIRE Movement |

|---|---|---|

| Definition | Employer-sponsored retirement benefit providing fixed income post-retirement. | Financial Independence, Retire Early; self-funded, aggressive saving and investing. |

| Retirement Age | Typically 60-67 years. | Often 40s or 50s, depending on savings rate. |

| Income Source | Monthly pension payments guaranteed by employer. | Investment portfolio withdrawals (stocks, bonds, real estate). |

| Risk Level | Low risk; employer or government guarantees payments. | Higher risk due to market dependence and portfolio management. |

| Flexibility | Less flexible; fixed payout structure. | High flexibility in retirement timing and spending. |

| Savings Requirement | Employer and employee contributions, less individual control. | High personal savings rate (50%+ income often required). |

| Tax Treatment | Tax-deferred growth, taxed at withdrawal. | Depends on investment accounts; often tax-efficient strategies used. |

| Typical Target | Secure, steady retirement income. | Early financial independence and lifestyle freedom. |

Understanding Pension Plans: Traditional Approach to Retirement

Pension plans offer a structured, employer-managed retirement savings system that guarantees a fixed income based on salary and years of service, providing financial security through predictable monthly benefits. The traditional approach emphasizes long-term employment and gradual accumulation of retirement funds, contrasting with the FIRE Movement's focus on aggressive saving and early financial independence. Understanding the stability and reliability of pension plans helps retirees evaluate their income sources against the more flexible but variable strategies of the FIRE Movement.

What is the FIRE Movement? Principles and Goals

The FIRE Movement, or Financial Independence Retire Early, centers on aggressive saving and investing to achieve financial independence well before traditional retirement age. Its principles include minimizing expenses, maximizing income, and building a robust investment portfolio to cover living costs indefinitely. The ultimate goal is to retire early by creating passive income streams that replace salary, allowing individuals to pursue personal passions without financial constraints.

Key Differences Between Pension Plans and FIRE

Pension plans offer guaranteed, employer-managed retirement income based on years of service and salary, providing financial stability with minimal personal investment risk. The FIRE (Financial Independence, Retire Early) movement emphasizes aggressive saving and investing to achieve early retirement through personal financial discipline and market returns. Key differences include the source of retirement funds--defined benefit versus self-directed investments--and the timing and flexibility of retirement options.

Financial Security: Guaranteed Income vs. Self-Funded Wealth

A traditional pension plan offers guaranteed income for life, providing financial security through steady, predictable payments even during market downturns. In contrast, the FIRE (Financial Independence, Retire Early) movement relies on self-funded wealth accumulated through aggressive saving and investing, which can offer greater flexibility but comes with market risk and income variability. Evaluating pension stability versus the potential growth and risks of FIRE strategies is critical for long-term retirement financial security.

Flexibility and Lifestyle: Pension Plan vs. FIRE Movement

Pension plans provide stable, predictable income but often lack flexibility, tying retirees to a fixed retirement age and limited lifestyle changes. The FIRE (Financial Independence, Retire Early) movement emphasizes aggressive saving and investing to achieve financial freedom, allowing individuals to retire early and tailor their lifestyle with greater autonomy. Flexibility and personalized lifestyle choices make FIRE appealing for those seeking control over retirement timing and daily activities, contrasting the traditional pension's structured approach.

Risks and Challenges: Pension Plan Limitations vs. FIRE Uncertainties

Pension plans offer a stable income stream but carry risks such as underfunding, inflation eroding purchasing power, and limited flexibility in retirement choices. The FIRE movement introduces uncertainties including market volatility, withdrawal rate sustainability, and the challenge of accurately predicting long-term expenses without guaranteed benefits. Evaluating these risks highlights the trade-offs between institutional reliability in pension plans and the self-managed, variable nature of FIRE strategies.

Investment Strategies for Pension Plan Holders and FIRE Followers

Pension plan holders often rely on conservative investment strategies centered around fixed income securities and employer-sponsored funds to ensure stable retirement income. FIRE (Financial Independence, Retire Early) movement followers prioritize aggressive investment portfolios with a strong emphasis on low-cost index funds and high equity allocations to maximize early wealth accumulation. Both approaches require disciplined financial planning, but pension plans focus on risk mitigation while FIRE strategies emphasize rapid asset growth.

Tax Implications for Pension Plans and Early Retirement

Pension plans offer tax-deferred growth where contributions reduce taxable income upfront, but withdrawals during retirement are taxed as ordinary income. The FIRE (Financial Independence, Retire Early) movement relies heavily on taxable investment accounts and Roth IRAs, which often entail paying taxes upfront but benefit from tax-free withdrawals. Understanding the long-term tax implications of pension withdrawals versus early access to investment gains is critical for optimizing retirement income and minimizing tax liabilities.

Who Should Choose Pension Plan or FIRE? Suitability and Considerations

Individuals seeking stable, guaranteed income and risk-averse retirees typically benefit from traditional pension plans due to their longevity protection and employer-backed security. The FIRE movement appeals mainly to disciplined savers with high income potential and the flexibility to manage investment risks and lifestyle choices early in life. Suitability depends on factors like risk tolerance, career stability, financial literacy, and the desired timeline for retirement independence.

Blending Pension Plans with FIRE: Is a Hybrid Strategy Possible?

Blending pension plans with the FIRE (Financial Independence, Retire Early) movement creates a hybrid retirement strategy that leverages the stability of guaranteed income alongside aggressive savings and investment growth. Pension plans provide a reliable baseline income, reducing the risk during early retirement phases, while FIRE methods emphasize financial independence through high savings rates and investment diversification. This combined approach offers a balanced path, optimizing both security and flexibility for a more resilient retirement plan.

Related Important Terms

Hybrid Retirement Strategy

A Hybrid Retirement Strategy combines the stability of traditional pension plans with the flexibility and early financial independence goals of the FIRE (Financial Independence, Retire Early) movement, offering a balanced approach to retirement planning. By leveraging guaranteed pension income alongside aggressive savings and investment tactics from the FIRE philosophy, individuals can optimize long-term financial security and maintain lifestyle freedom during retirement.

CoastFIRE

CoastFIRE emphasizes achieving early financial independence by aggressively saving and investing in the early years, allowing investments to grow passively until traditional retirement age without additional contributions. Unlike traditional pension plans that provide a fixed monthly income, CoastFIRE leverages compound interest and minimal ongoing contributions after the initial accumulation phase, offering greater flexibility and control over retirement timing and lifestyle.

BaristaFIRE

BaristaFIRE combines part-time work with strategic retirement savings, offering a flexible alternative to traditional pension plans by allowing early financial independence with reduced reliance on full-time employment. This approach emphasizes balancing a sustainable income stream from side gigs or part-time jobs while building investment portfolios to support long-term retirement goals.

Glide Path Investing

Glide path investing optimizes asset allocation by gradually shifting from high-risk equities to low-risk bonds as retirement approaches, benefiting both traditional pension plans and the FIRE movement. While pension plans rely on predictable contributions and professional management, the FIRE movement leverages glide paths for disciplined risk reduction to secure early retirement through aggressive saving and investing.

Dynamic Withdrawal Rate

Dynamic withdrawal rate strategies adjust retirement withdrawals based on real-time market performance and portfolio value, offering greater flexibility compared to fixed pension plans that provide predetermined, steady payouts. FIRE Movement advocates often use dynamic withdrawal methods to sustainably extend portfolio longevity, contrasting with traditional pension plans' guaranteed but inflexible income streams.

Sequence of Returns Risk

Pension plans provide a stable, guaranteed income stream that shields retirees from sequence of returns risk by offering predictable payments regardless of market fluctuations. In contrast, the FIRE movement exposes individuals to sequence of returns risk since drawing down from invested assets during market downturns can significantly diminish retirement savings and longevity.

LeanFIRE

LeanFIRE emphasizes achieving financial independence through aggressive saving and minimalistic living, contrasting with traditional pension plans that rely on steady, long-term employer contributions and predictable retirement income. Individuals pursuing LeanFIRE prioritize early retirement by maximizing savings rates and reducing expenses, whereas pension plans offer structured benefits often tied to years of service and fixed payout formulas.

Self-Directed Pension Plans

Self-directed pension plans offer retirees greater control over investment choices and portfolio diversification compared to the FIRE movement's aggressive savings and early retirement strategies. These plans allow personalized asset allocation and tax-advantaged growth, providing flexible income streams that can adapt to changing retirement goals and market conditions.

Pension Buyout

Pension buyouts offer a lump-sum payment alternative to traditional pension plans, providing retirees immediate access to funds instead of lifelong monthly payments, aligning with the FIRE movement's emphasis on financial independence and early retirement. This option allows individuals to manage their retirement savings actively, potentially increasing flexibility and control compared to conventional pension structures.

Bridge Employment

Bridge employment acts as a strategic complement between traditional pension plans and the FIRE (Financial Independence, Retire Early) movement by enabling retirees to gradually transition into full retirement while maintaining income stability and social engagement. This phased approach enhances financial security and personal fulfillment by allowing individuals to leverage pension benefits alongside part-time or flexible work opportunities.

Pension Plan vs FIRE Movement for retirement. Infographic

moneydiff.com

moneydiff.com